Today’s Animal Spirits is brought to you by Betterment Advisor Solutions and KraneShares

See here for more information on Betterment’s Advisor Solutions

See here for more information on KraneShares covered call strategy

Get a random Animal Spirits chart here

On today’s show, we discuss:

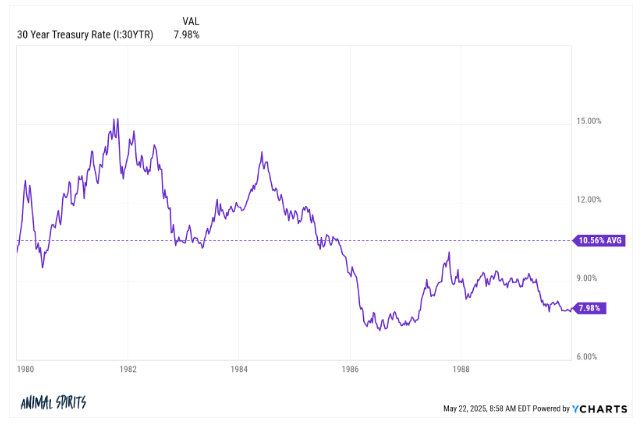

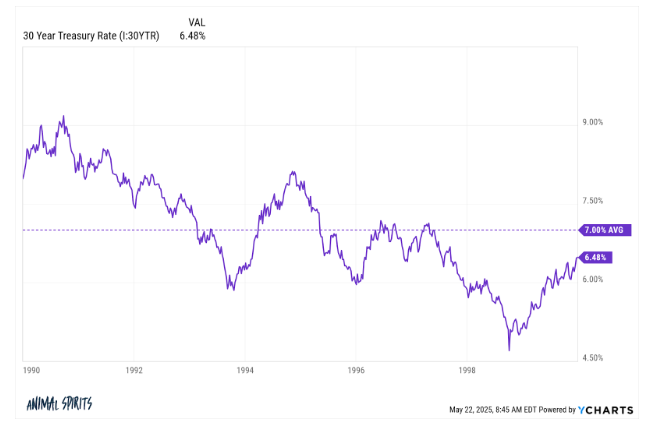

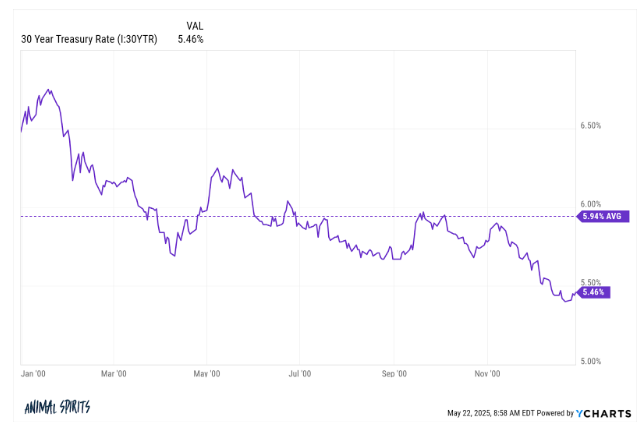

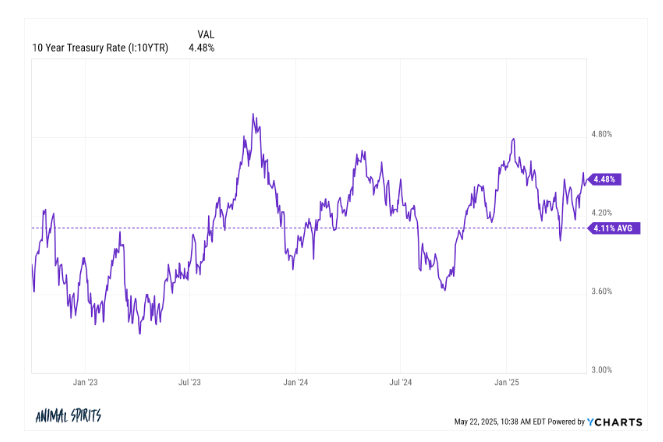

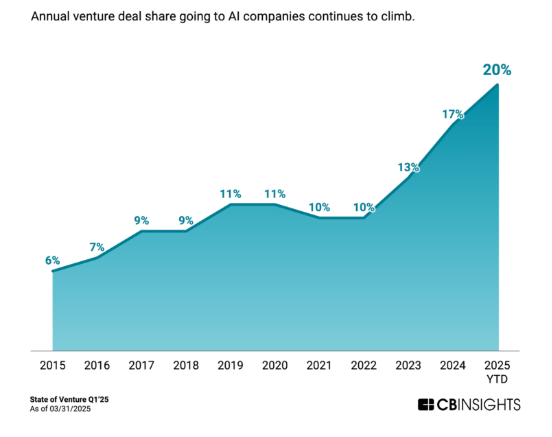

- This is What Normalization Looks Like (Mostly)

