This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

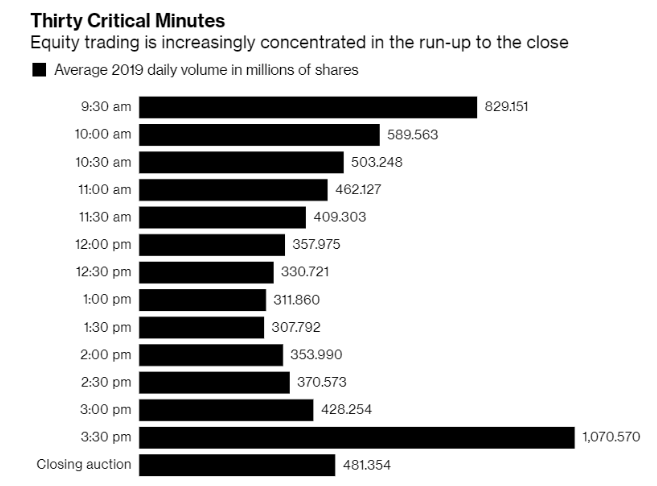

- Does all the high-frequency trading at the start and end of the day matter?

- What trends will die off with the baby boomer generation?

- Is Rich Dad, Poor Dad real? Does it even matter?

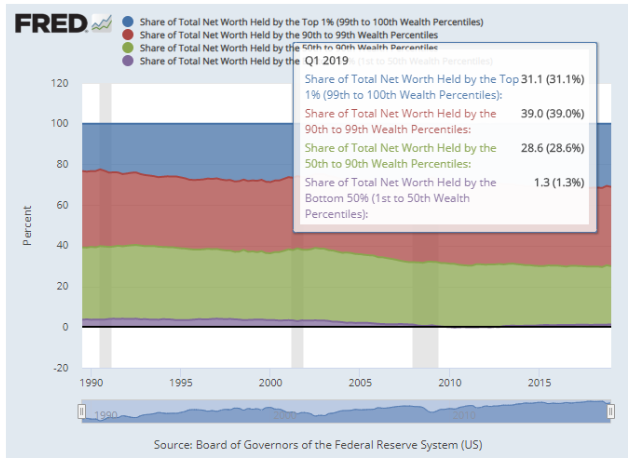

- Visualizing wealth inequality

- Walmart’s competition with Amazon

- Are banks a big short again?

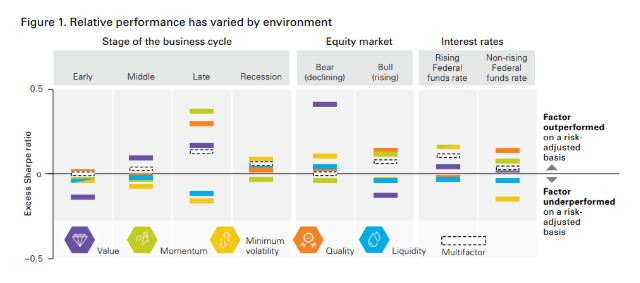

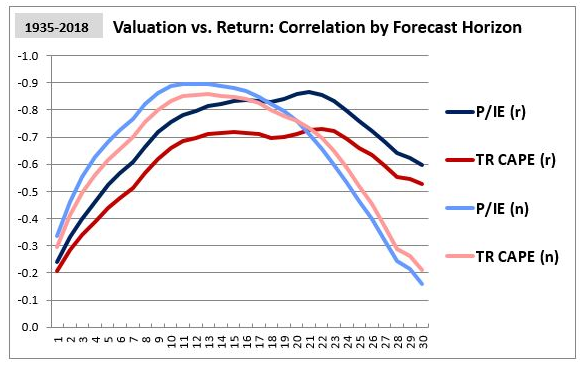

- Value investing and low volatility stocks

- Why did valuations get so low during the late-70s/early-80s?

- Why does the government charge such high rates on student loan debt?

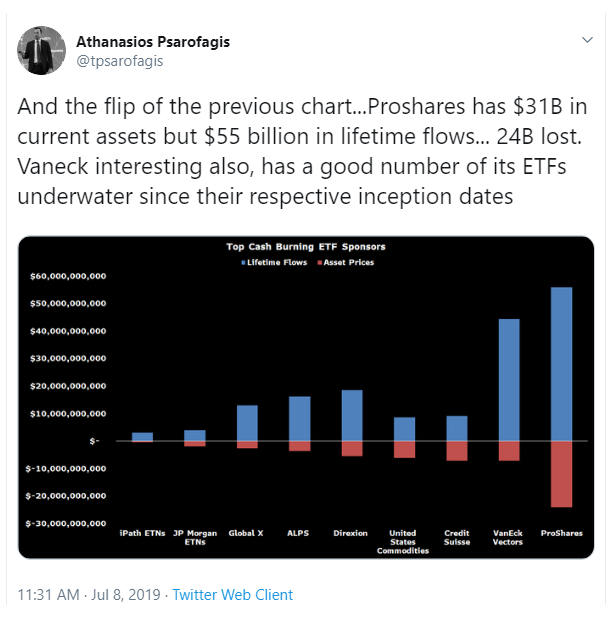

- Where fund money goes to die

- The John Oliver of finance

- Crypto derivatives

- Is Woj his own brand?

- Celebrating saving milestones

- Which to attend: Our Wealth/Stack Conference or a golf tournament?

Listen here:

Conference mentioned:

- $100 off our Wealth/Stack conference by clicking here.

Stories mentioned:

- The earnings season playbook

- Wall Street fights machines with trend-chasing on steroids

- HQ Trivia lays off 20% of workforce

- Mad Magazine is all but dead

- The ultimate hypocrite

- Walmart e-commerce is losing lots of money

- Your next checking account could get you a Spotify subscription

- Is value dead?

- Cycle-based factor timing

- The earnings mirage

- Understanding the market through passive flows

- Obama signs overhaul of the student debt program

- The government is now officially in the banking business

- Good investors make investing harder

- Crypto derivatives

Books mentioned:

- Blockbusters by Anita Elberse

- The Algebra of Happiness by Scott Galloway

- How Will You Measure Your Life by Clayton Christensen

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook and Instagram

Subscribe here: