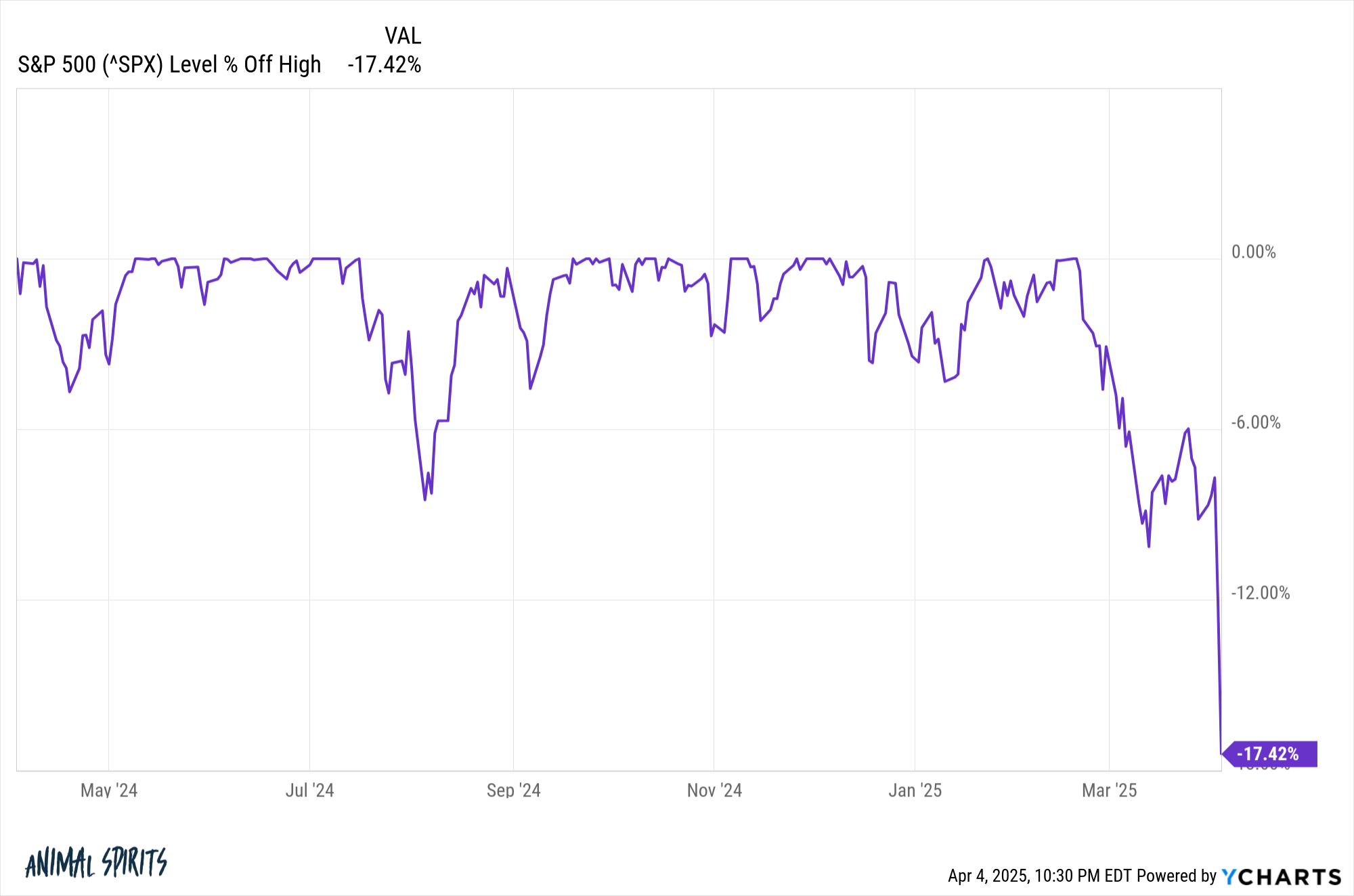

The S&P 500 is approaching bear market territory and it happened in a hurry:

This drawdown profile doesn’t even look real. It looks like an intern fat-fingered the wrong number on the spreadsheet.

The speed and ferocity of this downturn is a good reminder that risk can happen fast. The stock market lost nearly 11% in just two days. Woosh…gone.

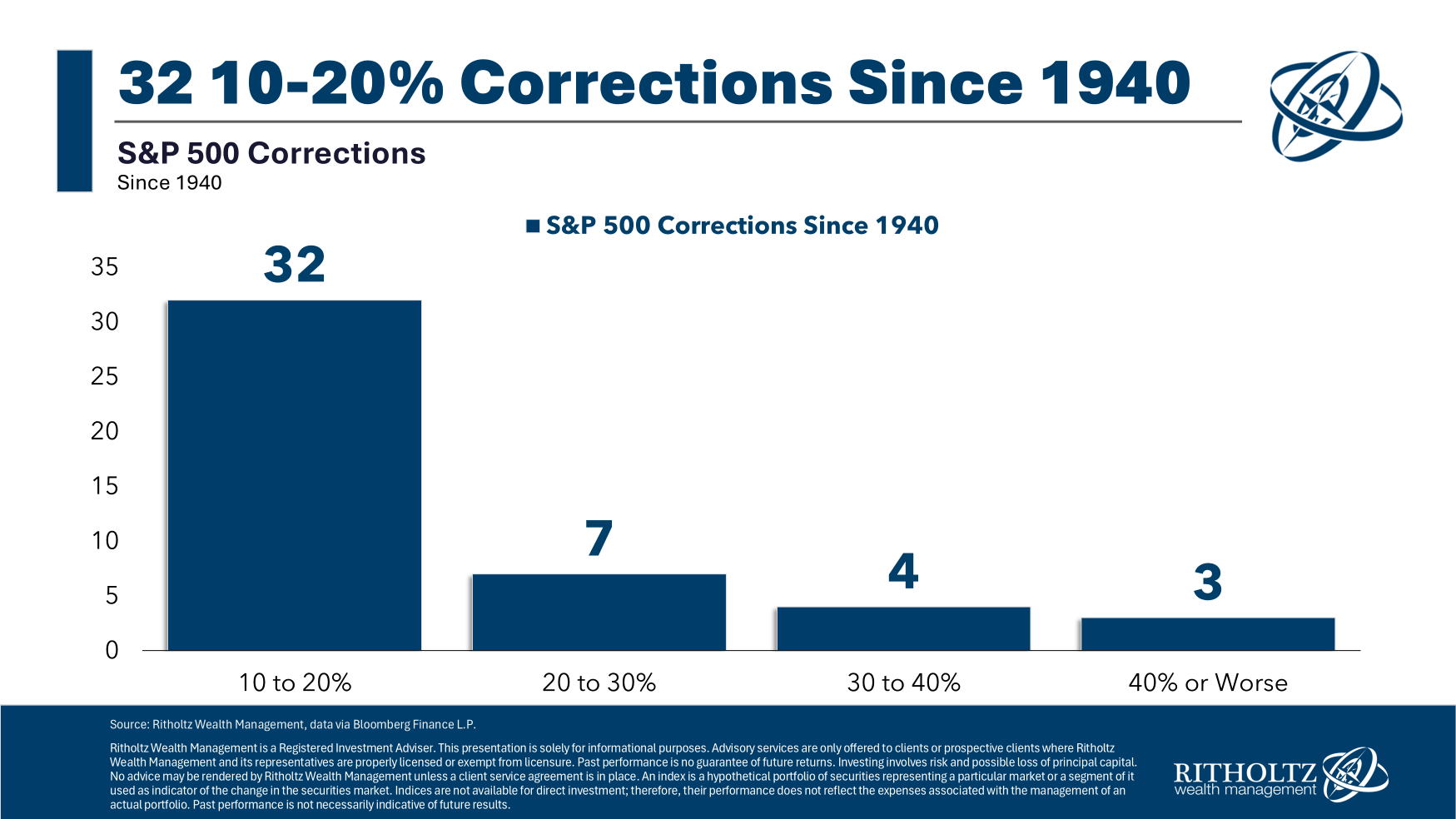

Since 1940 there have been 46 double-digit corrections.

Most of those corrections didn’t turn into bear markets. Just 14 out of those 42 drawdowns turned into a 20% or worse bear market. That’s 30% of the total, meaning 70% of the time a correction did not morph into a full-fledged bear.

In half of those 14 bear markets, losses were more than 30%. Three of them turned into a crash of 40% or more.

Here is the breakdown over the past 85 years:

Great, thanks for the history lesson Ben but this tells us nothing about the current environment which no one has ever seen before.

That’s true.

We’ve never been through a trade war like this before. There is no playbook.

History shows thar most of the time these things don’t get completely out of control but sometimes they do. That doesn’t make the current environment any easier to handicap but it’s always like this when you’re in the eye of the storm.

We’re already a stone’s throw away from a bear market. I would be surprised if this downturn doesn’t turn into a bear. At this rate, one more big down day and we’re there.

If the current tariff plan stays in effect for more than a month or two it would not shock me to see the stock market down 30-40%.

These policies will crush margins, profitability, investment and business confidence. I don’t say this lightly. The stock market doesn’t take this type of disruption lightly either.

If there are concessions and negotiations, the damage could be contained.

Here’s something no one likes to say in times like these: I don’t know.

I don’t know if these tariffs are here to stay or not.

I don’t know when the pain will subside.

I don’t know what will cause the selling to end.

I do know panicking will not help you make better investment decisions. Times like these are why you have an investment plan in the first place.

In my next piece, I’ll share what I’ve been doing during this sell-off and what my own plan calls for during chaotic markets.

Further Reading:

A Short History of Tariffs