On this week’s Animal Spirits with Michael & Ben we discuss:

- Stocks are not bonds, dividends are not written in stone.

- How we think about small cap stocks in a portfolio.

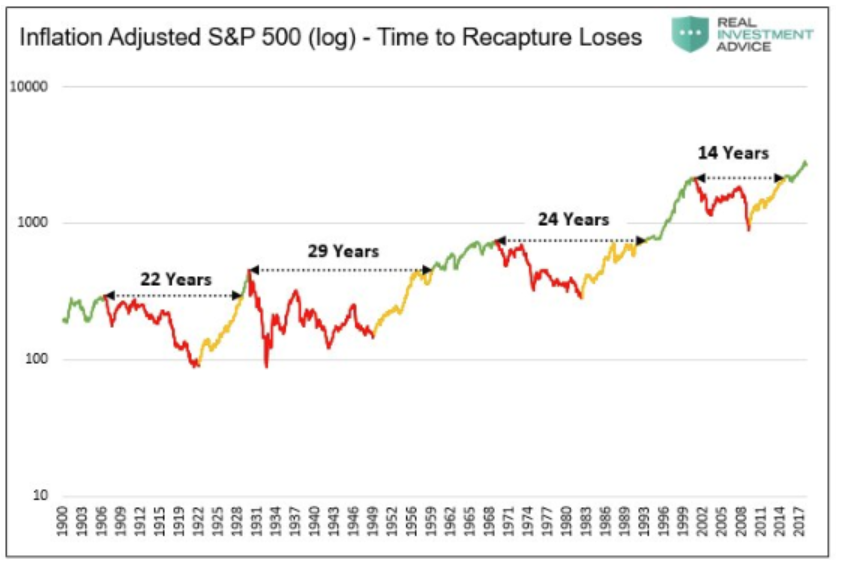

- Why you have to take historical market data with a grain of salt.

- Are the findings from the famous marshmallow experiment a myth?

- Why portfolio construction and risk management are underrated.

- Not all athletes are terrible investors.

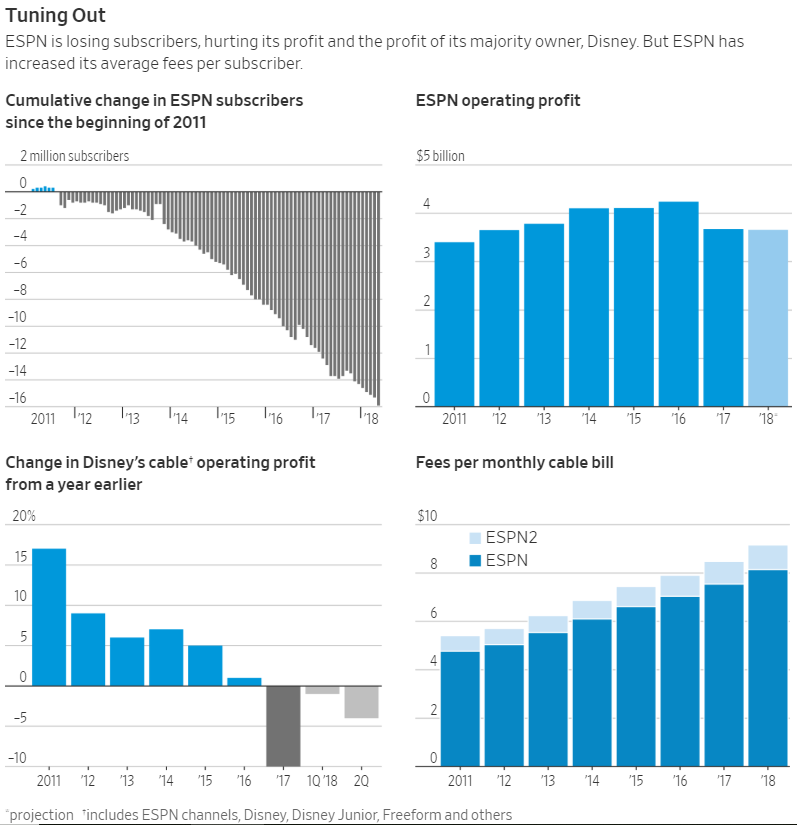

- The downfall of ESPN and what the company has in common with Fidelity Investments.

