I get a lot of emails from young people in the finance world asking for career advice.

Career advice is hard.

Your path is often dictated by some combination of circumstance, timing, network, hard work and luck (good and bad). I look back on my career and realize it would be nearly impossible to replicate. One or two decisions here or there and things could have worked out much differently.1

That doesn’t mean all guidance on work decisions is useless. You just have to apply it to your personal situation and do your best.

I always loved this idea from former Red Sox and Cubs savior Theo Epstein about how to get ahead when you’re just starting out:

Whoever your boss is, or your bosses are, they have 20 percent of their job that they just don’t like. So if you can ask them or figure out what that 20 percent is, and figure out a way to do it for them, you’ll make them really happy, improve their quality of life and their work experience.

If you do a good job with it, they’ll start to give you more and more responsibility.

I’ve never been a big resume guy in terms of telling people what you can do to help. I’m a show-me guy. Don’t tell me how you can help — show me!

Early in my career I underestimated the importance of communication in financial services when it comes to the show-me side of the equation. Buffett once said, “The most important skill in finance is salesmanship.”

Everyone is in sales whether you recognize that fact or not.2

In finance that could mean storytelling, charts, data, history or context.

I produce a lot of charts because visuals are almost always more impactful than words when explaining the markets. I hear from a lot of advisors about the charts I use here. One of the reasons I started doing annual updates of certain charts and figures was because so many people were asking for them.

We use plenty of charts for client updates and prospect decks at Ritholtz Wealth too.

We’ve been making changes and using different iterations for years but never really settled on a specific template we loved. It never felt like we had the right person or team for the job.

Last year Chart Kid Matt Cerminaro cold emailed Michael and said he wanted to help improve the appearance of our charts and pitchbooks. His email included a handful of RWM-branded charts for us to look at.

They looked great.

So we hired Matt part-time to help make our presentations look better. He quickly became indispensable to our daily lives, sending us new research, charts and ideas. He started formatting all of the charts and tables for my blog. Matt immediately made our lives easier.

We had no choice but to hire him full-time.

Then an idea formed.

How do you make it easier for other advisors to create their own client presentations? Matt found a designer and programmer. They spent months building, formatting and fine-tuning.

The outcome of all their hard work is Exhibit A, a new service that allows advisors to create custom branded charts and marketing decks:

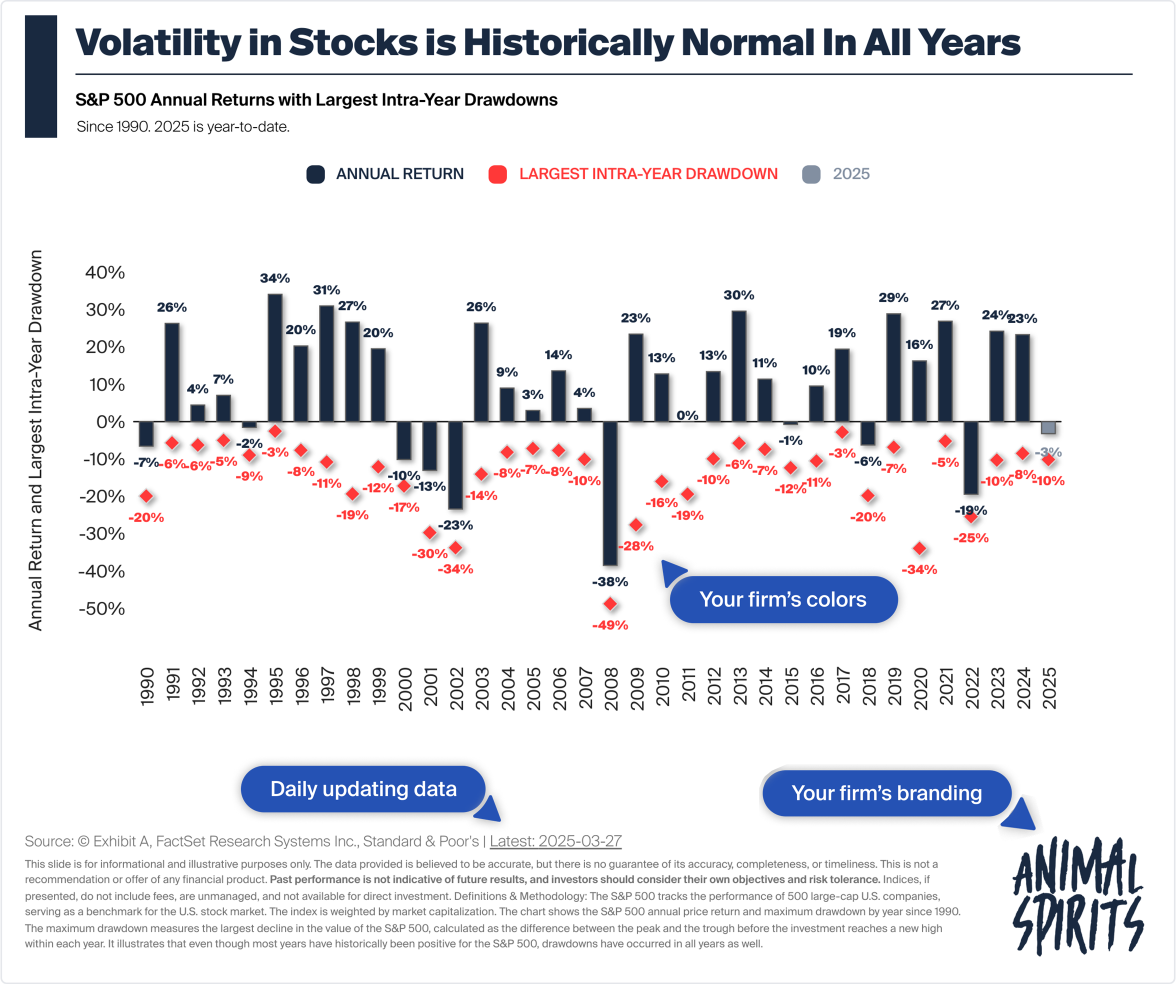

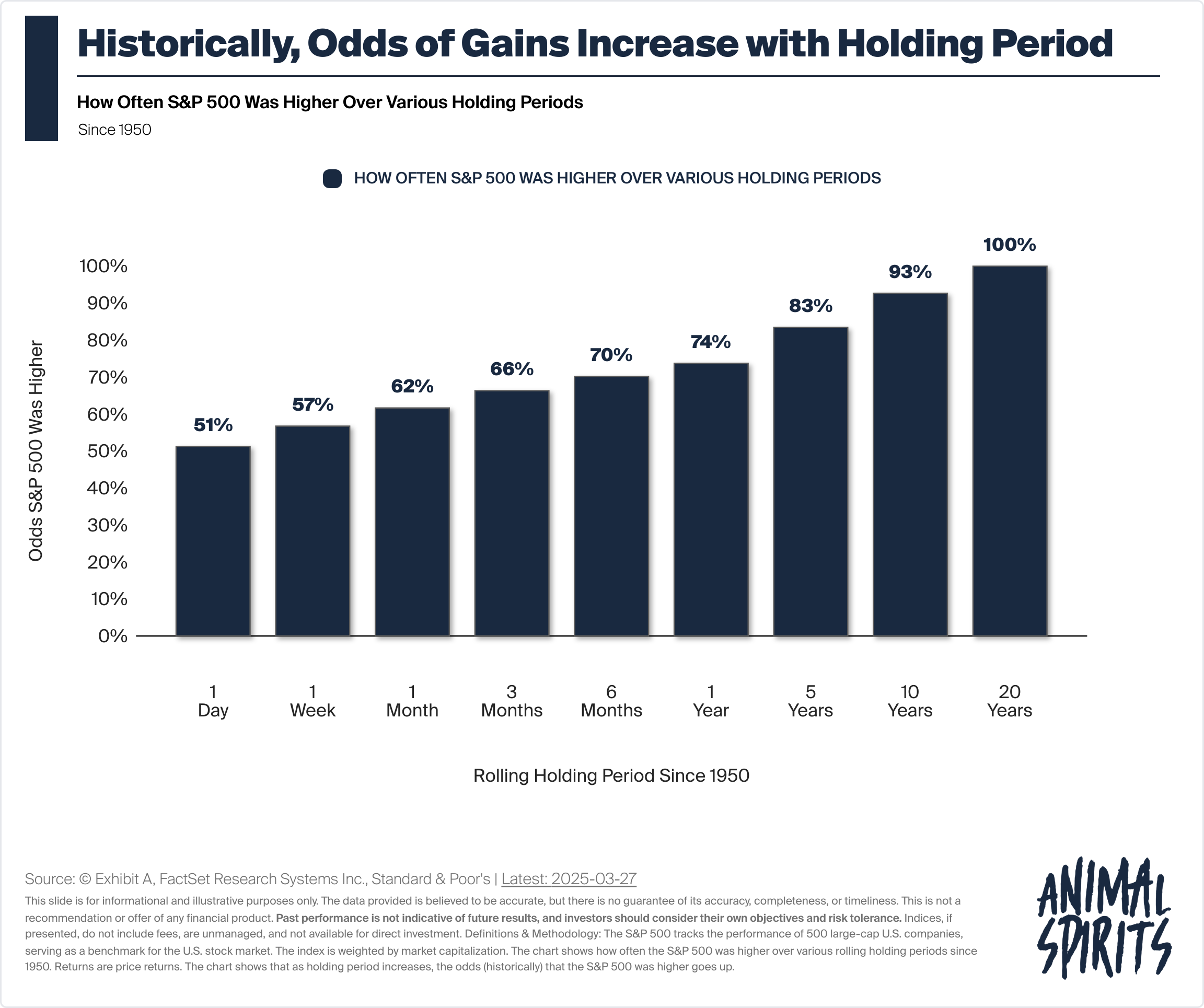

Here’s a favorite of mine that’s on the platform:

I know plenty of advisors who don’t have the time, tools or know-how to do this on their own. This is a very useful solution.

I’m proud of Matt and team for what they’ve built.

They took the 20% rule to the next level.

If you’re an advisor interested in a free trial, check out Exhibit A here.

Further Reading:

Useless Career Advice

1I started this blog on a whim with no dreams or aspirations and it completely changed my career. In an alternate world I would have been too scared to start writing in public and my career would be totally different.

2I’m not a natural salesman but someone once told me that blogging is sales for introverts. I like that.