Let’s walk through a quick thought exercise:

How many homeowners could afford the monthly payment on their house at current levels of mortgage rates and home prices?

Take the current value of your home, subtract 20% for a down payment and slap a 7% mortgage rate on it. Could you afford it?

I did this for my house. The monthly payment would be nearly three times what we’re currently paying!

To be fair, our 3% mortgage rate isn’t the only reason the monthly payment is that much lower. We lived in another house for 10 years and built up equity that was rolled into our current house.

But my theory is a large percentage of current homeowners would have a difficult time affording the payment on their own house if they were forced to buy it at prevailing market rates.

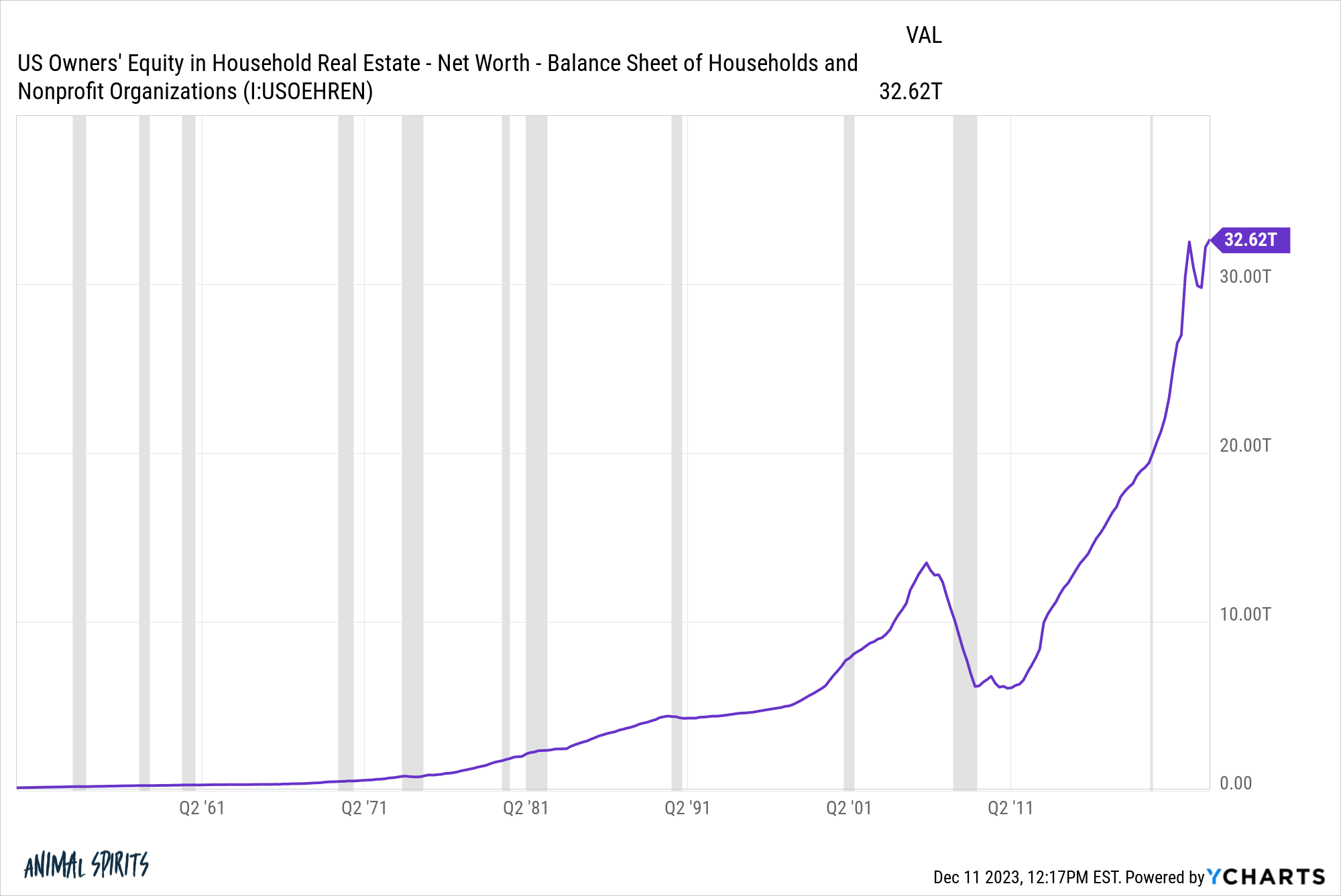

The equity piece is why this exercise is purely theoretical. Americans have an obscene amount of equity in their homes right now:

We’ve gone from $16 trillion in home equity at the end of 2017 to more than $32 trillion today. Home equity has doubled in a little less than six years.

Housing price gains are a big reason for the increase but low rates have helped a lot too.

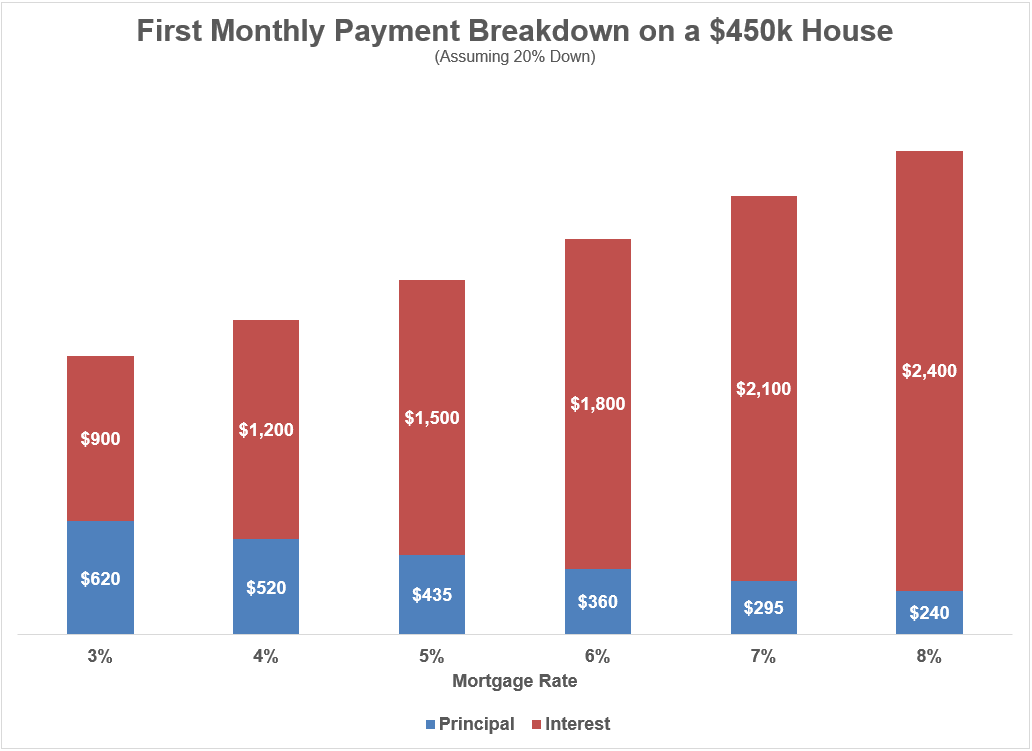

When mortgage rates are 7-8%, so much more of your payment goes towards paying interest expenses.

Here’s a look at the monthly payment breakdown by principal and interest expense for a $450k house, assuming 20% down at various 30 year mortgage rates:

At lower mortgage rates, more of your payment goes towards principal at the outset of the loan. Plus homebuyers can buy bigger and better homes at lower rates because your payment goes further.

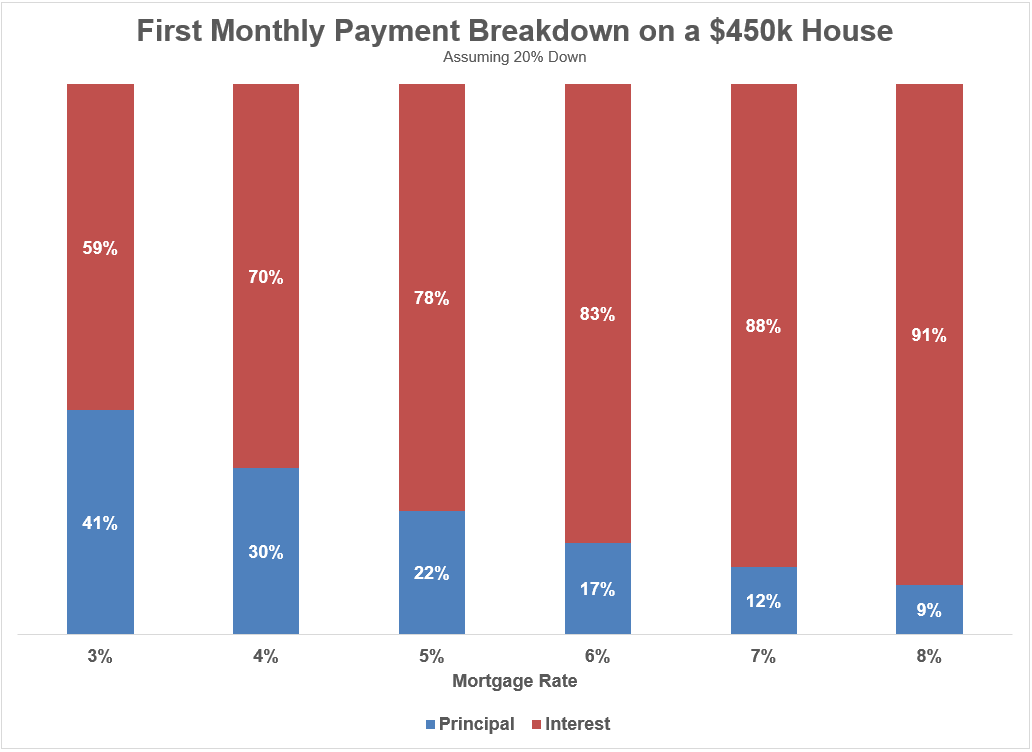

Now look at this same example on a relative basis:

Over 90% of your first payment goes towards interest expense on an 8% mortgage. By contrast, it’s less than 60% on a 3% mortgage rate.

Over the course of the first five years of the mortgage using these assumptions:

- at a 3% rate, 44% would go to principal paydown while 56% of payments would cover interest expense.

- at an 8% rate, just 11% would go to principal paydown while 89% of payments would cover interest expense.

I’m typically not a fan of buying a starter home in hopes of trading up in a few years because the costs of buying and selling are excessively high. A starter home trade-in is an even worse idea when mortgage rates are higher because you’re barely building any equity unless housing prices rise even further.

If you were to stay in an 8% mortgage rate for the life of the loan, you’d be paying more than $590k in interest costs. With a 3% loan, interest expense over the life of a 30 year mortgage is $186k.

Obviously, the hope for homebuyers in the current rate environment is they’ll eventually be able to refinance at lower rates. That should help.

But the numbers are eye-opening from the perspective of a first-time homebuyer.

Some would say this is a return to normalcy in the mortgage rate market.

The average 30 year mortgage rate since the 1970s is close to 8%:

The late-1970s/early-1980s time frame was an outlier but even if you look at the average since 2000 it’s been more like 5%. So the sub-3% pandemic rates were a historical outlier as well.

There are always going to be winners in losers in the capitalist system under which we operate.

But those winners and losers are rarely decided in a such a short window in something as big and important as the housing market.

There are plenty of homeowners who have benefitted from the pandemic housing boom.

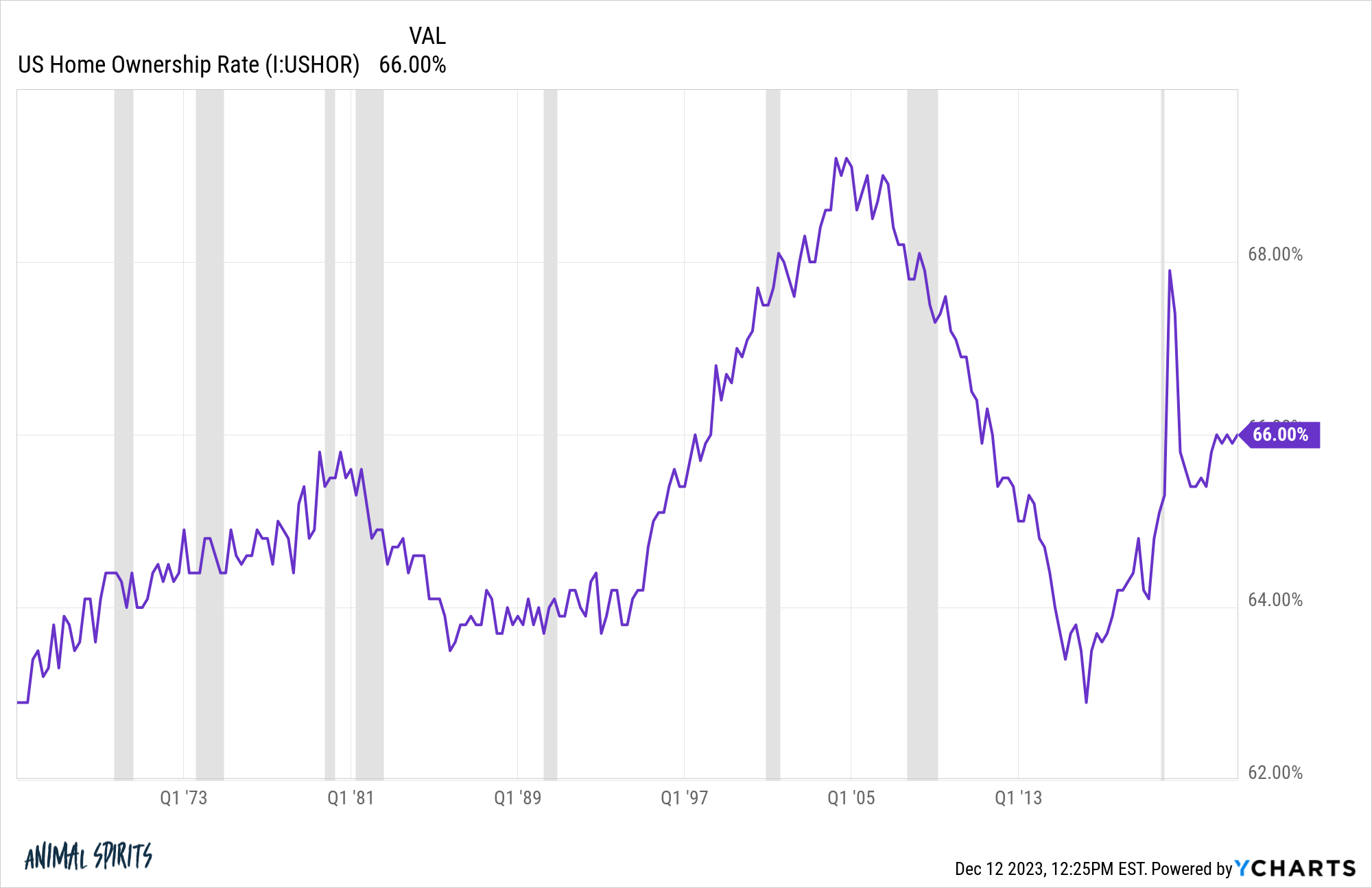

The homeownership rate hasn’t been impacted by today’s unhealthy affordability levels just yet but I’m guessing we’ll see this tick down in the years ahead.

The bad news for buyers is housing prices and mortgage rates are up.

The good news is we’ve experienced something similar in this country before. Housing prices skyrocketed in the 1970s and 1980s following the huge uptick in inflation. Mortgage rates went to double-digit levels.

It was painful to buy. But many people still did because of career or family or an investment or all of the other reasons people buy a house.

They slowly but surely built equity. They refinanced. They renovated. The moved.

It might not feel like it right now but that will happen again this time as well. Housing activity will thaw out and people will begin moving again.

Just count yourself lucky if you owned a home before prices went skyward and mortgage rates were historically low.

Most homeowners likely couldn’t afford to buy their own house right now if they were forced to pay current prices and borrowing rates.

Further Reading:

Why Are Mortgage Rates So High?