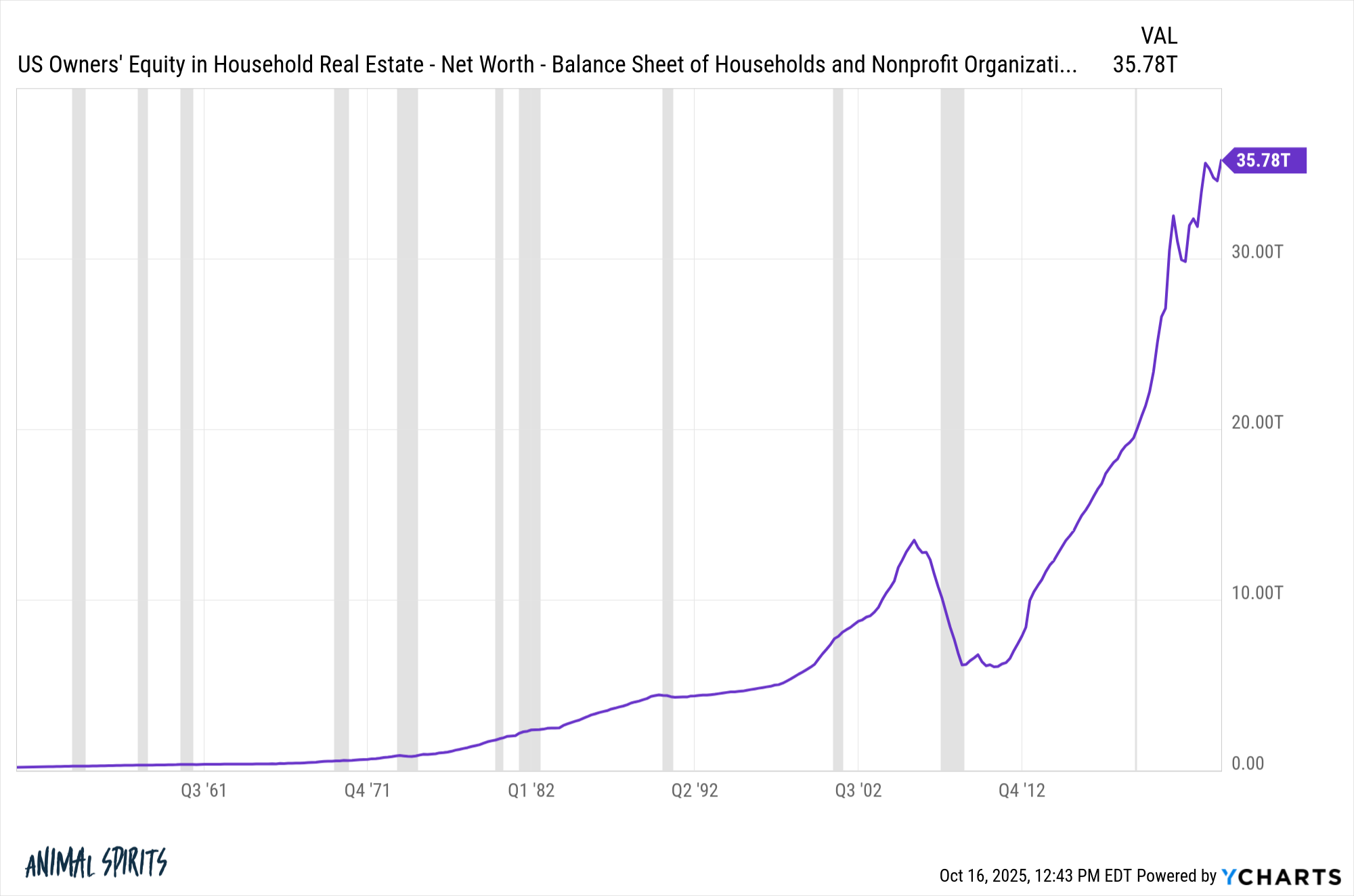

The amount of wealth created in the housing market this decade is staggering.

Home equity for all American homeowners has nearly doubled from $19.5 trillion at the end of 2019 to almost $36 trillion today. The $16 trillion gain in the past 6 years is more than the total amount of home equity heading into 2017.

The combination of a housing and stock market boom means U.S. households have never been richer than they are today. We’ve minted a lot of millionaires this cycle.

According to Bloomberg, there are now more than 24 million millionaire households in America which is around 1 in 5 households. One-third of this group has become a millionaire in the past 8 years.

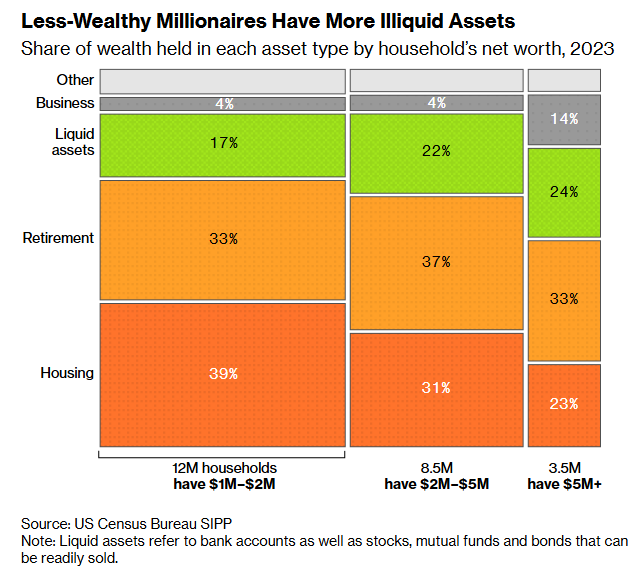

The problem is that most of that net worth is not liquid. Instead, it’s mostly tied up in a house or retirement accounts. Bloomberg explains:

Despite this relative affluence, today’s millionaires rarely have anywhere near $1 million to spend however they want. For the barely-millionaires, households with a net worth between $1 million and $2 million, the vast majority of that wealth is illiquid. They typically had 66% of their wealth tied up in a primary home and retirement accounts in 2023, an increase of eight percentage points since 2017.

To spend freely, millionaires typically need to be a lot richer. Households with $5 million or more had about 24% in easier-to-access bank or brokerage accounts in 2023, compared to 17% for those closer to the $1 million mark.

You have to move up the wealth scale a decent amount until the liquidity profile changes substantially, making your wealth easier to access.

Here’s the visual:

No one should feel sorry for these paper millionaires. This is a first world problem. A one-million-dollar net worth still puts you in the top 18% or so of U.S. households (and the top 1% worldwide). A million ain’t what it used to be but it’s still a large amount of wealth, relatively speaking.

The downside of being house-rich and having your portfolio essentially locked up in retirement accounts is that you might not feel very rich.

If you think about it, housing is one of the trickiest forms of wealth. It’s an illiquid asset. There are tons of frictions and fees involved when you buy or sell. There are ancillary costs.

It’s not easy to tap your equity either. Your options look like this:

- You could open up a home equity line of credit or do a cash-out refinance but that requires borrowing more money.

- You could use your equity as a down payment for a new home but that also means paying the now higher housing prices.

- You could sell your house to either downsize or become a renter but you’re always going to have to live somewhere.

- You could perform a reverse mortgage when you retire but that’s a complicated process.

- You could live somewhere else and rent out your home to provide some income but there are still a lot of costs and potential headaches involved in that process (and again you have to live somewhere).

Obviously, being house rich is much better than being house poor but you need to understand these dynamics when trying to build wealth. Building wealth in a house is easier than using it.

You can get your money out of retirement accounts early but that could require penalties and taxes. You have to be patient if you have an illiquid net worth. That’s the downside.

On the other hand, for most people, this is a good thing!

When you are essentially forced to hold financial assets for the long-term that’s how you build wealth. It allows for more compounding. It reduces the taxes, fees, and potential mistakes you might make from performing unnecessary transactions.

One of the biggest financial benefits of owning a home is the fact that it’s a form of forced savings. This is why a house is by far the biggest financial asset for most people in the middle class.

If you’re a millionaire who has the majority of your net worth tied up in your house or retirement accounts it might not feel like you’re very rich right now because you can’t really spend that wealth.

But this just means you’ll be wealthier in the future because you can’t spend that money now.

You’re incentivized to keep your money compounding in your home and tax-deferred retirement accounts.

This is a good thing for your future net worth.

Michael and I talked about the problems with being house rich and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

How to Make Money in Real Estate

Now here’s what I’ve been reading lately:

- Two useful AI tactics (Seth Godin)

- How is it possible for NYC’s median rent to be $1,600? (Maximum New York)

- 20 years! (Abnormal Returns)

- All the money and none of the satisfaction (Of Dollars & Data)

- You can go your own way (Irrelevant Investor)

- Why were there so many bearer bonds at Nakatomi Plaza? (Calm Down)

- A tribute to Diane Keaton (The Ringer)

Books: