A reader asks:

Ben Carlson, do you think it’s fair to describe you as a permabull?

This is a fair question.

I am a big proponent of thinking and acting for the long-term, buy & hold investing and keeping an optimistic bias about the future. I am a glass-is-half-full kind of guy.

If the choice were between being a permabull or permabear I’d choose permabull all day long. Permabears are the bane of my existence.

But I wouldn’t describe myself as a permabull for the simple fact that I know bad things can and will happen. It’s hard to be bullish all the time when you know downturns are inevitable.

This week I was doing some back-of-the-envelope retirement projections. I’m 43 years old. I have no idea when I’ll want to retire but I assumed 65 just because that’s the standard number. So I’ve got 20+ years to go.

In those two-plus decades, there will probably be two to three recessions, three to four bear markets, at least one giant market crash, maybe a financial crisis or two, geopolitical crises, war, political upheaval, and a few events that are completely out of left field (like a pandemic).

No one knows these things for certain, but that’s my baseline assumption. I know bad things will happen and I’m still investing for the long haul and optimistic about the future.

I was asked in a recent interview to share three of my favorite underrated investing books. One of those selections was Devil Take The Hindmost by Edward Chancellor.1

It’s my all-time favorite financial history book. Each chapter provides a historical account of speculation gone wrong — from the original stock markets in the 1600s to the South Sea bubble, the Railway Mania, the 1929 crash and the Japan Bubble Economy of the 1980s.

Each historical event is unique in its own way but human nature is the one constant. We get too excited. We take things too far. The good times eventually turn into bad times.

The good times are more fun, of course, but I love reading about the crashes. Dreams vanquished. People getting completely wiped out. Prices going lower than anyone ever thought possible.

I’m not heartless. I don’t derive pleasure from reading about the pain of others. It’s just that reading financial history has 100% made me a better investor because it reminds me you have to stay humble to stay in the game.

And it’s learning about the bad times — war, recessions, financial crises, market crashes, etc. — that provide the best lessons. No one learns anything from a bull market. The tests are given during the downright terrible times.

Although our history as a species is littered with tragedy, suffering, setbacks, and conflict, people continue to wake up in the morning looking to better their situation. Throughout all of the wars, disasters, financial crises and economic downturns, our history is also full of progress, innovation, determination and higher standards of living.

In an op-ed for The New York Times published in October of 2008 Warren Buffett wrote the following:

Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

Well, in the 21st century we’ve experienced three major wars, 9/11, three recessions, two 50%+ market crashes, a failed coup attempt on the Capitol building, a pandemic that literally shut the world down, and the highest inflation in four decades. Yet the Dow rose from 11,497 to 43,275.

Unpleasant things can happen in the short run and things can still work out lovely over the long run.

It all depends on your time horizon.

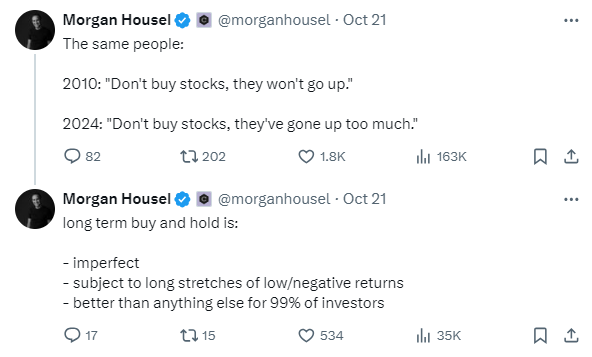

Morgan Housel had an excellent tweet this week that I wholeheartedly agree with:

To paraphrase Churchill, buy & hold is the worst investment strategy there is…except for all the others.

However, just because I’m a buy & hold investor at heart does not mean I am permanently bullish.

I recognize that corrections, bear markets, crashes, and economic contractions will occur. I also recognize that the ~10% historical stock market return includes those events. You take the good with the bad.

The good has always outweighed the bad. I’ll continue to keep that as my baseline philosophy until it’s proven wrong.

Morgan joined me on Ask the Compound this week to tackle this question:

We also answered questions about how to write engaging content, defining your audience when writing, how to balance stories vs. numbers in a presentation and more.

Further Reading:

50 Ways the World is Getting Better

1The other choices were What I Learned Losing a Million Dollars and The Money Game.