Coming out of the Great Financial Crisis there was this running narrative that the United States economy was the cleanest dirty shirt in the laundry hamper.

Yes, our economic recovery was tepid but the rest of the world was a mess.

The European Union was falling apart. Emerging markets were in disarray. China seemed like it wanted to put up a fight for our economic seat on the throne but never made a serious attempt to displace the mighty king.

The U.S. has led the way coming out of the pandemic as well but this time we’re not just winning because everyone else is losing.

The United States is dominating the rest of the world, financially speaking.

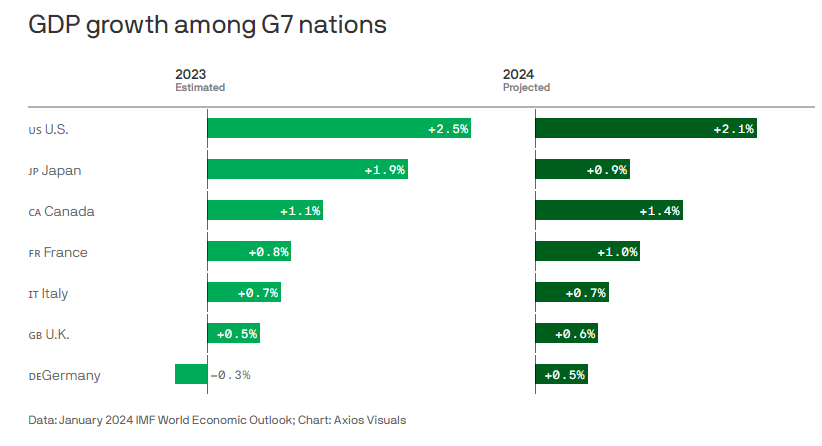

Axios laid out 2023 economic growth along with the 2024 projections:

The U.S. had higher growth than its nearest competitors in 2023 and looks like it should do the same this year.

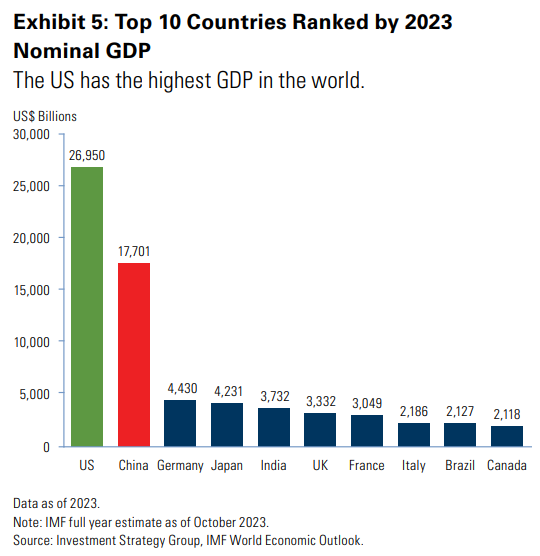

Goldman Sachs has a breakdown of economic size by nominal GDP:

China is closing in, but the fact that they have 1.4 billion people to our population of 330 million makes the size of our economy even more impressive.

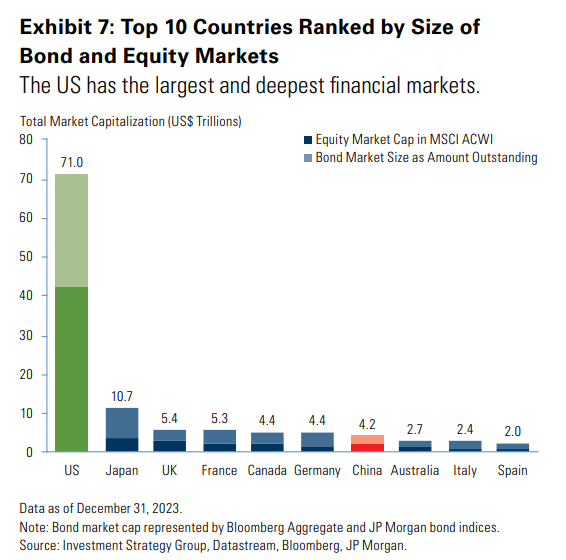

While China is close in terms of GDP, no other country is in the same ballpark when it comes to the size of our stock and bond markets:

The United States has many advantages over the rest of the world — the global reserve currency, friendly neighbors to the north and south, plentiful natural resources, military power, oceans on two of our coastlines, etc.

But the sheer size, breadth and liquidity we have in our financial markets is a massive advantage when it comes to commerce, innovation, entrepreneurship and wealth-building.

It’s kind of amazing how the U.S. has only extended its lead when it comes to the capitalization of financial markets despite widespread globalization.

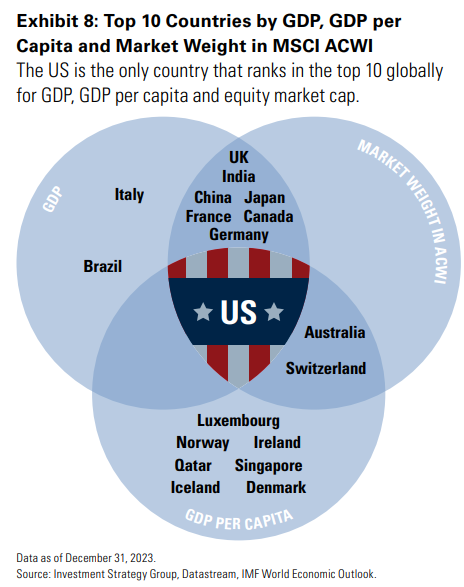

I looked at the biggest holdings for the Vanguard Total World Stock Market Index Fund. Twenty-one out of the top 25 holdings are based in the U.S. The 13 biggest companies in the index are all based in the U.S.1

U.S. stocks make up a little more than 60% of the entire world index.

Putting it all together, here’s a God Bless America Venn diagram from Goldman:

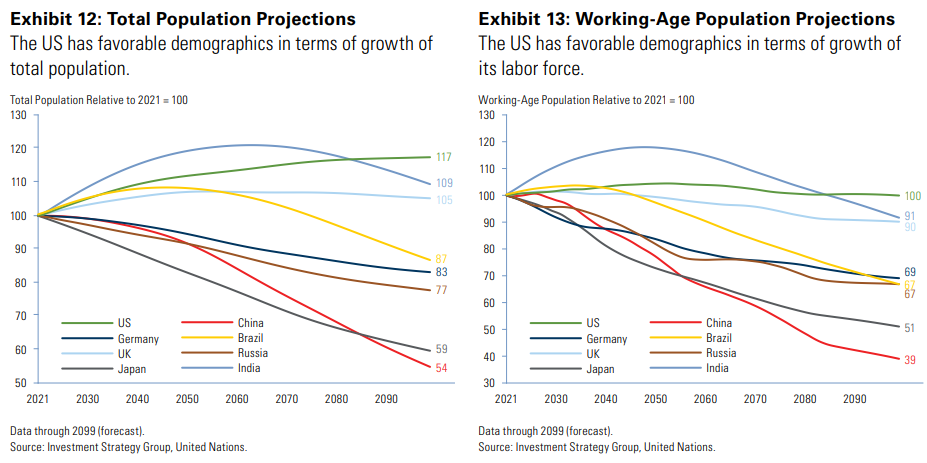

We also have the most favorable demographics of any developed country in the world going forward:

China is in huge trouble on this front.

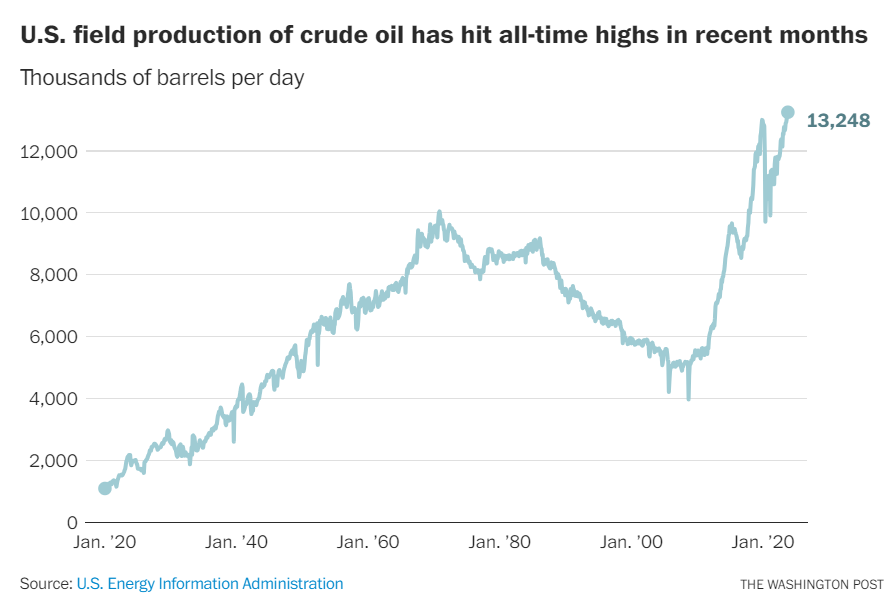

One of the most surprising leadership developments for the U.S. is on the energy front.

This comes from a recent piece in the Washington Post:

Oil, natural gas, renewables — production of nearly every major source of energy has recently touched all-time highs. In fact, production of each has roughly doubled since 2000.

To put this in perspective, the United States is producing more oil than any other country in history.

That sounds pretty good to me. Look at these all-time highs:

I don’t want to jump the gun here, but we’re now essentially energy-independent or close to it.

Do we have problems in this country? Of course we do. And we always will.

I could list off all of our issues but you already know them because you’re inundated with constant negativity on the news, Internet and social media every day.

Everyone these days focuses almost exclusively on the negatives because it causes a reaction.

But if you take a step back from the constant deluge of pessimism, there is a lot of good going on in the United States of America.

It’s a shame so many people are blind to the positives right now.

They say the winners write the history books.

Some people point to survivorship bias when looking at the growth in economic output and financial markets in the United States over the past 100 years or so.

I can’t guarantee that same level of output from here.

But I am fairly confident the U.S. will be one of the authors of the history books going forward as well.

I remain bullish on my country.

Further Reading:

Stop Betting Against America

1Taiwan Semiconductor is the 14th, making it the largest foreign company in the total world index.