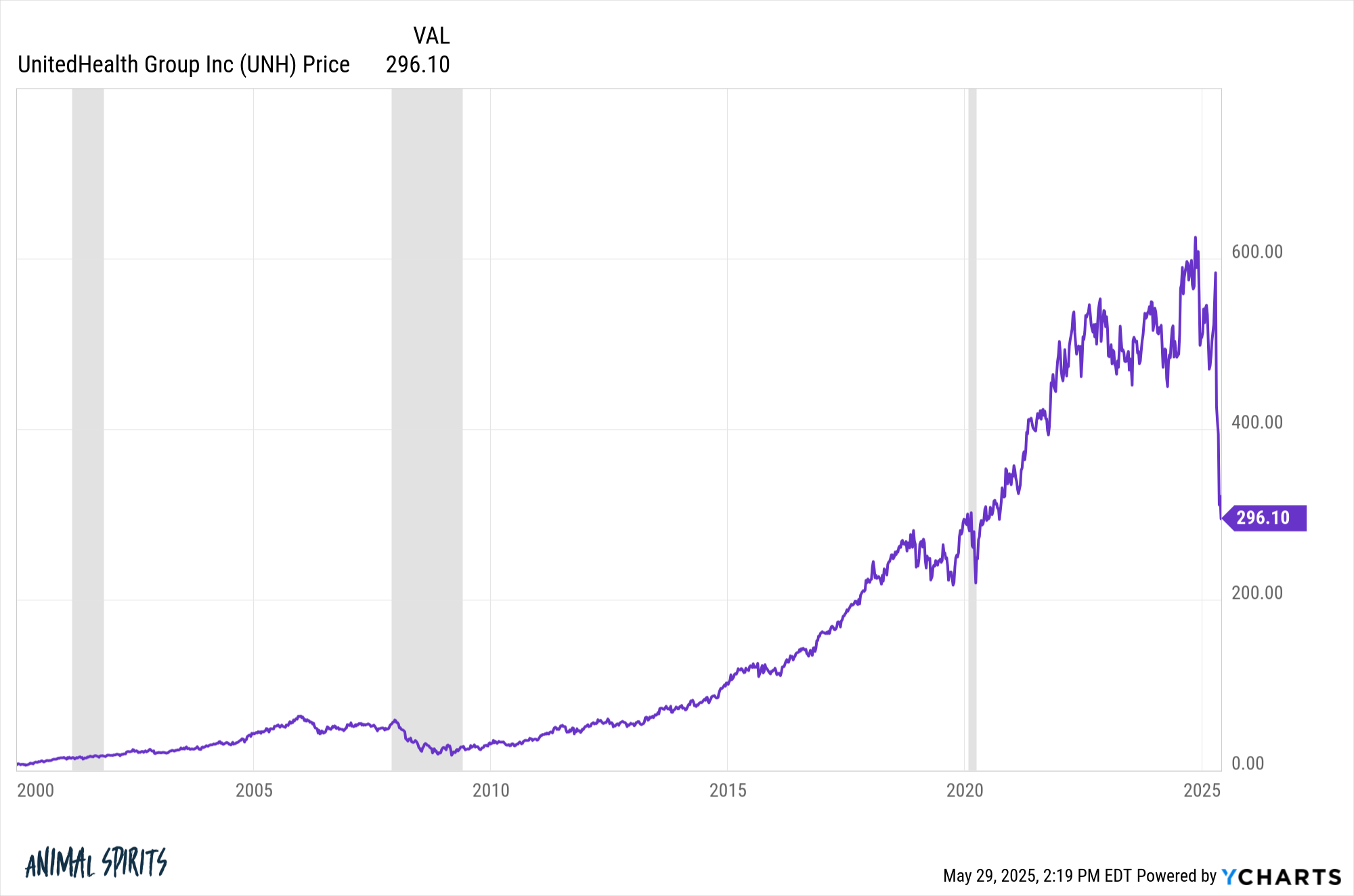

Coming into April, UnitedHealth was the second biggest stock in the Dow behind Goldman Sachs.1

The stock was performing well even during the Tariff Tantrum. While the stock market was down 15% on the year, UnitedHealth was up as much as 18% in mid-April.

Then it fell off a cliff, Wile E. Coyote-style. This long-term chart looks like a fat-finger mistake on a spreadsheet:

The stock is down a little more than 50% in a month, a massive crash in such a short period of time for a company that was worth nearly $600 billion.

The big question for investors who want to avoid catching a falling knife is this: Will it come back?

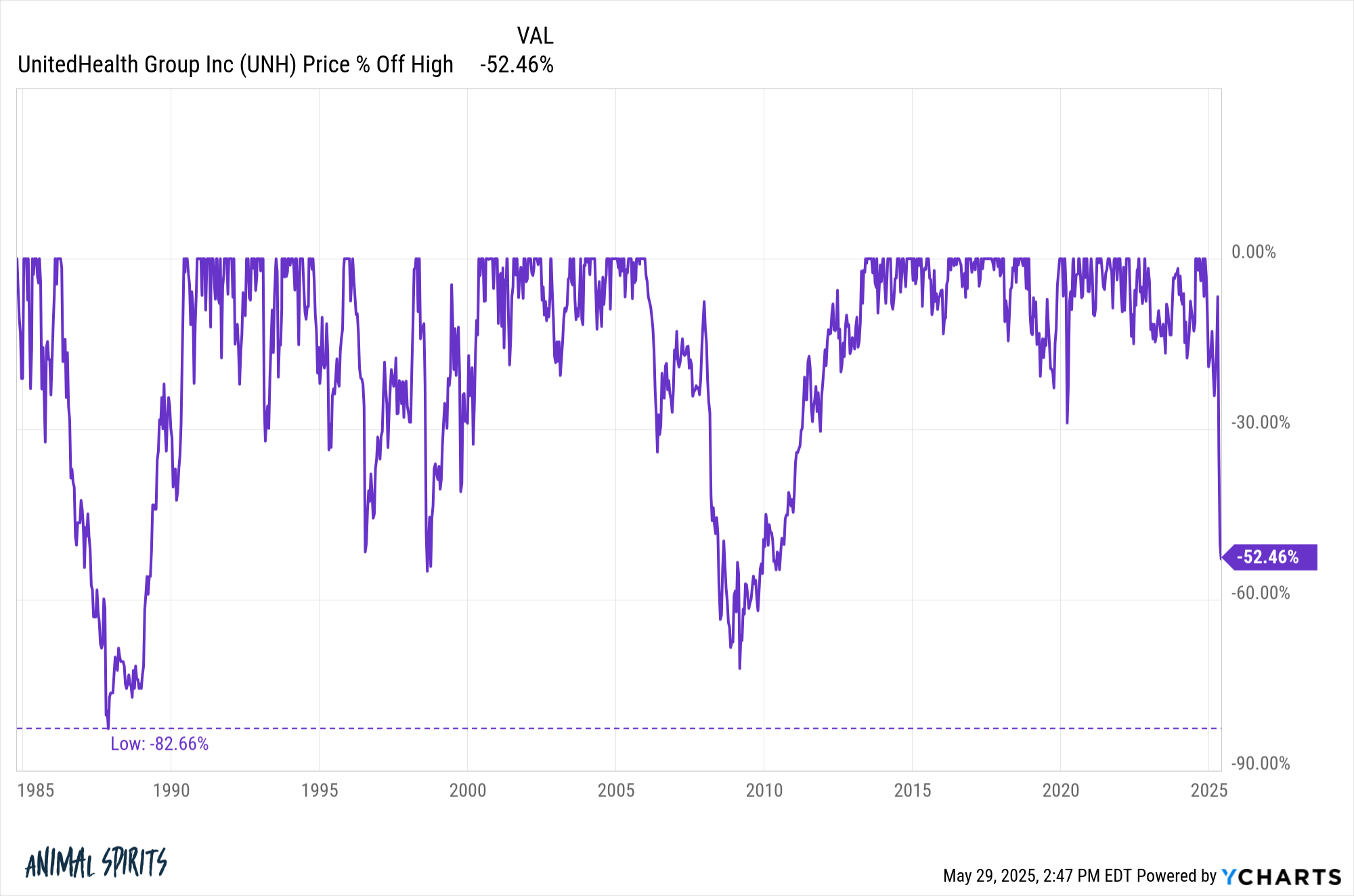

In its history the stock has experienced bigger drawdowns on three separate occasions:

It fell more than 80% in the 1980s, nearly 55% in the late-1990s and 72% during the Great Financial Crisis. Each time it came back.

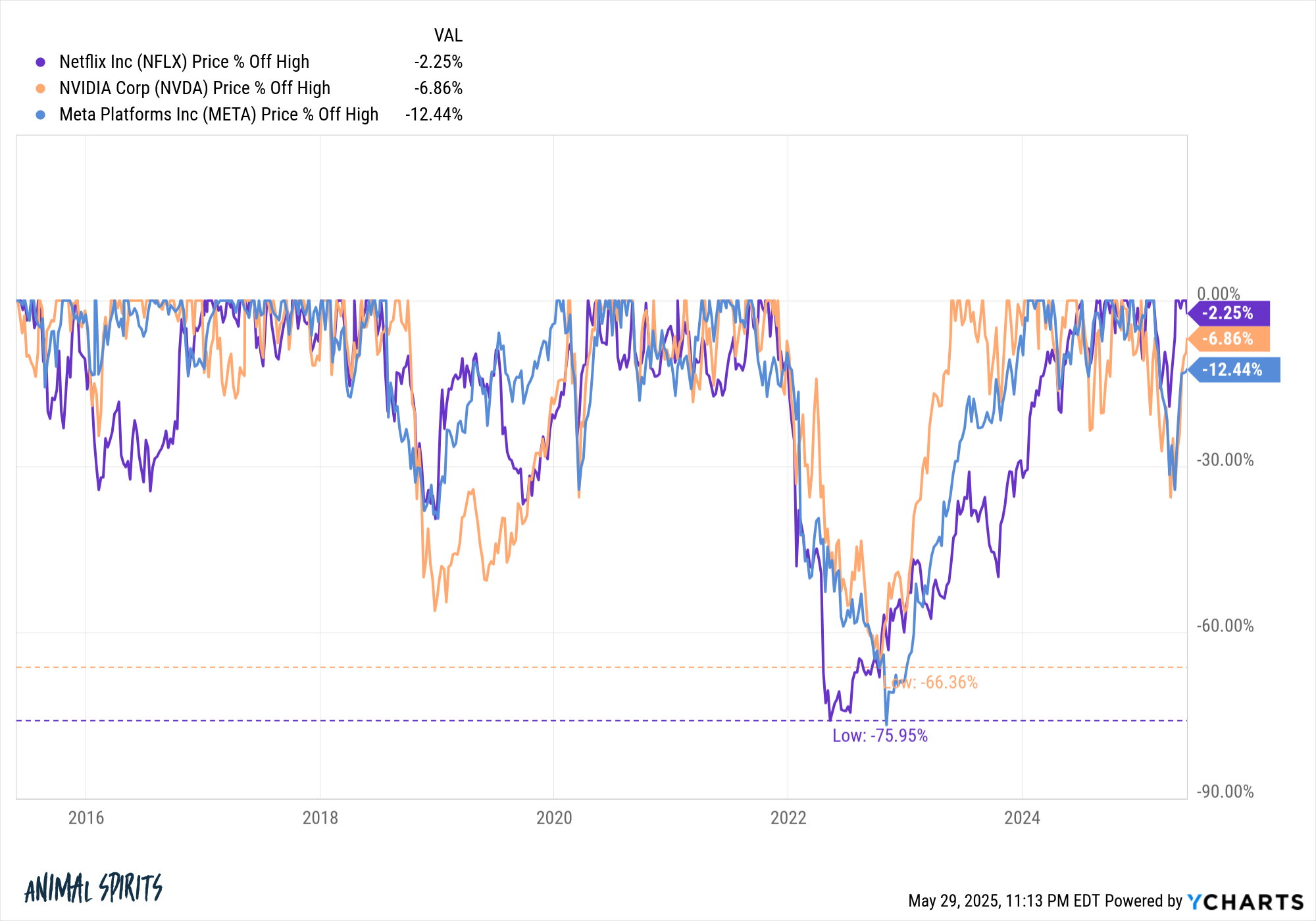

There are more recent examples of well-known companies going through gigantic drawdowns only to come roaring back:

Nvidia lost two-thirds of its value. Facebook and Netflix each fell 76% in recent years. These were fantastic buying opportunities in name-brand companies.

This is the dream for stockpickers.

However, many stocks do not come back from large drawdowns.

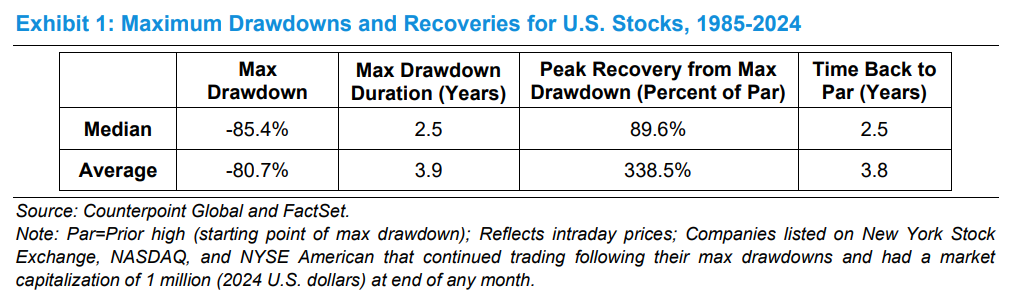

Michael Mauboussin has a new research piece about the drawdowns and recoveries of individual stocks. He looked at 6,500 stocks in a 40 year period from 1985-2024 and discovered the median drawdown was an astounding 85%:

54% of these stocks never managed to recover their previous peak. The reason the average recovery gain is so much bigger than the median is because a handful of stocks skew the numbers higher. The odds aren’t in your favor.

Well known companies like Citigroup:

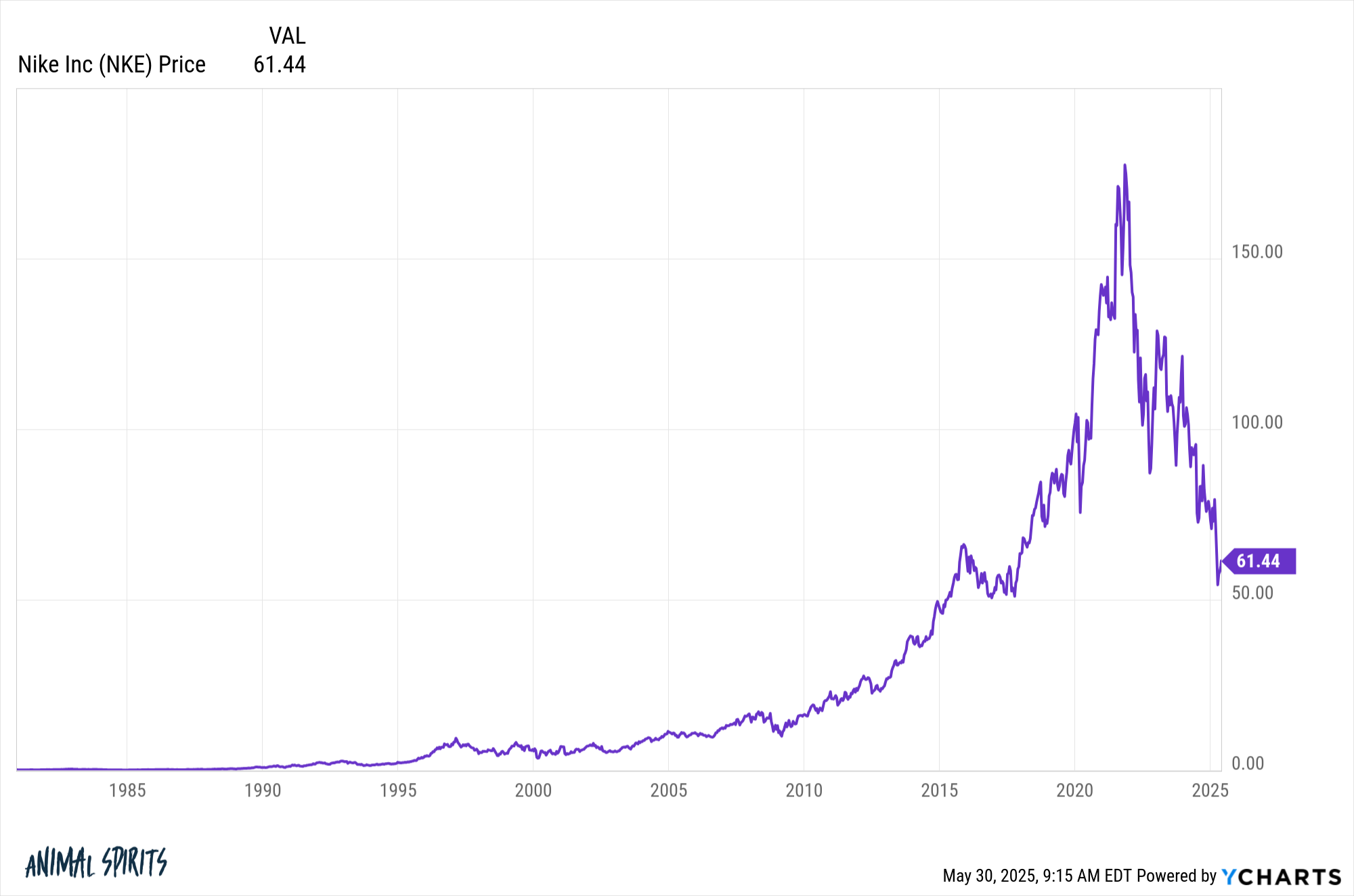

Nike:

