Today’s Animal Spirits is brought to you by Franklin Templeton and the CME Group:

See here to learn more about the Franklin International Core Dividend Tilt Index ETF (DIVI)

See here for more information and education on futures and options across all major asset classes

On today’s show, we discuss:

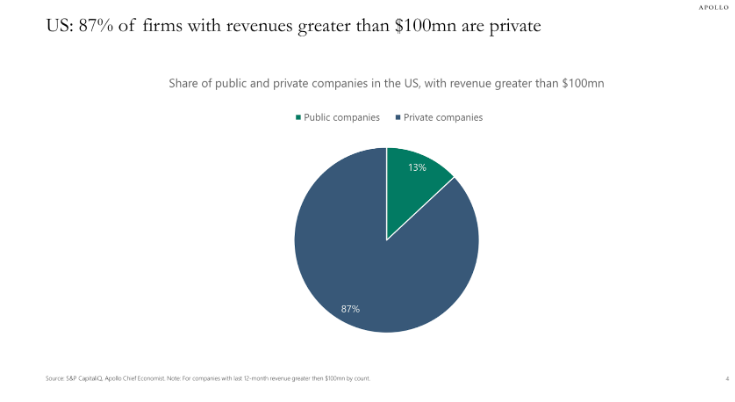

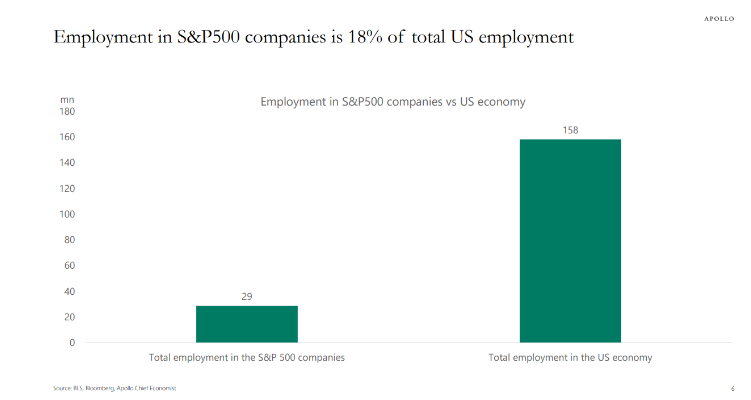

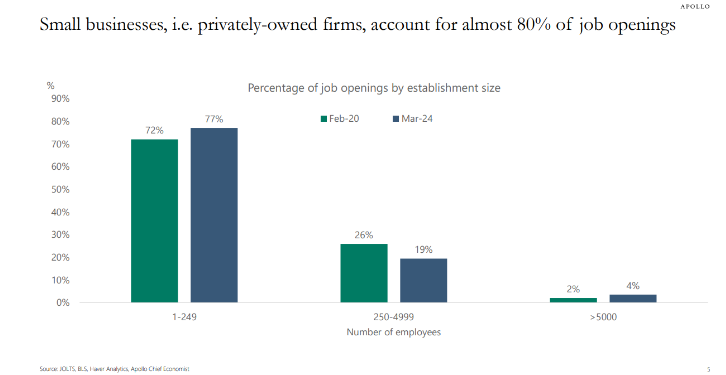

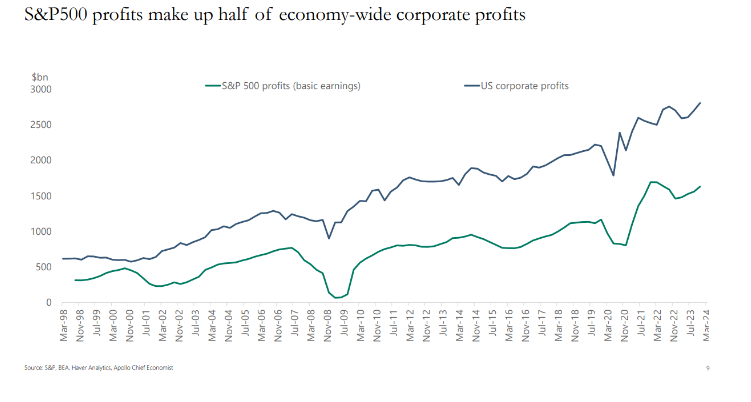

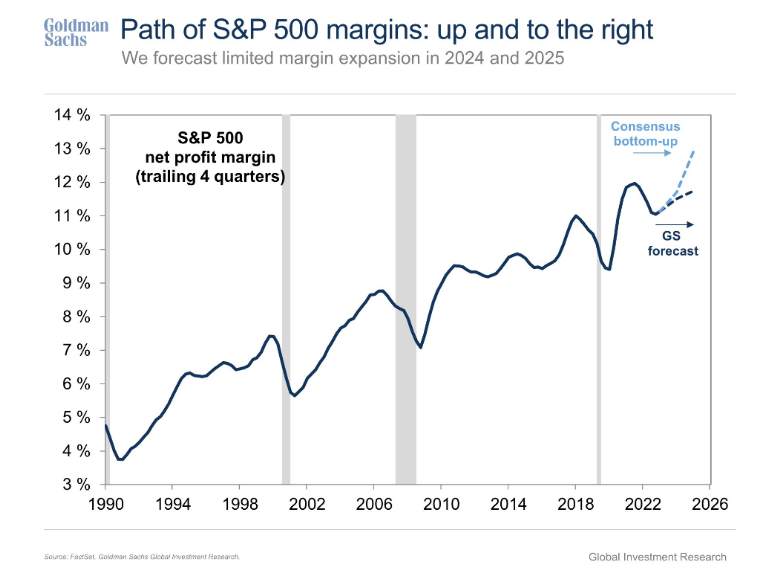

- Public markets are a small part of the economy

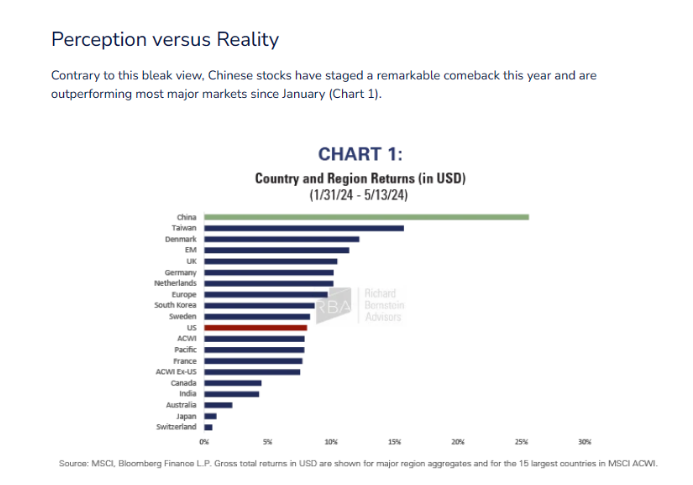

- Investors are striking gold all over

- ‘Dumb money’ loses $13.1B in latest GameStop stock mania

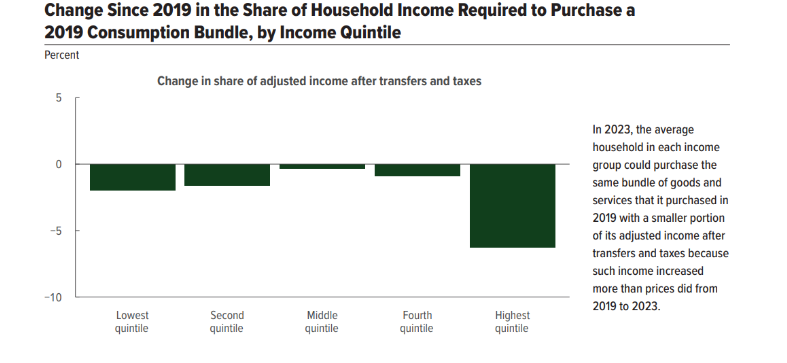

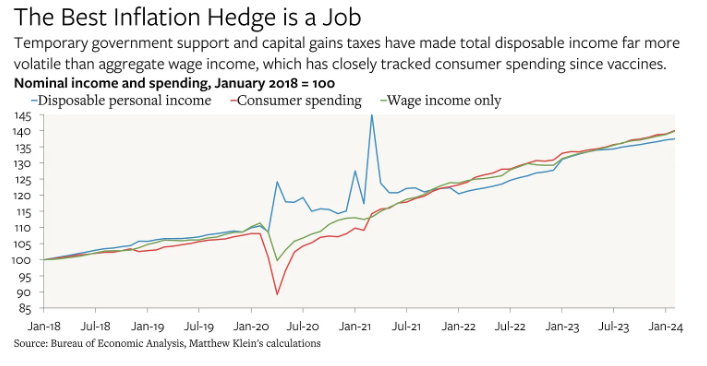

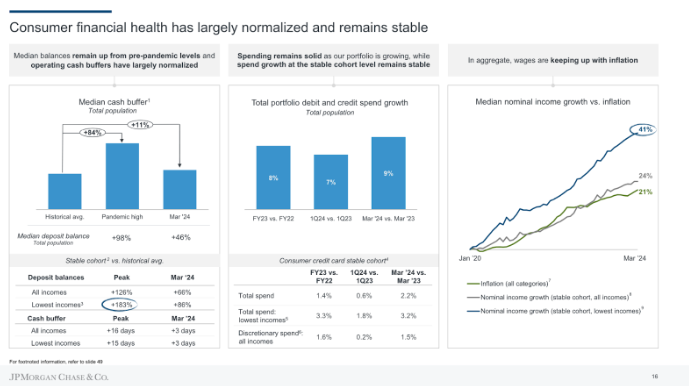

- An update about how inflation has affected households at different income levels since 2019

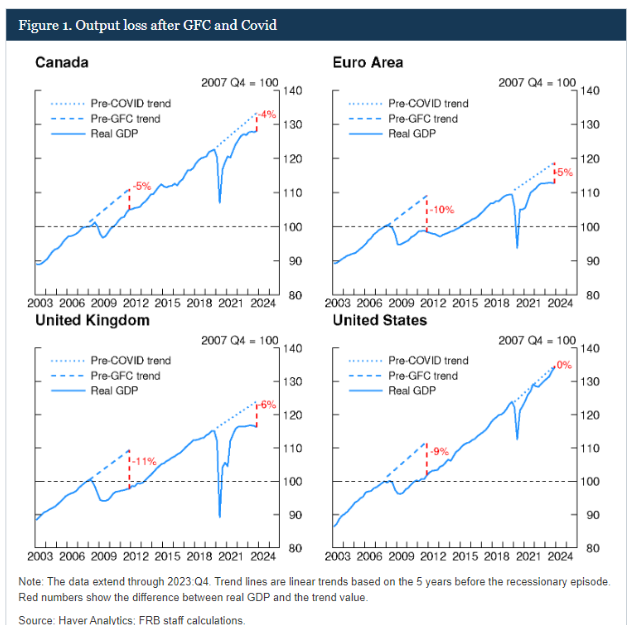

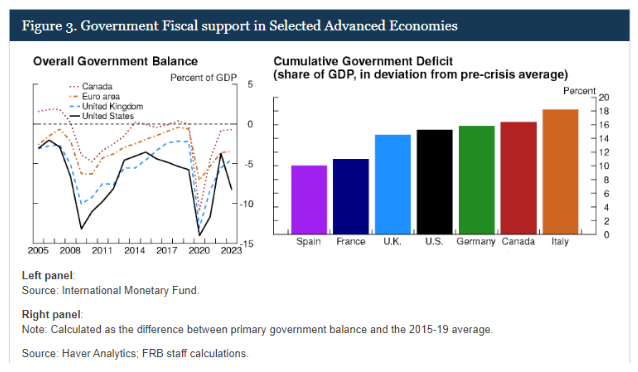

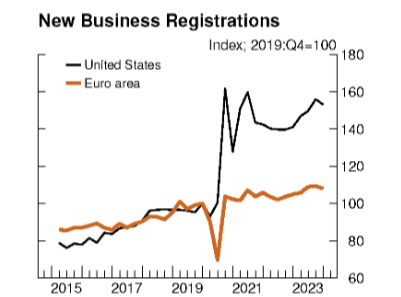

- Why is the US GDP recovering faster than other advanced economies?

- Who’s buying Bitcoin ETFs

- 2024: When to IPO in the age of uncertainty

Listen here:

Recommendations:

- Talk Your Book: Higher For Longer

- Blended

- The Judd Apatown Sign of the Times

- Inside Kevin Costner’s $38M Horizon gamble

- Daniel Stern on the WTF Podcast

- Diner

- Outer Range

Charts:

Tweets:

I know it's cool to say retail traders are YOLOing right now 'cause of $GME et al.

But then why is this put/call ratio – the most accurate and reflective of retail sentiment we know of – still in the pessimistic half of its range?

Whatever YOLOing is happening is not in the… pic.twitter.com/VCLyFdjCYh

— Jason Goepfert (@jasongoepfert) May 13, 2024

My problem with the stock market is it’s just one big casino where the people in charge rig it to fuck over the little guy and make all the money for themselves #DDTG pic.twitter.com/pDPtgtZYvn

— Dave Portnoy (@stoolpresidente) May 15, 2024

❖ TARGET TO REDUCE PRICES ON 5,000 FREQUENTLY SHOPPED ITEMS

Target announced it will lower prices on approximately 5,000 frequently shopped items across its assortment. The retailer has just reduced prices on about 1,500 items, with thousands more price cuts planned to…

— *Walter Bloomberg (@DeItaone) May 20, 2024

That’s three high-profile consumer companies cutting prices in May. #CPI

1. McDonald’s

2. Target

3. Wendy’s$MCD $TGT $WEN @CNBC @talmonsmith @byHeatherLong @knowledge_vital #DoveBait 🕊️ https://t.co/DOf7JG2c2v pic.twitter.com/lXIEgsPLSr— Carl Quintanilla (@carlquintanilla) May 20, 2024

MORGAN STANLEY: Our survey shows “nearly 60% of consumers are getting ready to travel this summer.. Higher income consumers are more likely to travel this summer and .. spend more this year vs. last, .. a net +32% increase in spending intentions.” $RLX pic.twitter.com/96ILhU16wA

— Carl Quintanilla (@carlquintanilla) May 15, 2024

B of A: “.. Lower-income consumers: no clear signs of cracks ..

“.. lower-income spending has generally

outpaced higher-income spending on a y/y basis since early 2023, even excluding

necessities (i.e., groceries and gas). This is consistent with the strength in blue-collar

wage… pic.twitter.com/51T8ppBlVW— Carl Quintanilla (@carlquintanilla) May 16, 2024

The "soft" components of @NFIB small business optimism say things are as bad as they were during the Global Financial Crisis.

The "hard" components say we're not even close to that (but we've still hit a rough patch over the past couple years) pic.twitter.com/Scw3Tfi7sD

— Kevin Gordon (@KevRGordon) May 14, 2024

Statement from Scarlett Johansson on the OpenAI situation. Wow: pic.twitter.com/8ibMeLfqP8

— Bobby Allyn (@BobbyAllyn) May 20, 2024

Update: @JSeyff and I are increasing our odds of spot Ether ETF approval to 75% (up from 25%), hearing chatter this afternoon that SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they'd be denied). See… https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) May 20, 2024

$IBIT ended up with 414 reported holders in its first 13F season, which is mind boggling, blows away record. Even having 20 holders as a newborn is bfd, highly rare. Here's a look at how the btc ETFs compare to other ETFs launched in Jan (aka the Class of 2024) in this metric. pic.twitter.com/ngicEdbaTq

— Eric Balchunas (@EricBalchunas) May 16, 2024

The 13Fs are in for Q1 2024! The TLDR? Institutions are buying. Summary data:

* 1,028 firms with more than $100m report owning bitcoin ETFs

* Collectively, they own $10.9 billion.

Already a massive success, and just a downpayment on what's to come.

— Matt Hougan (@Matt_Hougan) May 16, 2024

FINAL 5/20 U.S. Bitcoin ETF inflows of +$235 million ✅

That's 3,518 #Bitcoin vs 450 daily supply 🧮 pic.twitter.com/IHTmWBCyVS

— HODL15Capital 🇺🇸 (@HODL15Capital) May 21, 2024

Where is advertising spend going?

Comparing the 3-year growth CAGRs and insane scale of $GOOG's, $META's, and $AMZN's advertising revenue streams: pic.twitter.com/NkBchD5HKS

— Quartr (@Quartr_App) May 9, 2024

$WMT US CEO: Spending is consistent; high-end consumer growth remains strong.

"In terms of the consumer, 'consistent' is the best word we would use to describe spending across income groups. We've had more growth,…among high-end consumers. That remains true"

— The Transcript (@TheTranscript_) May 16, 2024

Surprise motherf—. Dexter Seasons 1-8 are coming to Netflix in the US on June 19! pic.twitter.com/Bl5OD1dRiN

— Netflix (@netflix) May 20, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

This episode is sponsored by Franklin Templeton. To learn more about the Franklin International Core Dividend Tilt Index ETF (DIVI), please visit: https://www.franklintempleton.com/investments/options/exchange-traded-funds/products/21412/SINGLCLASS/franklin-international-core-dividend-tilt-index-etf/DIVI

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.