A reader asks:

A little about me: I’m 38 (getting close to middle age) and moved to the U.S. from India in 2008 for my master’s degree. I started working full-time in 2011 but delayed contributing to my 401(k) until 2014, as I wasn’t sure I’d stay here permanently. Life changed when I met my wife, and now we have beautiful twin daughters. My 401(k) is now around ~$380K, with allocations to ETFs and stocks like QQQ, SMH, AMZN, GOOG, and LRCX along with large-cap S&P 500 index funds. I also have around $575K in taxable brokerage accounts. My two questions are: (1) Am I taking on too much risk? (2) How does my progress compare to others in my age group?

This is a cool story.

This guy came to America for an education, started a family and is now well on his way to financial freedom. The American dream.

The other side of the American dream is financial anxiety. Almost everyone has it, even people with lots of money.

You and your family are doing quite well. Despite a late start to 401k savings, between the tax-deferred and taxable brokerage account you’re worth nearly $1 million. That’s an incredible accomplishment before age 40.

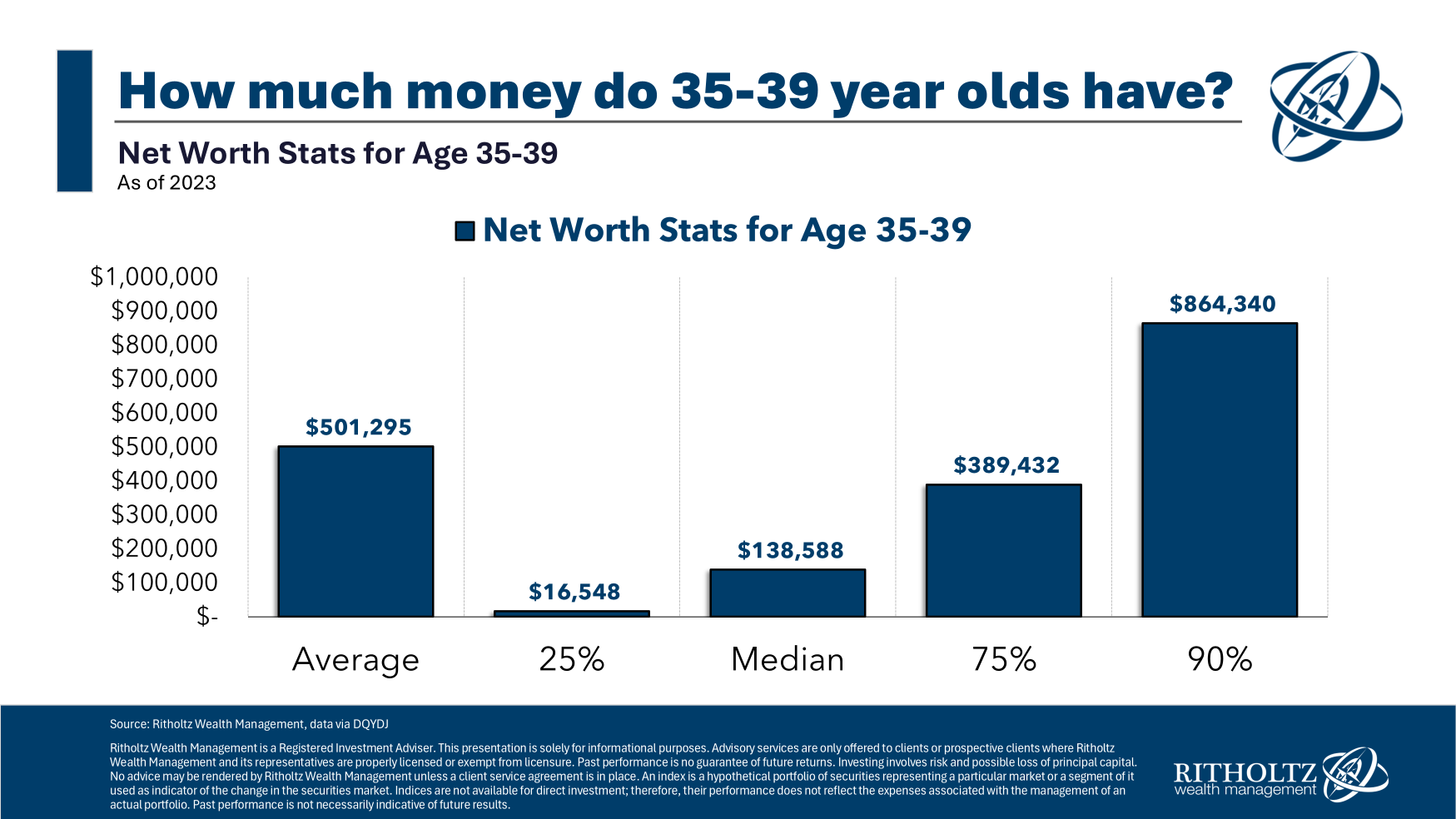

Your progress compared to others in your age group is strong to quite strong:

The median net worth for people in the 35-39 age range is a little less than $140,000. Your $955,000 puts you squarely in the top 10% of your peer group.1

It can be interesting to look at these numbers to see how you stack up but I’m not a fan of comparing your finances to that of your age group, friends, neighbors, co-workers or anyone else.

What good does it do you?

The only thing that matters is how you are progressing towards your own personal goals. Other people don’t have the same risk profile, time horizon or circumstances as you. It’s silly to use others as your benchmark because the only outcome is likely jealousy and envy.

Money goals are personal just like your risk profile. It’s hard to say if you’re taking too much risk or not because risk is subjective.

Here are some questions to ask yourself when it comes to tracking progress and figuring out your risk profile:

When are you going to spend the money? This helps you figure out your time horizon for investing.

What are your current spending habits? Spending is the biggest blindspot for personal finance experts. It’s not all about saving; you need to enjoy some of your money, but you need to have a good handle on your spending levels to understand your financial needs.

How much money do you make? Income is one of the most important variables when it comes to building wealth. You have to save some of that income but it’s much easier to save when you make more money.

How much do you save each year? Your savings rate is a good way to chart your financial progress. A 10% savings rate should be the goal. Anything in the 20-30% range or up and you are doing fantastic.

When do you want to retire? It’s OK if you don’t know yet but this is helpful in determining how long until you need some more conservative assets to see you through retirement.

How big of a margin of safety do you require? Risk appetite is personal and often determined more by your personality, upbringing and past experiences. Some people need a bigger margin of safety than others. Your preference for risk comes down to some combination of math and feelings (which aren’t easy to quantify).

How comfortable are you with volatility and drawdowns? You’ve survived thus far with an all-equity portfolio. How well did you handle the Covid crash of 2020 or the 2022 bear market? The best predictor of future behavior is past behavior.

How much money are you willing to see evaporate? Dollar losses matter more than percentage losses the more money you accumulate. A 40% drawdown on $100,000 is a loss of $40,000. All it takes to lose $40,000 on a $1 million portfolio is a 4% loss. Losing 40% of your portfolio means seeing $400,000 evaporate. What’s your line in the sand? That can help better determine your asset allocation and willingness to accept more or less risk.

Do you have a portfolio or a plan? Stocks, mutual funds and ETFs are holdings that make up a portfolio. But ticker symbols alone do not make an investment plan. A plan requires making good decisions ahead of time about your asset allocation, buy and sell decisions, rebalancing policy and matching your investments with your goals.

Your goals are the only benchmark that matters.

Bill Sweet joined me on Ask the Compound this week to discuss this question:

We also touched on questions about managing your brokerage account, the best way to optimize asset location, RSUs vs. HELOCs when paying for a home renovation and jewelry as an asset class.

Further Reading:

10 Money Revelations in my 40s

1And these peer rankings are net worth figures. This reader didn’t mention how much debt or home equity his family has, if any.