A reader asks:

Are there any changes we can make today that would reduce the risk or exposure to potential risk if the federal government causes a recession in 2025? I’m trying to determine if I should adjust my 401k allocations to be less equity and more fixed income in case the stock market goes bear on us.

Since 1950 there have been 11 recessions in the United States.

That means, on average, we’ve experienced a recession in one out of every seven years or so. The average length of those recessions is 10 months.

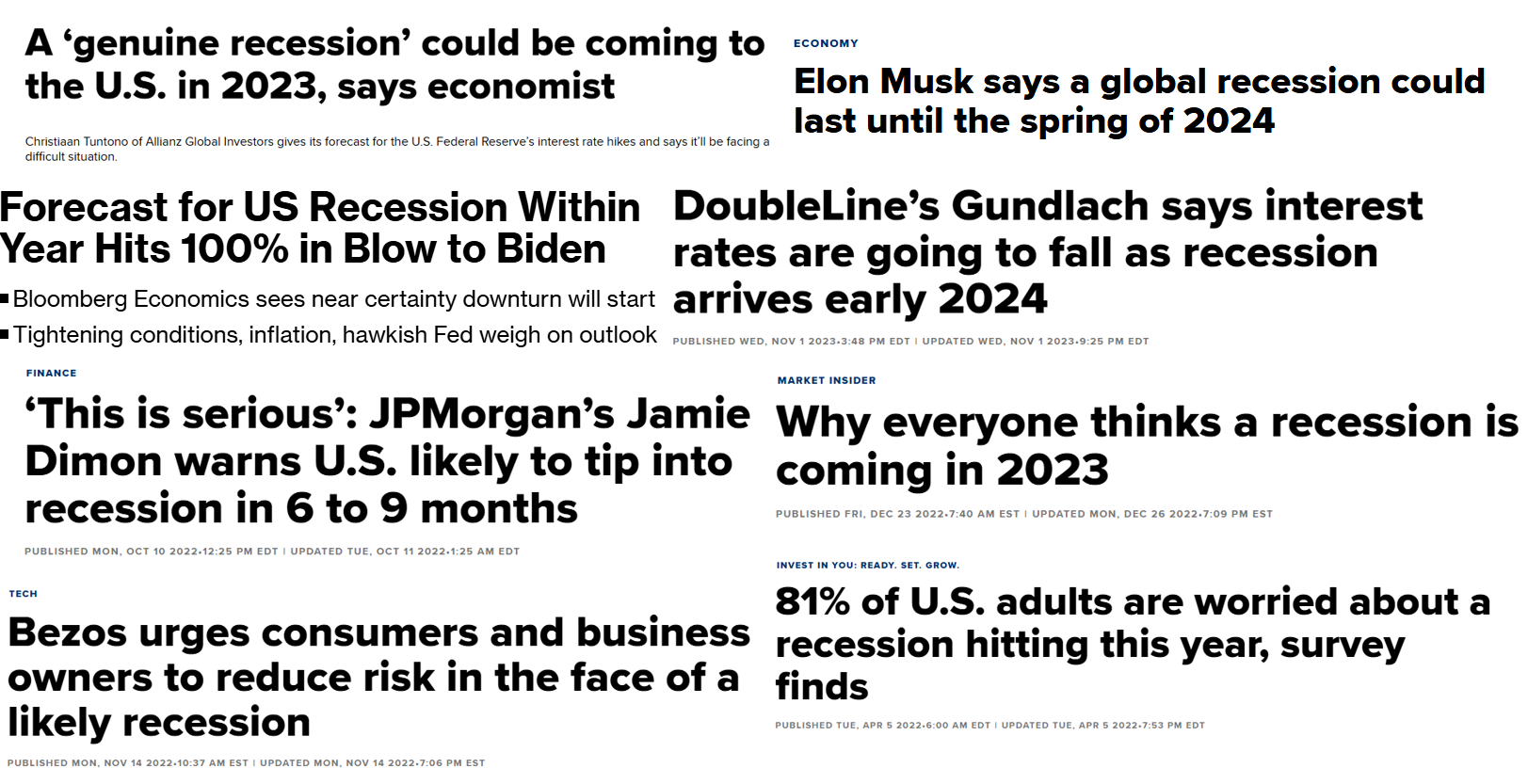

Reality, of course, does not play out like the averages. There were two recessions in the span of three years from 1980-1982. There were no recessions in the entire decade of the 2010s. Everyone and their brother thought a recession was a certainty in 2022, but it never happened.

Whatever the reason is for the next recession — the government, the Fed, a financial crisis, a pandemic, a black swan event, my wife deciding to stop shopping at Amazon — I don’t have confidence in anyone’s ability to predict it in advance.

Sure, someone will do it.

And then they’ll spend the rest of their career trying to predict the next one every chance they get. That’s exactly what happened to all of the pundits who “called” the 2008 financial crisis. They’ve all been living off being right once in a row for years. And they’ve all spent the past 15 years predicting the next bubble or financial crisis that never came.

I hate the idea of trying to time the market based on a recession forecast. Let’s say you’re right about it this one time. You sell your stocks and up your fixed income or cash sleeve. Now what?

When do you buy back in? What happens when you’re wrong? Do you try your hand at predicting all future downturns as well?

Could now be a good time to lighten up on risk a little bit after a hard-charging bull market? It might be. There is always the risk of a downturn. Even if we don’t get a recession we could be due for a stock market correction.

I just don’t like the idea of trying to time the market using macro indicators. No one can do this on a consistent basis.

I’m 43 right now. Time is promised to no one, but if I’m lucky I have maybe 40-50 years left in the tank. I’m planning on experiencing at least 10 or more bear markets, including 3 or 4 that constitute an all out crash. There will also probably be at least 6-7 recessions in that time as well.

Maybe more, maybe less.

What are the odds that I will be able to call all of them in advance? Less than 0%?

The odds of me screwing things up would rise exponentially if I tried to sidestep every setback.

I build the bad times into my plan. I have liquid savings to see me through the painful periods. I have a long time horizon. Why should I care what happens in the next 12 months to money that I’m not going to touch for 20-30 years?

I’ve worked with thousands of wealthy people over the years. Not once did someone tell me they got rich by timing recessions.

I’d prefer that you view a situation like this as an opportunity for rebalancing rather than trying to time the market. If you own a diversified portfolio of stocks, bonds, cash, and whatever else, you’re likely overweight stocks because the stock market performed so well these past two years.

Bonds have done OK. Cash gave you a decent yield but the U.S. stock market was up more than 20% two years in a row.

Now might be a great time to rebalance–some investors even like to over-rebalance at times.

I’m simply never going to be a fan of timing your buys and sells based on your ability to predict the timing of the next recession.

I don’t know when and I don’t know why but we will have another recession eventually. You can prepare for this eventuality without trying to predict it in advance.

The best way to prepare is to set an asset allocation that fits your risk profile and time horizon, regardless of the economic environment.

I covered this question in detail on this week’s Ask the Compound:

We also answered questions about the impact of index funds market bubbles, what you need to know about being on a non-profit investment committee, selling stocks for a house down payment and spending money on restoring a classic car.

Further Reading:

How Often Are We In a Recession or Bear Market?