Today’s Animal Spirits is brought to you by Nuveen and YCharts:

See here for Nuveen’s alternatives solutions

See here for YCharts new risk profiles

Get a random Animal Spirits chart here

On today’s show, we discuss:

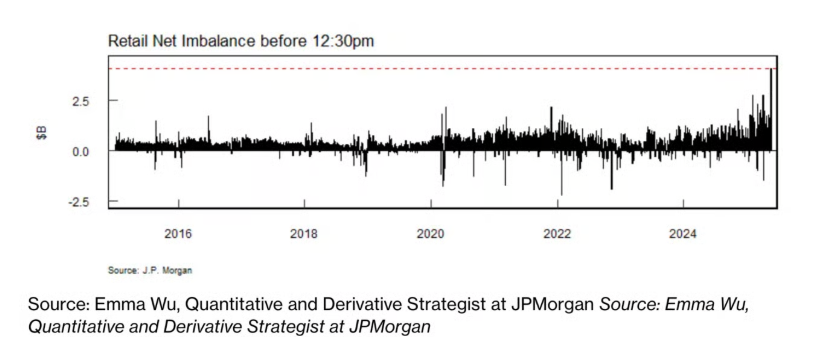

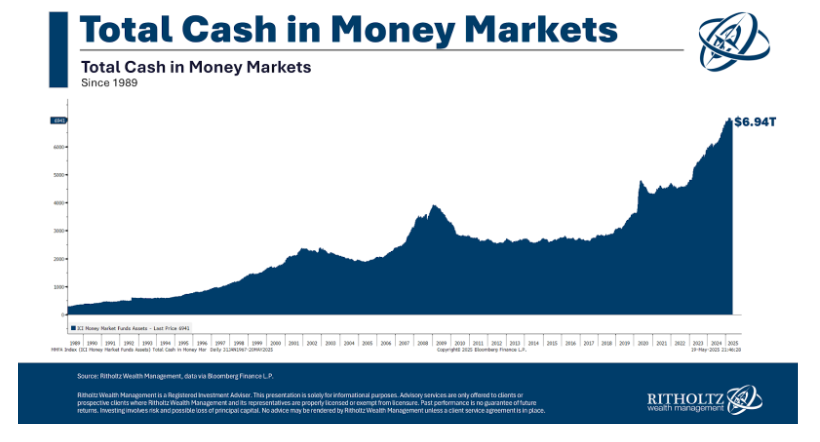

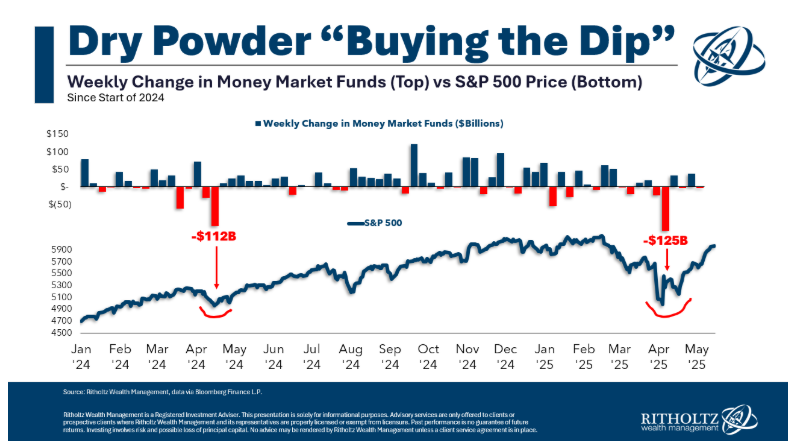

- Retail Traders Go on Record Dip Buying Spree, Calming a Jumpy Stock Market

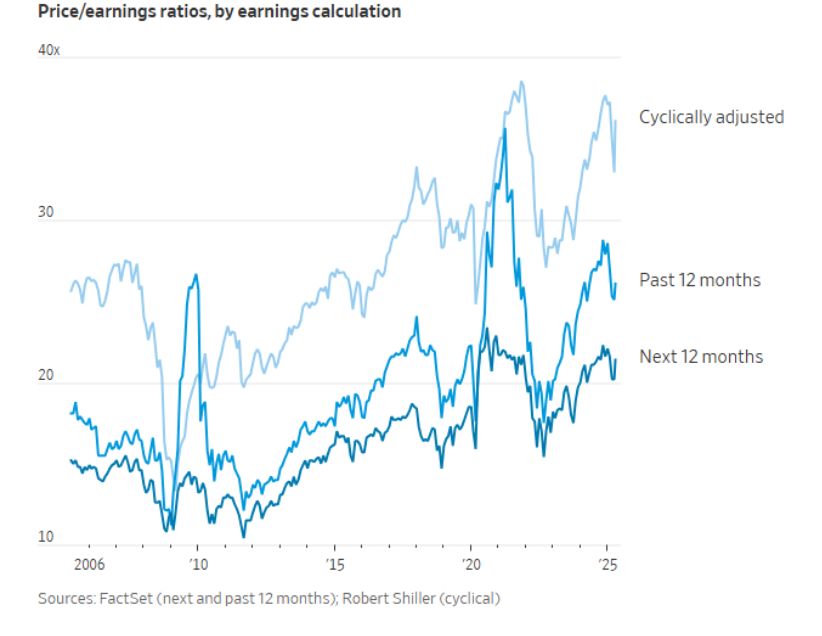

- Just How Expensive Are Stocks After All the Ups and Downs? We Check the Math.

- Steve Cohen says stocks could retest their April lows, sees a 45% chance of recession

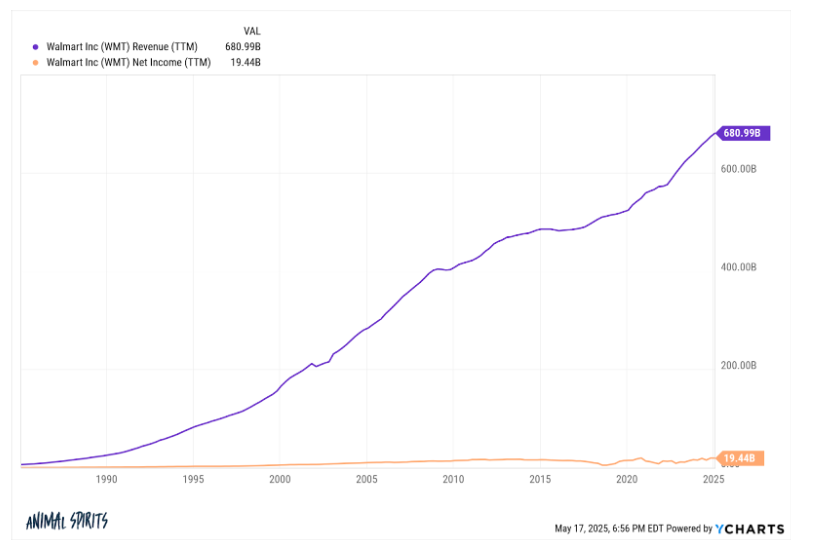

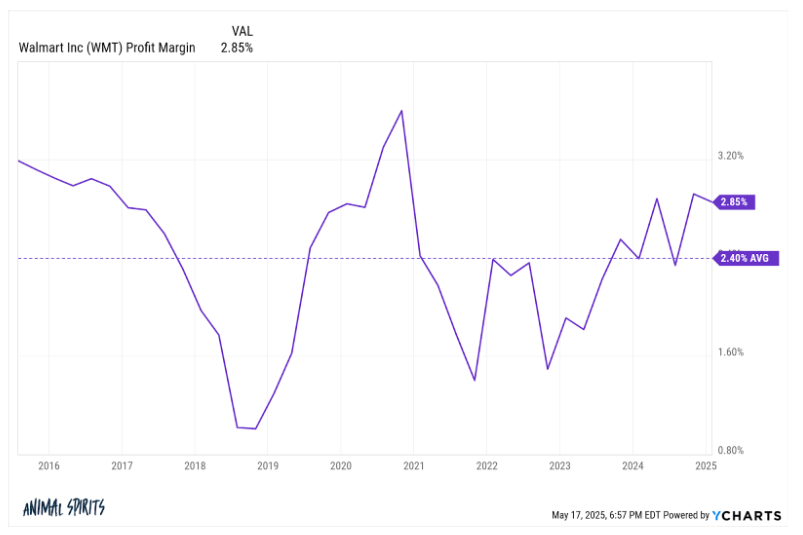

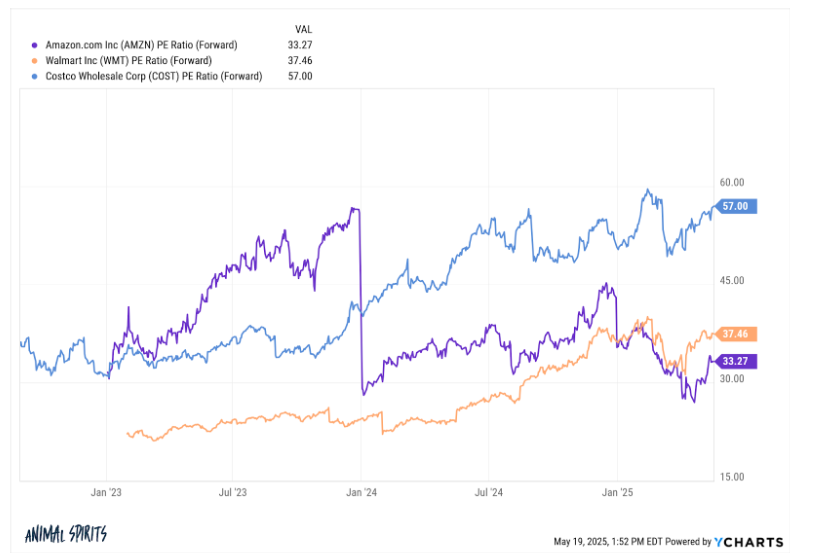

- Walmart CFO says price hikes from tariffs could start later this month, as retailer beats on earnings

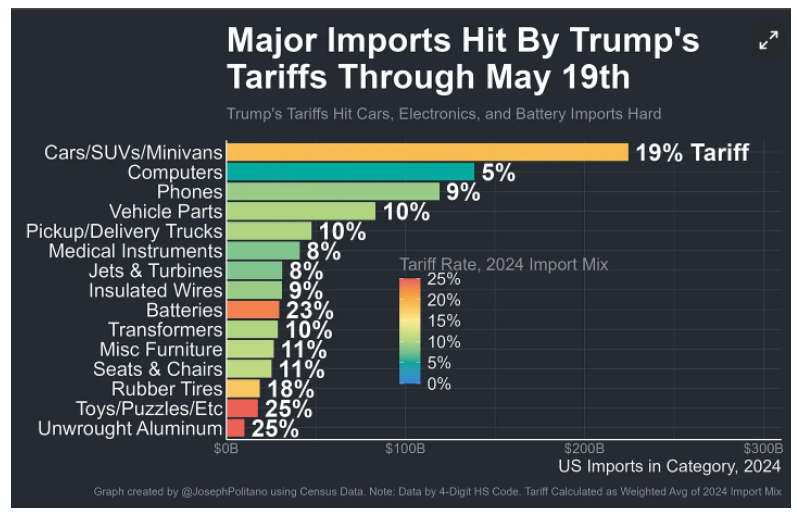

- Trump’s Retreat Still Leaves Tariffs at 90-Year Highs

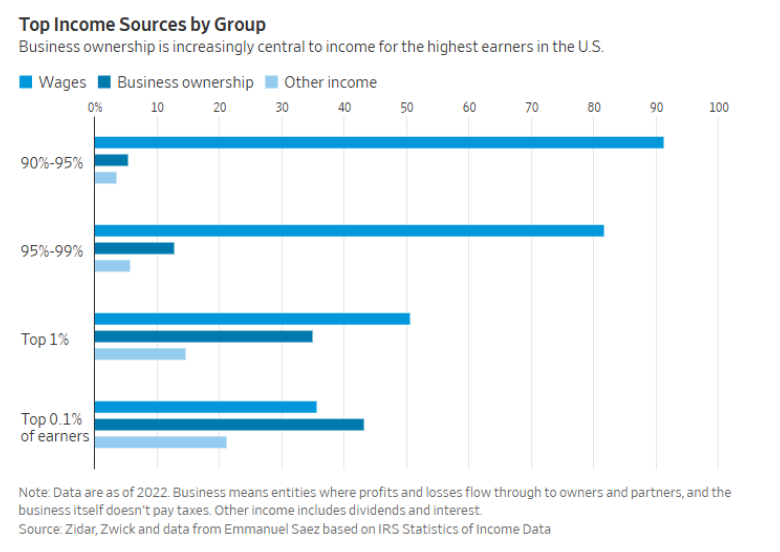

- Meet the ‘Stealthy Wealthy’ Who Make Their Money the Boring Way

- Takeout Used to Be a Convenience, Now It’s a Culture

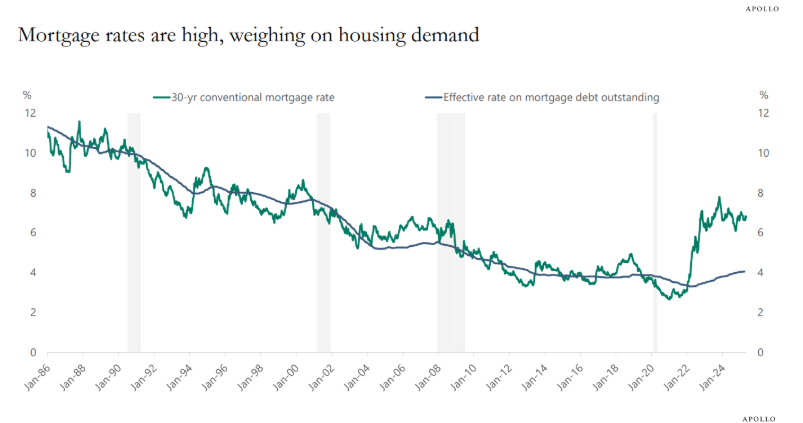

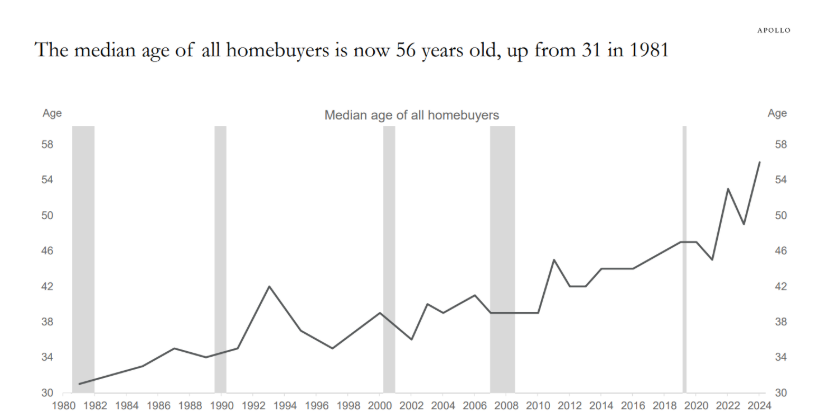

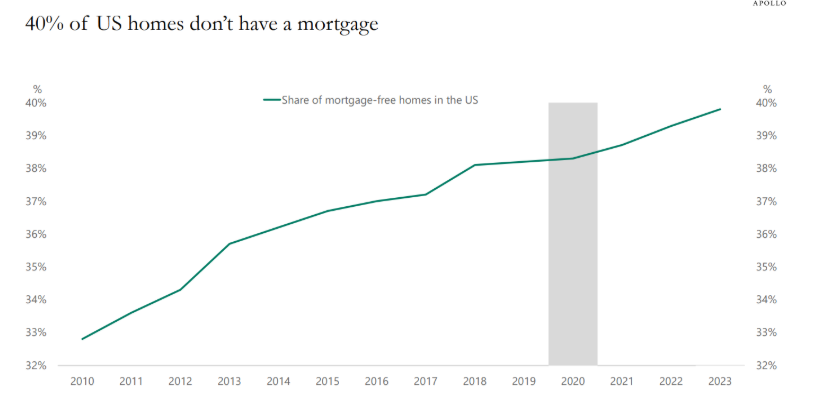

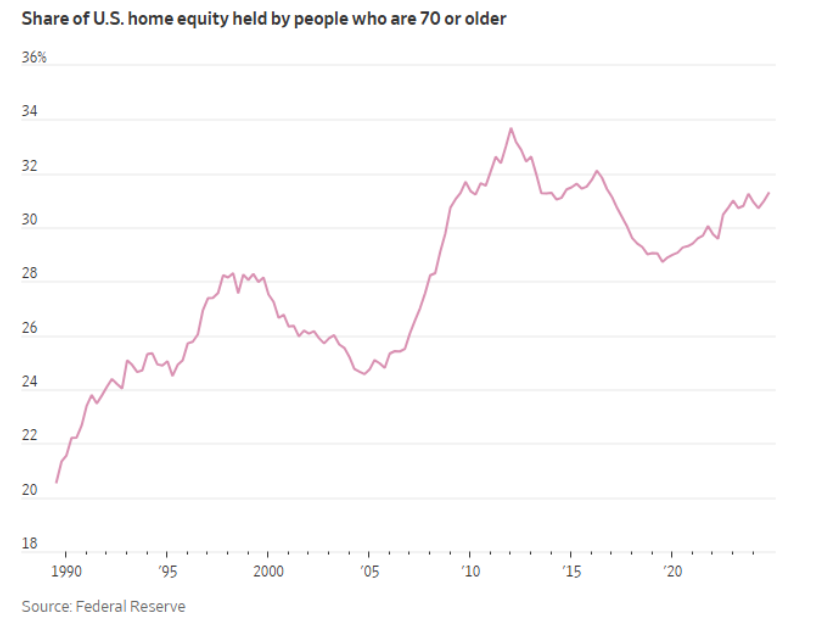

- US Housing Outlook

- When Leaving the House to Your Heirs Backfires

- Klarna’s losses widen after more consumers fail to repay loans

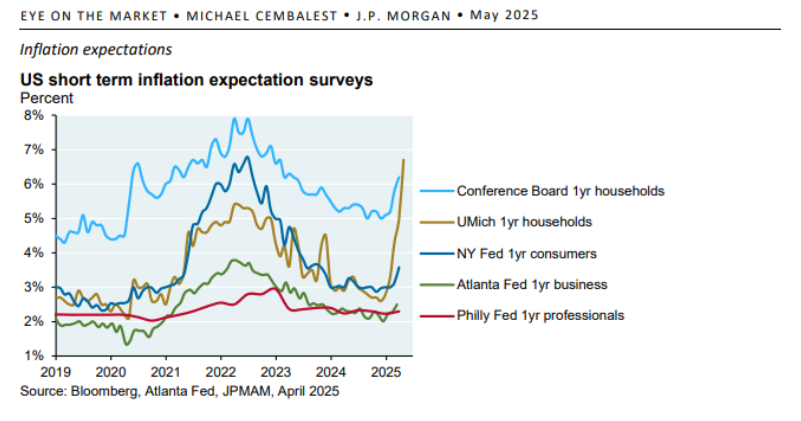

- Consumer sentiment slides to second-lowest on record as inflation expectations jump after tariffs

- Why Are So Many Retirees Filing for Social Security Earlier?

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

$VOO has now taken in $46b more than any other ETF, or nearly 400% more. A lead like this is unheard of. At this rate it will out-inflow everyone by $100b. This is Tiger Woods at the 2000 US Open basically.. pic.twitter.com/xrpB3StMKv

— Eric Balchunas (@EricBalchunas) May 19, 2025

Both SPY and QQQ are on track for perfect weeks.

Rising every day for an entire 5-day calendar week.

This doesn't happen during bear markets. pic.twitter.com/rw3pvhcJqk

— Jason Goepfert (@jasongoepfert) May 16, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product