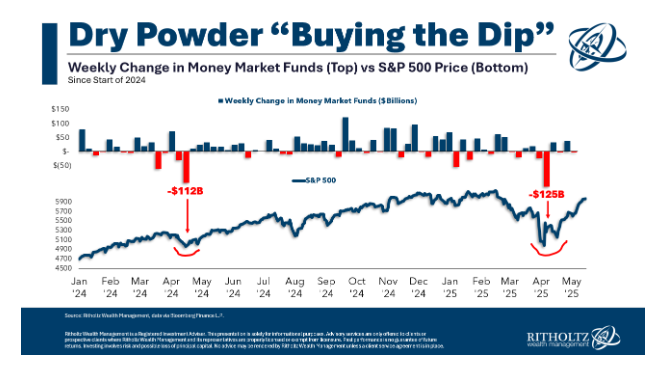

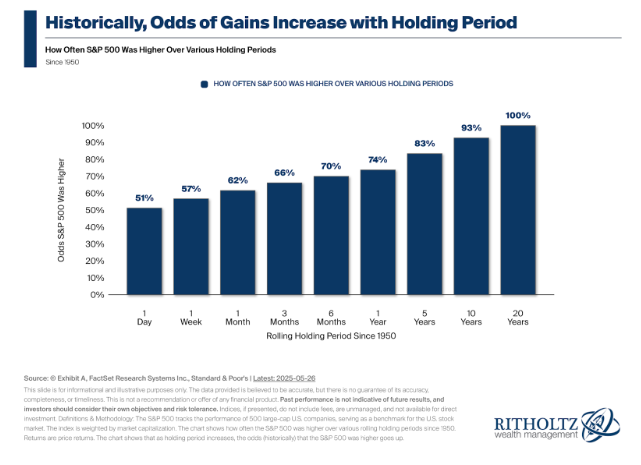

- The Gut-Wrenching Play in Investing Right Now: Buy and Hold

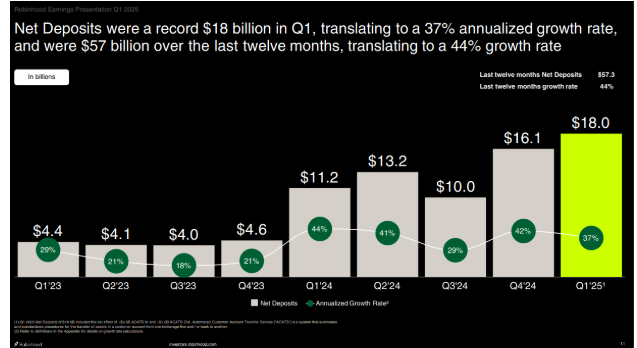

- Is Retail the Smart Money Now?

- The Jaw-Dropping Cost of a Hamptons Girls’ Weekend

- ‘It’s a Weird Time to Be Rich Right Now’

- Does College Still Have a Purpose in the Age of ChatGPT?

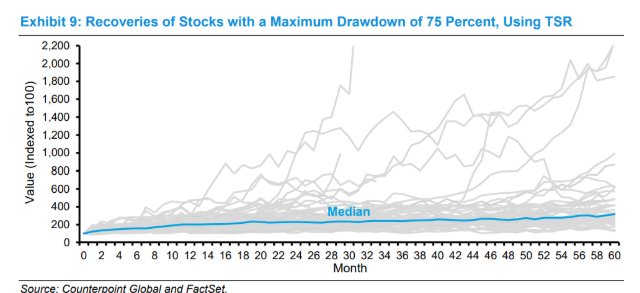

- Drawdowns and Recoveries

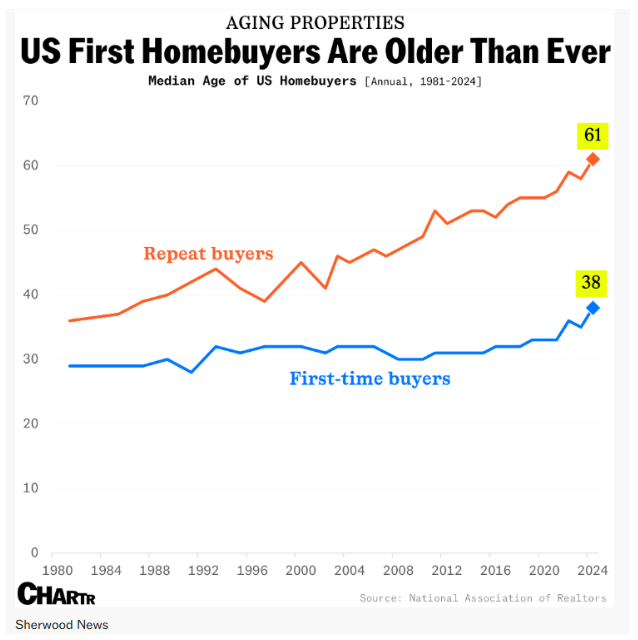

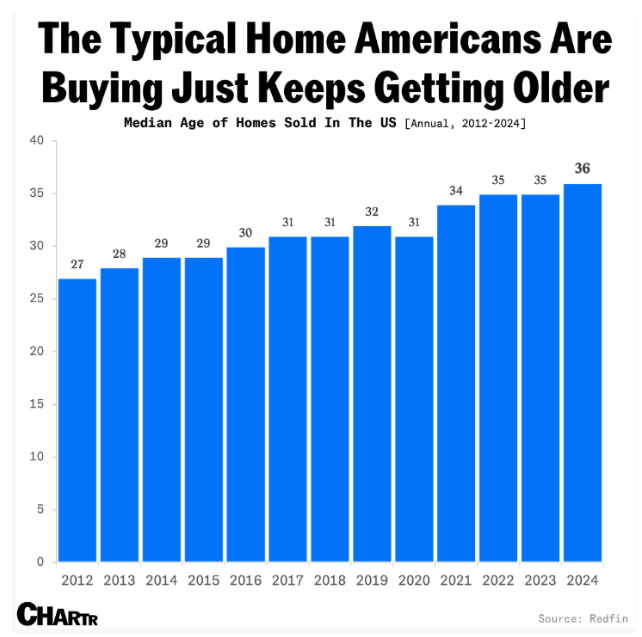

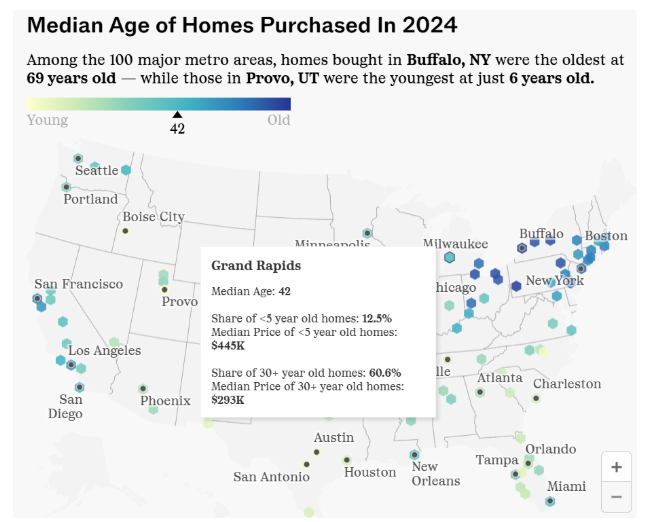

- America’s homes, and the people who buy them, are getting older

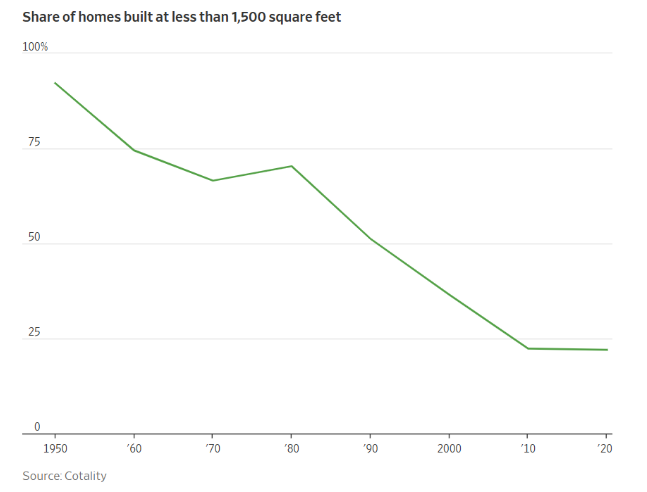

- American Homes Are Shrinking. Why Are They Still So Unaffordable?

- Private equity founder warns retail investors risk being saddled with worst assets

- Some Things I’ll Never Spend Money On

- Weekend reading: You will probably die old. That’s a good thing.

- ‘Lilo & Stitch,’ ‘Mission: Impossible’ Deliver Memorial Day Box-Office Record

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

JUST IN 🚨: Japan's 40-year bond yield hits 3.63, an all-time high 👀 pic.twitter.com/BQ40PDCSH9

— Barchart (@Barchart) May 22, 2025

Existing homes. Slowest sales pace for any April since 2009. 🇺🇸 @gregdaco.bsky.social

— Carl Quintanilla (@carlquintanilla.bsky.social) 2025-05-22T15:28:55.763Z

Today 87% of US companies with >$100M in revenue are private, while 13% are public. The growth of private market investing over the years (source: Morgan Stanley research): pic.twitter.com/LO2iYk3572

— Jeff Richards (@jrichlive) May 26, 2025

Netflix’s share of TV viewing is flat from a year ago.

YouTube grew by 3%, more than every other streamer combined. pic.twitter.com/JcKTVFUTxa

— Lucas Shaw (@Lucas_Shaw) May 20, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product