The AI craze is in full effect so everyone is trying to figure out who the winners will be.

Maybe it will be the upstarts, some new start-up that gives you your own personal assistant in your ear, on your iPhone and at your desk.

Or maybe it will be the big tech players who have gobs of money to throw at AI like Microsoft, Google and Facebook.

Maybe it’s a company like NVIDIA that supplies the chips and software. As the old saying goes: don’t dig for the gold, sell the picks and shovels.1

I’m sure there are plenty of people out there with all kinds of useful and useless strategies for picking the winners in this space.

My stance on this subject is that it‘s hard to pick the winners.

That may sound like a copout but it’s the truth.

There was a story in Bloomberg this week about how Cathie Wood’s ARKK fund missed out2 on the mammoth gains in NVIDIA this year:

Cathie Wood’s flagship exchange-traded fund closed out its Nvidia Corp. stake in early January. Then, came the artificial intelligence frenzy that sent the stock and its big tech peers on a tear.

The chipmaker has added around $560 billion in market capitalization since Wood dumped her shares — with the last $200 billion of that surge coming overnight after the company handily beat earnings.

Although Wood holds Nvidia across several of her smaller funds, investors in the flagship ARK Innovation ETF (ticker ARKK) have mostly been left out of this year’s blistering 159.90% rally.

In February, when Nvidia traded for $234 a share, roughly 50 times forward earnings, Wood said the valuation was “very high.”

A lot of people dunked on this news because an innovation fund missed out on one of the biggest beneficiaries of the highest innovation potential we’ve seen in years.

My takeaway from this is how difficult it can be to spot these trends in advance.

Every tech person on the planet has been pushing crypto, Web3 and the metaverse incessantly for the past 3-4 years.

Then ChatGPT seemingly comes out of nowhere, gets 100+ million users and AI takes the tech world by storm. Out of all the innovations we’ve been beaten over the head with during this cycle, no one was really talking about the potential for AI yet here we are.

This stuff is not easy.

So what’s my strategy?

I prefer to let the indexes pick the winners for me. Sure, that’s boring and it’s not going to get me rich overnight but I have time.

And I know for sure that the biggest winners from AI are eventually going to find their way to the top.

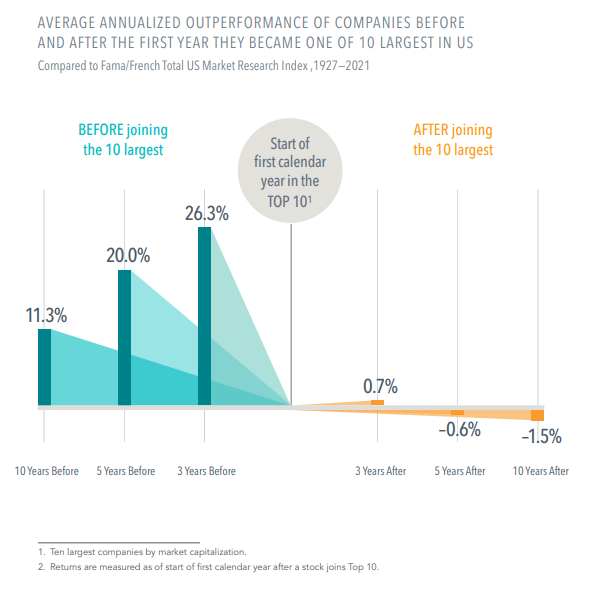

Dimensional Fund Advisors has this great chart that looks at the annualized outperformance of companies 3, 5 and 10 years before they make it into the top 10 biggest stocks and compares that to the 3, 5 and 10 years after they join the ranks of the top 10:

There are two ways to look at this data:

(1) Size is often the enemy of outperformance. It’s much harder to meaningfully outperform once you become one of the biggest stocks. The top 10 essentially becomes the market once they reach the peak.

(2) You want to own the stocks that will eventually make it into the top 10. I just don’t know how to pick them ahead of time.

So while it’s true that many behemoth stocks go on to underperform the market once they reach the top of the heap, there are plenty of other winners waiting in the wings to take their spot.

Let’s look at an example to see how this has played out in the past.

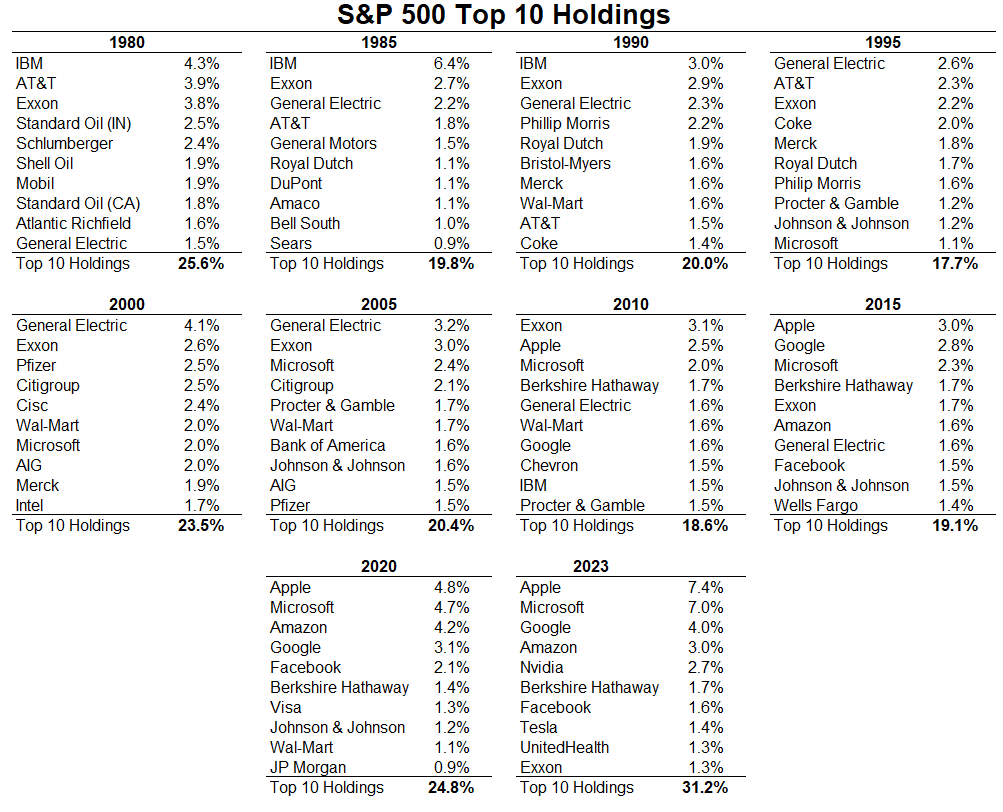

Here are the historical top 10 names every 5 years going back to 1980 along with an update of the top 10 today:

General Electric was the biggest company in the S&P 500 until 2005. The stock has been cut in half since then:

The S&P 500 is up nearly 400% in that same time frame so GE didn’t hold the market back by any means.

How is this possible?

Well, NVIDIA wasn’t even on the top 10 list in 2005 or 2010 or 2015 or 2020. Yet since 2005 the stock is up a staggering 13,000%.

The gains in a stock like NVIDIA more than made up for the losses in a stock like General Electric.

Index funds ride the winners. And while they don’t completely discard the losers right away, the stocks that are coming up pick up the slack for the eventual underperformers.

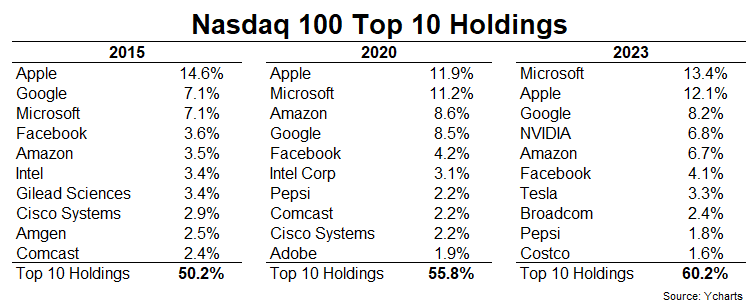

The top holdings are even more concentrated in the tech-heavy Nasdaq 100. Here’s a look at how the top 10 has evolved since 2015:

NVIDIA wasn’t even in the top 10 of the Nasdaq 100 in 2020!

Hendrik Bessimbinder’s work found that just 86 companies accounted for half of all the gains in the stock market since 1926. And all of the wealth creation in the stock market since than can be attributed to around one thousand of the top-performing stocks, which is just 4% of the total.

Some people look at that kind of data and assume that means they should just pick the best-performing stocks.

Sounds good, in theory, and good luck with that strategy.

I look at that kind of data and assume I have no chance of consistently picking those huge winners that fall into the 4% club.

So I let the market pick those winners for me.

It’s boring but effective.

Michael and I talked about AI winners and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Is an AI Stock Market Bubble Inevitable?

Now here’s what I’ve been reading lately:

- The bet (Reformed Broker)

- The problem with the 4% rule (Mad Fientist)

- 5 rules for building wealth (Sapient Capital)

- The joys of prepayment (Humble Dollar)

- The Simple Path to Wealth (JL Collins)

- Ranking every episode of Succession (The Ringer)

1I don’t know if this strategy actually works but it sounds smart when you say it.

2To be fair, ARK did hold NVDA for quite some time before this year. They’ve just missed the last leg of the rally.