A month ago, Michael and I were talking about the epic bull market, and I asked him where the euphoria was:

Markets were rocking, but the sentiment didn’t match the gains quite yet.

Sentiment can change in a hurry. It feels like the election was a spark that seems to have awoken the animal spirits.

Just look at some recent headlines:

Look, I’m not saying this is the dot-com bubble 2.0 all over again1 but there’s excitement in the air again for investors. And I’m not just talking about sentiment surveys.

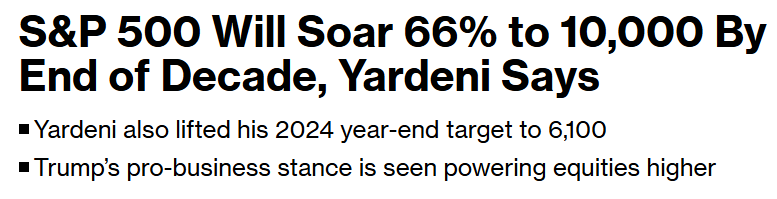

Here’s a story from Bloomberg this week:

And the lede:

The “animal spirits” being set loose by the economic policies of President-elect Donald Trump will send the S&P 500 to 10,000 by the end of the decade, according to veteran strategist Ed Yardeni.

To be fair going from S&P 6,000 to S&P 10,000 by the end of the decade is an annual gain of around 11% per year. Add in some dividends and we’re talking 12% per year or so. That’s higher than most predictions but not a grand slam by any means. Still, that’s a fairly aggressive stance considering the S&P 500 is up something like 16% per year for the past 15 years.

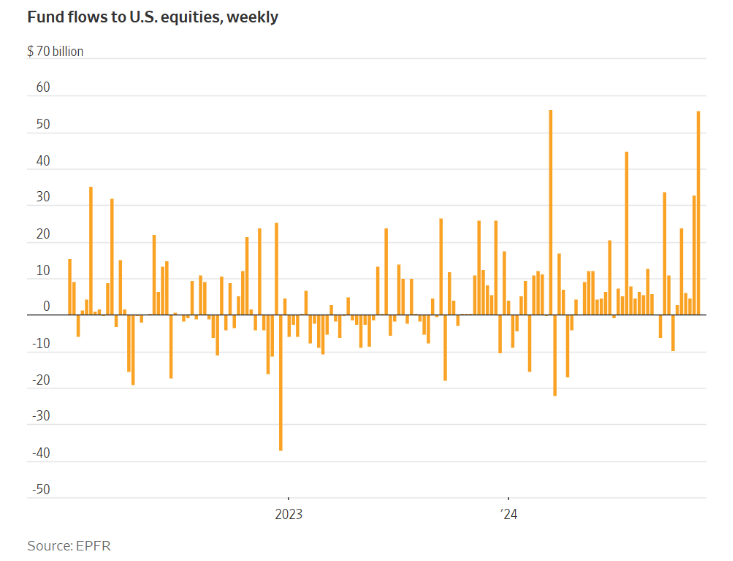

The Wall Street Journal says investors are betting on a melt-up:

People are betting with their wallets:

We just saw the second-biggest inflow to U.S. equities since 2008. We’ve been in a bull market for some time now yet money just keeps coming.

One of my favorite parts of reading the Journal is when they interview normal investors. Here’s one from this article:

Joe Johnson, 37, said he has waded into hot stocks including Nvidia, Tesla and a crypto play, MicroStrategy. His portfolio has swelled this year, and he is feeling so good about the market that he is thinking about pouring his cash pile into stocks. He is eyeing such industrial giants as Caterpillar and Deere, which he believes will benefit from a strong economy.

“I am bullish on the market,” Johnson said. “The euphoria everyone is feeling is warranted.”

I’d be lying if I said these kinds of anecdotes didn’t make me a little nervous.

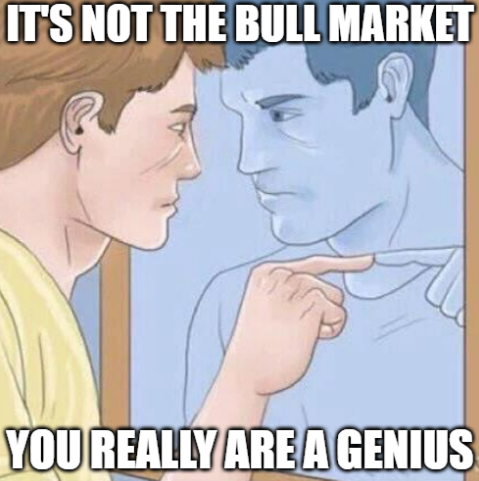

Bull markets make you feel invincible. Everyone feels like a genius in a bull market.

Markets are always and forever cyclical. So are investor emotions. You never want to get too high or too low because the market can be unforgiving to those who go to extremes.

However, I wouldn’t dare make any predictions based on headlines, flows or investor actions.

While it is true the pendulum swings back and forth, it can go much further in either direction than you assume. This bull market has made many intelligent people look very dumb by trying to predict when it’s going to come to an end.

I personally prefer a bull market that climbs a wall of worry. Once everybody is in the pool I get a little nervous.

Timing the market is notoriously difficult but it’s probably not a bad time to rebalance and ensure you have an asset allocation in place you feel comfortable with during both bull and bear markets.

And just because the markets are getting a little crazy doesn’t make them any easier to predict.

As Meir Statman once said, “The market may be crazy, but that doesn’t make you a psychologist.”

Michael and I talked about market sentiment, ETF buying patterns and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

So Much Money Everywhere

Now here’s what I’ve been reading lately:

- The Detroit Lions are like eating Cherry Pie in Traverse City (Freep)

- Some not so good financial goals (Oblivious Investor)

- The real value of money (The Leading Edge)

- The things you can’t buy (Of Dollars & Data)

- America doesn’t really have a working class (Noahpinion)

- What I learned from John Rekanthaler (Morningstar)

- You only have to get rich once (Young Money)

- The making of Sideways, 20 years later (Wine Enthusiast)

Books:

1Yet. Just kidding. We still have a ways to go but I wouldn’t count it out with the AI revolution coming.