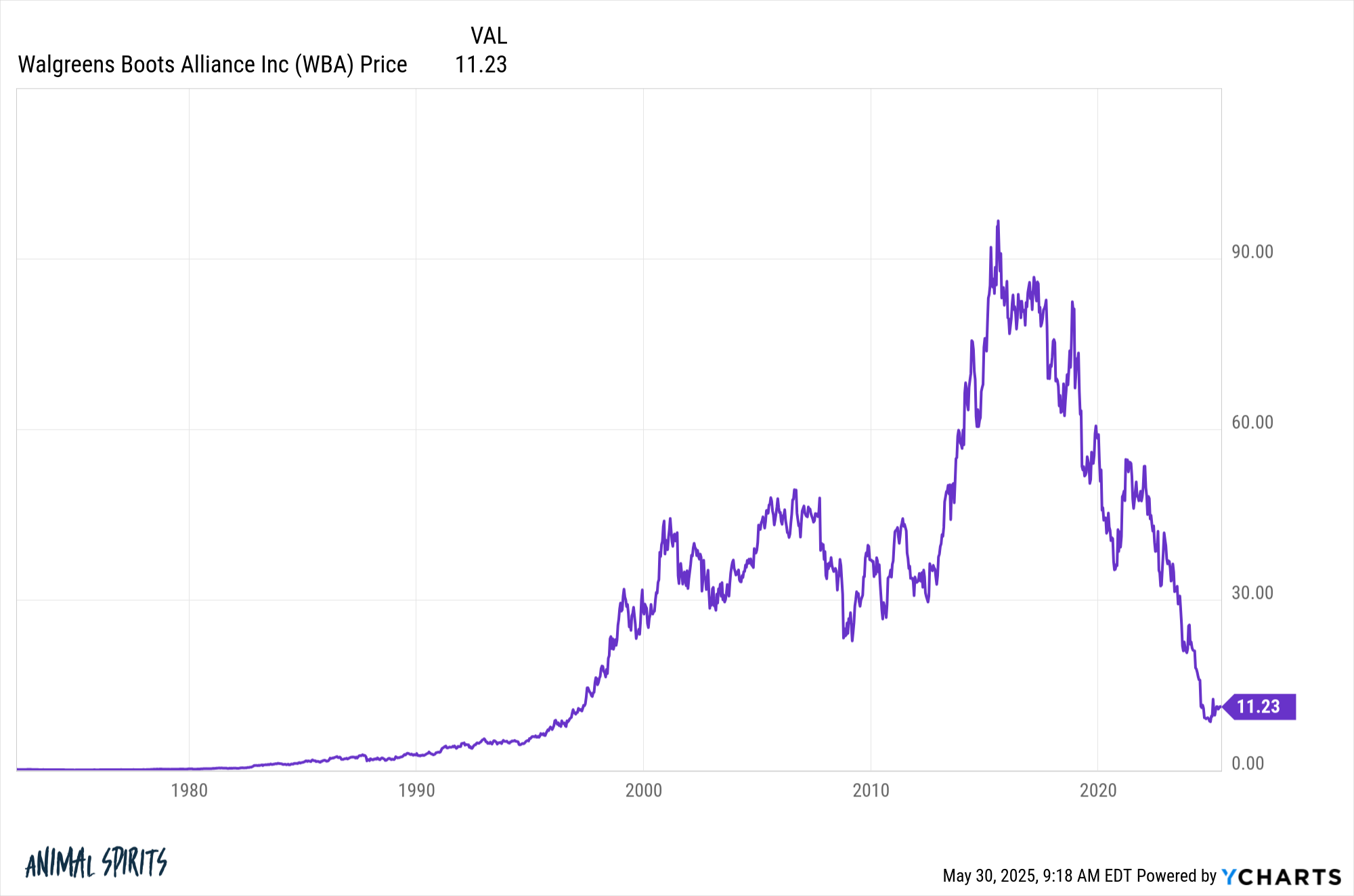

Walgreens:

