There’s an old story about Joseph Kennedy in which a shoeshine boy started giving him stock tips while he was sitting in a chair getting his shoes buffed.

That was all he needed to hear. Kennedy immediately returned to his office and sold all of his stock holdings. That was in 1929 right before the stock market topped and had the worst crash in history.

I’m not sure how accurate this story is, but it’s been posited that he made a killing by timing the market, which helped build the Kennedy fortune.

The peak before the Great Depression was chock-full of signs of the top. Professor Irving Fisher infamously stated in October 1929 that stock prices had reached “what looks like a permanently high plateau.”

Stock prices crashed more than 80% from that call.

The biggest crashes all have signs like this.

Here are some good ones from The Big Short on the housing market:

Next, the baby nurse he’d hired back in 2003 to take care of his new twin daughters phoned him. “She was this lovely woman from Jamaica,” he says. “She says she and her sister own six townhouses in Queens. I said, ‘Corinne, how did that happen?'” It happened because after they bought the first one, and its value rose, the lenders came and suggested they refinance and take out $250,000–which they used to buy another. Then the price of that one rose, too, and they repeated the experiment. “By the time they were done they owned five of them, the market was falling, and they couldn’t make any of the payments.”

A friend of Danny’s returned from a night on the town to report he’d met a stripper with five separate home equity loans.

In the spring of 2007, Fed Chairman Ben Bernanke told Congress that the subprime mortgage crisis was likely contained. That didn’t age well.

Whenever the current cycle takes a turn for the worst, there will be quotes, forecasts and investor actions that won’t age well either. That’s just how this works.

Maybe it’s something like this Barron’s cover story from this past week:

Anecdotes and magazine covers don’t cause anything but something like this will go down with a sinking ship.

Investors have been searching for THE top for a number of years now.

Eventually someone will be right through dumb luck because markets cannot go up forever. Something will cause a downturn or financial crisis eventually. That’s how this system works. We can’t help ourselves.

The problem is these things are extremely difficult to predict in advance.

In December 1996, Fed Chairman Alan Greenspan gave a speech that introduced the term ‘irrational exuberance’ into the financial lexicon:

But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy?

Markets around the globe plunged the next day. Many wondered if Greenspan had called the top of a market that looked overextended.

The S&P 500 was up more than 20% on the year when Greenspan made his comments. It was up more than 37% the year before. From 1980-1996, the S&P 500 was up nearly 1,200% in total or 16% per year heading into Greenspan’s talk.

The bull market felt quite long in the tooth, in the 9th inning, on its last legs, you get the picture.

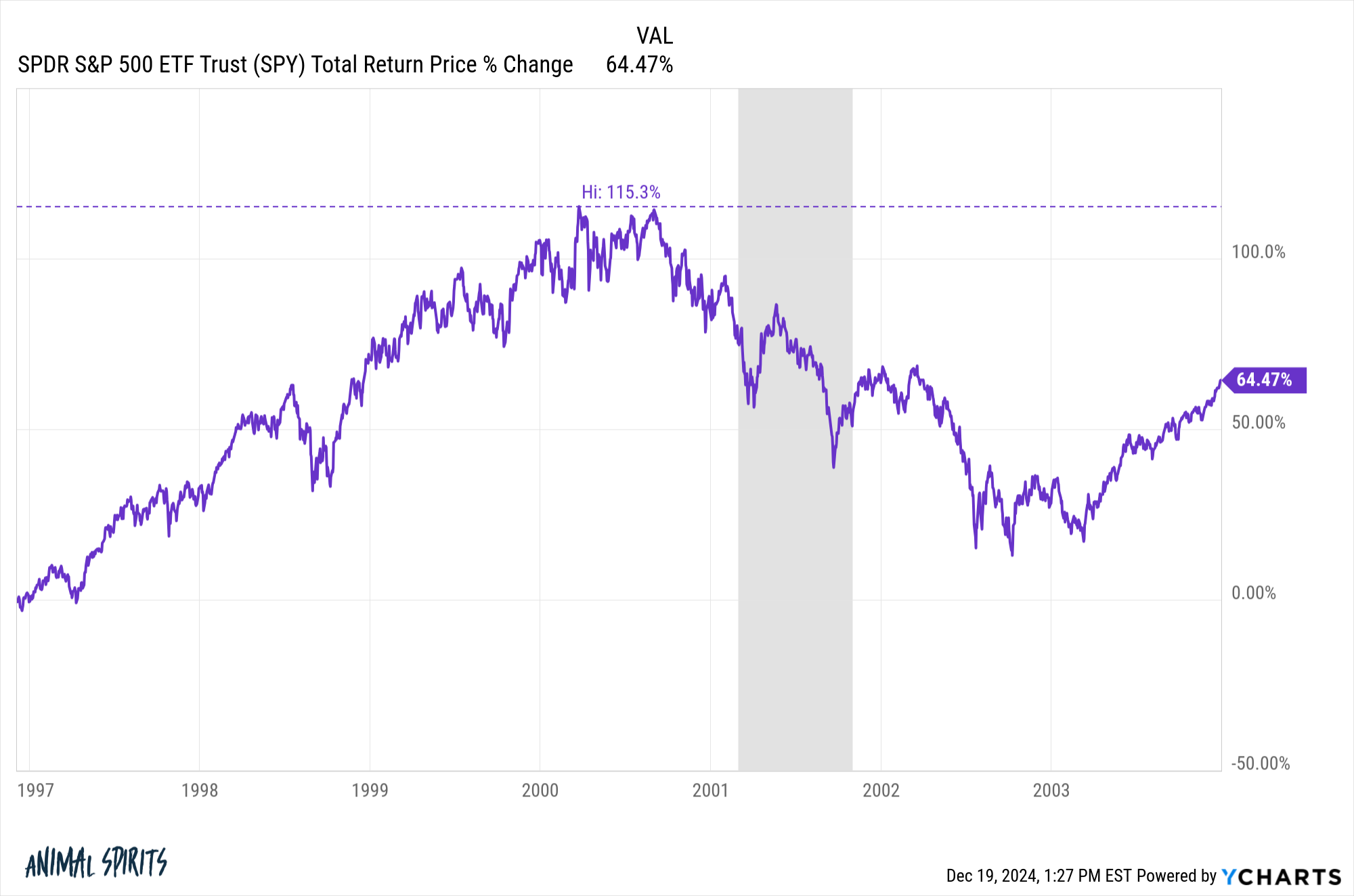

Following a minor hiccup in the days following Greenspan’s speech, the bull market continued:

From the day of his speech through March 2000, the S&P 500 was up 115% in total. That’s an annualized return of more than 26% per year.

The market did crash eventually, falling more than 50% when the dot-com bubble finally popped. But even at the lows of that crash in 2002 the market was higher than it was in 1996 when irrational exuberance was first uttered.

These are all extreme examples. I’m not saying we’re due for another 1929, 2000 or 2007 peak that leads to a monstrous crash or financial crisis. I’m also not suggesting we’re setting up for another dot-com-style melt-up.

These things could happen, of course. You never know! But I don’t have the ability to predict the timing or magnitude of booms and busts. No one does.

There are some warning signs of speculation and over-heating in the markets right now. We could be setting ourselves up for a comeuppance in the years ahead.

Or things could get even crazier.

It’s always hard to tell how far the pendulum will swing or when it will start swinging in the other direction.

There are few certainties in the markets.

One thing I am certain of — no one has the ability to call tops (or bottoms).

Michael and I talked about signs of the top and the potential for things to get even crazier on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

An Epic Bull Market

Now here’s what I’ve been reading lately:

- The Benjamin effect (Contessa Advisors)

- Market uncertainty (TKer)

- Aparigraha (Belle Curve)

- 4 stock market lessons (Humble Dollar)

- The degenerate economy (Abnormal Returns)

- The new Christmas classic (The Ringer)

Books: