On this week’s Animal Spirits with Michael & Ben we discuss:

- Some proposals from Barron’s on changes Warren Buffett should make at BRK.

- The latest letter from Howard Marks.

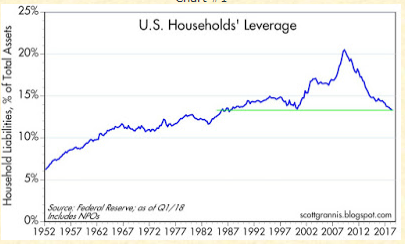

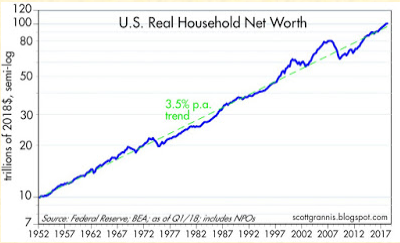

- Why the ‘mother of all credit bubbles’ isn’t as bad as you might think.

- Why it makes no sense to compare government debt to household debt.

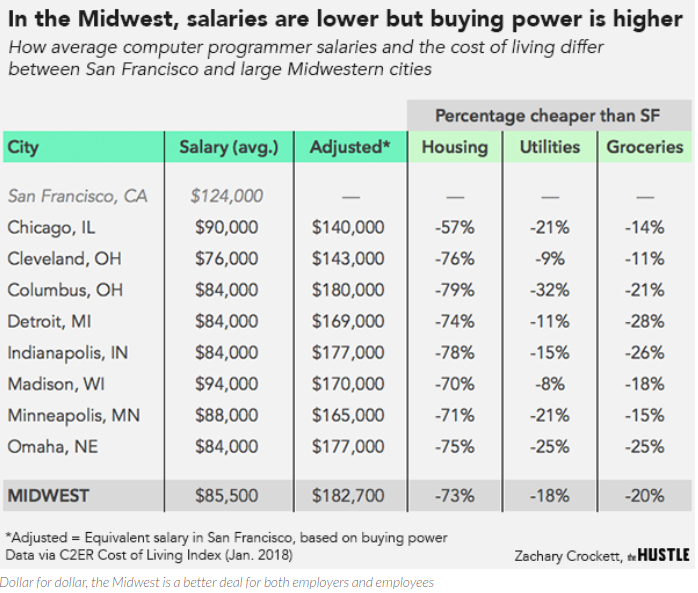

- Should computer programmers move from Silicon Valley to the Midwest?

- Why the source of the investor behavior gap isn’t poor market timing abilities.

- The enormity of WeWork’s private market valuation.

- Overly optimistic wealth expectations by millennials.

- Manipulation in bitcoin prices.

- Skill vs. luck in professional sports.

- The Tesla circus and much more.

Listen here:

Stories mentioned:

- Preparing Berkshire for a future without Buffett

- Investing without people

- Welcome to the ‘mother of all credit bubbles’

- Household leverage hits a 30 year low

- Time to not freak out about debt again

- Mergers would make AT&T, Comcast the world’s most indebted companies

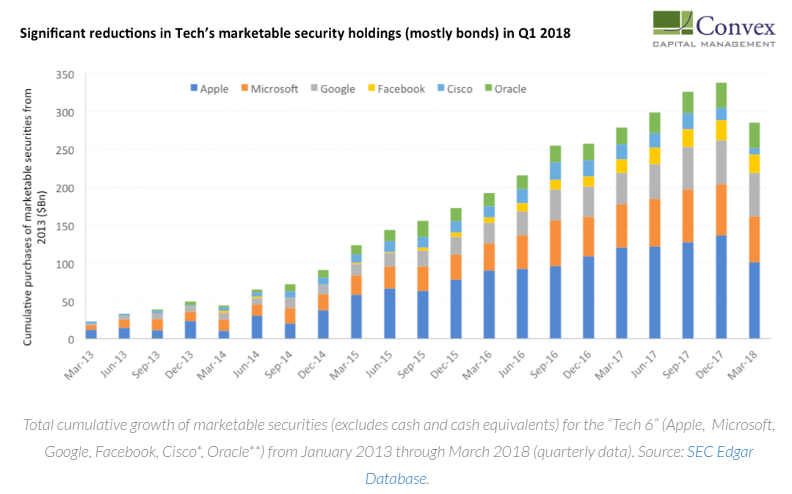

- Big tech loses its appetite for bonds

- Tech’s great migration to the Midwest

- Hindsight bias in dollar-weighted returns

- WeWork in talks to double market valuation

- Millennials and money survey

- Combined wealth of millionaires surges to more than $70 trillion

- Bitcoin prices have been manipulated

- Predicting the World Cup is like trying to beat the market

- How Draymond Green sacrificed to build the Warriors’ dynasty

- Tesla chief Elon Musk accuses worker of sabotage

Books mentioned:

- The Most Important Thing by Howard Marks

- The Geometry of Wealth by Brian Portnoy

- The Lords of Creation: The History of America’s One Percent by Frederick Lewis Allen

- The Great Depression: A Diary by Benjamin Roth

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: