In December 2020 I wrote a short history of chasing the best performing funds.

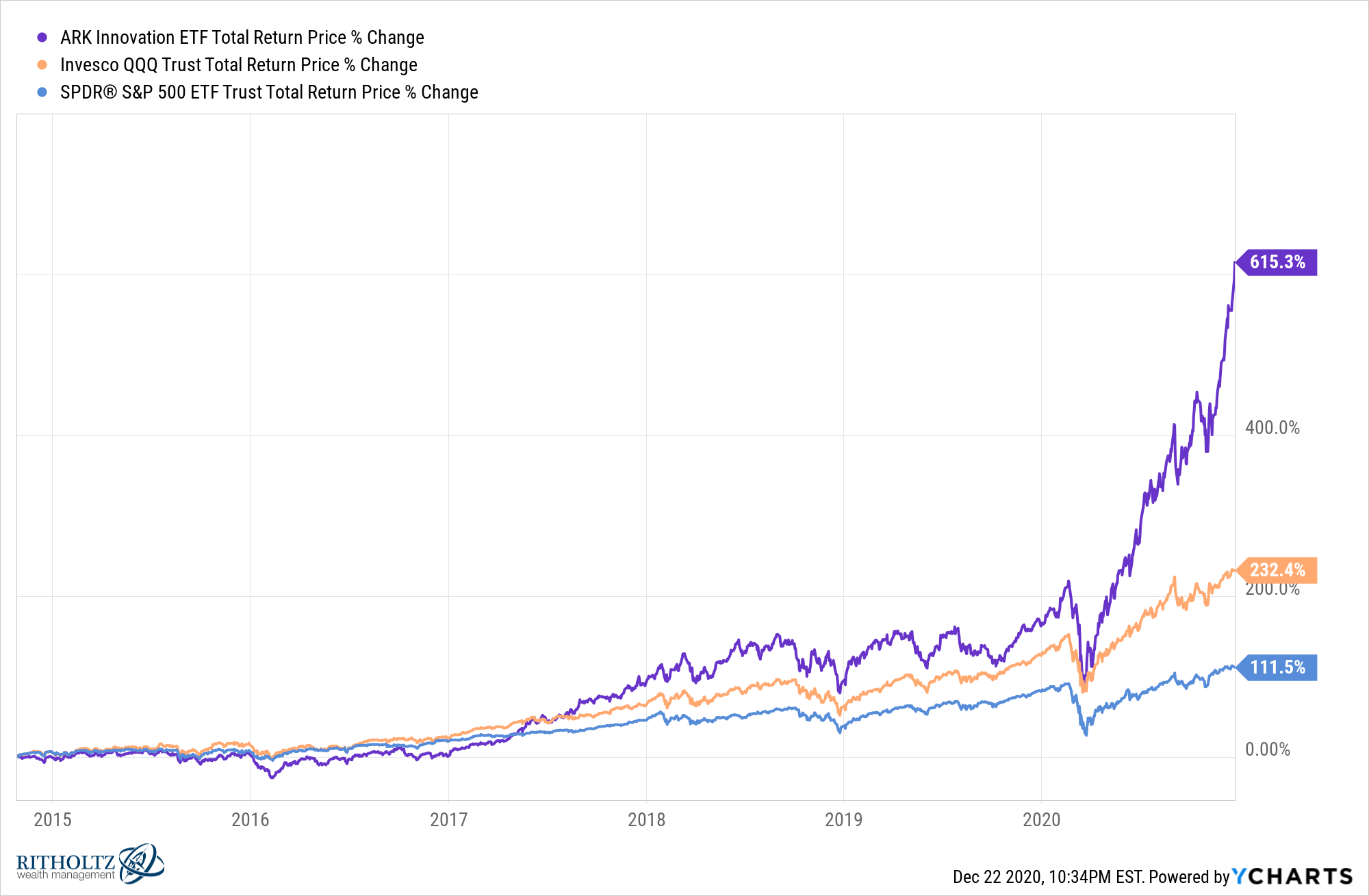

At the time, Cathie Wood’s ARK Innovation fund was on fire, absolutely destroying the market:

Wood quickly became one of the most famous fund managers alive. She was in the headlines every day. Her stock picks and pronouncements about the future were reported by every financial media publication in the country.

Investors took notice. Billions of dollars flooded in. The fund went from a little less than $2 billion at the start of 2020 to $18 billion by year end. Some of that was price appreciation. Most of it was investors chasing the hot dot.

Here’s what I wrote at the time:

ARKK cannot outperform at this pace forever. There is bound to be a misstep or the style will simply fall out of favor for a period of time. Many of the investors chasing the hot dot will head for the exits at that point.

Investors don’t have a great track record when it comes to chasing the hottest fund of the day.

I hate to be that person, but I’ve seen this movie before and it ends with a behavior gap.

I assumed ARKK had to underperform because no one has the ability to keep up that kind of run with money flowing in like a tsunami. I’m not sure I assumed the underperformance would be as great as it has been.

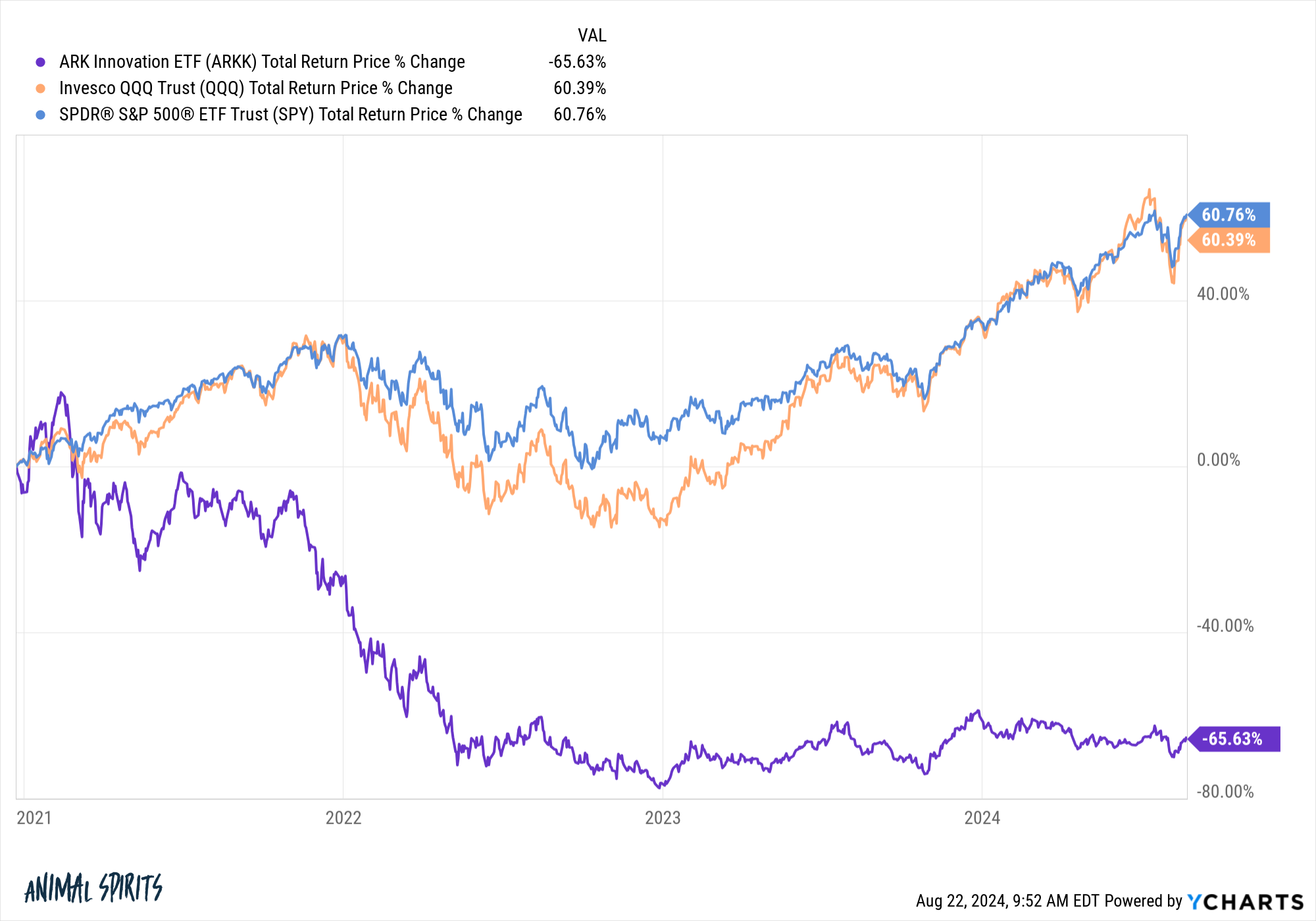

These are the returns since I wrote that piece at the tail end of 2020:

The fund has been decimated.

What makes it all the more surprising is this happened in the midst of an AI boom (that some are already calling a bubble). An innovation fund missed out on perhaps the biggest innovation of this decade and beyond.

As always, beating the market is hard.

Assets peaked in early-2021 at close to $30 billion:

The timing by investors here was predictably godawful.

You had a spectacular run of performance which brought in a flood of money. That was followed by terrible performance which was inevitably followed by money rushing to the exits.

This will likely go down as one of the biggest investor dollar losses in history.

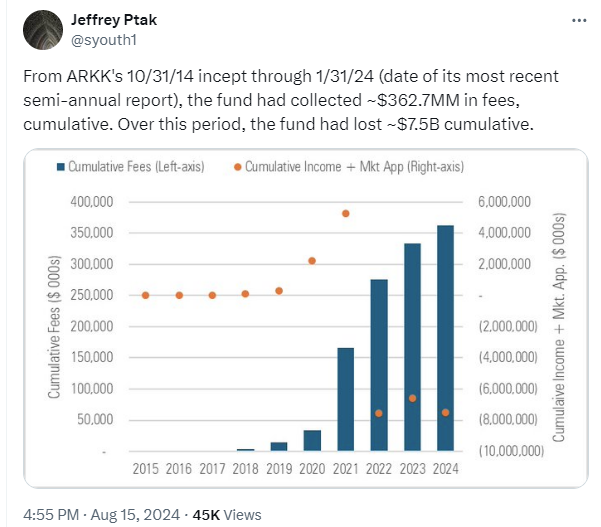

Morningstar’s Jeffrey Ptak shows the fnud has lost investors $7.5 billion since inception:

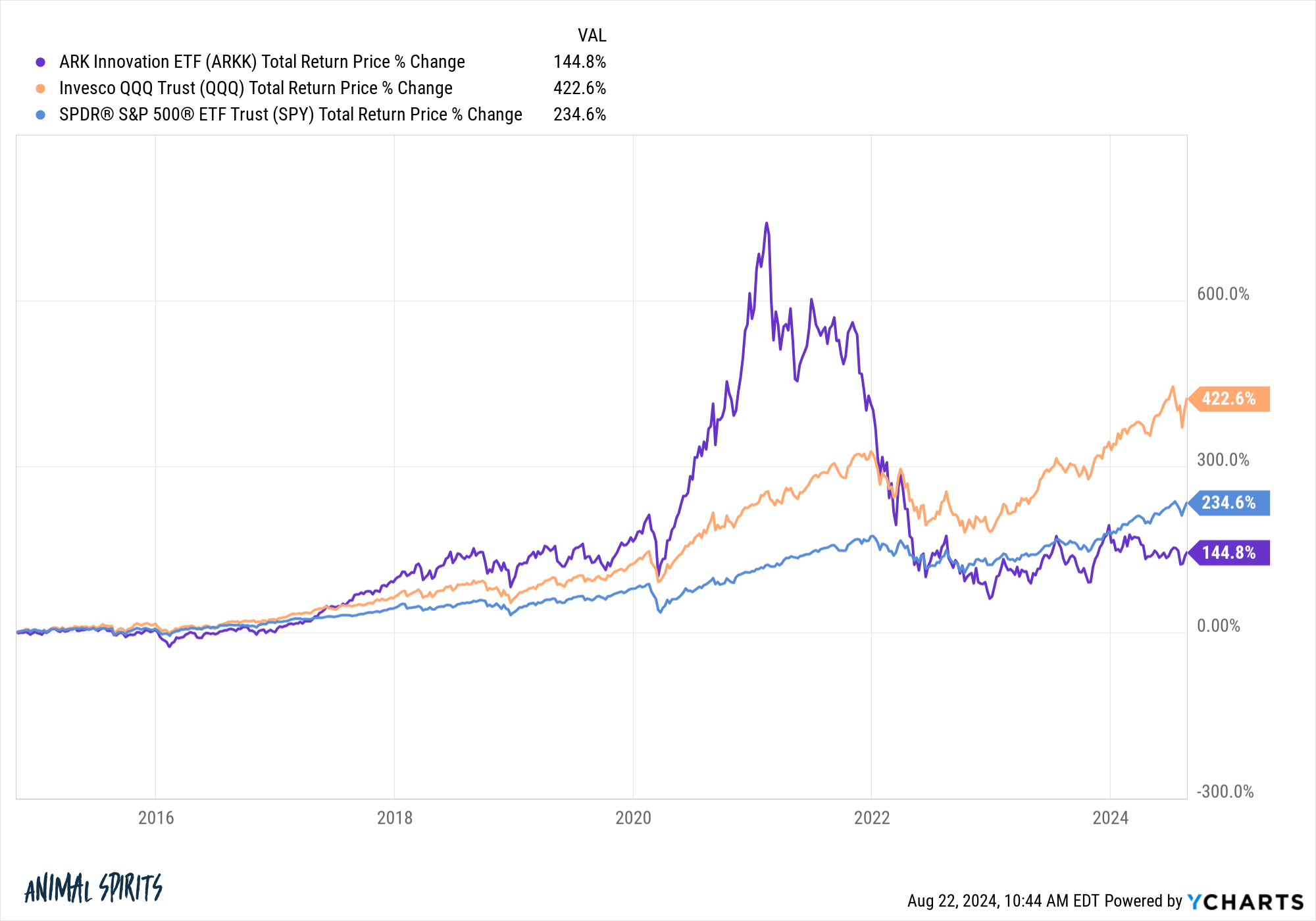

Now, this doesn’t mean the fund itself has been underwater since its inception. While ARKK has underperformed the S&P 500 and Nasdaq 100, the returns going back to the start of the fund are positive:

It’s just that investors all got on the boat right before a gigantic storm hit.

This was a textbook case of a star fund manager who was on a heater that was bound to end at some point. Investors couldn’t have timed it any worse.

Chasing star fund manager performance is nothing new.

It has happened before.

It will happen again.

It’s human nature.

Michael and I talked about the history of star portfolio managers and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

A Short History of Chasing the Best Performing Funds

Now here’s what I’ve been reading lately:

- On the clock (Humble Dollar)

- The great rewiring (Advisor Perspectives)

- Politics and your portfolio (Optimisticallie)

- A triple economic boom from demographics (Ciovacco Capital)

- Beer city is so much more than a drinking town (CNN)

- Home insurance is becoming a real big problem (Kyla’s Newsletter)

Books: