Today’s Animal Spirits is brought to you by Betterment:

See here for more information on Betterments RIA solutions

Get a random Animal Spirits chart here

On today’s show, we discuss:

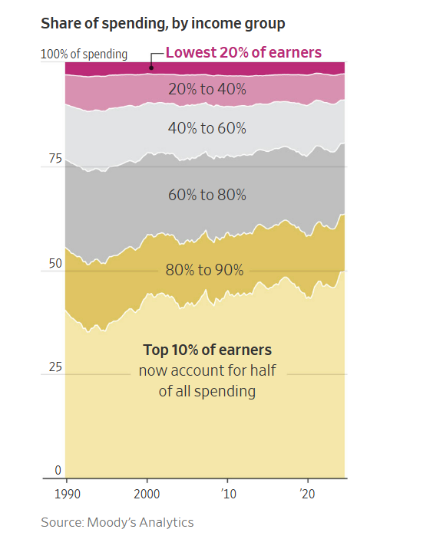

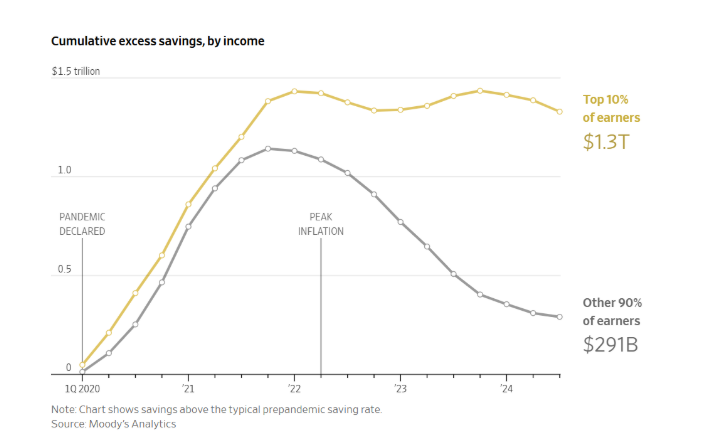

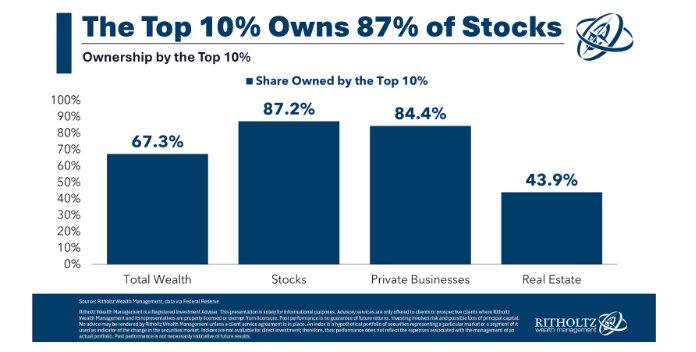

- The U.S. Economy Depends More Than Ever on Rich People

- Velvet Ropes Everywhere

- Berkshire Hathaway shareholder letter

- Why I think AI take-off is relatively slow

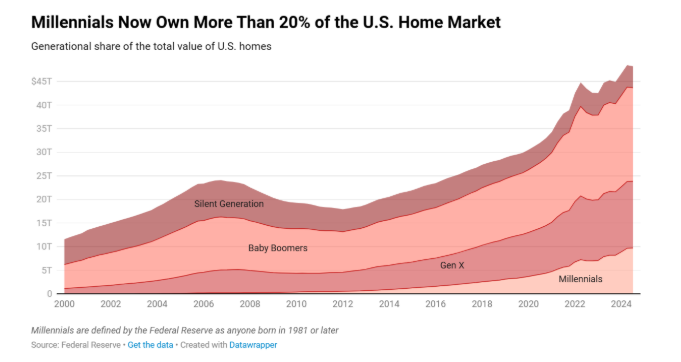

- U.S. Housing Market Gained $2.5 Trillion in Value in 2024

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

Industrials flagging weakness for months. Global growth sluggish for months. Hiring and quits rates near the lows for months. Housing impaired for months. Blame tariffs all you want but that’s a tempest in a teapot. Real issues have been brewing for a while. pic.twitter.com/nAcm6AxA5C

— RenMac: Renaissance Macro Research (@RenMacLLC) February 21, 2025

Steve Cohen bearish for one of the first times in years.

— THE SHORT BEAR (@TheShortBear) February 24, 2025

While growth and momentum stocks were in the doghouse this week, Consumer Staples stocks had a party (ex $WMT and $COST). 4%+ gains for more than half of the sector: pic.twitter.com/YHzw6tQYcE

— Bespoke (@bespokeinvest) February 21, 2025

It’s amazing how much money people can make by idly allocating into stuff

It’s even more amazing how much money people lose by trying to actively trade stuff

It’s even even more amazing how heavily people shit on the first while they fail at the second

— loomdart – Holy War Arc (@loomdart) February 23, 2025

1) I have a lot of sympathy for gov’t employees: I, too, have not checked my email for the past few (hundred) days

And I can confirm that being unemployed is a lot less relaxing than it looks

— SBF (@SBF_FTX) February 25, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product