Today’s Animal Spirits is brought to you by Franklin Templeton ETFs:

See here for more information on Franklin Templetons Low Volatility, High Dividend ETF Strategy.

On today’s show, we discuss:

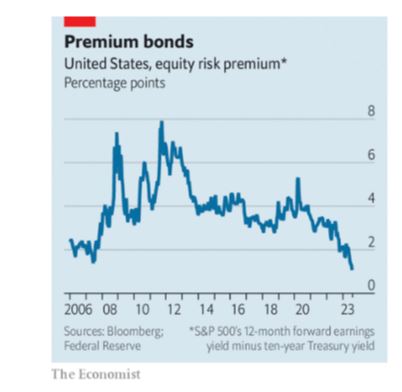

- American stocks are at their most expensive in decades

- Traders are not pricing in a policy of benign neglect on US inflation

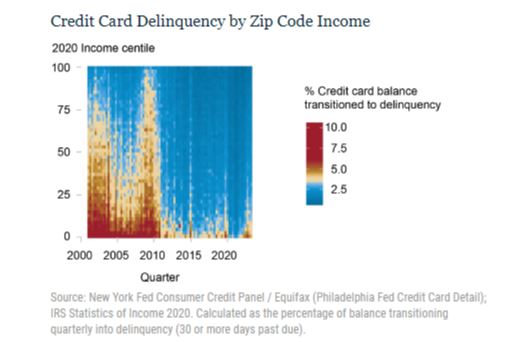

- Credit card markets head back to normal after pandemic pause

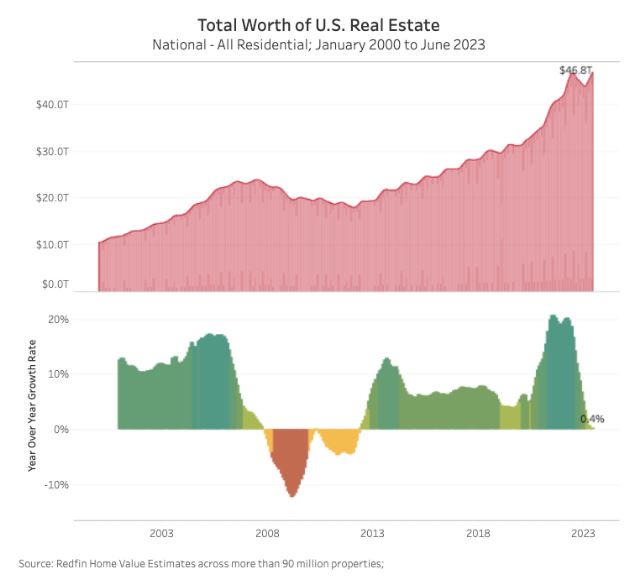

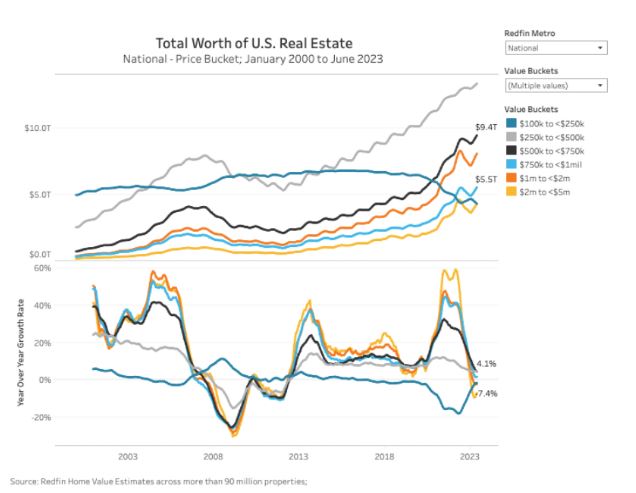

- US housing market recovers the nearly $3T it lost, hitting record $47T in total value

- Home stretch: How untapped equity could sustain the consumer

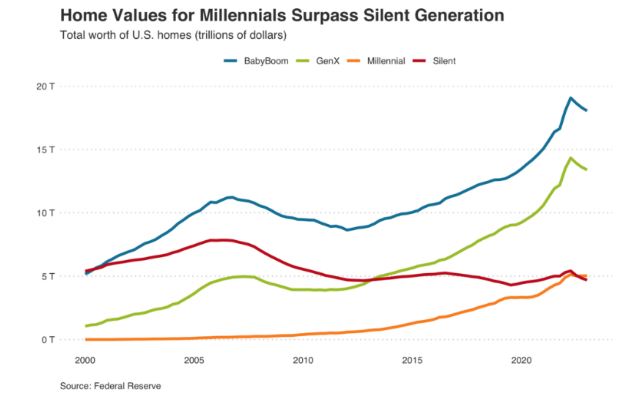

- Unluckiest generation falters in boomer-dominated market for homes

- The next massive consumer tailwind

- Amazons leader on Alexa, Echo, and other devices plans to leave

- What will it take for ESPN to break into sports betting?

