Compound interest may be considered the 8th wonder of the world, but it’s the kind of sight that’s going to take a long time to see in person.

The problem for most people is the majority of the gains from compounding come at the end and very few have the patience necessary to get to that point. But if you do have the ability to let time be your friend in the markets, even minor advantages can lead to much better outcomes.

Paul Merriman thinks just a half percent can change your financial situation in retirement (as mentioned on a recent podcast with Meb Faber). He explains;

If you save $5,000 a year for 40 years and make only 8% (the “small” mistake), you’ll retire with about $1.46 million. But if you earn 8.5% instead, you’ll retire with nearly $1.7 million. The additional $230,000 or so may not seem like enough to change your life, but that additional portfolio value is worth more than all of the money you invested over the years. Result: You retire with 16% more.

Your gains don’t stop there. Assume you continue earning either 8% or 8.5% while you withdraw 4% of your portfolio each year and that you live for 25 years after retirement. If your lifetime return is 8%, your total retirement withdrawals are just shy of $2.5 million. If your lifetime return is 8.5% instead, you withdraw about $3.1 million. That’s an extra $600,000 for your “golden years,” a bonus of three times the total dollars you originally saved.

Your heirs will also have plenty of reasons to be grateful for your 0.5% boost in return. If your lifetime return was 8%, your estate will be worth about $3.9 million. If you earned 8.5% instead, your estate is worth more than $5.1 million.

Obviously, earning better returns on your investments is always going to help your cause but this idea behind improving your performance just a half percent can pay dividends through more than just market gains.

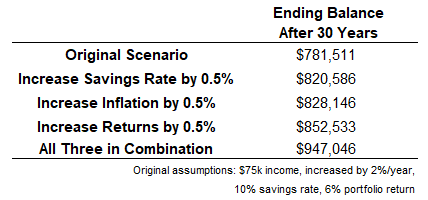

Let’s assume we have a couple with a household income of $75,000 who have 30 years to save for retirement. Each year we’ll increase their income by 2% to account for raises and inflation. They decide to save 10% of their income each year. We’ll also assume they earn a more modest return than what Mr. Merriman uses in his example and make 6% a year on their investments.

Over a 30 year period, this household would end up with $781k and change. Not bad.

But changing those assumptions by just a half percent can make things even better.

Let’s assume they increased their savings rate by a half percent from 10% to 10.5%. That gives an ending balance of $820k. Better.

Now we’ll keep the savings rate at 10% but increase the inflation in their earnings by half a percent to 2.5% to account for better career prospects. This bumps the ending balance up to $828k. Even better.

Finally, keeping all other assumptions as they were in the original example, what if we increased investment returns by half a percent from 6% to 6.5%? Now the balance jumps to $852k. Now we’re talking.

Bringing it all together, let’s assume each of the three variables are each increased by a half a percent (10% to 10.5%, 2% to 2.5% and 6% to 6.5%). The combination of a slight increase in all three would have added more than $165k to the ending balance, bumping it up from $781k to $947k.

Here’s a table to summarize:

Investment performance had the biggest impact but simply increasing all of our assumptions by just half a percent made a huge difference on the bottom line.

Obviously, this says more about the power of compound interest than anything. Over long enough time frames the snowball gets bigger and bigger from even minor increases to the original assumptions (and of course no one’s financial situation ever plays out as linearly as this example but the point remains).

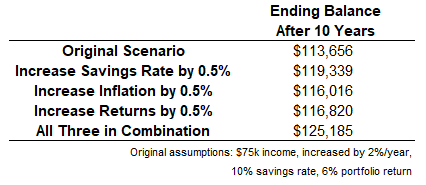

So I wanted to see how things would look over a shorter time horizon as well. Here’s how the numbers look after just 10 years:

These minor increases don’t move the needle as much in 10 years but you still would have been better off by $8k or so by a half percent increase in each. That’s more than you would have saved on an annual basis at the outset of this scenario. And in this example increasing your savings rate does more for you than increasing your investment returns.

This is one of the reasons more people don’t take advantage of compound interest. It takes a long time to see the benefits. And the majority of the gains are back-loaded.

There is also something to be said for the power of minor edges adding up big time over the course of your investing lifecycle. Things like:

- Keep your investment costs low.

- Slowly increasing your savings rate over time.

- Consistently saving while treating investment contributions like a periodic bill payment.

- Bettering your career prospects to increase your income over time.

- Avoiding behavioral investment mistakes which can act as a counterweight to the benefits of compounding.

Each of these improvements can help in their own way, but when you put them all together it really adds up.

Even half a percent can make a big impact on your finances if you’re able to stay out of your own way.

Source:

A half a percent that can change your retirement (Paul Merriman)

Further Reading:

Income Alpha