In the hierarchy of institutional investors, you won’t find a more competitive group than college endowments. They’re in constant competition with one another and the markets. It’s almost like a bizarre finance version of Duke-North Carolina in basketball or Michigan-Ohio State in football.

Endowment funds try to invest in only the best money managers – utilizing both the public and private markets – to find the very best investment opportunities. They’re well-staffed and well-educated. They have access to the best and brightest minds in finance and are able to invest in funds that are reserved only for those with many millions or even billions of dollars and the right connections.

Peer rankings are everything to these funds. Many of the employees who run these endowments actually receive performance bonuses tied to how well they do in relation to their peer rankings. (This is an absurd way to manage money but that’s a topic for another time.)

So every year when the NACUBO-Commonfund Study of Endowments comes out you can be sure that these schools are quick to see how their returns stack up against the competition. The latest results for fiscal year-end June 30, 2016 were released earlier this past week. This year these results included more than 800 college endowments, representing $515 billion in assets, ranging in fund size from a little over $1 million on the low end to $35 billion for the largest fund (Harvard). The average fund size is $640 million, so these colleges control vast amounts of money.

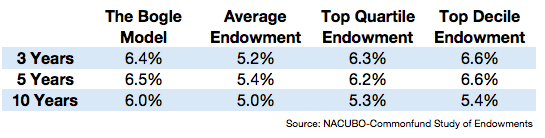

As I’ve done in the past, I broke down these numbers to see how things stacked up against a simple Vanguard 3-fund portfolio* which I have labeled the Bogle Model:

I have to say that the numbers this year surprised me. I would expect the simple index fund portfolio to beat the average returns (that’s just math), but the fact that the Bogle Model portfolio was in the top quartile and even top decile of endowment returns is insane when you consider the depths these universities will go try to beat the market and how sophisticated they are in the eyes of other professional investors.

These funds are invested in venture capital, private equity, infrastructure, private real estate, timber, the best hedge funds money can buy; they have access to the best stock and bond fund managers; they use leverage; they invest in complicated derivatives; they use the biggest and most connected consultants, and the vast majority of these funds still fail to beat a low-cost Vanguard index fund portfolio.

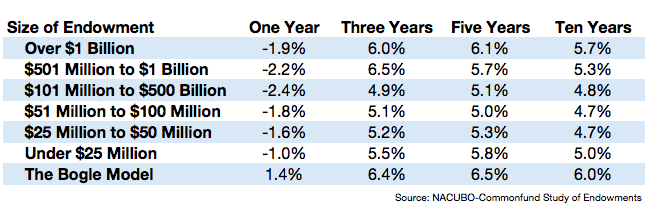

Here’s a further breakdown by endowment size to see how things look by assets:

Larger funds have a slightly better track record than the smaller funds but this gap has narrowed substantially in recent years. Here’s how the asset allocations stack up among the various groups of endowments:

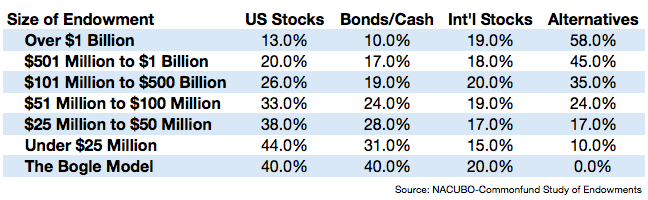

You can see that most of the funds have gone all-in on the Yale Model, which relies heavily on alternative investments. Funds with over $1 billion have the majority of their portfolio in alts, but even funds in the $51-$100 million range have almost a quarter of their assets in these complex investment vehicles. Needless to say, it hasn’t paid off very well lately.

It’s possible that index funds have simply had a better environment in this cycle, but I think the Yale Model is going to be a failure for all but a select few top notch institutional investment programs going forward. Here’s why:

- The low-hanging fruit has been picked. The premiums once reserved for those willing to look in the private markets have compressed substantially, especially when you consider the types of deals these funds need to move the needle.

- Costs are still prohibitive. The increased competition for money managers in the institutional space has yet to really drive down costs like we’ve seen in the retail world. As long as institutions continue to pay outsized fees, the majority of them are going to receive below average results.

- No one wants simple advice. The most important thing you can do as an institution is to focus on your goals, asset allocation, costs, people, policy, plan, and behavior. But few are willing to give this type of advice in the institutional space because simple and low-cost don’t sell very well when you’re dealing with millions or billions of dollars. Everyone is willing to pay the ego premium in hopes of beating the Ivy League schools.

- It’s hard. I know from personal experience that running this type of portfolio is hard work. The due diligence, monitoring, legal paperwork, investment skill and understanding of complex investing strategies is through the roof when trying to run the Yale Model. Picking a single successful fund manager is hard, but picking an entire portfolio of them and then managing it is nearly impossible. Very few individuals can do it and even fewer institutions have the organizational framework in place to pull it off.

This has nothing to do with active vs. passive investing. This is all about simple vs. complex, operationally efficient investment programs vs. operationally inefficient investment programs and high-probability portfolios vs. low-probability portfolios. Investing is hard enough as it is before introducing a complex, inefficient, low-probability investment style.

That’s why the simple, efficient, high-probability Bogle Model wins.

Further Reading:

How to Improve the Alternative Asset Management Industry

*The Vanguard portfolio is made up of the Total U.S. Stock Market Index Fund (40%), the Total International Stock Market Index Fund (20%) and the Total Bond Market Index Fund (40%). The total cost of this portfolio is a rounding error at around 0.07% in the ETF versions of these funds.