I first read The Millionaire Next Door a year or so into my first job.

I didn’t know a thing about what it takes to get wealthy so the book was eye-opening for me as a 20-something trying to figure out my career and finances.

The general thesis of the book is that the prototypical millionaire is not what you think.

They live below their means, prioritize saving over spending, don’t spend frivolously on luxuries, budget their money, think long-term and save/invest something like 20% of their income. The millionaires next door are disciplined with their money, are more likely to drive a Ford than a Bentley and avoid status symbols.

Half of them lived in the same house for more than 20 years and 80% of them were first generation affluent.

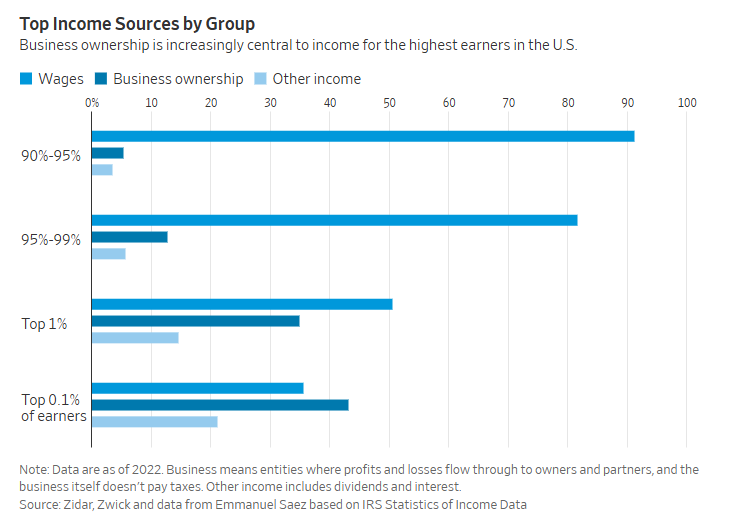

The one thing that really stuck out to me at the time was that most millionaires are self-employed or own a business. In fact, self-employed people make up less than 20% of the workers in America but account for nearly two-thirds of the millionaires.1

And it’s not flashy, high-tech companies. The two-comma club mostly owns and operates unglamorous yet steady, profitable businesses.

The book was originally published back in 1996.

Is it still true today?

When it comes to business ownership, yes.

The Wall Street Journal has a profile of the stealthy wealthy (aka the millionaire next door):

The largest source of income for the 1% highest earners in the U.S. isn’t being a partner at an investment bank or launching a one-in-a-million tech startup. It is owning a medium-size regional business. Many of them are distinctly boring and extremely lucrative, like auto dealerships, beverage distributors, grocery stores, dental practices and law firms, according to Zidar and Zwick.

Here’s the breakdown among the top 10%:

This group is also growing:

Their analysis of anonymized tax data from 2000 through 2022 suggests the importance of such business ownership to the U.S. economy has grown. The share of income that ownership generates has increased to 34.9% in 2022 from 30.3% in 2014 for the top 1% earners.

The number of such business owners worth $10 million or more, adjusted for inflation, has more than doubled since 2001, to 1.6 million as of 2022.

This may seem like a pipe dream to a lot of people. Starting a business is hard. It’s risky. There are no guarantees it will work.

The best way to supercharge your wealth is to own equity. If you do so in a business you own or work at, that certainly helps. The next best thing is to own equity in publicly traded stocks.

The good news is that it’s never been easier to invest in the stock market. When The Millionaire Next Door was originally released, the authors noted that fewer than 25% of households owned stocks or mutual funds. Today, it’s more like 60%. That’s progress.

In the book, Thomas Stanley and William Danko lay out seven common denominators among people who successfully build wealth:

The world looks much different than when this book was first released. People probably spend more money than they used to, even the millionaire next door types. But building wealth still takes discipline, sacrifice and hard work.

I don’t see those attributes ever changing.

Further Reading:

Your Household CFO

1Another stat I highlighted is that millionaires tended to live in neighborhoods comprised mostly of non-millionaires, who outnumbered them 3-to-1.