Today’s Animal Spirits is brought to you by YCharts and Fabric:

See here for 20% off your initial YCharts Professional subscription (new customers only)

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

Get a random Animal Spirits chart here

On today’s show, we discuss:

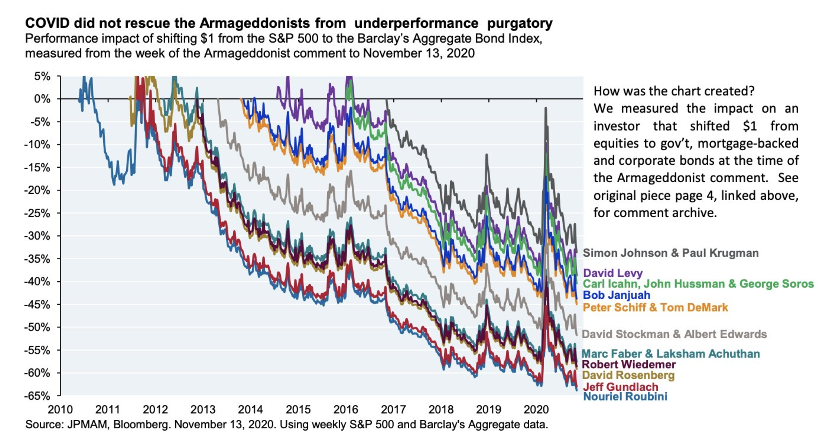

- Memo From the Chief Economist: Lament of a Bear

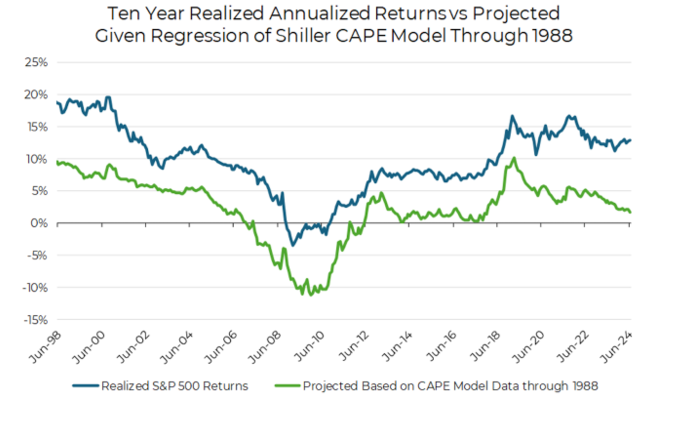

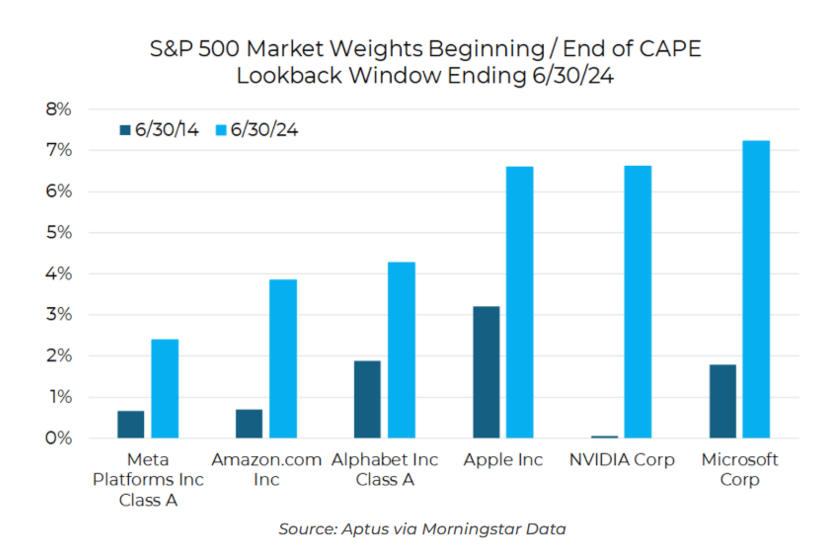

- Beware CAPE Crusaders: Limitations of Shiller’s Ratio in Modern Market Valuation

