There are Twitter accounts that spend their time lamenting why we don’t build cathedrals, castles and architecture like they did in the past.

I get it.

I’ve been to Europe before. The castles, the churches, the opera houses, the landmarks, the art, etc. It’s mind-boggling people were able to build these things without the technology we have available today.

I have an appreciation for classic architecture and art.

But there are things we build today that people in prior centuries couldn’t even dream of.

We build trillion companies. Apple is our Colosseum. Microsoft is our Taj Mahal. Google is our Sistine Chapel. Amazon is our Notre-Dame. Nvidia is our Eiffel Tower.

Am I being a tad facetious here? You be the judge.

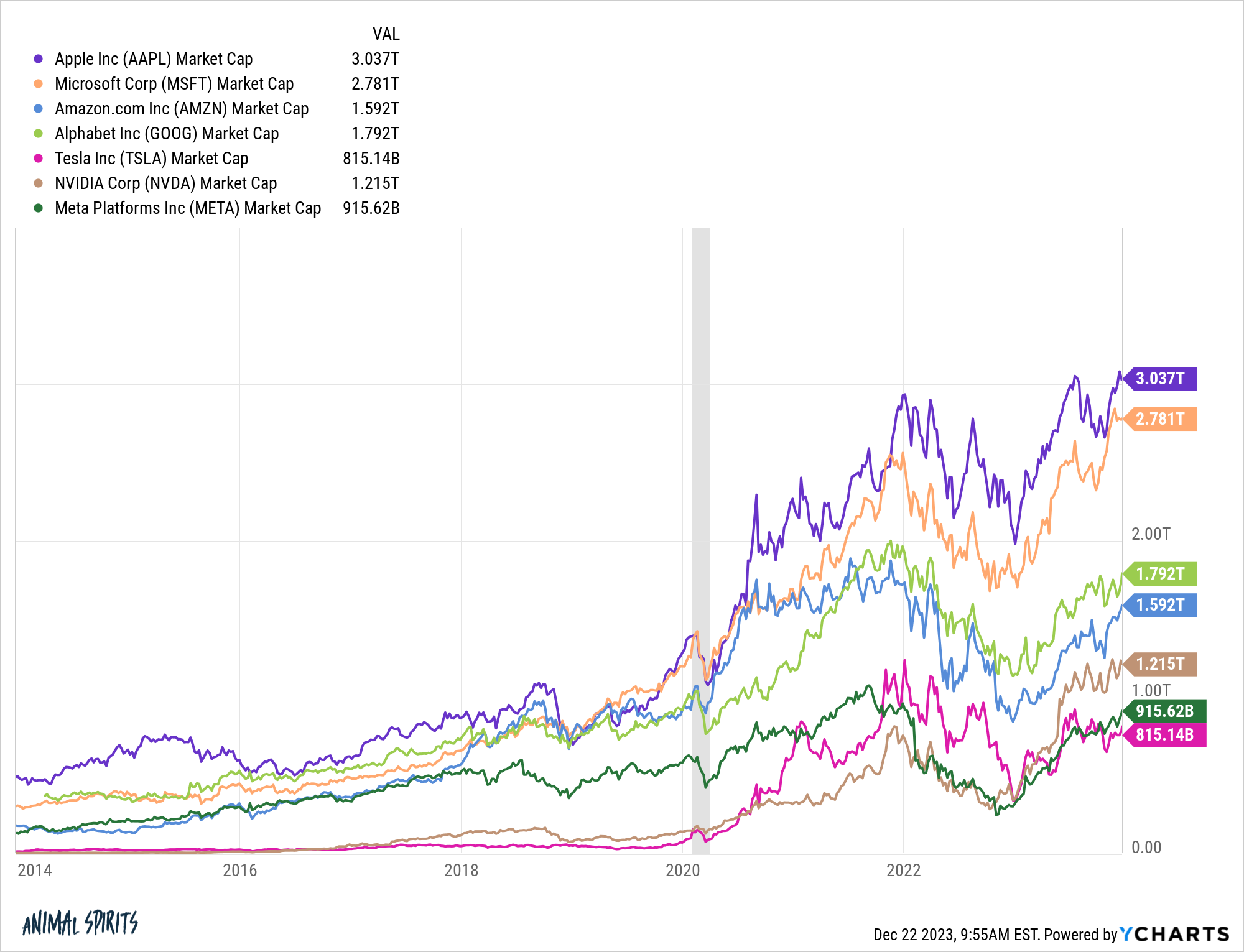

Look at the sheer size of these companies:

These seven companies alone are worth more than $12 trillion in market cap.

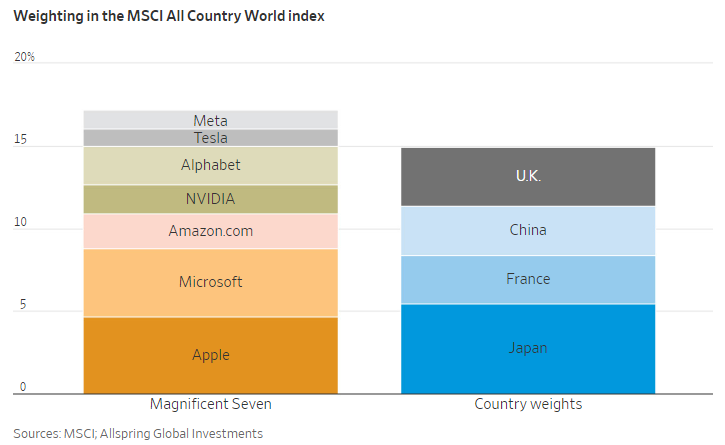

The Wall Street Journal tried to put the Magnificent Seven into perspective:

These seven stocks combined are bigger than the stock markets of the United Kingdom, China, France and Japan put together.

Apple is roughly the same size as Japan. Microsoft is bigger than the UK. Google is nearly the size of the entire French stock market.

As much publicity as these companies get, I feel like we almost don’t spend enough time talking about how insane these numbers are.

These seven stocks were worth around $1.5 trillion a decade ago. So they’ve added more than $10 trillion over the past 10 years.

While buildings and art require maintenance and upkeep, when stocks begin to crumble, new ones rise up to take their place.

There isn’t a single company in the top 10 of the S&P 500 that was at the top of the heap in the 1980s. The only company remaining in the top 10 from the 1990s is Microsoft. By 2010 it was just Apple and Microsoft in the top 10. Nvidia and Tesla were on the outside looking in as recently as 2020.

There will be new trillion-dollar companies that come from AI or climate change or something else we aren’t even thinking about.

Plus, plenty of people can enjoy these works of art.

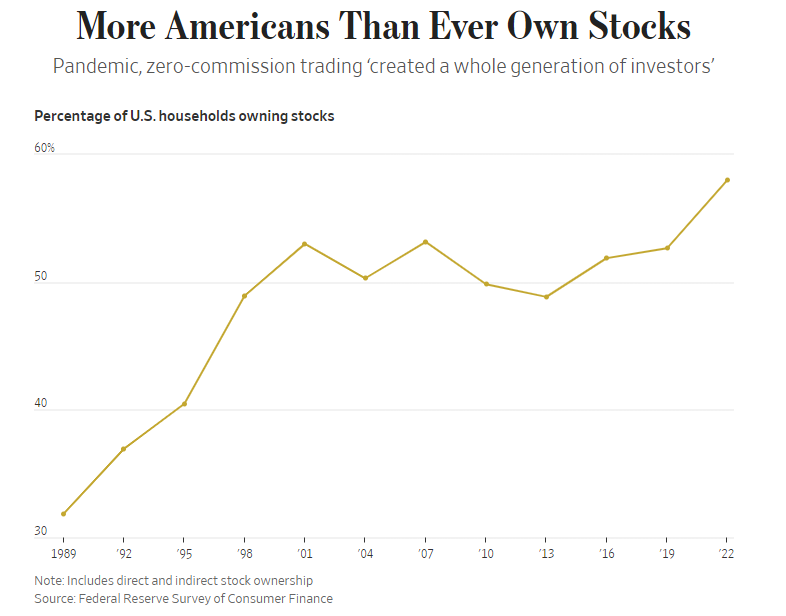

The barriers to entry are getting lower by the year. More and more people are able to take part due to better technology, lower costs and more account options.

Another Journal story this week showed we’ve broken out to new all-time highs in the number of households that own stocks:

The share of households that own stocks has gone from 53% in 2019 to 58% by the end of 2022. Only a third of households owned stocks in some form in 1989. In the early-1980s it was less than one-fifth.

This is an extraordinary development.

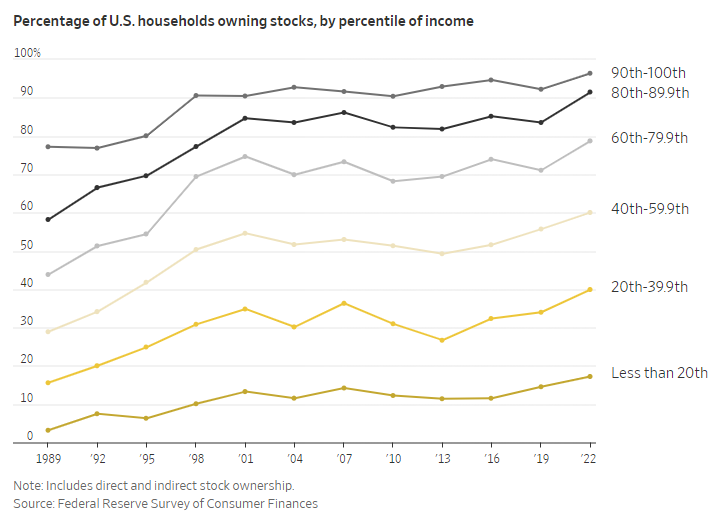

It’s not just people at the top end of the income scale who own stocks anymore:

Yes, the rich still hold a large share of the stock market but the fact that we’re seeing an uptick at the middle and lower income range is encouraging.

The United States has seen its share of the global stock market capitalization go from 15% at the outset of the 20th century to around 60% today. We’ve built the greatest wealth creation machine ever devised along with 5 corporations worth more than $1 trillion and more on the way.

I don’t know if we’re going to be able to keep this up but the stock market is one of the more impressive structures ever built.

Michael and I talked about how impressive our stock market is and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Can the U.S. Continue to Dominate the Long Run?

Now here’s what I’ve been reading lately:

- A quant winter’s tale (FT)

- 5 ways you managed to lose money this year (Josh Brown)

- Dear Young Advisor (Belle Curve)

- 75 facts for 2023 (The Idea Farm)

- Why TIPS are a unique asset class (Oblivious Investor)

Books: