Predicting the future is hard and forecasting is not really my forte so here’s my list of things that probably won’t happen in 2025:

1. You probably won’t get rich overnight. Someone will. Probably not you or me.

2. No one will predict the biggest risk or upside catalyst. The biggest risk this decade was a pandemic no one could have possibly seen coming. It changed the economic, market and political landscape in ways that will be felt for decades.

And while the tech world was trying to sell us all on the metaverse and Web 3 (remember that one?), Chat GPT seemingly came out of nowhere and AI essentially carried the stock market in the past 24 months.

No one predicted these events and it’s unlikely someone will predict the next big catalyst either.

3. The Detroit Lions probably won’t win the Super Bowl. It’s been so much fun watching the best Lions team ever but we’re snake-bitten with injuries.

They have the best offense and roster in the league but too many guys are hurt on defense.

I’m preparing myself now so I’m not so disappointed when the heart-breaking loss happens.1

4. You probably won’t time the market perfectly. In the fall of 2022 I had a slug of cash to invest and dumped a lump sum into stocks.

In hindsight it was pretty fortuitous timing.

In 2023 I had a slug of cash to invest but decided to dollar cost average in over the course of a year or so.

In hindsight it was the wrong strategy in a market that went straight up.

Timing the market is mostly luck. No one ever does it perfectly.

The good news is a long time horizon is the ultimate equalizer. The timing of your purchases doesn’t matter that much if you think in terms of decades.

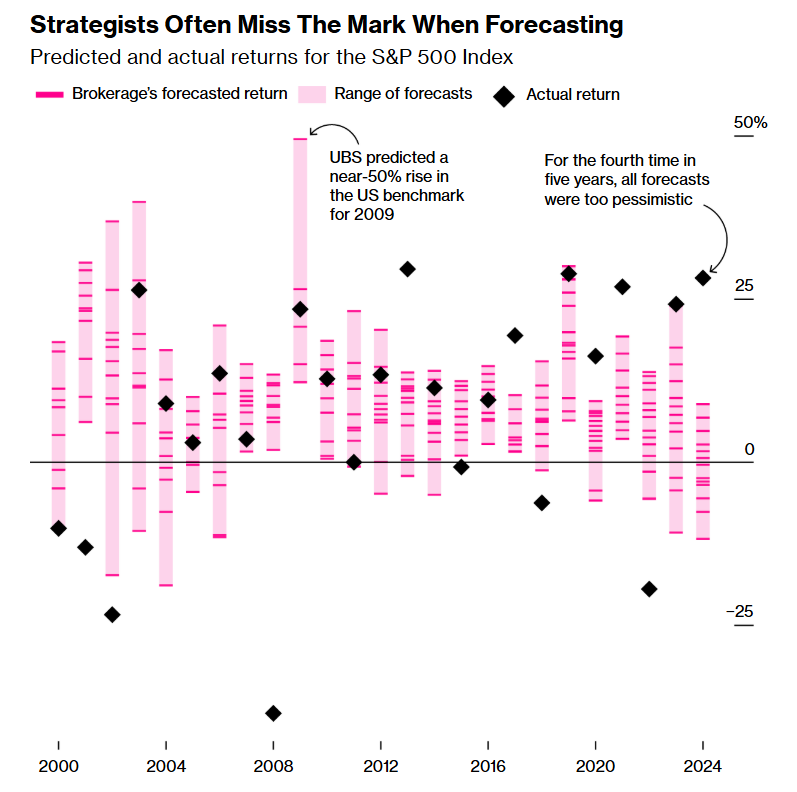

5. 2025 probably won’t work out according to expert forecasts. Bloomberg collected all of Wall Street’s annual forecasts this century to show the range of predictions versus the actual results:

Forecasting the short-term is hard:

If hearing the brokerages’ average 2025 forecast of a 9.1% gain is giving you a sense of déjà vu, you’re onto something. Over the past 25 years, 53% of the 376 firm forecasts surveyed by Bloomberg clustered between 0% and 10%.

In seven of the past eight years, the market’s returns were outside the range of all forecasts compiled, often collectively underestimating the index’s return potential.

Ben’s forecasting model is probably better at expectation-setting than Wall Street strategists.

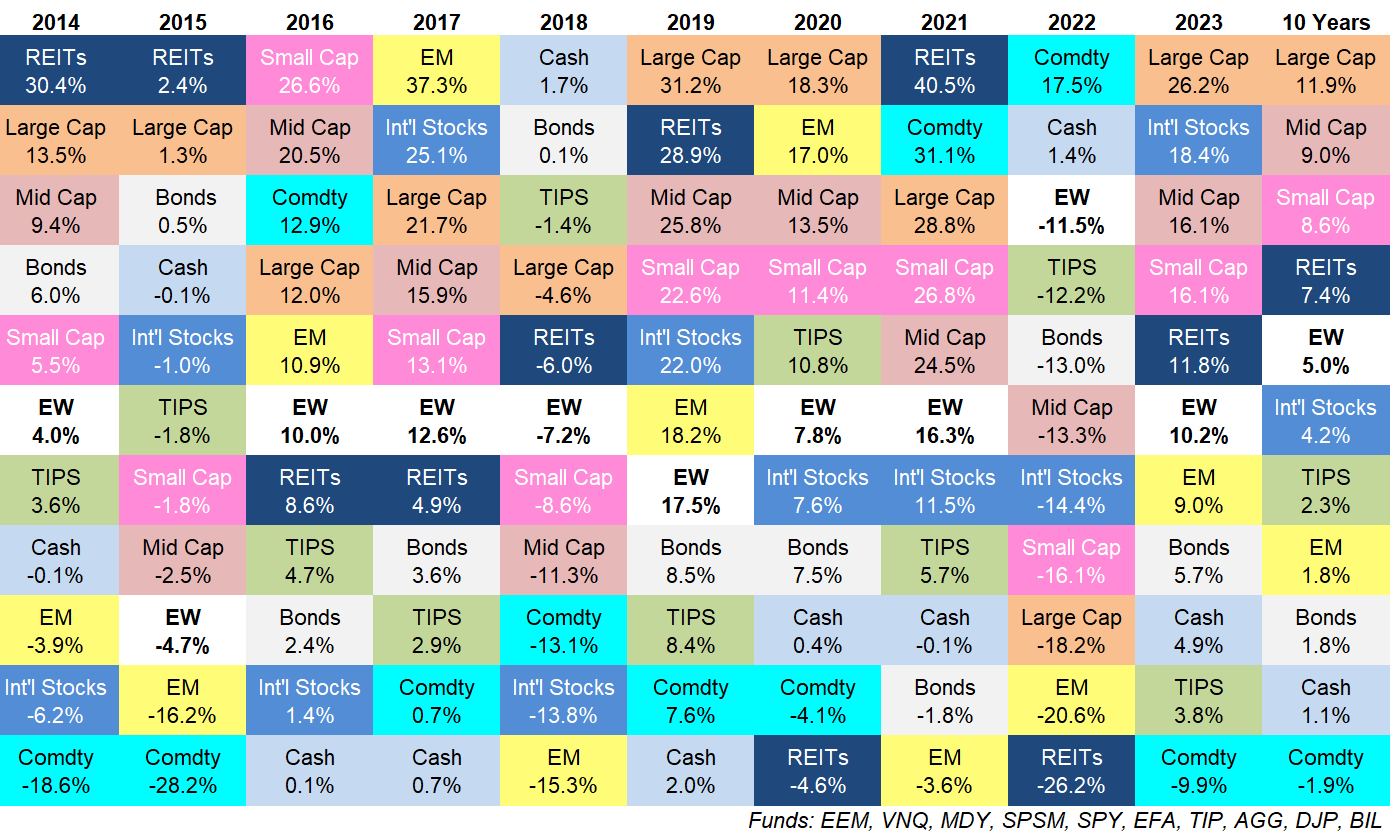

6. You probably can’t predict what the best-performing asset class or strategy will be. I’ll be updating my favorite performance chart early in the new year.

There is little rhyme or reason from one year to the next.

7. You probably won’t like something about the economy. People were upset during the Great Financial Crisis because housing prices crashed and wouldn’t go up.

People are upset now that housing prices are too high.

In the 2010s inflation and wage growth were too low.

In the 2020s inflation and wage growth are too high.

There is no such thing as a perfect economic environment for everyone.

8. You probably won’t outperform the market. Some people will. Most won’t. The good news is outperforming is not a prerequisite for financial success.

9. You probably won’t pick the best-performing stock. These are the five best-performing stocks in the Russell 3000 Index so far in 2024:

- GeneDx Holdings (WGS) +2,740%

- Rigetti Computing (RGTI) +1,630%

- Sezzle Inc (SEZL) +1,190%

- Dave Inc (DAVE) +1,070%

- SoundHound (SOUN) +1,030%

I follow the stock market pretty closely. I’m not ashamed to admit I’ve never heard of any of these companies.

The only way I’ll ever own the best-performing stock is in my total stock market index fund. I’m OK with that.

10. You probably won’t find joy and contentment from your favorite influencer. I’ve met a handful of the biggest personal finance experts. Some of these same people who preach about being zen with your finances and finding your ‘enough’ obsess over how much they make and have an unhealthy relationship with money.

Most of the people who seem to have life figured out on social media are full of it.

11. You probably won’t see everything in your portfolio do well. Sure, if you have a concentrated portfolio it’s possible to see everything firing on all cylinders but trees don’t grow to the sky.

Being a long-term diversified investor means dealing with leaders and laggards.

12. You probably won’t guess the timing of the next correction. One of my favorite Warren Buffett anecdotes comes from a quarterly letter he wrote in the 1960s when one of his clients called to warn him stocks had further to fall while they were already in correction territory.

This was his response:

If you knew in February that the Dow was going to 8652 in May, why didn’t you let me know it then?

And if you didn’t know what was going to happen during the ensuing three months back in February, how do you know in May?

I’m fairly confident the stock market is due for a correction.

I am not confident at all in my ability to predict the timing or magnitude of said correction.

Preparation is easier than predictions.

Further Reading:

My Year-End Stock Market Forecast

1And yes I’m trying really hard for a reverse jinx here. Maybe we’ll just score 45 points on everyone in the playoffs.

2The Dow at 865 back then is crazy considering it’s around 43,000 now.