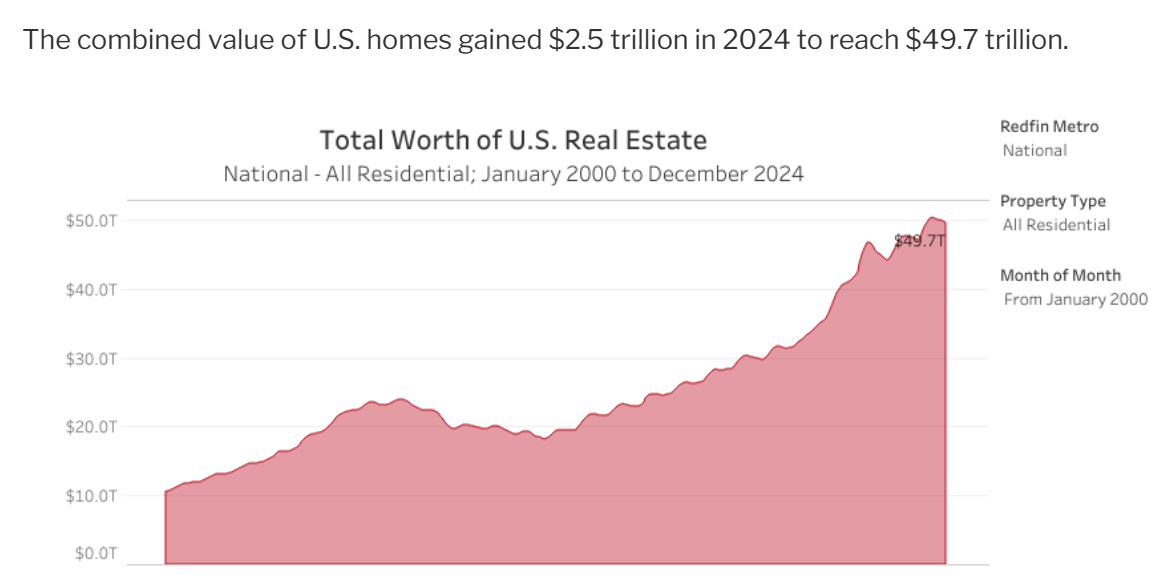

According to Redfin, the U.S. housing market is now worth a stone’s throw from $50 trillion:

Depending on the day, that puts the housing market roughly on par with the total value of the U.S. stock market. In the past decade alone the total value of the housing market has more than doubled (from $23 trillion in 2014).

Considering mortgage rates averaged nearly 7% in 2024, it’s hard to believe housing prices were up another 5% in 2024. That gain follows annual housing returns of +19%, +6%, +6% and +4% from 2021-2024.

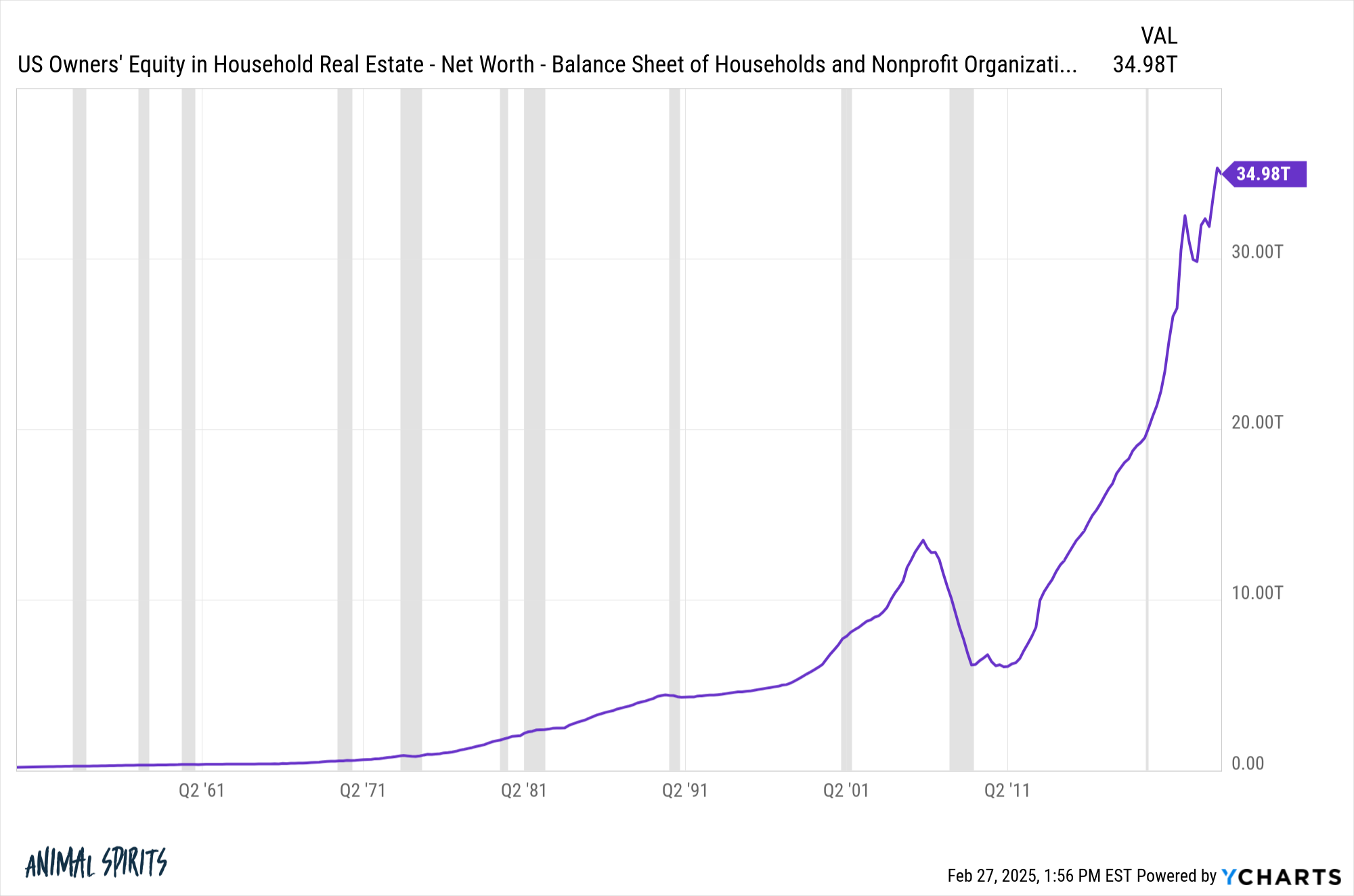

When you throw in the fact that 70% of that $50 trillion is equity, Americans are sitting on some healthy housing gains.1

Despite all of that home equity just sitting there, consumers aren’t tapping it just yet (via Sonu Varghese):

My guess is a lot of this has to do with the fact that home equity loans are in the 7-8% range right now. One would imagine more people will be tapping that equity if rates ever come down. We shall see.

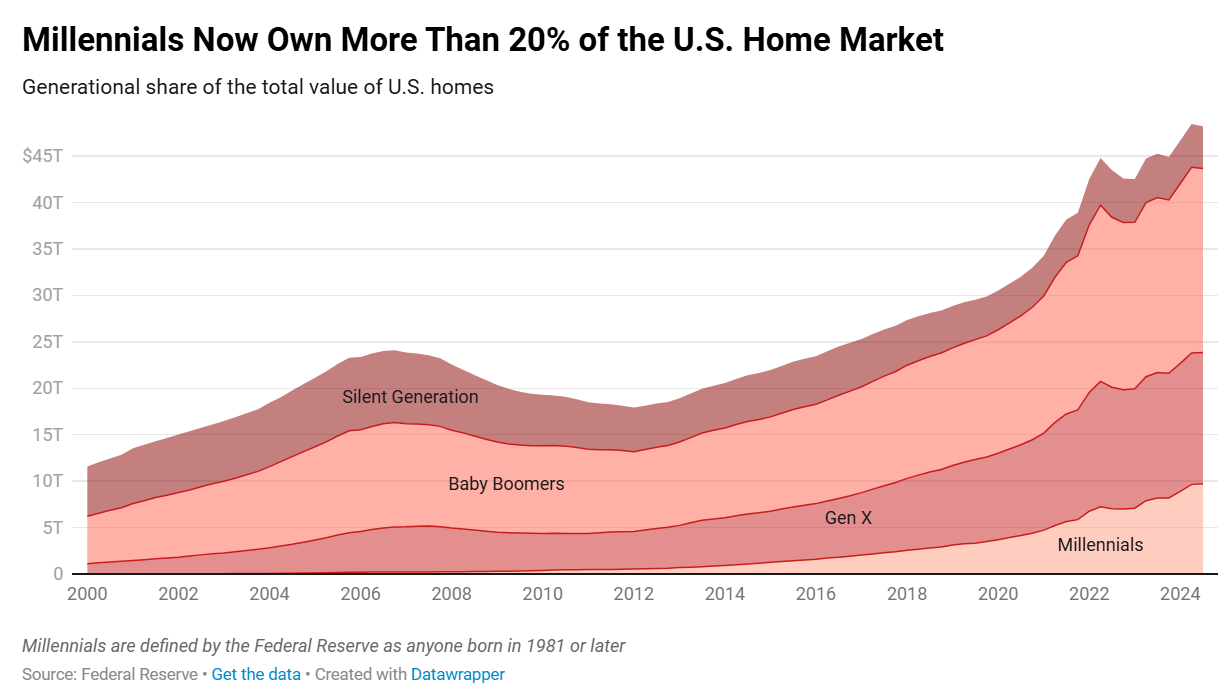

A lot of that equity resides with baby boomers, who own 40% of the housing market. Many of them now have houses paid off as well, which makes sense considering their age. Gen X makes up nearly 30% of the market but millennials are coming on strong:

I know it’s hard for many young people to buy a home right now. Prices are high. Rates are high. Insurance rates are high. Monthly payments are high.

Some young people are out of luck. Others are making it work with higher incomes and/or help from their parents.

Millennials are the biggest generation and they will be the largest generation of homeowners at some point in the next couple of decades. It’s just math.

So what happens to the housing market from here?

Your guess is as good as mine. The best-case scenario is that price increases grind to a halt for a few years so incomes can play catch-up. If housing prices do fall it’s not the end of the world because there is such a big margin of safety.

The worst-case scenario for prospective homebuyers is that prices keep rising 3-5% per year, and mortgage rates remain above 6% for an extended period.

We have a lot of problems right now that don’t have simple solutions. The simple solution to fix our housing market is to build more homes. It works. Just look what happened to rents in Austin when developers built more apartments:

Maybe the homebuilders and construction industry aren’t able to make this happen, but I can’t figure out why our politicians aren’t prioritizing it. Housing impacts everyone in some capacity.

Hopefully someday it will happen.

Michael and I talked all about the housing market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Timing the Housing Market: When Should You Sell?

Now here’s what I’ve been reading lately:

- 6 financial mistakes made by Jonathan Clements (Humble Dollar)

- Talking stocks on the golf course (Downtown Josh Brown)

- Why AI is off to a relatively slow start (Marginal Revolution)

- The baby boom in 7 charts (Our World in Data)

- How your asset allocation should change with age (Of Dollars & Data)

Books:

1Obviously it’s not all gains. A lot of that equity comes from people paying down their mortgages.