Emerging market stocks as a group are dangerously close to the accepted definition of a bear market.

Since peaking in late-January earlier this year, the MSCI Emerging Markets Index is now down 19.65% (not including dividends). It’s down around 10% on the year.

If history is any guide, the stocks of these developing nations will fall 20% or more. And if it doesn’t happen now, it will likely happen in the not-too-distant future.

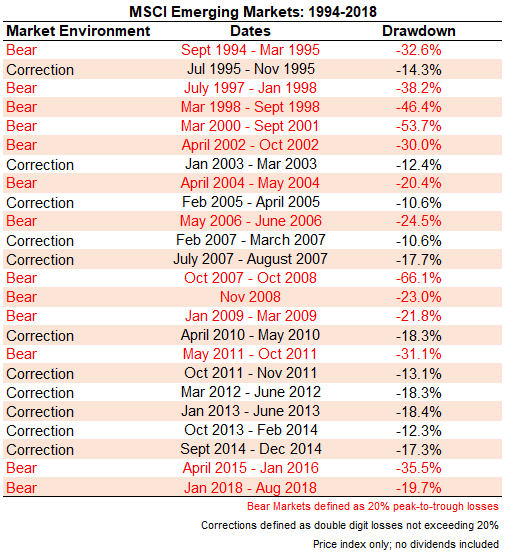

There is plenty of data on the history of corrections and bear markets for the S&P 500 but I couldn’t find much on emerging markets. So I took the daily data going back as far as I could find it and ran the numbers from 1994 to present:

A number of things stood out after going through the data:

- Emerging markets are ridiculously volatile, even by stock market standards. Since 1994, the S&P 500 has experienced 7 corrections and 4 bear markets1 while emerging markets have been hit with 11 corrections and 13 different bear markets.2 This means the combination of corrections and bear markets in emerging markets have outnumbered those in the U.S. by a factor of more than 2-to-1.

- Most investors may not realize emerging markets actually bottomed in October 2008 during the financial crisis. After this they staged a violent rally of more than 30% before falling more than 20%, rising 30%+ again and then falling 20%+ one more time. But they never fell back to that October bottom again. The S&P 500 bottomed out in March of 2009.

- Bear markets are the norm in emerging markets. While they’re fairly rare in the S&P 500, bear markets have occurred once every other year, on average, since 1994 for EM stocks. That number is just one out of every 6 years for the S&P.

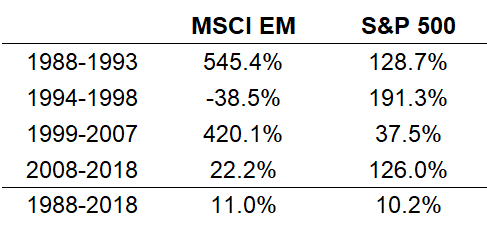

- Although the fluctuations may be too much for some investors to handle, adding a volatile asset class that is uncorrelated to U.S. stocks can actually add value from an overall portfolio perspective. The following table shows total returns by different regimes and goes from 19883 through July of this year:

- The gains in these developing countries can be infrequent, yet large at times. The losses can be frequent and painful. It’s not always the greatest experience but adding even a small allocation to EM stocks can offer a nice rebalancing bonus for those disciplined enough to stick with it. The problem is most investors don’t understand the bone-crushing volatility emerging markets typically exhibit so they invite performance chasing on steroids.

Further Reading:

A Short History of Foreign Stock Market Corrections

1I’m including the 1998 and 2011 19%+ downturns as bear markets even though they didn’t technically hit the 20% threshold. If you don’t agree take it up with my editor (me).

2I’m including the current downturn as a bear. Close enough in my book. I round up.

3It’s worth noting very few investors could, let alone did, invest in emerging markets in the late-1980s or even the 1990s.