A reader asks:

My RMD is 100% S&P 500. Do you have any strategies on taking distributions from the RMD? Should I take 1/12th of the RMD each month? Wait until the end of the year and take it all out hoping the value will increase over the year? Redeem during traditionally strong stock market months? What are your thoughts on this?

This is a good question because there are plenty of strategies for when to buy stocks, but people rarely discuss when or how to sell.

First things first, let’s talk about required minimum distributions.

Required Minimum Distribution (RMD) is the minimum amount that you must withdraw annually from certain retirement accounts — traditional IRA, 401k, SEP IRA, 403b, etc. — once you reach a specific age.

You must start taking RMDs by April 1st of the year after you turn 73 (if you were born before 1960) or 75 (if you were born 1960 or later).1 Those numbers have moved up in the past and probably will again in the future.

Why do they have RMDs?

The U.S. government wants those taxes you’ve been deferring.

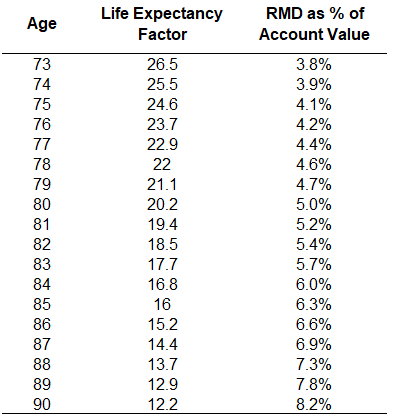

Now let’s look at how they are calculated:

Let’s say you have $1,000,000 in your 401k at age 75. You would have to take out a little more than $40,000 from your account.

OK that’s enough of a crash course in RMDs.

The real question is when should you sell?

Let’s invert this — when should you buy?

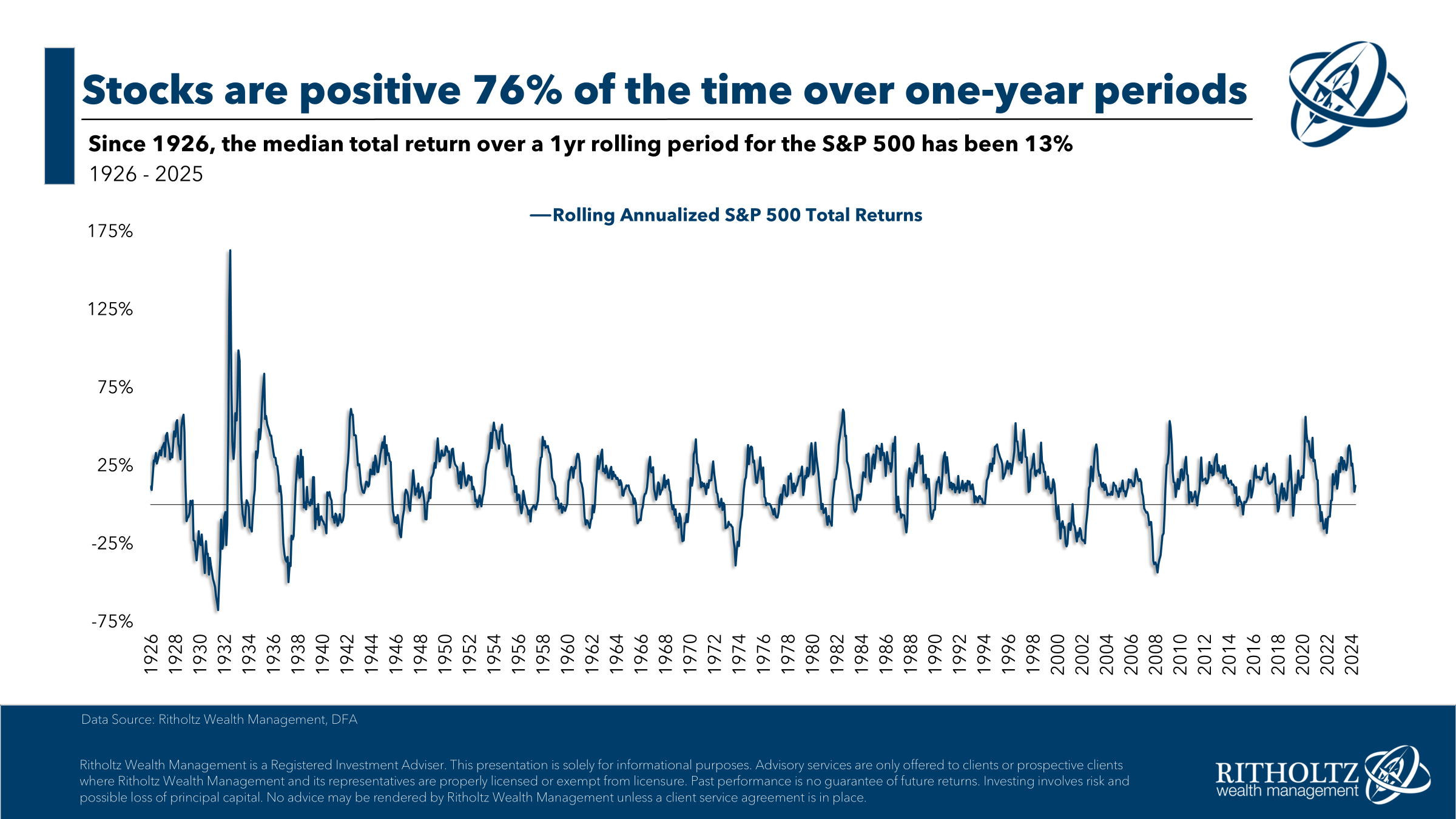

Well, the stock market usually goes up. I looked at all rolling 12-month periods using monthly returns going back to 1926:

The stock market was up 76% of the time on a one-year basis.

So if you have a pile of cash you’re sitting on, the probabilities would tell you that investing it in a lump sum is better than dollar cost averaging into the market.

Inverting this line of thinking would mean dollar cost averaging out or waiting for the last possible moment to sell would give better results than selling it all upfront.

The spreadsheet answer is that you should buy fast and sell slow to take advantage of the fact that the stock market usually goes up.

That’s what the math, spreadsheets, and market history tell you to do. However, some people cannot stomach the math for psychological reasons. This is why some investors dollar-cost average a pile of cash into the markets even when they know investing a lump sum is the better option.

Averaging in is a hedge against bad timing or bad luck, which is a totally reasonable sleep-at-night strategy.

If you pull out your entire distribution at the beginning, end, or middle of the year, you could run into bad timing or bad luck by selling in a drawdown. Most of the time, that won’t happen, but sometimes it will.

If you’re really worried about that scenario maybe selling once a month or once a quarter makes more sense.

I like the idea of selling at the very end of the year because it allows more growth potential. You’ll have all that cash ready to spend in the next year. Plus, one sale is a simpler strategy than selling multiple times a year.

I don’t think there really is a right or wrong answer here.

Whatever you decide to do I would advise you pick a strategy and then stick with it regardless of the short-term outcomes.

Don’t keep changing the intervals based on what you wish you had done because of the market’s behavior.

Set it, forget it and go enjoy your retirement.

I broke down this question in detail on this week’s Ask the Compound:

We also touched on questions from our audience about holding stocks in your emergency fund, the best way to pay for home renovations, how teachers should factor pensions into their retirement plans and some of my favorite fiction book series.

Email us if you have a question: AskTheCompoundShow@gmail.com

Further Reading:

Rebalancing with Required Minimum Distributions

1After that first one then you have until the end of the year to take them.