Today’s Animal Spirits is brought to you by Argent Capital:

See more information here for Argent Capitals Mid Cap Strategy

On today’s show, we discuss:

- The stock market’s up big this year — but not because of earnings growth

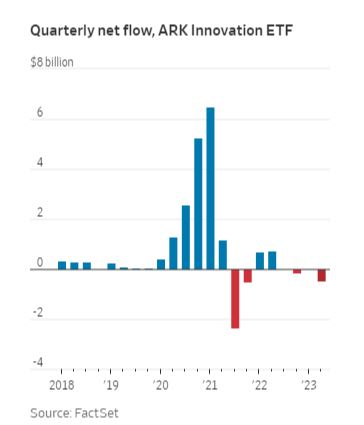

- Investors Are Bailing on Cathie Wood’s Popular ARK Fund

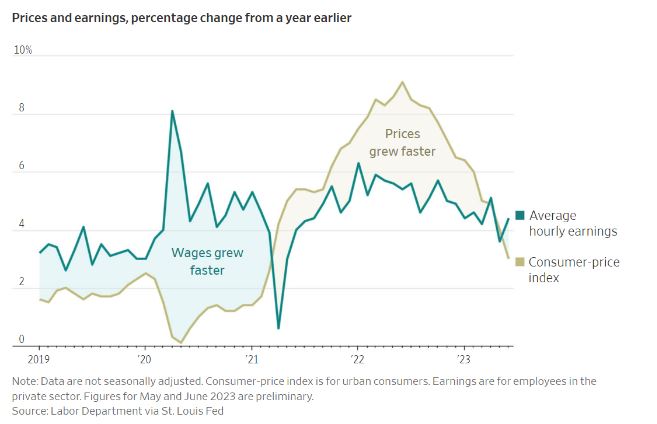

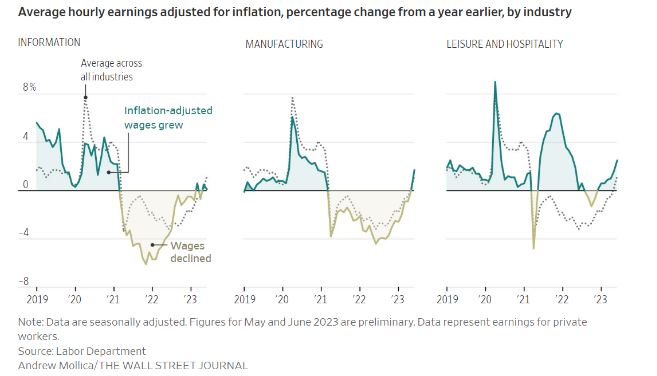

- Pay Raises Are Finally Beating Inflation After Two Years of Falling Behind

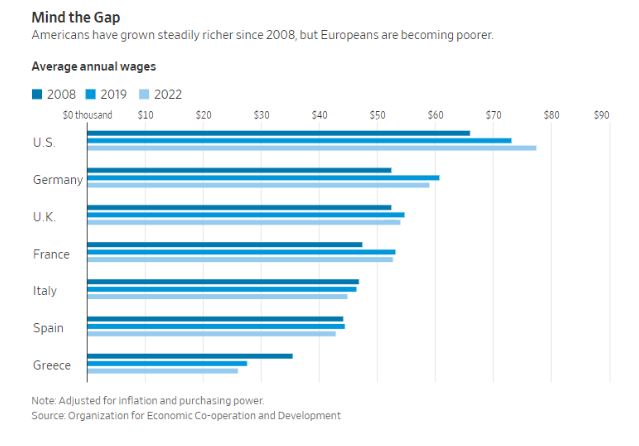

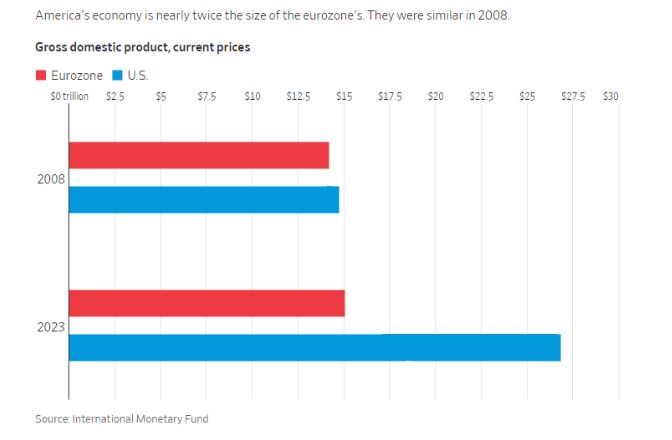

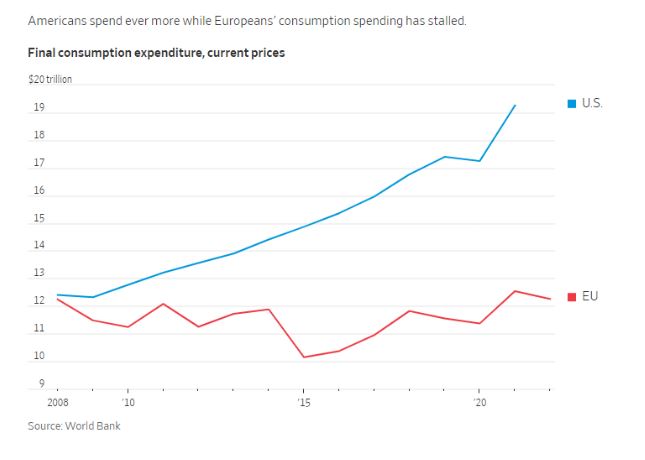

- Europeans Are Becoming Poorer. ‘Yes, We’re All Worse Off’

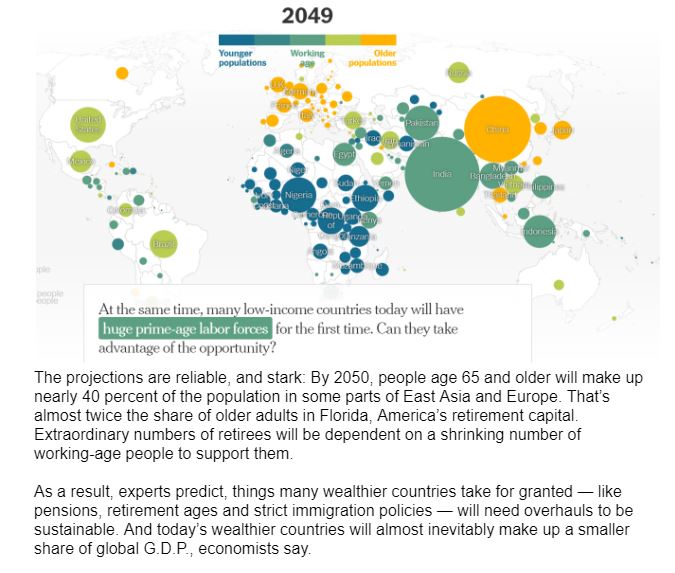

- How a Vast Demographic Shift Will Reshape the World

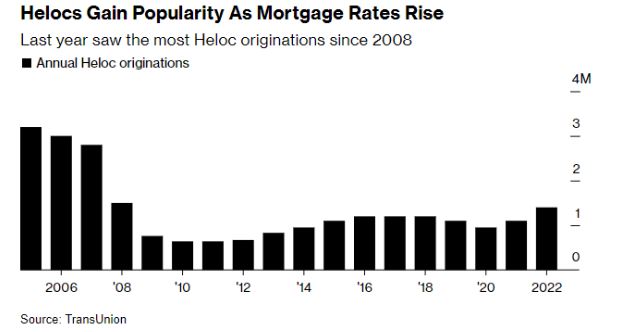

- US Homeowners are Tapping $9T in Real Estate Wealth

- META Threads Engagement Has Dropped Off Since Red-Hot Debut, Tracking Firms Say

- Retail Sales Rose in June for Third Straight Month

- JP Morgan Earnings

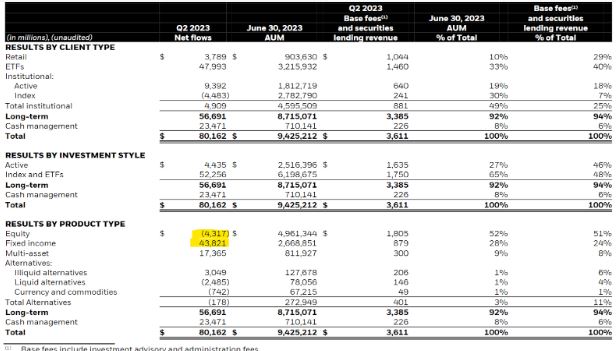

- BlackRock Earnings

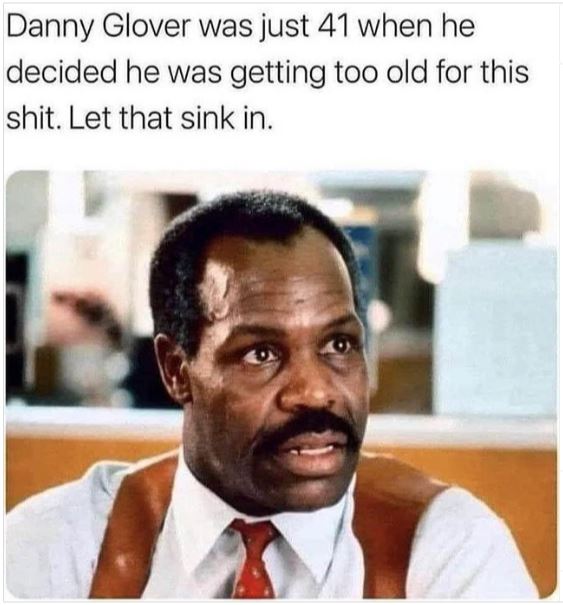

- We look younger

Tropical Bros Shirts:

Listen Here:

Recommendations:

Charts:

Tweets:

https://twitter.com/mark_dow/status/1678868126921007108?s=12

Money market funds took in $43bil last week…

Have now taken in nearly $900bil since Oct 2022 S&P 500 low.

S&P 500 ↑ 25%+ during this time.

via @Todd_Sohn pic.twitter.com/15hJUwRU2A

— Nate Geraci (@NateGeraci) July 11, 2023

https://twitter.com/psarofagis/status/1680926180092903425

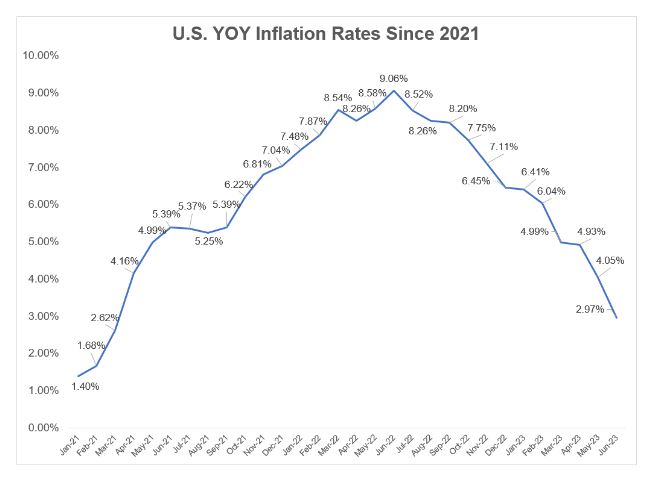

I have zero empirical evidence to support this, but I’d be willing to bet the inflation reduction was pretty close to:

15% slower fiscal policy

35% tight monetary policy

50% mean reversion and supply chain normalization.— Cullen Roche (@cullenroche) July 15, 2023

Interesting tidbit from today's CPI data… Airline fares down 8.1% m/m and 18.9% y/y and cheapest since March 2022 — even in the busy summer season. Is it US airlines ramping back up capacity? Or consumers getting wary about travel? pic.twitter.com/sHCrVqh6nX

— Simone Foxman (@SimoneFoxman) July 12, 2023

Goldman Sachs chief economist Jan Hatzius:

"We are cutting our probability that a US recession will start in the next 12 months" to 20% from 25%.

"The recent data have reinforced our confidence that bringing inflation down to an acceptable level will not require a recession." pic.twitter.com/DYInbxCf1H

— Nick Timiraos (@NickTimiraos) July 17, 2023

Spreads on high-yield bonds have fallen to the lowest since April 2022. If credit is a forward looking indicator, it's suggesting we're not going to see any kind of default cycle of note. pic.twitter.com/RgeOPL92At

— Lisa Abramowicz (@lisaabramowicz1) July 17, 2023

* AMAZON: FIRST DAY OF PRIME DAY SINGLE LARGEST SALES DAY EVER

* AMAZON PRIME MEMBERS BOUGHT OVER 375M ITEMS WORLDWIDE$AMZN

— Carl Quintanilla (@carlquintanilla) July 13, 2023

Since the banking turmoil started in early March the stock market is up 12%, interest rates are generally down, and the dollar is weaker. This is not what I would have expected. pic.twitter.com/hTYaLf51cn

— Jason Furman (@jasonfurman) July 13, 2023

The significant rise in short rates has had no impact on aggregate household disposable income.

Interest income from rising rates has equally matched the rise in debt service costs. Both are up 170bln annualized since the post-covid bottom, equally offsetting each other. pic.twitter.com/qFiwjIHqZD

— Bob Elliott (@BobEUnlimited) July 17, 2023

https://twitter.com/rainnwilson/status/1679183901359738881?s=12

Linear TV's share of total TV viewing has dropped by 12% in the last two years and will soon slip below 50%.

(Netflix and YouTube will soon account for as much TV viewing as all the broadcast networks combined.) pic.twitter.com/iz8VPDcfXC

— Lucas Shaw (@Lucas_Shaw) July 18, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.