Some thoughts and questions on what’s been happening in the markets of late:

The market still has veto power. Seeing bond yields scream higher Tuesday night was the first time I got nervous about the possibility of a financial crisis:

The bond market is probably what spooked the White House into the 90-day pause on tariffs. The New York Times said as much:

The economic turmoil, particularly a rapid rise in government bond yields, caused Mr. Trump to blink on Wednesday afternoon and pause his “reciprocal” tariffs for most countries for the next 90 days, according to four people with direct knowledge of the president’s decision.

The selling of bonds was probably some overleveraged investors, people raising cash and foreign governments hitting the sell button.

Regardless of the reason, the prospect of a falling stock market mixed with rising bond yields, slowing economic growth and higher inflation was enough to force a pause in tariff policy.

The bond market forced Trump’s hand for the time being.

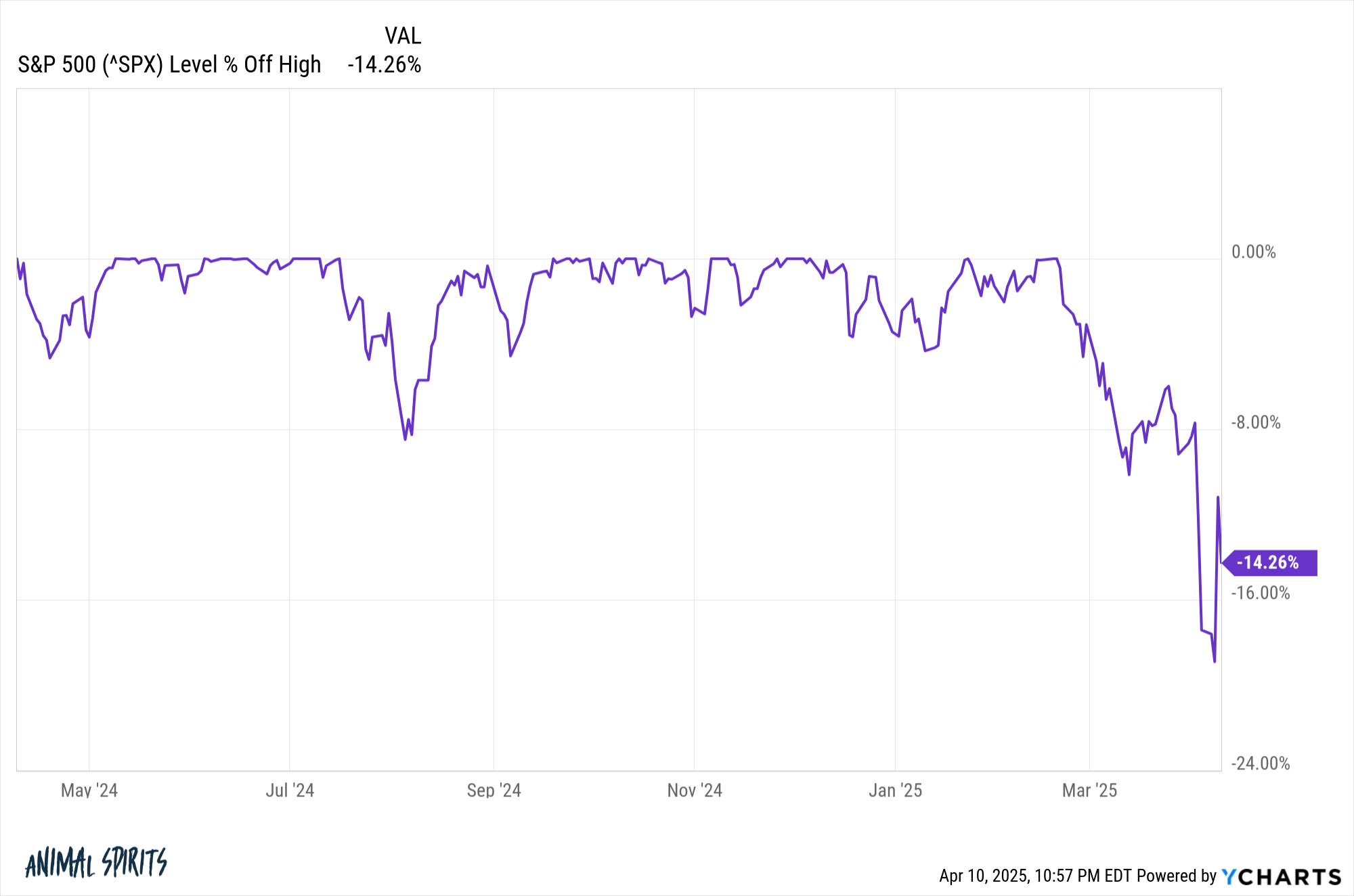

The stock market is re-pricing immediately. In the last six trading days the S&P 500 has experienced daily moves of -4.8%, -6.0%, +9.5% and -3.5%%.

The re-pricing is happening on the fly with little notice.

We went from one of the worst 3-day runs ever to one of the best days ever in less than a week followed by another big down day.

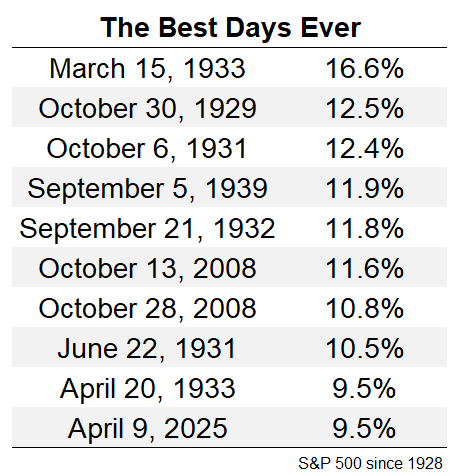

According to my data, Wednesday’s giant move higher was the tenth-best day ever for the S&P 500 going back to 1928:

It didn’t last.

Just look at this back-and-forth action:

The market is moving faster all the time and shows no signs of slowing down.

We might go into a recession. This comes from The Wall Street Journal:

Trump played his cards close to his vest. He told advisers that he was willing to take “pain,” a person who spoke to him on Monday said. He privately acknowledged that his trade policy could trigger a recession but said he wanted to be sure it didn’t cause a depression, according to people familiar with the conversations.

I never thought we would see a president push us into a recession on purpose but it sounds like he’s seriously considering it. Hopefully we get some deals and details so companies and the market can move on.

But it sure seems like the probability of a recession is rising by the day.

Could this be another forgotten bear market? Let’s think through the other side of further stock market pain — what if that was the bottom?

The stock market was briefly down more than 20% in the futures market on Sunday night but the closing low so far is a peak-to-trough drawdown of 18.9%.

We didn’t technically get to the 20% bear market definition. There have been plenty of close calls over the years:

- 1976-1978: -19.4%

- 1990: -19.9%

- 1998: -19.3%

- 2011: -19.4%

- 2018: -19.8%

Is there really a difference between down 19% and down 20%?

Only in the eyes of the history books.

The stock market is not always the right scoreboard. This picture of Jim Cramer made the rounds on social media in April 2020:

The economy was crashing and millions of people were losing their jobs but the stock market was flying.

People couldn’t believe the stock market was going nuts while the economy was in a state of suspended animation. It didn’t seem fair but the stock market is forward-looking (and it was right back then).

It’s possible we could see a similar dynamic play out this time around. Businesses and consumers have yet to feel the effects of tariffs.

I don’t know if we’re going into a recession but let’s pretend we are for scenario planning purposes.

We could be setting up for a situation where the stock market crashes before we even begin to sniff the actual recession. And if we do get a recession (still an if) you could see the stock market rising while the economy stalls out.

We could see some head-scratching outcomes in the months and years ahead.

Therefore it makes more sense to pay attention to the impact on inflation, economic growth, interest rates and the unemployment rate as we move forward.

We’re not out of the woods yet. One good day in the stock market wasn’t the end of this ordeal.

The dollar keeps falling. Bond yields keep surging. Stocks are falling again around the globe. Tariffs are still as high as they’ve been in decades the way plans are currently constructed.

I don’t know how this will play out. Maybe Trump will keep his onerous tariffs and the global economy will have to adapt. Maybe markets keep punishing his policies and he taps out completely.

My only line of thinking right now is the range of outcomes has increased substantially in the past month or so.

Never a dull moment in the 2020s…

Michael and I talked about all of the market craziness on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode (I don’t – I recorded this one on Spring Break).

Further Reading:

A Short History of Tariffs

Now here’s what I’ve been reading lately:

- Why tariffs are bad (Discipline Funds)

- When uncertainty reigns (Bull & Baird)

- What to do in chaotic markets (Morningstar)

- American disruption (Stratechery)

- All of the tariff arguments (Noahpinion)