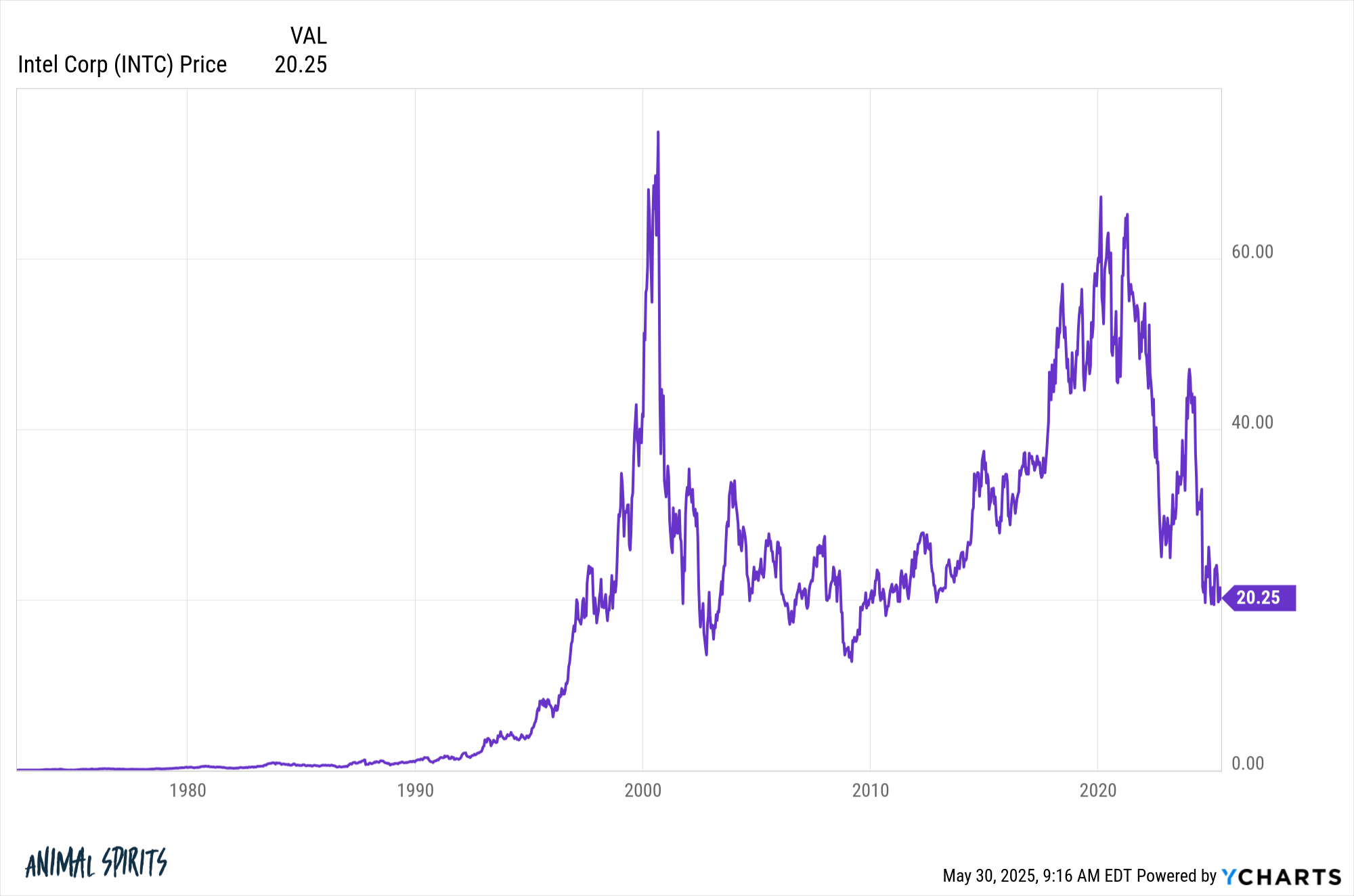

Intel:

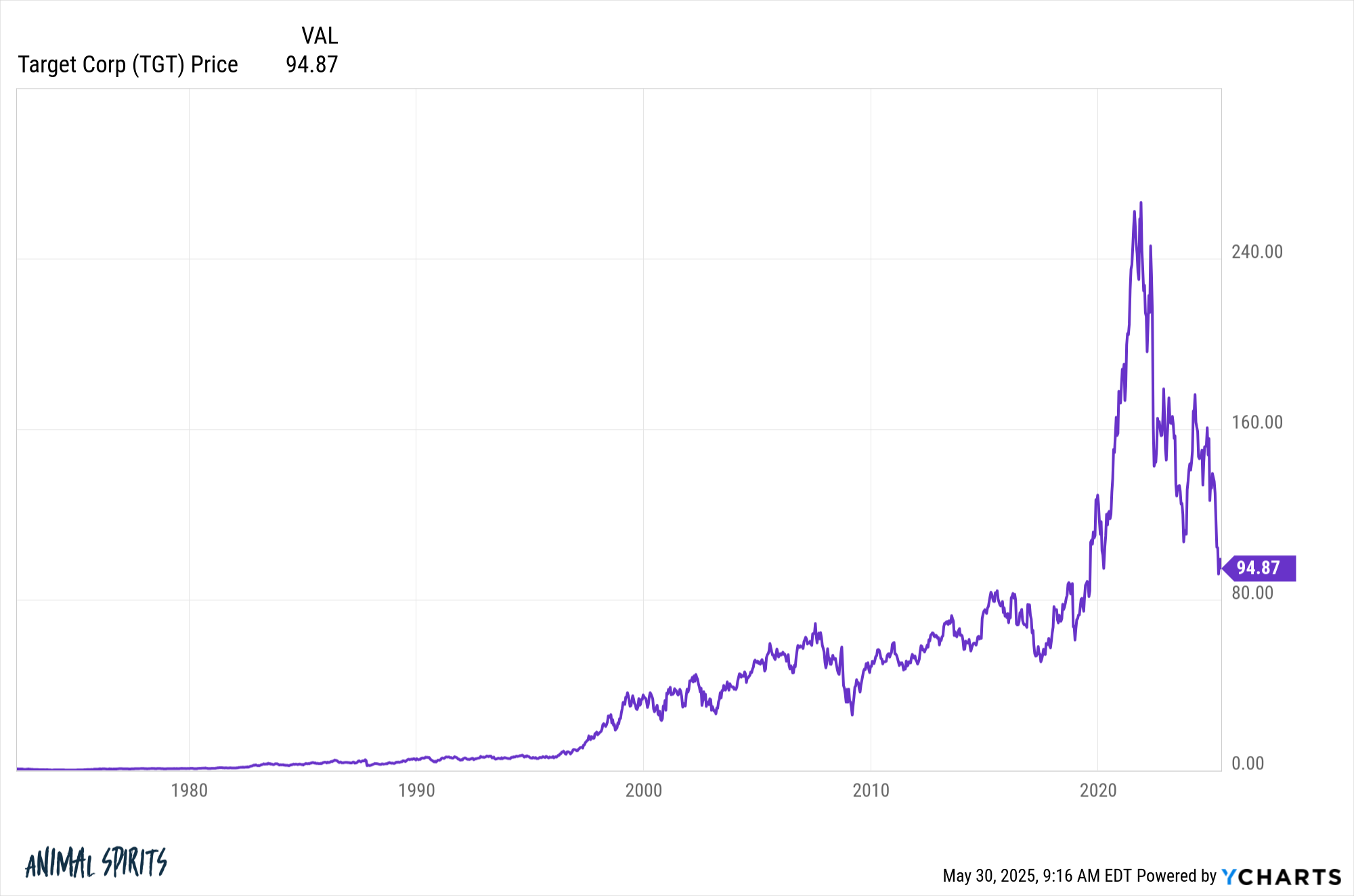

Target:

