Today’s Animal Spirits is brought to you by J.P. Morgan:

See here for more information on JEPQ, J.P. Morgan’s Nasdaq Equity Premium Income ETF.

On today’s show, we discuss:

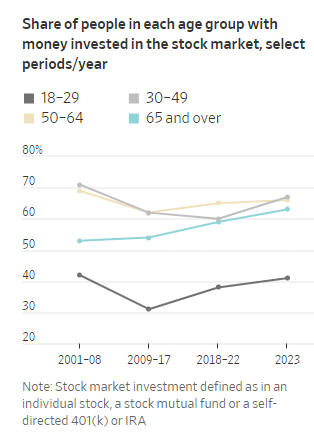

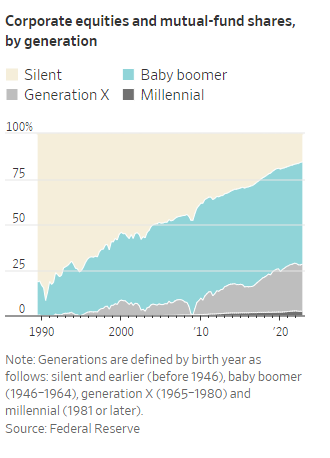

- Boomers Got Hooked on Stocks. Now They Can’t Let Go.

- Global inequality at lowest level in nearly 150 years

- Instant Pot’s Slower Sales Tip Gadget Maker Into Bankruptcy

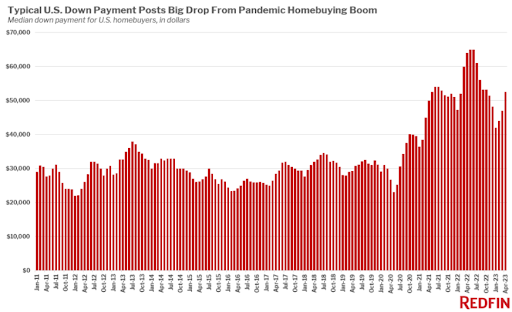

- Why Are Houses So Expensive?

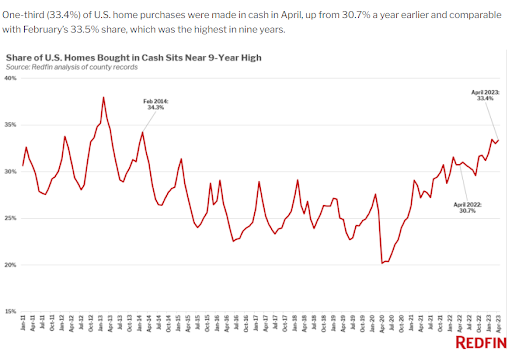

- One-Third of U.S. Homebuyers Are Paying in Cash, the Highest Share in Nearly a Decade

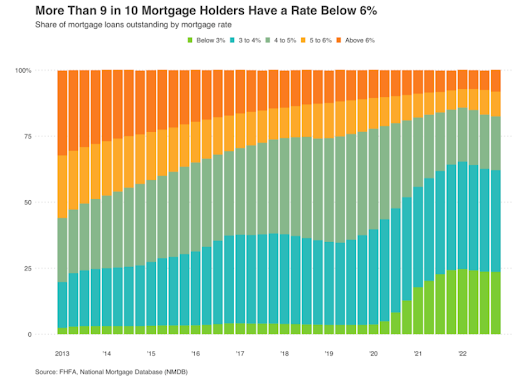

- Nearly Everyone With a Mortgage Has an Interest Rate Below 6%, Prompting Many to Stay Put

- Renters Are About to Get the Upper Hand

- How credit cards ruined the airport lounge

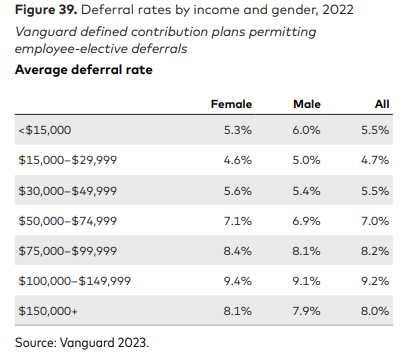

- How America Saves

Future Proof:

Tropical Bros Shirts:

Listen Here:

Recommendations:

Charts:

Tweets:

Since October S&P 500 low…

Money market funds have taken in $832bil.

Equity ETFs only $181bil.

S&P ↑ 20%+ in that span.

Still amazed at lack of equity ETF inflows this yr.

I remember when ETFs were the only reason markets moved higher btw.

via @Todd_Sohn

— Nate Geraci (@NateGeraci) June 6, 2023

Gundlach is deep in the financial industry bubble.

Stocks will be in a mania when I start hearing about them from people in Myrtle Beach. Nobody around here cares. It is not a mania. https://t.co/5dz2qfE24s

— Jared Dillian (@dailydirtnap) June 15, 2023

The New York Fed's Global Supply Chain Pressure index has gone from a record high to a record low in no time. pic.twitter.com/Zu6weGLrck

— Bespoke (@bespokeinvest) June 7, 2023

Even with 500bps of tightening, money just isn't all that tight.

In past cycles rates peaked >5% above core PCE inflation. Today the Fed's actions have brought rates to just match it. pic.twitter.com/mwRtEAuQ7K

— Bob Elliott (@BobEUnlimited) June 17, 2023

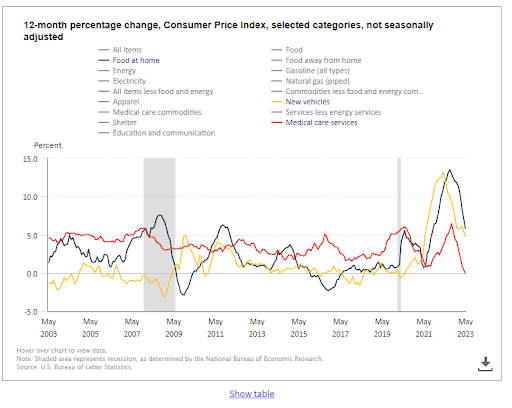

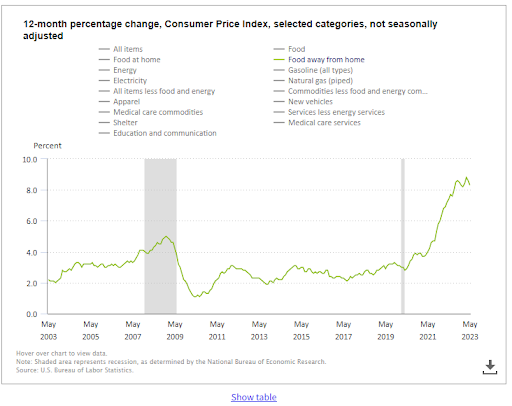

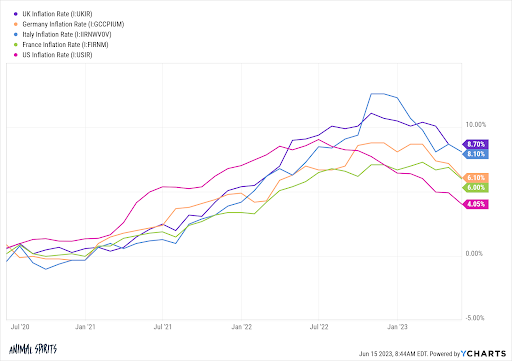

Er, thanks American consumers pic.twitter.com/uBemiGml4G

— Dario Perkins (@darioperkins) June 19, 2023

"The United States of America is effectively bankrupt."

— Eddy Elfenbein (@EddyElfenbein) June 13, 2023

The stock and bond market peak coincided with the top in inflation-adjusted M2 money supply. We're almost down to the pre-COVID trend level. There has never been a faster contraction in real M2 since 1960. pic.twitter.com/Cq4o8npIlW

— Samuel Lee (@svrnco) June 8, 2023

Sonos Reducing Workforce By 7% $SONO

— *Walter Bloomberg (@DeItaone) June 14, 2023

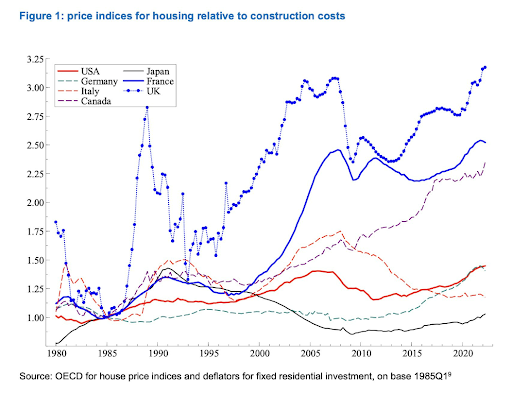

Home prices in the UK exceed the cost of building them by more than they ever have, because we have not built enough of them for many decades. A stunning new graph from Prof. John Muellbauer https://t.co/f0XX6fNDwJ pic.twitter.com/quN8T34v5P

— YIMBY Alliance (@yimbyalliance) June 16, 2023

Americans feel a lot better about their own lives than they do about their country.

73% rate their personal situation as good or excellent, but just 18% say the same of the US as a whole. @Morning_Joe pic.twitter.com/aQBWZusKSb

— Steven Rattner (@SteveRattner) June 7, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.