The pictures and videos from the wake of Hurricane Helene are unfathomable.

One emergency respondent said the flooding in parts of North Carolina resembles biblical devastation.

I can’t imagine trying to pick up the pieces if your town, home or business was destroyed by the storm.

The good news is this country is pretty good about rallying the troops to help in situations like these.

The bad news is these situations are happening more frequently. It seems like we have a “one in 100 year storm” once a year now.

Hurricanes. Wildfires. Floods. Tornados. Severe heat.

Climate change is one of the biggest risks to the housing market in the years ahead if these storms continue.

Last week Zillow announced they would be now including climate risk and insurance data on all home listings:

Zillow is introducing climate risk data, provided by First Street, the standard for climate risk financial modeling, on for-sale property listings across the U.S. Home shoppers will gain insights into five key risks–flood, wildfire, wind, heat and air quality–directly from listing pages, complete with risk scores, interactive maps and insurance requirements.

Some people might not care all that much about climate change, but homeowners definitely notice when their insurance bill goes up. You can lock in the price of your home and the mortgage rate, but insurance rates aren’t fixed.

Ther national average annual home insurance premium in 2023 was a little less than $2,400. But in Florida it was closer to $11,000 per year (that’s the highest in the nation).

As more people move to disaster-prone areas, the damage becomes more and more expensive. Some insurers have decided to pull out of certain states, areas or homeowners altogether. This makes insurance even more expensive, which causes some homeowners to forego home insurance.

The Wall Street Journal estimates 12% of homeowners don’t purchase homeowners’ insurance. I would expect that number to rise in the years ahead as insurance costs become more cumbersome.

So what happens when these high risk areas get hit by natural disasters that make it too expensive to insure?

This week a Florida Congressman advocated for the creation of a national catastrophic insurance fund that would essentially spread the costs among all the states:

Representative Jared Moskowitz, a Democrat, has filed legislation that would “spread the risk around” using federal bonds to mitigate the insurance burden.

“It would add no money to the deficit. It would allow states to buy bonds, that–when we have these one in 1,000-year events–would take that off of the plate of the insurance companies, which is driving up 25 percent of the cost on reinsurance,” Moskowitz said while appearing on Fox News on Saturday.

“Even if my bill doesn’t move or go anywhere, I think the United States government and Congress [have] to start realizing that we have to amortize the risk, we have to spread this risk around. It can’t just be on one state or two states to deal with this.”

On the one hand, more people have moved to the coasts where the risk of severe storms is heightened. They took that risk.

On the other hand, it’s hard for me to see local government officials sit around and let high insurance costs decimate their cities and towns.

This is bound to be a contentious issue in the years ahead.

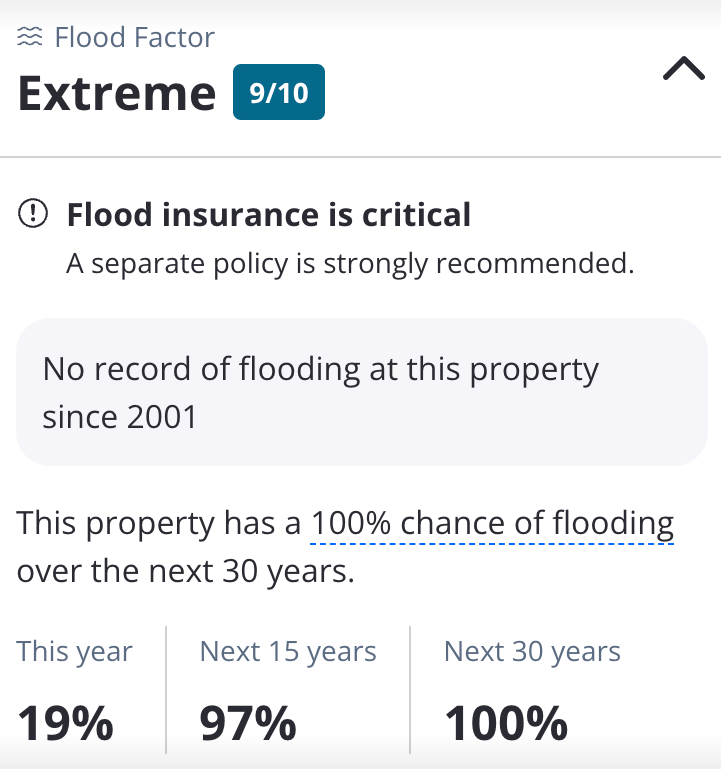

Our producer Duncan is from North Carolina. He sent me the Zillow climate risk report on a coastal home listed in North Carolina (not on the ocean):

I would have to think twice when presented with these facts or at the very least, use it as a negotiating tactic.

I have more questions than answers about how this all plays out:

- Do we see a change in migration patterns in the years ahead (people have been flocking to the south)?

- Will owning a home in certain areas become too risky for some people?

- Will owning a home in certain areas become too expensive for some people as insurance costs rise?

- Will home prices begin falling in high-risk areas?

- How long will insurers be willing to go into high-risk areas?

- At what point will the government step in to keep home insurance affordable?

It’s impossible to know how this all plays out because Mother Nature is unpredictable.

But make no mistake, this is one of the biggest risks for many homeowners in the years ahead.

At the very least, get ready to pay higher premiums on your home insurance.

Further Reading:

Is Auto Insurance Becoming a Crisis?