Today’s Animal Spirits is brought to you by YCharts:

See here to download YChart’s Debunking Investing Myths Deck

Sign up here for the Emerging Manager Showcase at FutureProof Citywide and here for more information on how to attend for free

Get a random Animal Spirits chart here

On today’s show, we discuss:

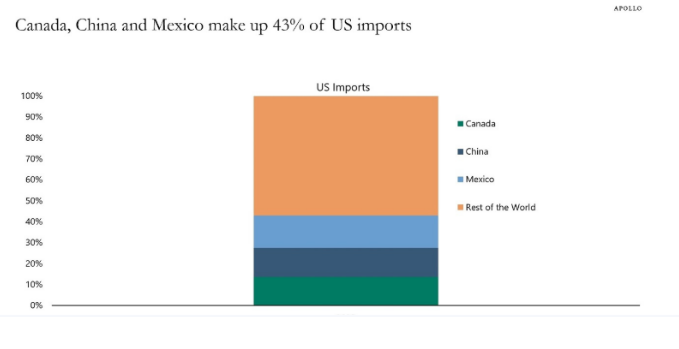

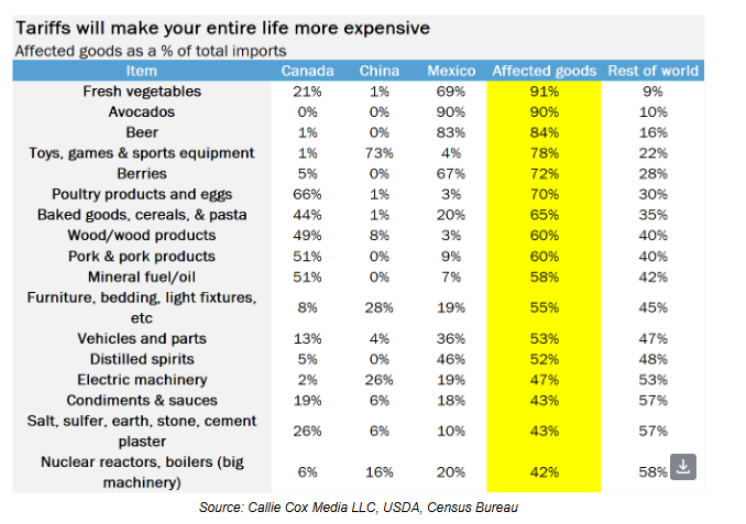

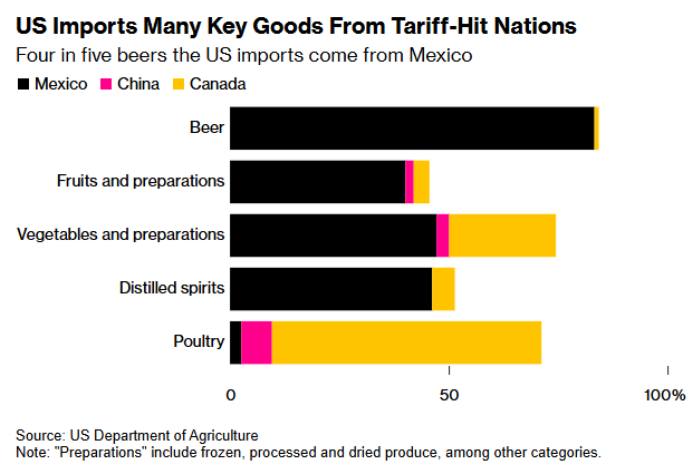

- The Dumbest Trade War in History

- The Products Trump’s Tariff Blitz Could Make More Costly, From Avocados to Cars

- Let’s Talk About Tariffs

- DOGE Gains Access to Payment System Doling Out Trillions to Americans

- Vanguard expense-ratio cuts to save investors $350M this year, firm says

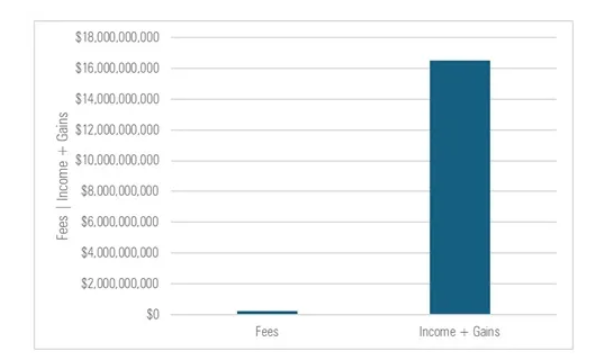

- Wall Street’s Levered ETF Boom Is Near-$1 Billion Money Spinner

- Leveraged ETF Investors Scored Gains Last Year. They Probably Also Left Billions on the Table.

- Parents Ditch 529 Plans and Embrace Bitcoin for College Savings

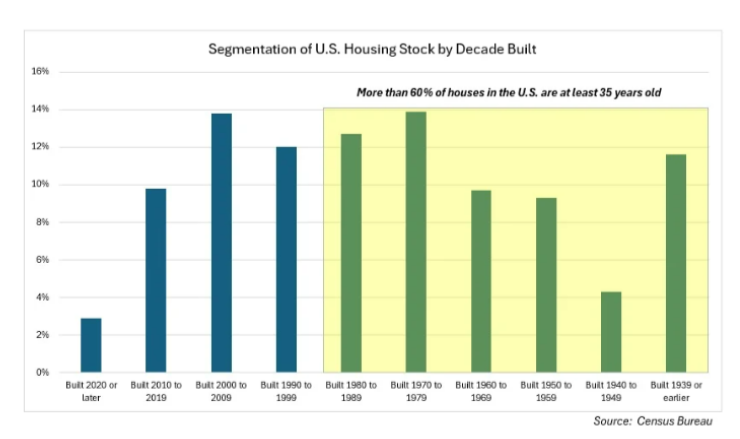

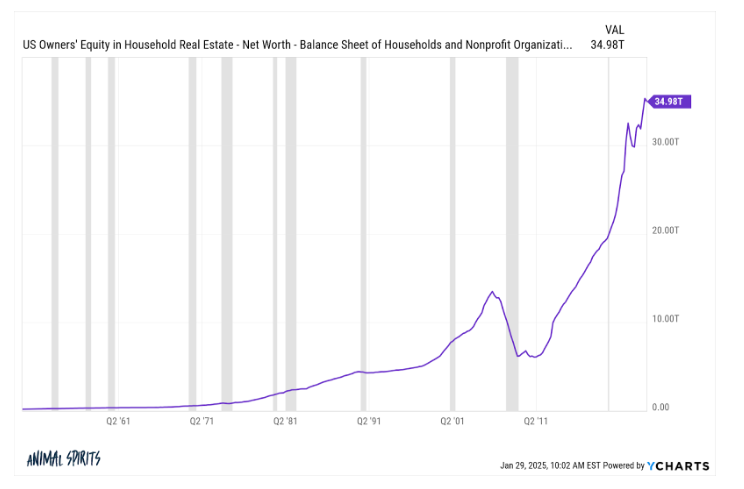

- The Implications of an Aged Housing Stock

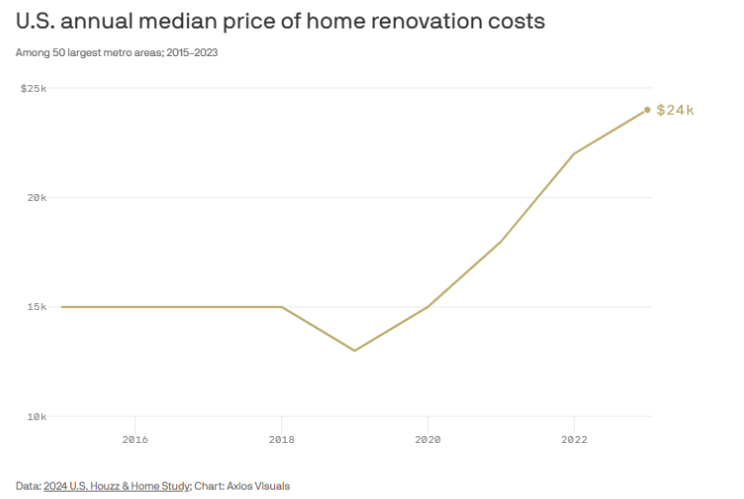

- Home renovation spending surges amid supply crunch

- Home Sweet Home: How Much Do Employees Value Remote Work?

- No, we will not ski with you

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

The Vanguard Effect in a nutshell.. $5T swing from high cost active to low cost passive over past decade. One new wrinkle tho: the very top shows active in ETF format is starting to grab some real flows (thx to being low(er)-cost and in ETF form). Killer chARTwork from @JSeyff pic.twitter.com/ZQGm4QVZfo

— Eric Balchunas (@EricBalchunas) January 31, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product