How much money do you have to make to feel rich?

It’s a subjective question.

A lot depends on your lifestyle, where you live, how much you spend and save, your peer group, and your vulnerability to comparison.

The comparison piece matters more than most are willing to admit. Wealth is relative.

Teddy Roosevelt once said, “Comparison is the thief of joy.”

It’s easy to say, but it’s much harder to abide by in the Instagram era, when everyone flaunts their wealth, world travels, and material possessions.

We live in a world where rich people don’t feel rich anymore.

The Wall Street Journal profiled people who make $400,000, a level some politicians are using as a new line in the sand to define wealthy households.

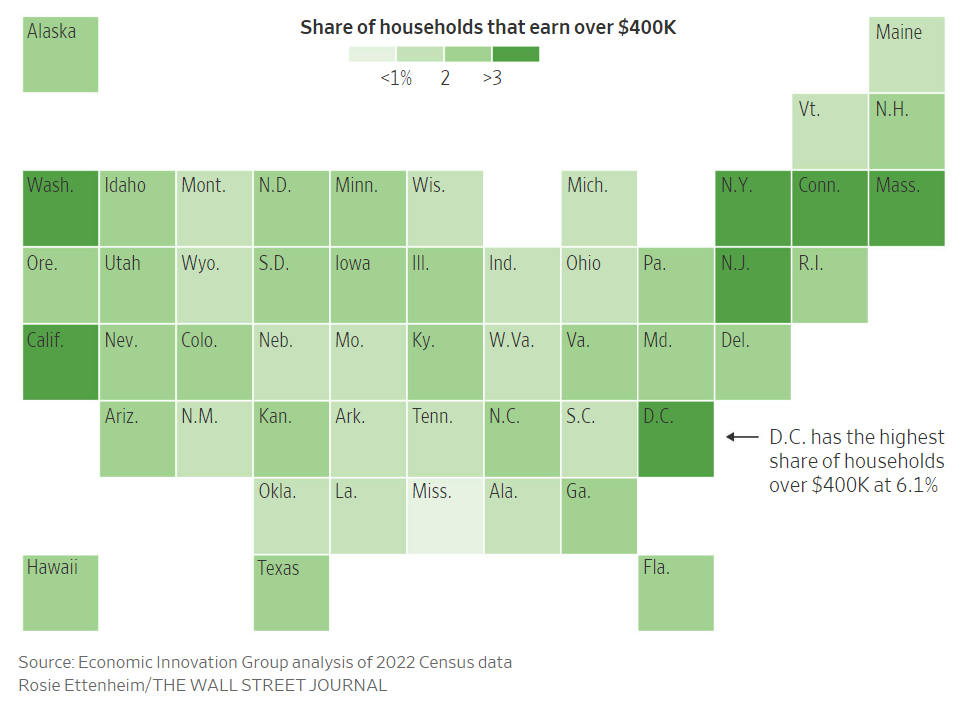

Just 2.6% of U.S. make $400,000 or more. Here’s a look at the breakdown by state:

Wealth is what you keep, not what you make but it’s hard to envision a world in which being in the top 3% of income is not considered rich.

Sometimes you have to call a spade a spade.

However, the Journal found people in the top 3% who didn’t feel rich:

“I don’t think of myself as rich. I think of myself as having worked really hard,” said Littles, a 41-year-old executive at a healthcare-staffing company in Tampa, Fla., whose pay has fluctuated around $400,000.

“I’ve hit the American dream and now I’m going to have to pay more taxes,” he said. “That doesn’t feel great to me. It’s demotivating.”

Everyone has their own definition of wealth but why do people with high incomes feel this way?

This one from the story helps explain the phenomenon:

Deyer said he could afford higher taxes but doesn’t think of himself as rich. He and his wife make coffee to avoid Starbucks and buy fruit based on what is on sale.

“We’re not extravagant people with high-end country-club memberships or a private jet or anything like that,” he said.

Sure, we make a lot of money and are comfortable, but some people are richer than we are! They have more stuff!

The goalposts begin to move when you make more money and increase your wealth.

If I could just make that much money I would be happy quickly morphs into Well, sure I make a lot of money but I don’t have as much money as those people.

The more money you make the more wealthy people you’re exposed to. That thief of joy robs you of the feelings of wealth because you see others who are more successful than you are, earn more than you and have more toys or bigger houses.

It’s also true that there are more people with higher incomes than there were in the past.

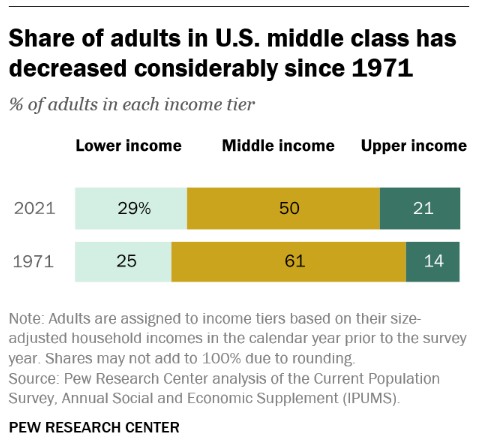

Pew Research shows how the income classes have evolved over the past 50+ years:

There are fewer people in the middle class but more people in the upper class (and lower class).

There are more wealthy people in America these days which means more competition for those predisposed to peer rankings.

If you’re in the top 10%, you want to be in the top 5%. If you’re in the top 5%, you want to be in the top 1%. If you’re in the top 1%, you want to be in the top 0.1%. And if you’re in the top 0.1%, you buy a professional sports franchise or fledgling social media network.

The hard part these days is that you’re not just trying to keep up with the Joneses down the street anymore. The Joneses are now all across the globe, and they constantly display their wealth for all to see on the Internet.

On the one hand, it’s depressing how relative comparisons about money can make it difficult for people to appreciate what they have.

On the other hand, relative comparisons keep the economic machine in the United States chugging along.

A lack of contentment can be detrimental to individuals but good for the system as a whole as people strive to improve their station in life.

Just know that it’s OK to admit you’re rich when you really are.

Michael and I talked about why people don’t feel rich even when they make a lot of money and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

$5 Million is Nothing

Now here’s what I’ve been reading lately:

- Three things to remember in times like these (Downtown Josh Brown)

- The shrinking behavior gap (Irrelevant Investor)

- Invest for the decades not the years (Of Dollars & Data)

- The strawberry revolution (Nature Communications)

- The death of my father (NY Times)

Books: