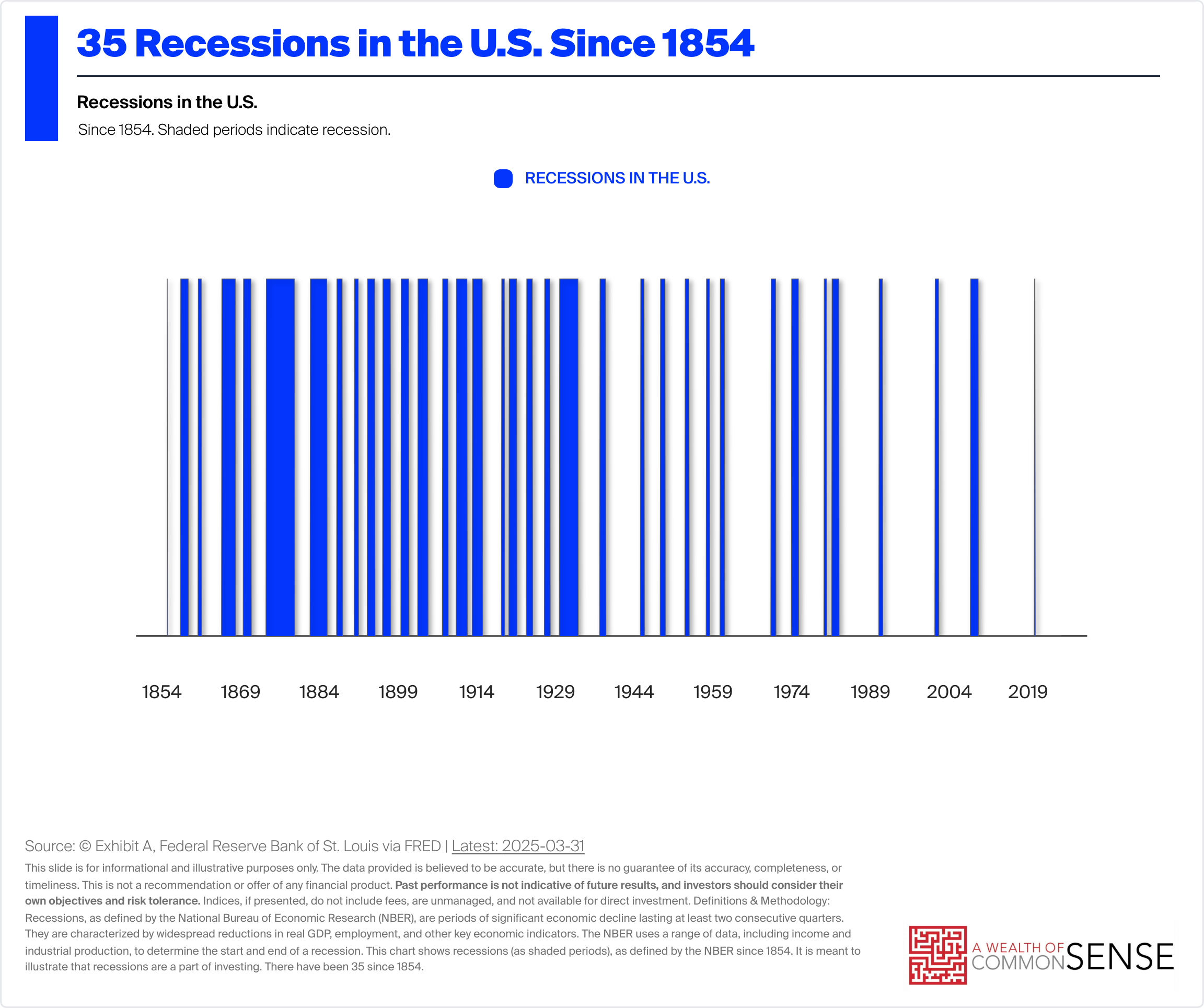

A recession is coming.

How do I know this?

Because that’s what happens sometimes:

We’ve had one every 5 years on average going back 170+ years.

Here’s the big question I don’t know the answer to: When?

I don’t know when the next recession will be here.

Maybe it comes from the trade war. A lot of people seem to think that’s a possibility.

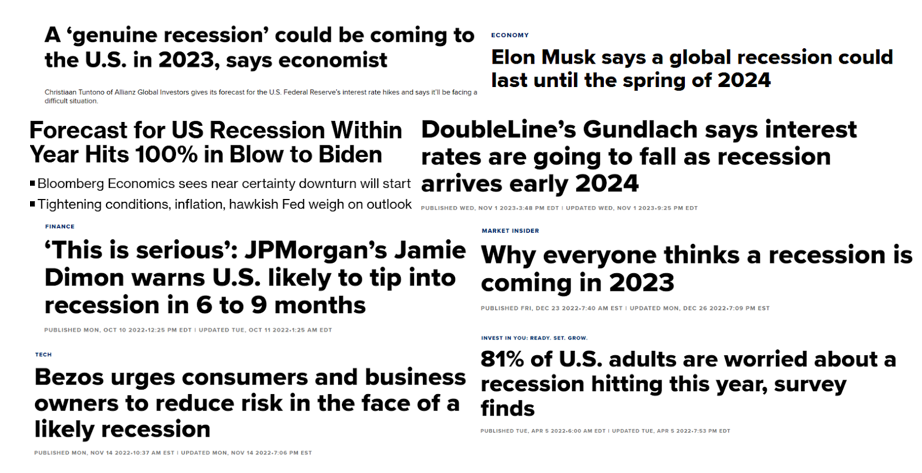

Is this a copout? I guess so — but I’ve learned the recession prediction game is much harder than people think.

There were a lot of people who thought a recession was a sure thing a few years ago and it didn’t happen:

In the past 15 years we’ve had exactly one recession that lasted just two months in the spring of 2020. That contraction was man-made and over in a hurry.

Whenever we do have an economic contraction, it’s going to be interesting to see how businesses and consumers react. Everyone is a little out of practice.

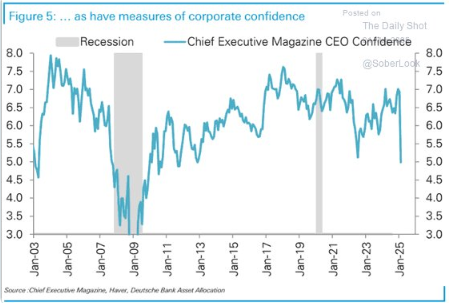

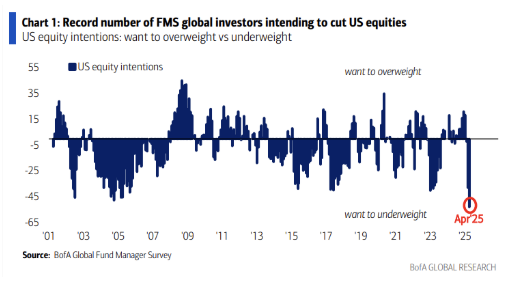

If consumer and business sentiment have a say, things aren’t looking so hot.

CEOs are worried:

Investors are worried:

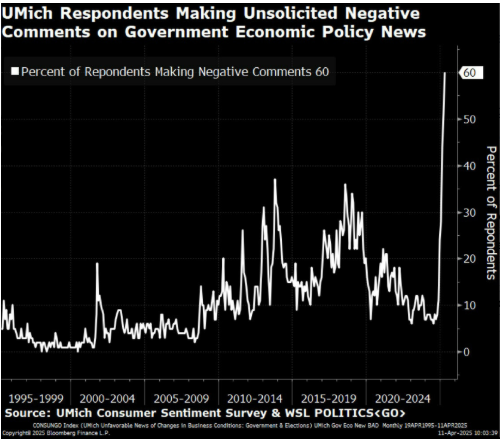

Consumers are worried:

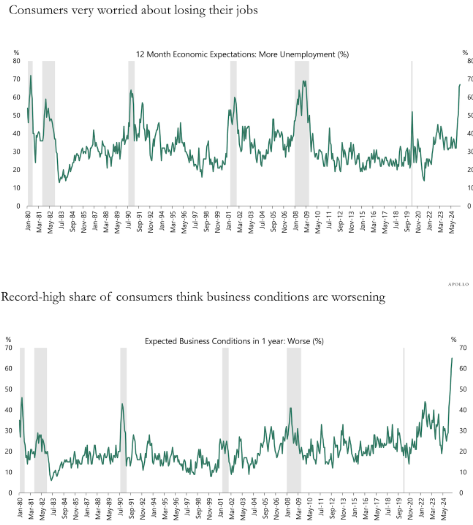

Employees are worried:

It is important to recognize this is sentiment not actions.

CEOs say they are losing confidence.

Investors say they intend to cut their U.S. equity exposure.

Consumers say they are worried about government policies, losing their job and business conditions worsening.

If actions match these sentiments readings then we are absolutely going into a recession.

I’m not so sure we can trust sentiment readings anymore, since they change so rapidly. You have to watch what people do not what they say.

My base case right now is probably a recession, but that’s just a guess.

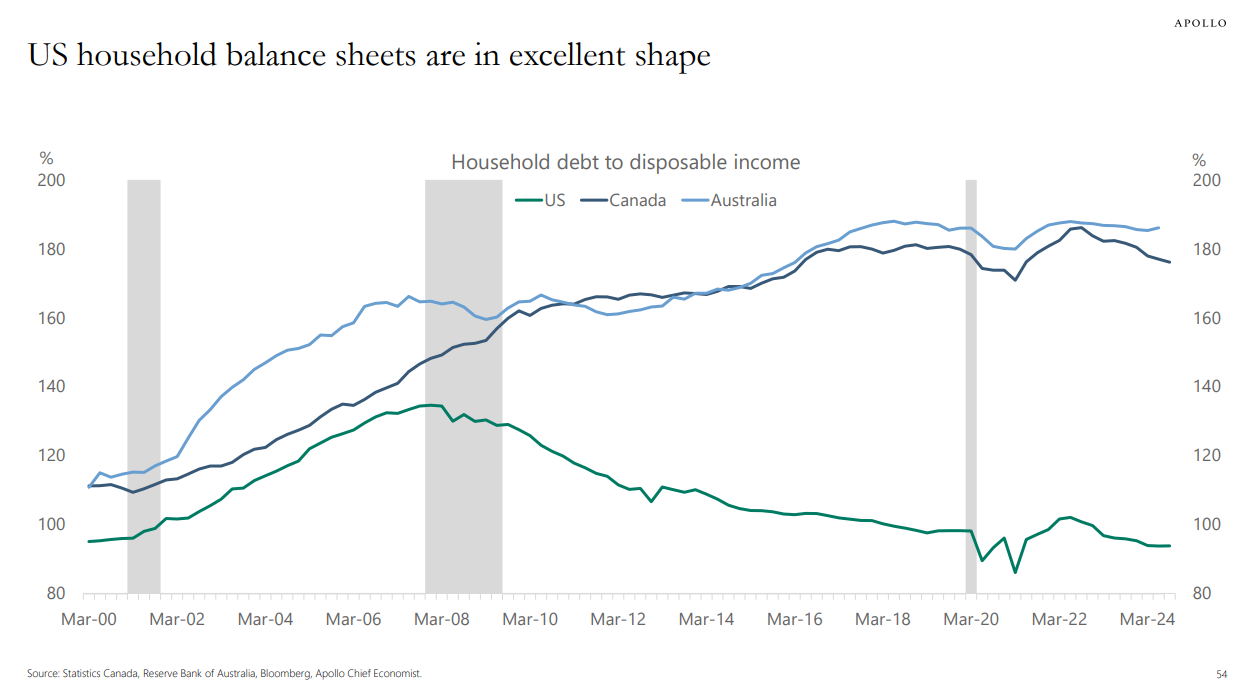

If we do have a recession the silver lining is that consumers as a whole are still in good shape:

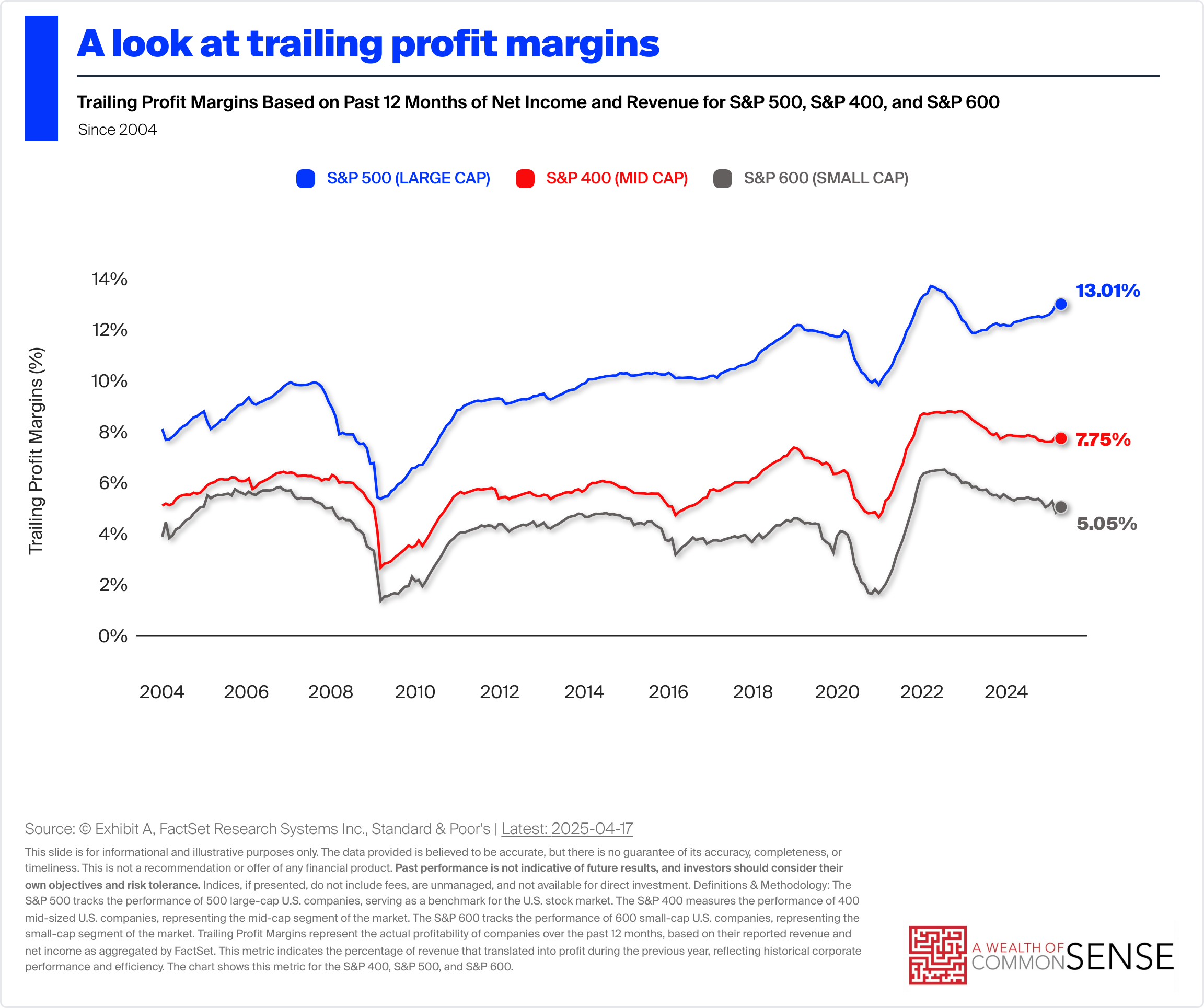

Profit margins for corporations remain near all-time highs:

There is a margin of safety in place.

My baseline would be a mild recession if and when it happens assuming we don’t get some kind of financial crisis.

Of course, a recession would still mean job loss, business closures, lower stock prices, etc. Even a mild recession wouldn’t be very much fun.

Preparation for a recession is the same regardless of where we are in the business cycle.

You carry a low debt load, have an emergency fund in place, keep a high savings rate, and give your finances some wiggle room and a backstop.

But you should do those things even if we don’t go into a recession in the coming months.

In conclusion:

A recession is coming at some point.

I don’t know when.

Life would be a lot easier if these events occurred on a set schedule so businesses and consumers could plan ahead.

Things will never be that easy.

The goal is to build a financial life that is durable enough to handle a slowdown, whenever it may occur.

Further Reading:

What Happens in a Recession?

Like the charts in this post? Check out Exhibit A to see how you can use them in your wealth management practice.