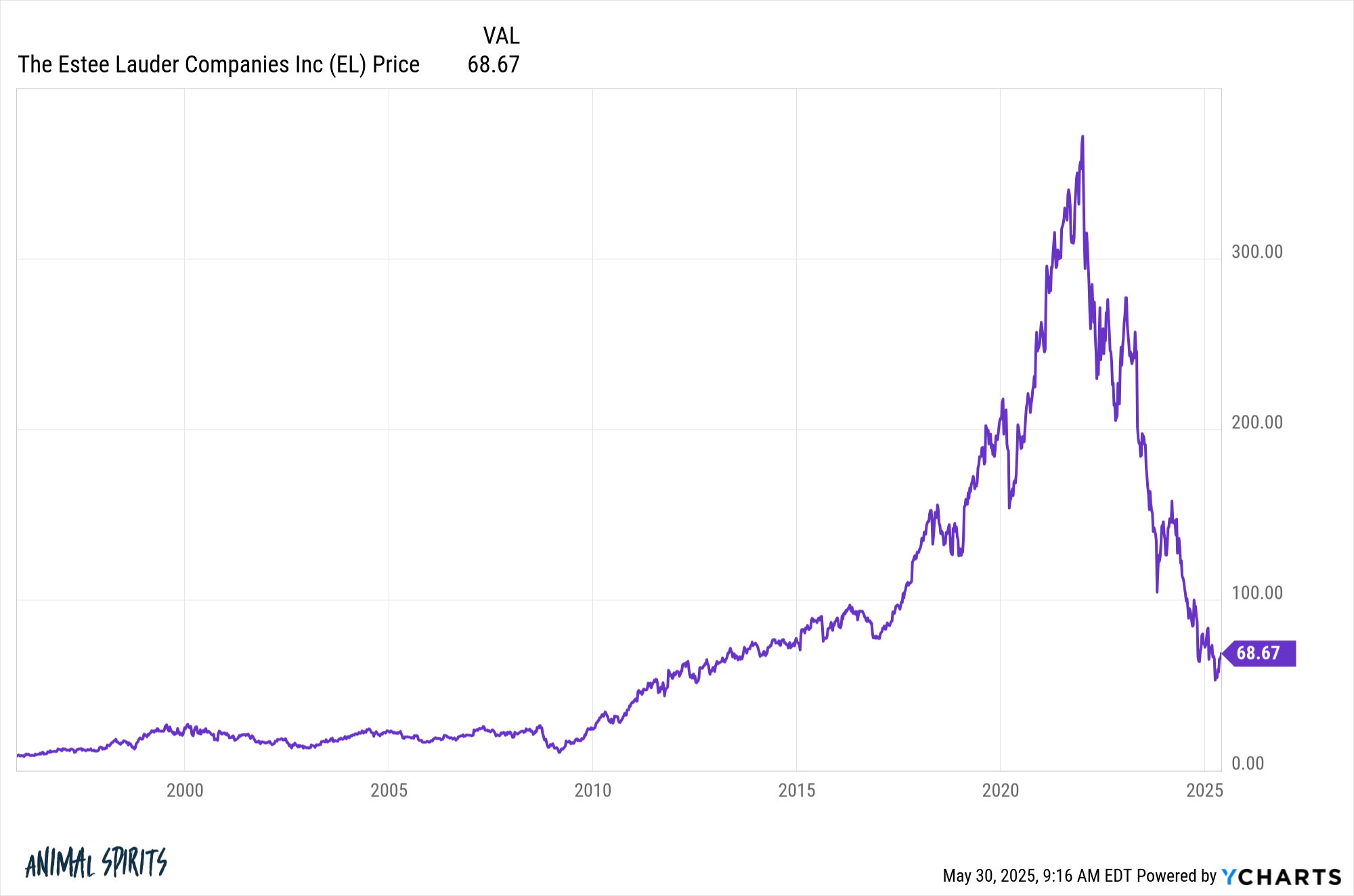

And Estee Lauder:

These companies are sitting on drawdowns of -87%, -65%, -88%, -73%, -64% and -82%, respectively.

Some have been in drawdowns from all-time highs for years. For some it’s been decades.

Being a contrarian can be a profitable strategy but there are some considerations if you plan on wading into the new lows list:

- You need to be patient.

- You need a plan beyond buying what’s gone down in price. Value matters too.

- You need a disciplined process that you are willing and able to follow no matter what the outcome is, because you’re never going to be able to time these things perfectly.

- Being a contrarian investor can be lonely and painful.

- Avoid anchoring to past price points. Stocks don’t have to trade back up to their previous highs just because they were there before. That past price level is meaningless if the fundamentals of the company or sector have changed.

- It’s easy to find things that are down in price but much more difficult to know if or when they will turn around.

- Trends can last much longer — in both directions — than most investors assume is possible. Emotions can cause prices to detach from fundamentals in a hurry and stay that way for a long time.

Obviously, no one actually buys at the top or the bottom. That’s a pipe dream. And you can still make money on stocks in a huge drawdown even if they don’t hit prior peak levels. This is just something to consider if you’re holding onto a stock that’s fallen drastically and waiting for it to break even.

It might not happen.

Some of these stocks will never rise to those heights ever again.

Michael and I talked about single stock drawdowns and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Stock Market Will Pick the Winners For You

Now here’s what I’ve been reading lately:

- The 2nd law of retirement (Kiplinger)

- Almost every financial decision requires judgment (Oblivious Investor)

- This is how they get you (Contessa Advisors)

- How bonds work (Of Dollars & Data)

- 5 mind-blowing market facts (OptimistiCallie)

- Exponential AI (Discipline Funds)

- Travel is no cure for the mind (More to That)

- An oral history of The Studio finale (The Ringer)

Books:

1Remember the Dow is a price-weighted index.