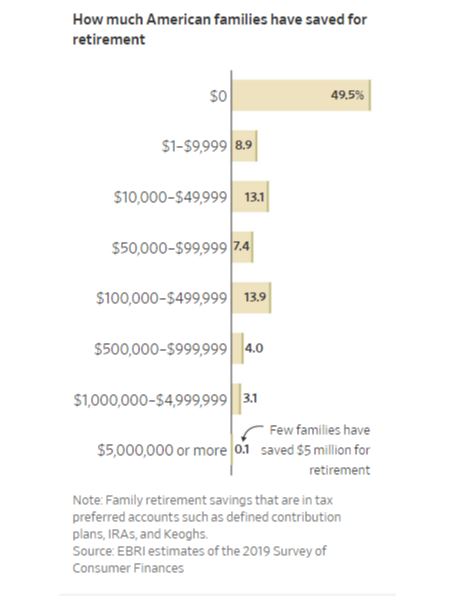

- Here’s what a $5M retirement looks like in America

- The happiness lottery

- How to use your dishwasher better

Tropical Bros Shirts:

Listen Here:

Recommendations:

Charts:

Tweets:

With “risk free” rates above 5%, the typically low-growth, high-dividend payers in the S&P are massively underperforming in 2023. The 101 non-dividend payers are up 20.4% YTD, while the 100 highest yielders in the index are down an average of 3.5% on a total return basis. pic.twitter.com/4JSV5YDZAy

— Bespoke (@bespokeinvest) August 12, 2023

Here ya go. Here's the chart that'll be in every chart curators' chart roundups tonight / this week.

From Goldman Sachs via the chart curators @TKerLLC https://t.co/GBbHG6P2oK pic.twitter.com/urHclv7Bmr

— Sam Ro 📈 (@SamRo) August 11, 2023

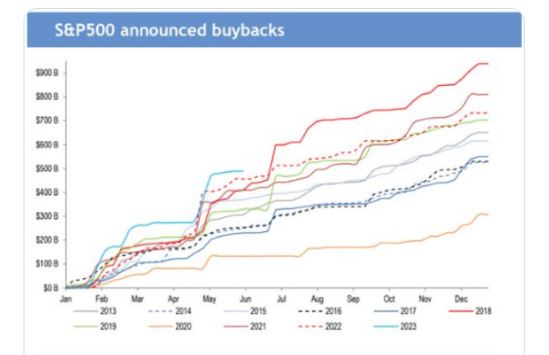

"We have seen very strong momentum in buyback announcements so far this year…[but] buybacks as a share of profits are still low."

– JPMorgan pic.twitter.com/CgjdqWmjtc

— Daily Chartbook (@dailychartbook) August 12, 2023

"According to FINRA margin data, this is the largest 6-month increase in leverage on record…[and] leverage increased by ~$300B in the last 12 months."

– Goldman Sachs pic.twitter.com/HP4WYAznri

— Daily Chartbook (@dailychartbook) August 2, 2023

With “risk free” rates above 5%, the typically low-growth, high-dividend payers in the S&P are massively underperforming in 2023. The 101 non-dividend payers are up 20.4% YTD, while the 100 highest yielders in the index are down an average of 3.5% on a total return basis. pic.twitter.com/4JSV5YDZAy

— Bespoke (@bespokeinvest) August 12, 2023

Look.

Consumer spending is ~70% of GDP.

It's hard to have a recession when spending is increasing at this pace and unemployment is still low. pic.twitter.com/OY07EZruPq

— Callie Cox (@callieabost) August 15, 2023

You: OMG credit card debt just hit a record $1 tril…

Me: stop right there. credit card debt is just 6% of $$$ people have in the bank, around the lowest %age in 20 years pic.twitter.com/Vb2Gk6lAK3

— Callie Cox (@callieabost) August 8, 2023

"…our deposit data continues to show signs that unemployment is picking up from these very low levels at a faster pace for higher-income earners." – BofA https://t.co/C8P20fSNxI pic.twitter.com/G1q64GG3zI

— Sam Ro 📈 (@SamRo) August 13, 2023

Investors accounted for ~24% of all US home purchase activity in Q2-2023. As is always the case, small investors were the overwhelming majority of those purchases (see red box).

These 'mom-and-pop' investors bought ~64 times the number of homes that institutions did in Q2-2023. pic.twitter.com/m9cbTJFhrd

— Rick Palacios Jr. (@RickPalaciosJr) August 9, 2023

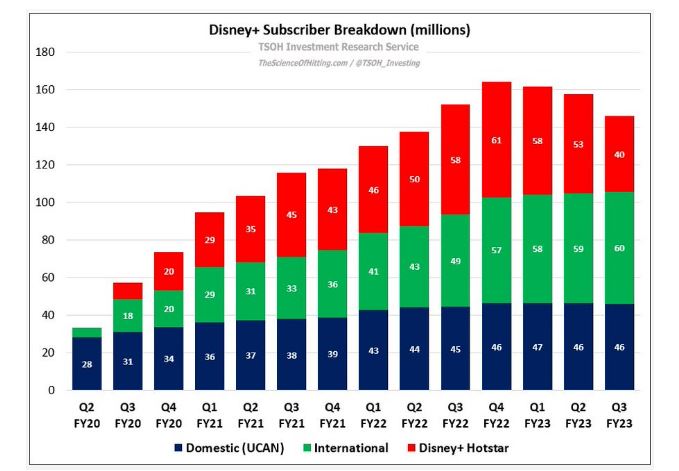

Q2 Streaming Subscription Changes:

Netflix: 5.9M

Peacock: 2M

Paramount+: 1M

Hulu: 100,000

Max: -1.8M

Disney+: -11.7M— Brandon Katz (@Great_Katzby) August 14, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.