A reader asks:

How worried should we be about government debt levels? People like Paul Tudor Jones and Elon Musk keep talking about how we’re going broke but what is the catalyst for an actual crisis here?

There seem to be two extreme views when it comes to government debt levels.

One is the view that government debt doesn’t really matter all that much since we have the global reserve currency and the ability to print as much of that currency as we’d like.

The other view is that government debt levels are reaching a tipping point that will lead to calamity.

I rarely think in extremes and believe a more nuanced view makes more sense on topics like this.

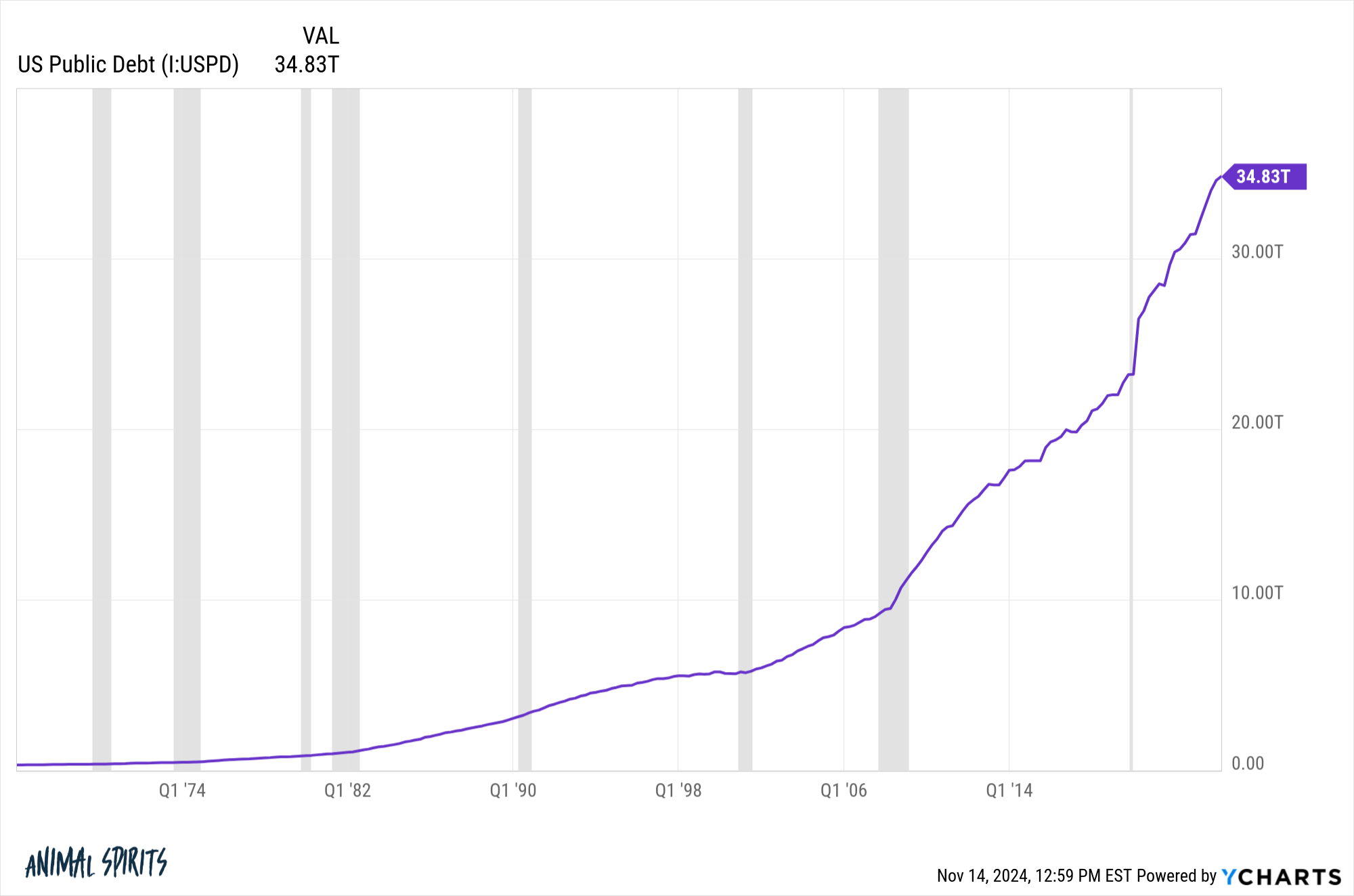

It is true that U.S. government debt is enormous:

Total government debt in the United States was around $23 trillion heading into the pandemic so debt levels are up 50% or so this decade alone.

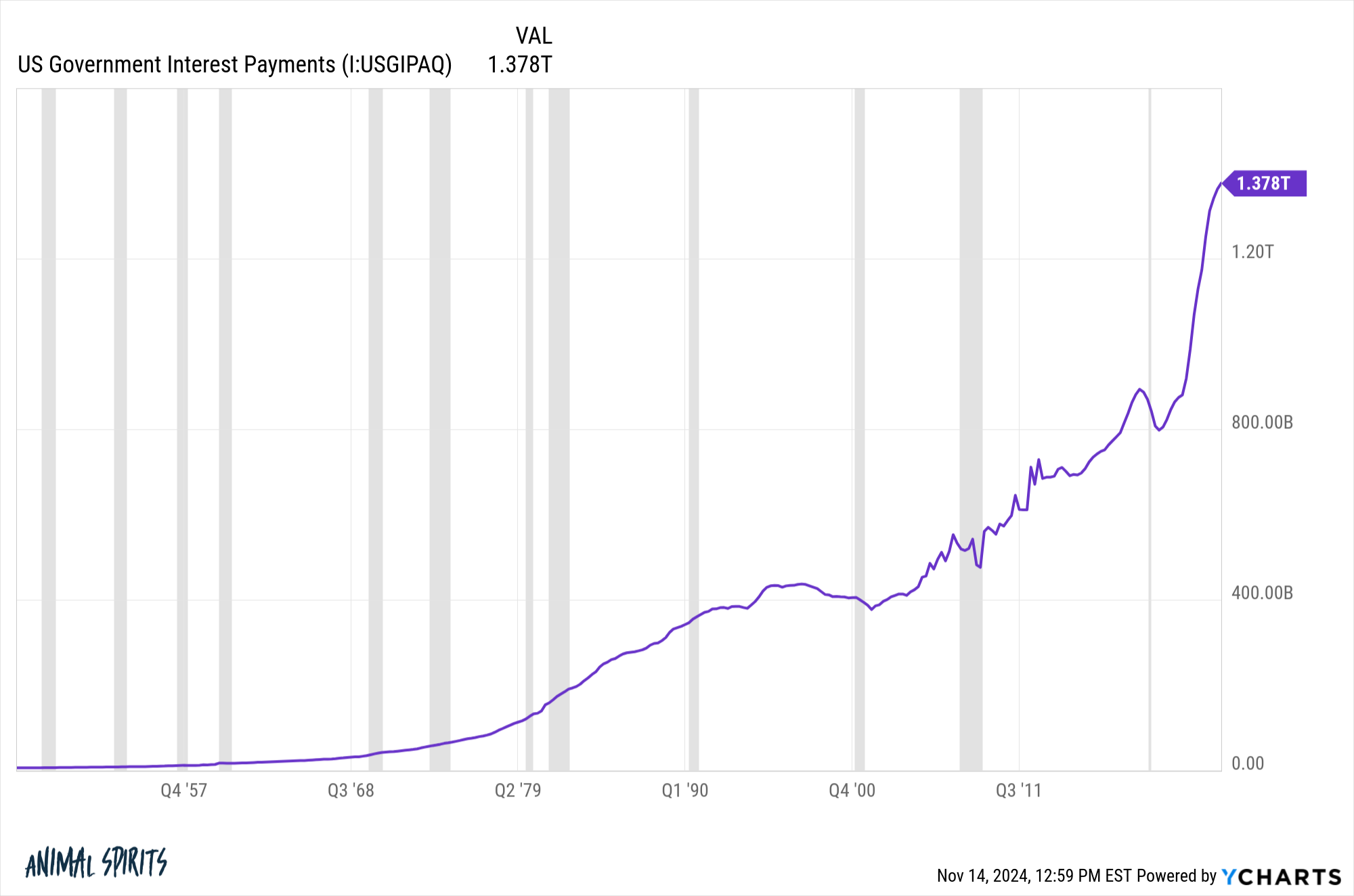

It’s also true that the interest we pay on government debt has risen considerably because we’ve taken on so much and interest rates are so much higher than they were in the 2010s:

The big worry is the interest expense will grow so large over time that it will crowd out spending that could be used elsewhere.

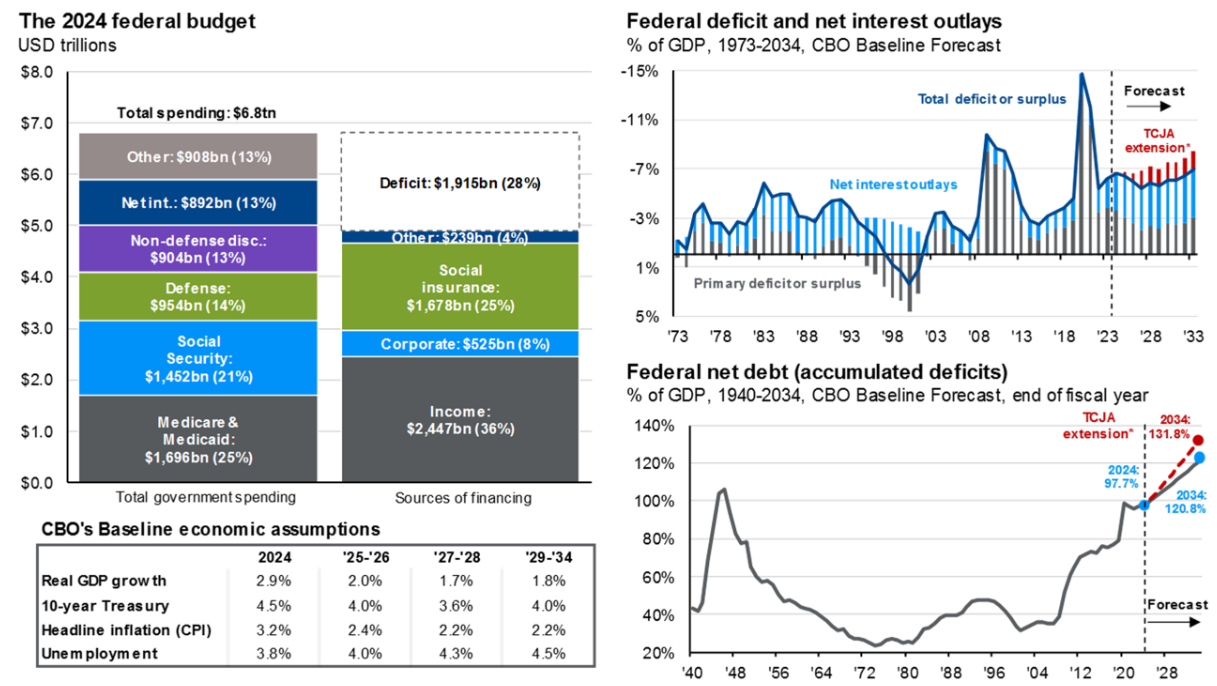

Here’s a useful breakdown from JP Morgan that shows the federal budget:

Interest expense makes up roughly the same amount as defense spending. Entitlements (Social Security and Medicare/Medicaid) still make up the bulk of the federal budget (46%) but interest expense is getting up there.

One of the reasons government debt gets people so worked up is because the numbers are so large. $35 trillion is a lot of money!

But you can’t look at debt levels on their own. You have to think of them through the lens of a $30 trillion U.S. economy.

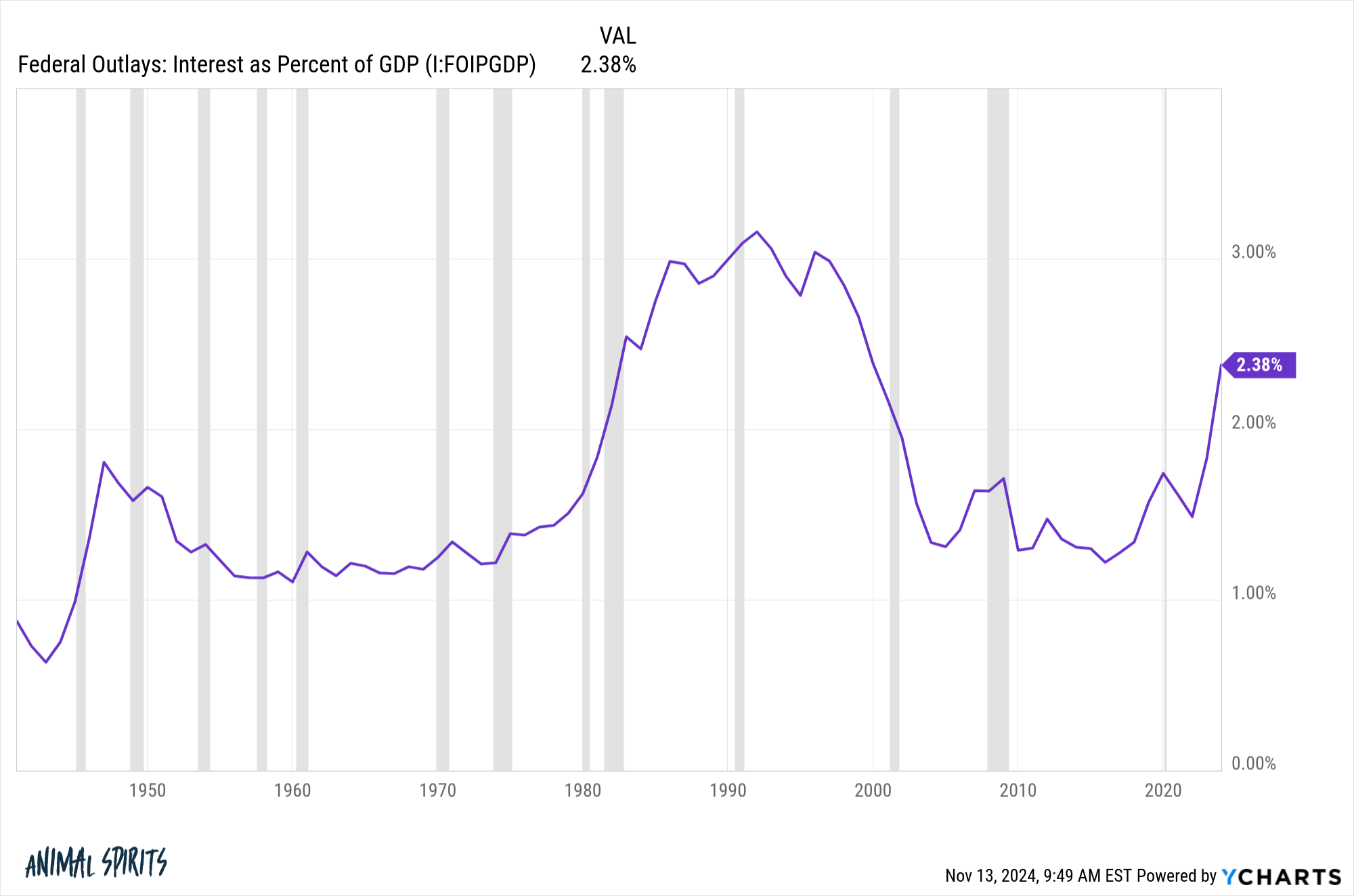

Here is interest expense as a percentage of GDP:

It’s shot up considerably in recent years but it’s still below 1990s levels. The Fed cutting interest rates should help on the margins.

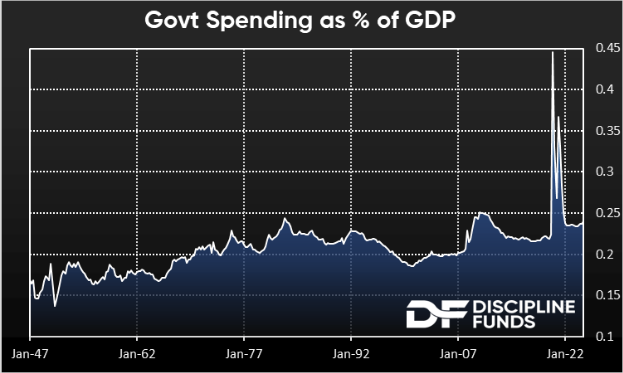

Here is government spending as a percentage of GDP:

Spending was 45% of GDP during the pandemic. That was obviously unsustainable but things are now back to normal.

This doesn’t take away from the fact that we’ve built up a ton of debt but it does put things into perspective.

The thing you have to understand is the United States government does not operate like a household when it comes to debt. You pay your mortgage off over time and eventually retire that debt.

The government’s budget is not at all like a household budget. First of all, the government can print its own currency. That helps in a pinch and it’s the main reason our government can’t go broke. Inflation is the true constraint when it comes to politicians spending money.

As long as the economy is growing, debt should be growing too.

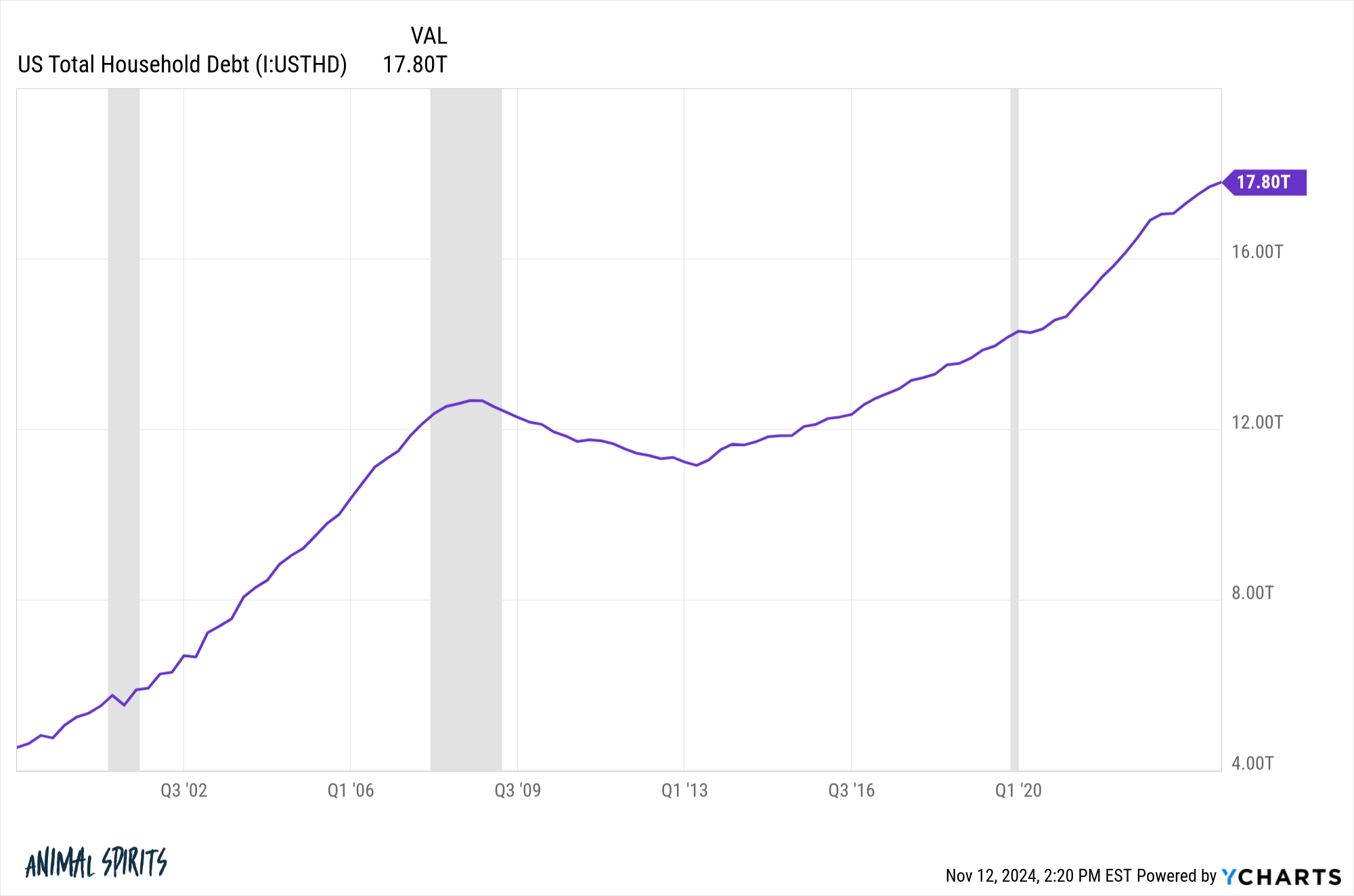

The same is true of consumer debt:

I would be more worried if you told me government and consumer debt were down in the coming decades. That would mean something is seriously wrong with the economy.

Debt grows because assets grow (remember government debt is an asset in the form of bonds for investors). Debt grows because the economy grows. Income grows. Prices grow. So of course debt will rise.

You can nitpick about the ways in which our politicians spend the money. No one is ever going to be completely satisfied on that front. There are certainly areas where the government can cut back and become more efficient.

But as long as the pie keeps growing it makes sense the debts will grow too.

Your biggest long-term worry about government spending should not be a day of reckoning where there’s some magic level that causes a financial crisis.

The biggest worry about government spending is inflation risk.

After living through the highest inflation in four decades, we now know rapidly rising prices are not politically beneficial.

Our country isn’t going broke, but the public hates inflation so much that it could act as the biggest constraint in the years ahead when it comes to tackling government spending.

Cullen Roche joined me on Ask the Compound this week to discuss this question:

We also talked about the impact of the deficit on the stock market, how tariffs work, the long-term trend of interest rates and how to fix government debt levels.

Further Reading:

The Relationship Between Wages and Inflation