- CAPE Fear: Why CAPE Naysayers Are Wrong

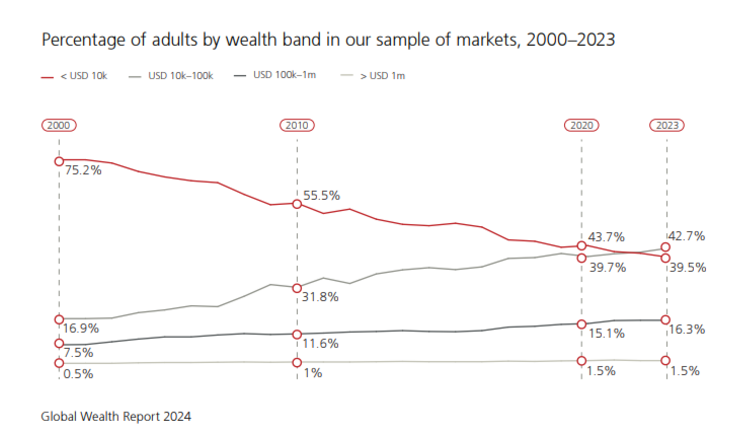

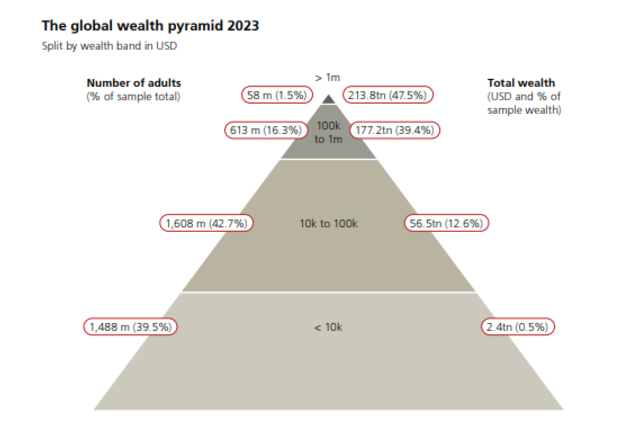

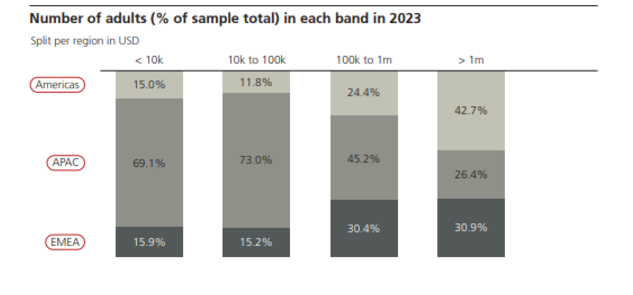

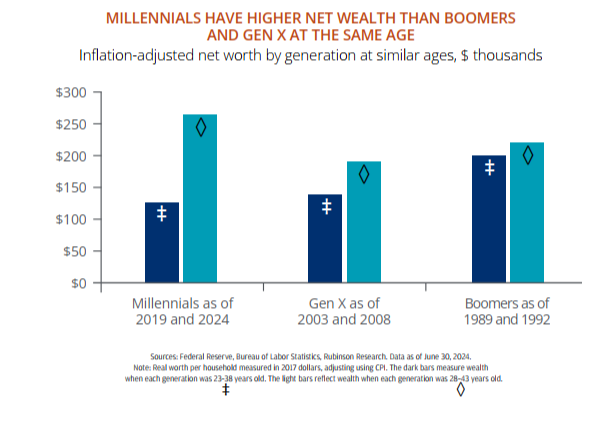

- Global Wealth Report 2024

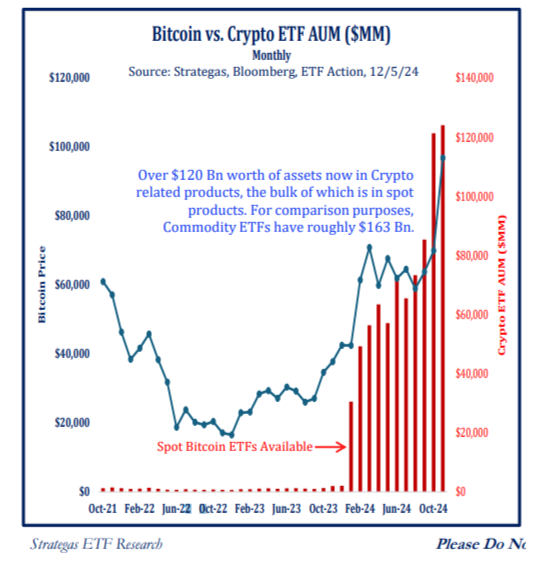

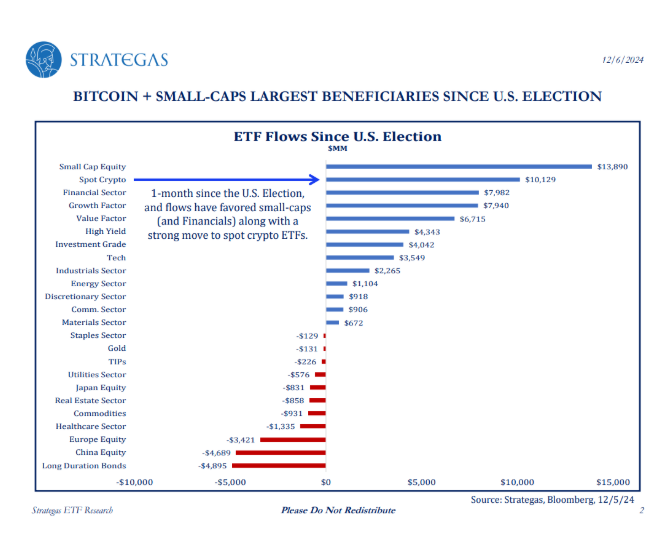

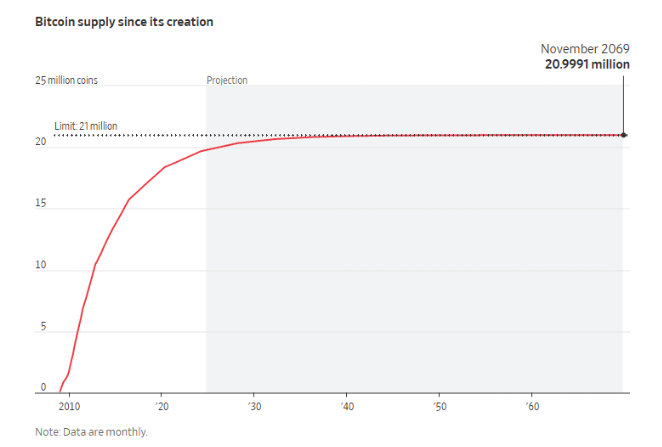

- Behind Bitcoin’s Rally Is a Simple Fact: Supplies Are Limited

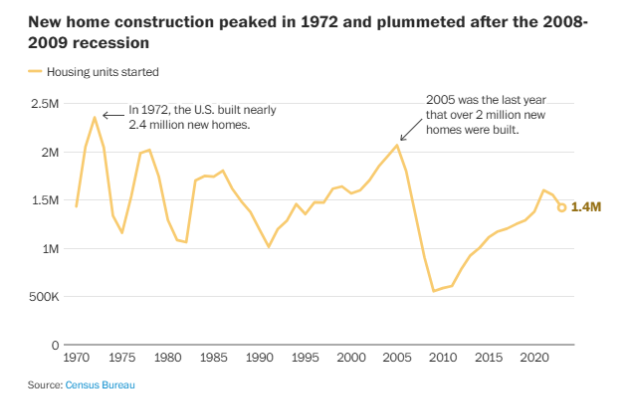

- A Michigan roofer’s smart plan to end the housing crisis

- The 50 Best Airplane Movies, Ranked

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

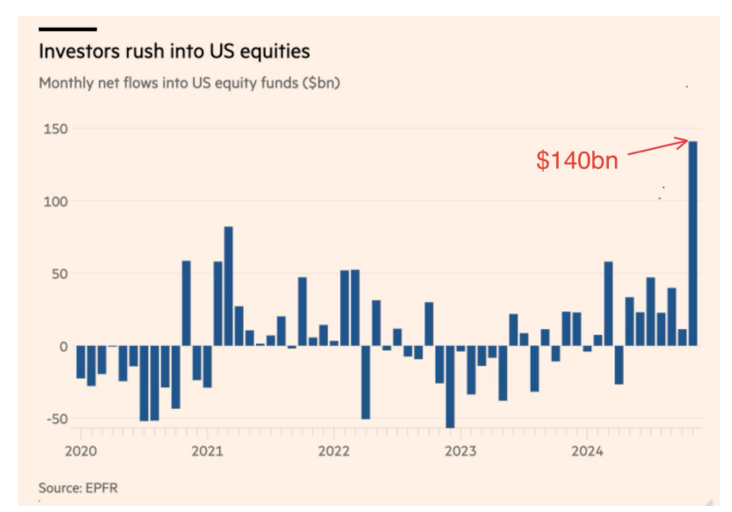

The S&P 500 is up 29% in total this year

The worst peak-to-trough drawdown was just 8.4%

There have been 56 new all-time highs

That's a new high 1 out of every 4 trading days

There have been just 3 down days of -2% or worse

What a year

— Ben Carlson (@awealthofcs) December 5, 2024

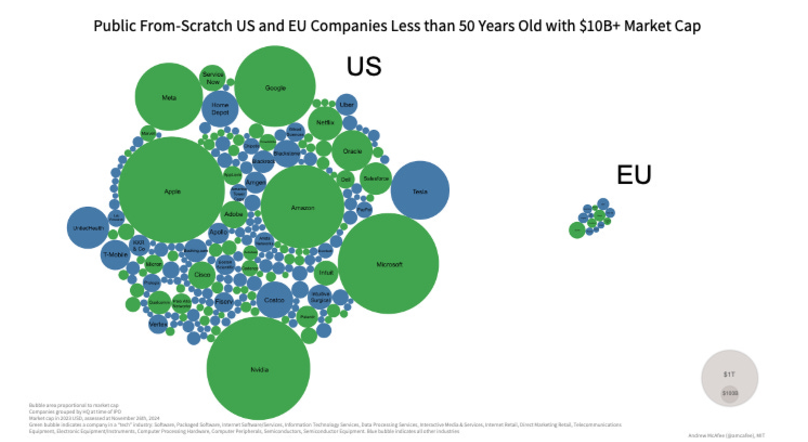

The bubbles on the left are US publicly traded companies that are less than 50 years old with a market capitalization of $10B+. The bubbles on the right are the same but for the EU.

Great visual from @amcafee's newsletter. pic.twitter.com/9cJOERV0Mw— César A. Hidalgo (@cesifoti) December 2, 2024

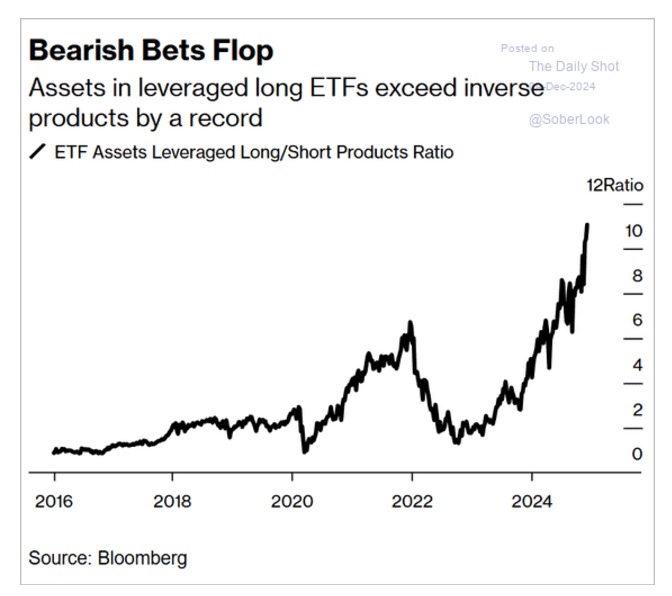

Here's a time-lapse of net assets in single-stock leveraged long ETFs, broken down by reference stock. Aggregate net assets have risen 12x over past 12 months. Single-stock ETFs referencing NVDA ($7.4B), MSTR ($4.8B), and TSLA ($4.0B) account for ~85% of all assets. pic.twitter.com/nU1yNe1ZQe

— Jeffrey Ptak (@syouth1) December 2, 2024

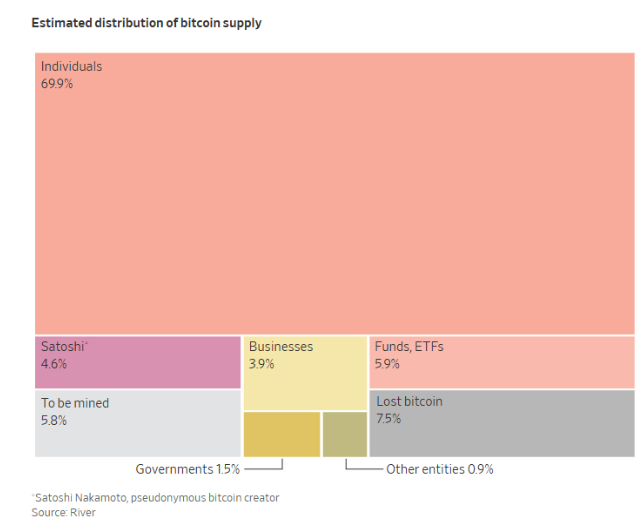

Blackrock, Fidelity, Microstrategy and the U.S. Government among the top 10.

Just as Satoshi intended. https://t.co/Fxh3xHhQyr

— Tyrone V. Ross Jr. (@TR401) December 7, 2024

Largest amount of liquidations since the FTX insolvency on $BTC now spot buyers stepping in hoovering up the liquidation cascade.

Thanks for playing pic.twitter.com/KeILGEPAhY

— McKenna (@Crypto_McKenna) December 5, 2024

Bitcoin really is proof that you don’t have to be right to make moneyEverything bitcoin ppl have ever predicted has been wrong…except the price going upIt’s actually kind of amazing(I say this w/no shade either, it’s impressive)

— Ben Carlson (@bencarlson007.bsky.social) 2024-12-05T13:20:06.598Z

I realize it's en vogue to parade around when your asset goes up. Just annoying seeing the "I told you back in 2014" posts when the stuff that people said in 2014 was totally off base lol.You can get rich being right for the wrong reasons, but don't act like a psychic.

— Jack Raines (@jackraines.bsky.social) 2024-12-05T13:19:46.206Z

Boy was this a sad thing to read. This is going to stick with me for a long time. https://t.co/RtugCrpkEZ pic.twitter.com/cJSfujnlGN

— Chris Vannini (@ChrisVannini) December 6, 2024

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.