A reader asks:

I’m looking to purchase a new home in the coming months as I’m in need of some additional space. I’m weighing my options with my existing home — to rent or to sell — which has a 3% interest rate and $200k in equity since I purchased it in 2016. My real estate agent along with many other pundits seem to default to renting it out as the no-brainer approach because of the 3% interest rate. However, if I took the $200k profit as a lump sum from the sale and invested it in the S&P 500, over 30 years it would surpass the monthly rental profit ($600) and eventual sale of the home. This includes investing the $600 profit into the S&P each month over the same 30 year period. From a risk perspective, finding quality tenants, assuming it rents out every single month, and maintenance/remodeling as the home gets older (built in 2000) seems to outweigh the risk of investing it in something like VTI. I’m a long-term investor and yearly market losses won’t cause me to withdraw the money or try and time the market. So, outside of portfolio diversification, doesn’t selling the home yield the greatest return? What am I missing?

Most financial questions are equal parts spreadsheet and behavioral psychology. But this one is like a heavyweight fight between the spreadsheets while the behavioral component is the undercard.

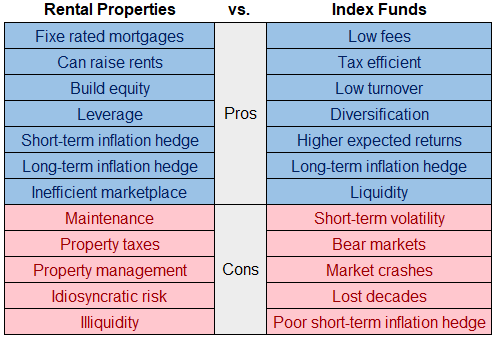

Let’s do the tale of the tape Tyson vs. Holyfield style:

Let me first say there are no right or wrong answers here.

There are people who have built wealth investing in real estate.

There are people who have built wealth investing in the stock market.

There are people who have lost wealth investing in real estate.

There are people who have lost wealth investing in the stock market.

You could run the numbers all you want but personal preference should win out with this question.

I understand where your real estate agent is coming from in terms of pushing you to turn your old place into a rental. That 3% mortgage is one of the best financial assets you can carry on your personal balance sheet right now.

Let’s assume you bought your house for $300,000 in 2016 and are now selling it for $500,000. This is a reasonable assumption since you’re sitting on $200,000 of equity.1

If you put 20% down on the house with a 3% mortgage that’s a monthly payment of a little more than $1,000. Now let’s say you wanted to buy your own house at the going rates for a 30 year fixed rate mortgage and price.

Not only would your down payment be $40,000 higher ($100k vs. $60k) but the monthly payment would shoot up to nearly $2,700.

Holding onto that 3% mortgage and turning it into a rental property sounds appealing when you think about it this way. Not only would you be able to build more equity, but you could increase the rent over time to account for your holding costs and inflation.

However, owning a rental property is no free lunch as this person astutely points out.

First of all, you have to find tenants. If they leave you have to find more tenants and that could mean time in-between renters where you aren’t receiving any income but are still on the hook for the costs of ownership.

Obviously, you can build things like taxes, insurance, maintenance and repairs into rent but there are likely going to be one-off costs you don’t plan for, especially when we’re talking about an older house.

A new roof or broken air conditioner could eat up months of profits in an instant.

Some people are more equipped than others to deal with the realities of being a landlord.

There is a good case to be made for taking your equity and investing it in the stock market but I could see other scenarios where the combination of rental income and home equity put you in a better place financially over the long haul.

This is the type of decision that I would make completely outside of the spreadsheet.

If you don’t want to be a landlord, owning a rental property is not for you. I don’t have the personality or tolerance for inconvenience, even if I know it can make for a solid investment for those who do.

Not all financial decisions have to be made strictly based on ROI or interest rates.

You also have to factor in the potential headaches involved.

We spoke about this question on the latest edition of Ask the Compound:

Bill Sweet joined me on the show again this week to tackle questions on targetdate funds, backdoor Roth IRAs, the tax implication of RMDs and how to factor pensions into retirement planning.

Further Reading:

The Housing Market Lottery

1The Case-Shiller National Home Price Index is up more than 70% since 2016 so this might even be conservative for the current value of the home considering the equity that’s been built over the past 7 years. Close enough though.