Here’s a headline from a Bloomberg story about the economy:

And the lede:

The recession calls are getting louder on Wall Street, but for many of the households and businesses who make up the world economy the downturn is already here.

This story probably could have been written yesterday but it was actually published a year ago, in July 2022.

If it seems like we’ve been reading about a looming recession for months and months now it’s because we have been.

Here’s another one from CNBC:

I don’t share these stories to poke fun. Predicting a recession 9-18 months ago seemed like a pretty safe bet.

The Fed told us they wanted to slow the economy. They wanted people to lose their jobs. They wanted to kill inflation. And history has shown that we’ve never seen a comedown from inflation at 2022 levels without experiencing an economic contraction.

Who knows?

Maybe the Fed will push too far. It could be like pushing over a pop machine where you have to rock it back and forth a few times before it goes over.

It’s also possible that things were so telegraphed ahead of time that we never overheated the economy enough to push it to its breaking point.

I love this take from the Wall Street Journal’s James Mackintosh trying to explain the relationship between an inverted yield curve and the resilient economy:

The inverted curve could also help explain why the recession hasn’t–yet–hit. The combination of an inverted curve and falling stock prices put a lid on the postpandemic boom in corporate investment.

When the curve inverted before the 1990 and 2008-2009 recessions, corporate investment went up, as the economy went into a final growth phase. This time CEOs and CFOs with an eye on the curve might have exercised some caution, helping moderate the boom and so extending the period of growth. Rather than talk ourselves into recession, maybe we merely talked ourselves out of a boom.

It’s certainly possible we talked ourselves out of a recession.

Beyond the Fed, inflation, government spendingthe usual macro stuff there was probably also an element of recency bias involved in the recession calls following the pandemic bust and boom.

Following the 2008 crisis, pundits spent a few years predicting a double-dip recession every chance they got that simply that never came. A cottage industry of recession callers was born out of the Great Financial Crisis because so many people missed that one.

Who would have expected the 2010s would be the first decade in modern economic history without a single recession after that?

The brief pandemic recession was impossible to predict ahead of time but the fact that it lasted just two months is part of the reason so many people assumed there was more pain to come.

Maybe one of the simplest reasons we haven’t had another recession yet is they’re relatively rare.

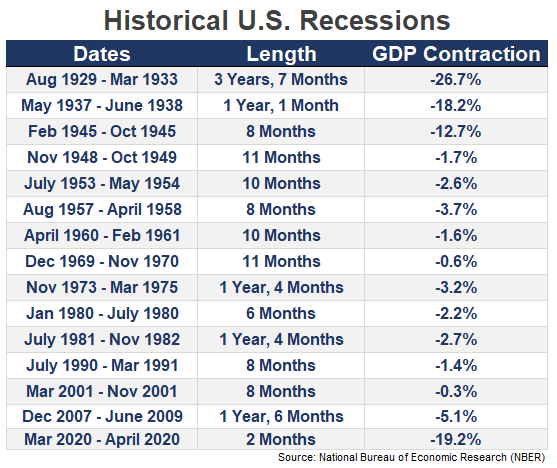

Here is a list of every recession going back to the Great Depression:

By my count, the U.S. economy has been in the midst of a recession for 188 months since the summer of 1929. That means we’ve been in a recession roughly 16% of the time over the past 90+ years.

Alternatively, this means 84% of the time the economy is not in a recession and is thus in an expansion.

My general investing philosophy can be summed up as the stock market usually goes up but sometimes it goes down. Based on historical data, the stock market goes up a lot more than it goes down.

You could make a similar claim about the U.S. economy.

Most of the time the economy is an expansion but sometimes it goes into a recession.

Much like the stock market, it would be foolish to assume the good times will last forever. And when those good times end things will likely get bad for a while.

As the great Brian Flanagan once said, “Everything ends badly, otherwise it wouldn’t end.”

I don’t know how much longer this expansion will last. But if history is any guide, it could be longer than most economic pundits think.

Michael and I talked about recessions, booms and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

What If We Don’t Get a Recession This Year?

Now here’s what I’ve been reading lately:

- A tribute to Harry Markowitz (Discipline Funds)

- How to spend more money in retirement (Dollars & Data)

- Is value investing broken? (Brooklyn Investor)

- Numbers on a screen (Belle Curve)

- Jay Barachel on his stupid attempt to be a movie star (Daily Beast)

- Love and death in Silicon Prairie (Texas Monthly)