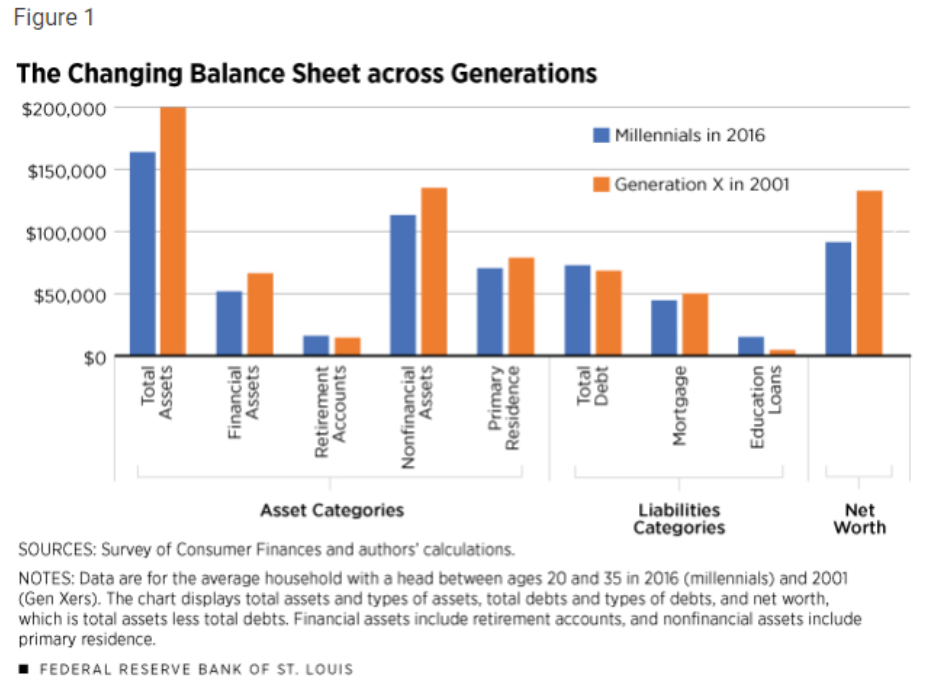

- Why millennials are behind Gen X at the same stage in life with their net worth.

- How to scare people with charts.

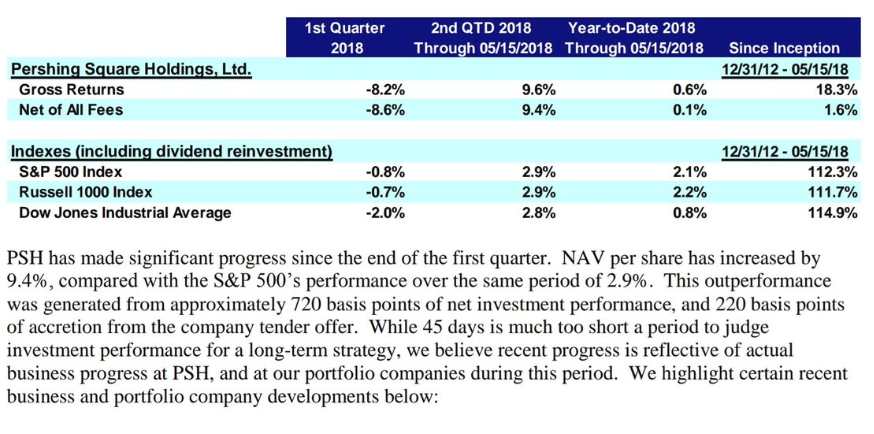

- The enormous chunk of returns eaten up by hedge fund fees.

- Why investing is overrated.

- How the age of your kids affects your reading output.

- Michael’s book of the summer and much more.

Listen here:

Stories mentioned:

- My dad has $1.8 million of GE stock — what should he do?

- Fact, fiction, and the size effect

- This is the small cap secret no one ever told you about

- What if there is no small cap premium?

- The myth of 1926

- Revisiting the marshmallow test

- Separating ingredients and recipe in factor investing

- Kevin Durant’s growing empire

- How a weakened ESPN became consumed by politics

- Fidelity searches for life after mutual funds

- The financial health of millennials

- Lessons from the past 25 years

Chart crime of the week:

Books mentioned:

Charts mentioned:

Podcasts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: