Today’s Animal Spirits is brought to you by Global X and CME Group:

See here to learn more about Global X’s suite of ETFs

See here for more information on CME Group’s valuable educational materials and trading tools and learn more about what adding futures can do for you.

On today’s show, we discuss:

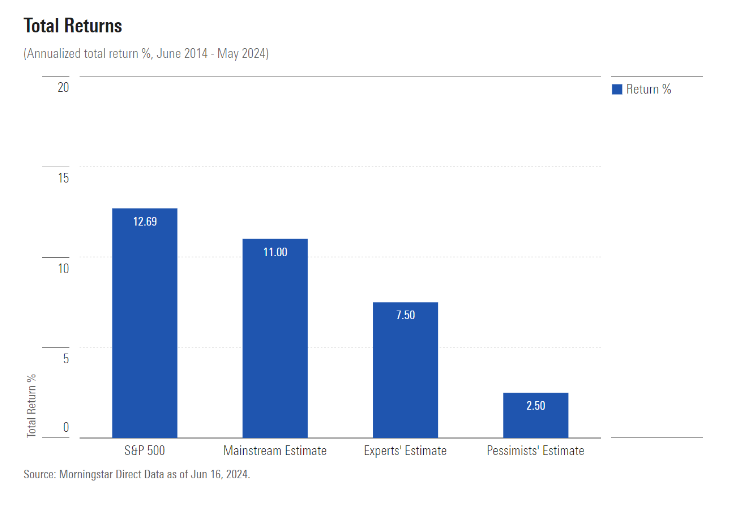

- US Stocks Beat Predictions Over the Past Decade. Can They Do It Again?

- Funds Stay Bullish, But Central Banks Hold Breath

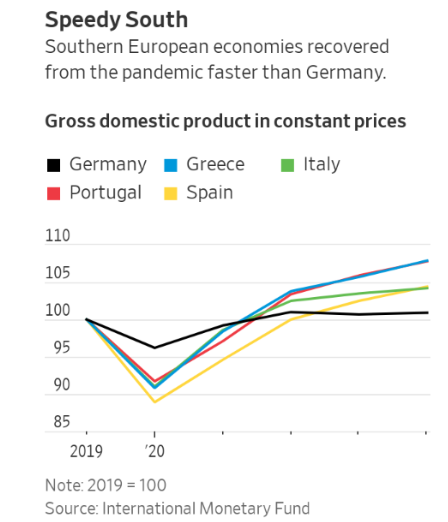

- Europe Has a New Economic Engine: American Tourists

- Stock-obsessed Gen Z are using astrology and tarot to invest–and swearing by the results to the tune of over $400,000

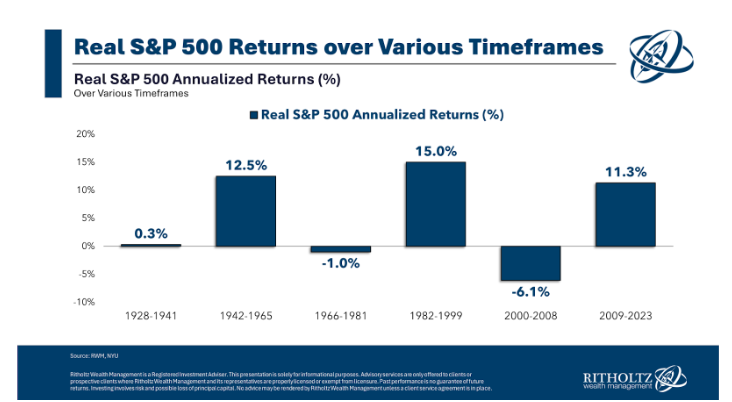

- Millennials & The New Death of Equities

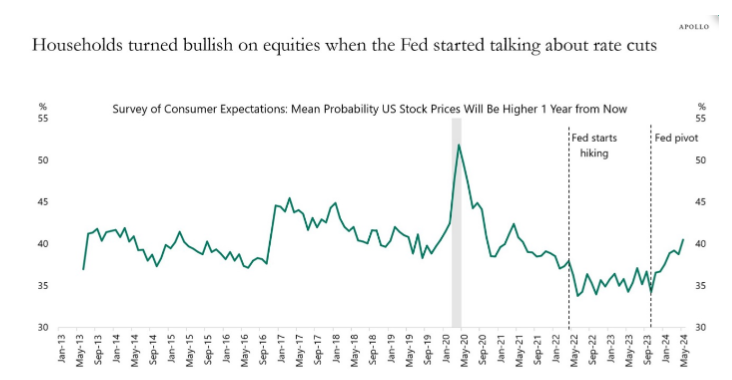

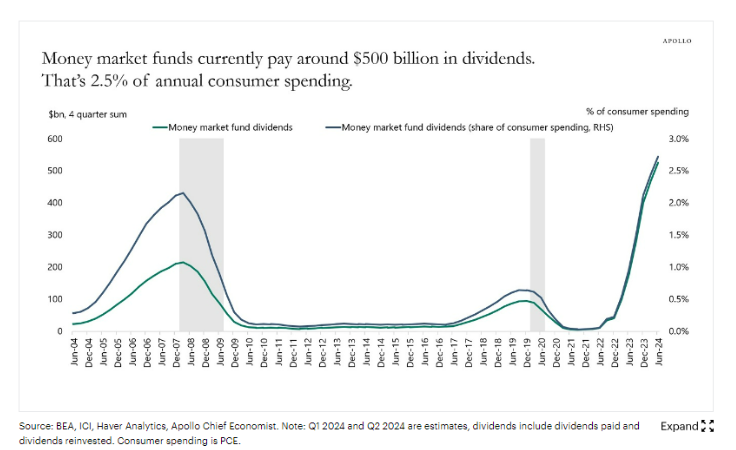

- The Positive Effect of Fed Hikes On Consumer Spending

- Bulgogi Tacos, Fire Pits and Tequila Bars: Concertgoers Shell Out for VIP Treatment

- 2024 Mid-Year Outlook: An Unstable Economic Equilibrium

- ‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

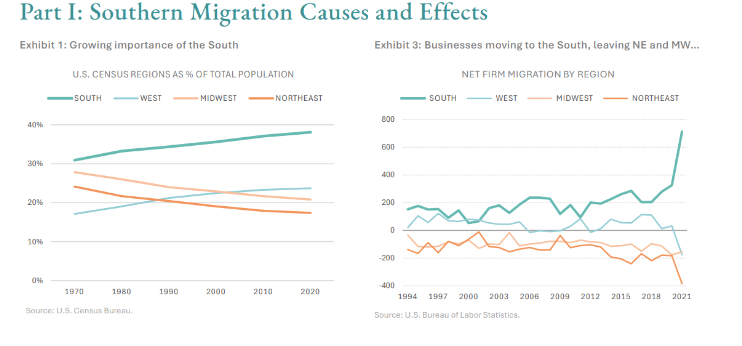

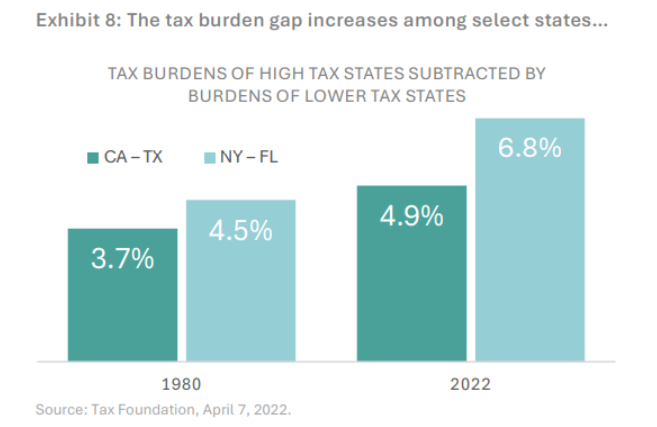

- Going South: Implications of Business and Population Migration

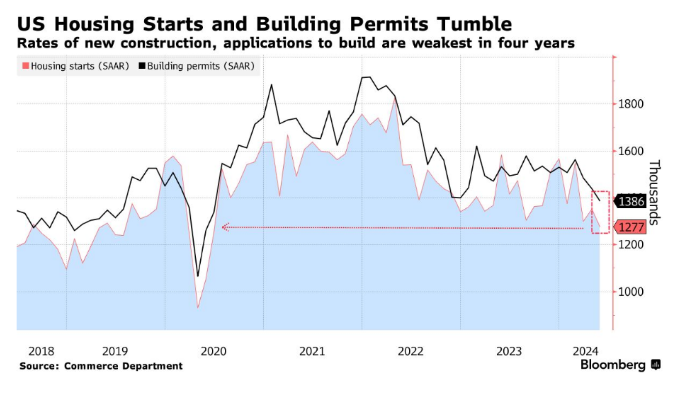

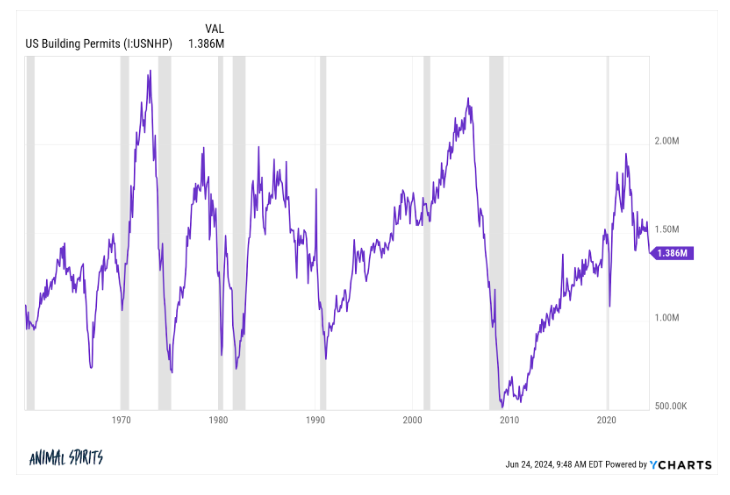

- New US Home Construction Plunges to Slowest Pace Since June 2020

- Goldman Sachs Global Insurance Survey

Listen here:

Recommendations:

Charts:

Tweets:

What explains this? pic.twitter.com/oWA1XrCNwe

— Eric Seufert (@eric_seufert) June 17, 2024

NVDA became the 12th company to be the largest in the SPX pic.twitter.com/7CHZzeFQHu

— Howard Silverblatt (@hsilverb) June 18, 2024

If you joined Nvidia 5 years ago as a mid-level product manager with an annual $70K stock grant over 4 years, just that initial grant would be worth ~$10.6M today.

— Ben Lang (@benln) June 19, 2024

who owns the stock market pic.twitter.com/0o4OFwsOvU

— Sam Ro 📈 (@SamRo) June 18, 2024

Existing Home Sales: pic.twitter.com/boXyjUPHxV

— Michael McDonough (@M_McDonough) June 21, 2024

I don't want to trigger anybody, but the OECD housing ranking of total affordability, size, and quality metrics has US at # 1. One can quibble about plenty, but this is not an unimportant fact. If your mental model has the US as an outlier the other way, it needs to be adjusted. pic.twitter.com/VMdkA7lM0b

— Judge Glock (@judgeglock) June 19, 2024

Per latest JPM institutional weekly survey, there's virtually no risk appetite to deploy fresh capital into equities. Investors continue to show no love for stocks in 2024. pic.twitter.com/pI7PMAyXR5

— Blake B. Millard, CFA (@BlakeMillardCFA) June 17, 2024

$VOO is a virtual lock to blow away the all time annual flow record, at $44.5b it is only $5b away and it's not even halftime. Also, 2.5x more cash than any other ETF this year (never seen this big a lead) and a mere $60b away from knocking off $SPY to become the new King. pic.twitter.com/zk5EMBGwYM

— Eric Balchunas (@EricBalchunas) June 14, 2024

Americans spend, on average, 6.7% of their income on groceries, the lowest in the world https://t.co/77iEOJ3flb pic.twitter.com/V6755gdigf

— Jeremy 'adjusted for inflation' Horpedahl 📈 (@jmhorp) June 20, 2024

HORIZON AN AMERICAN SAGA CHAPTER ONE has dropped to a $10M opening weekend, per new NRG tracking. That's down from $12M a couple weeks ago, despite an ad/promo blitz.

— Matthew Belloni (@MattBelloni) June 20, 2024

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.