Today’s Animal Spirits is brought to you by YCharts and Fabric:

See here for 20% off your initial YCharts Professional subscription (new customers only)

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

Get a random Animal Spirits chart here

On today’s show, we discuss:

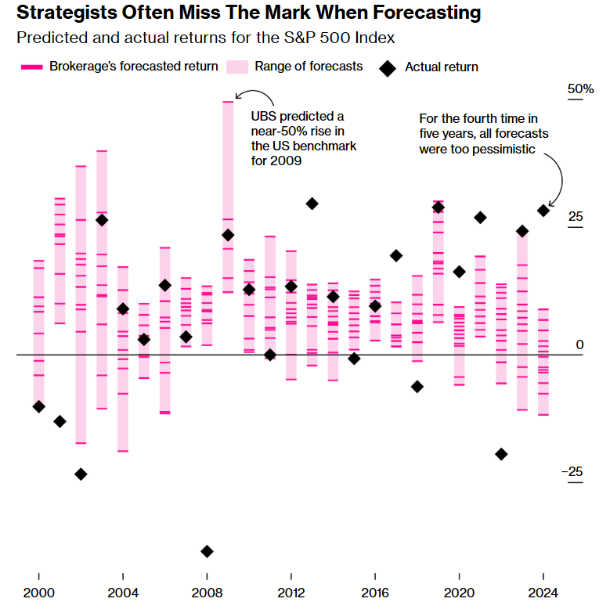

- Wall Street’s Market Forecasts Are Out for 2025 — Be Dubious

- Steve Ballmer, the Non-Investing Guru of Investing

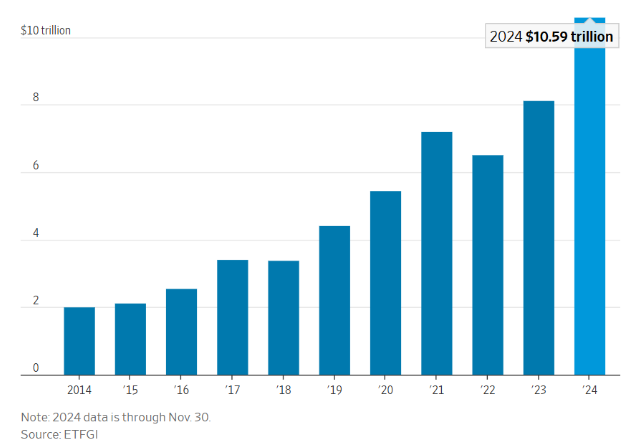

- A Record-Shattering $1 Trillion Poured Into ETFs This Year

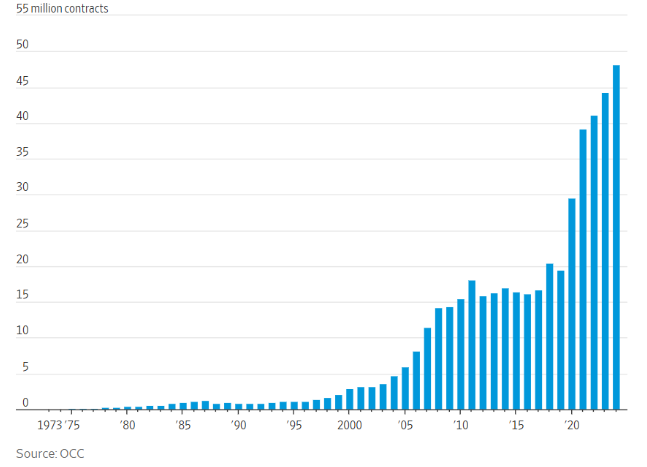

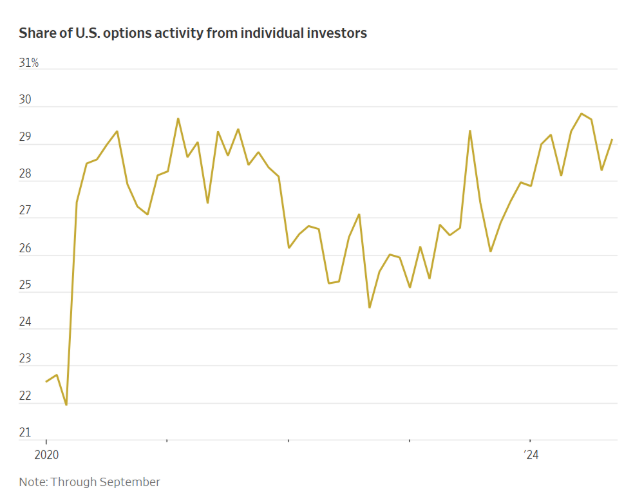

- A Thrill-Seeking Trade Amps Up Heading Into 2025

- Even Rich Retirees Fear Outliving Their Money

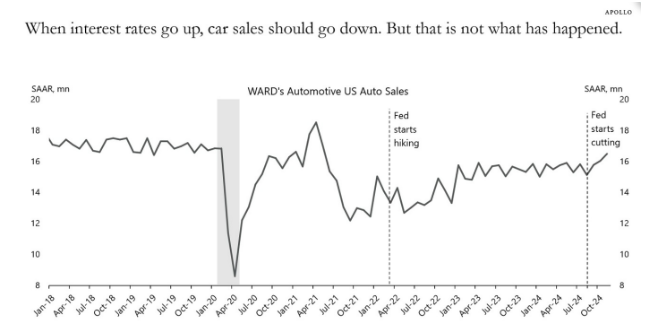

- Why Did Car Sales Not Decline When the Fed Raised Interest Rates?

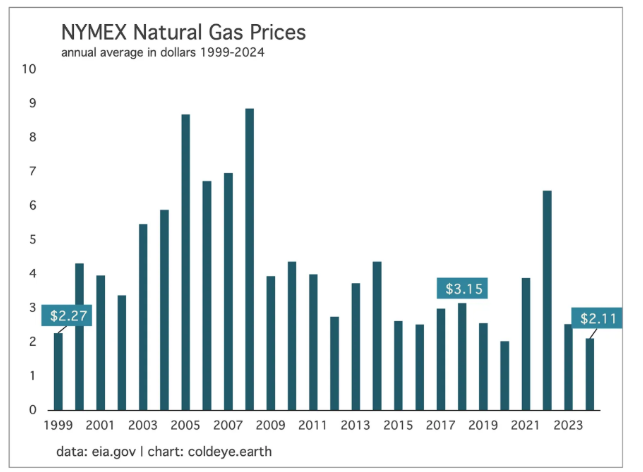

- Revenge of the Fossil Fuels

- What’s the Secret to Choosing a Good Airplane Movie?

- Here’s Why In-Flight Movies Make You Cry Like a Baby

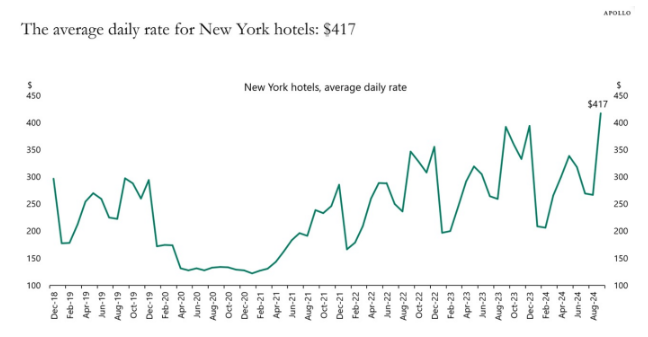

- $417 for a Hotel Room in New York

- Flying Was Already the Worst. Then America Stopped Using Headphones.

Listen here

Recommendations:

- Traffic: Why We Drive the Way We Do (and What It Says About Us)

- Dune: Part Two

- Anora

- Strange Darling

- The Substance

- Challengers

- Civil War

- Love Lies Bleeding

- Smile 2

- Mads

- HitMan

Charts:

Tweets/Bluesky

GS: Wealth Effects from the Equity Market Rally Should Provide an Additional Boost to Consumer Spending in 2025 pic.twitter.com/zSex23v0RB

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) December 30, 2024

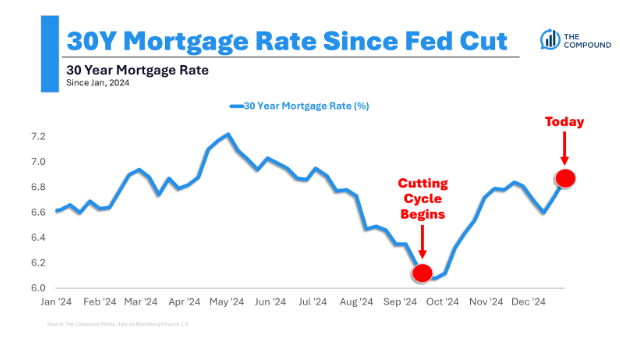

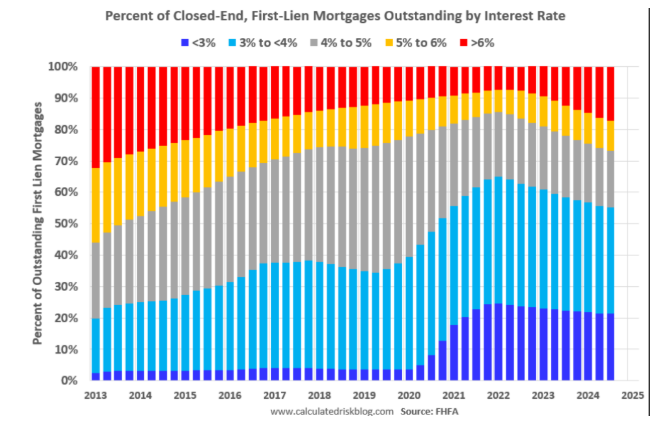

I've been arguing that 6% to 7% would be the "new normal" for mortgage rates. The so-called "neutral rate" has been moving up. If we add 2% inflation, 2%+ real rate, a normal yield curve, and 30-year rates 175bp above the 10-year yield … that puts mortgage rates in the 6% to 7% range.

— Bill McBride (@calculatedrisk.bsky.social) 2024-12-27T23:20:18.049Z

Spielberg on casting ‘Saving Private Ryan’ (1998), in 2012 interview with Roger Ebert. pic.twitter.com/RmrfGdIi9k

— John Farmer (@john_j_farmer) December 23, 2024

Follow us on Facebook, Instagram, and YouTube.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product