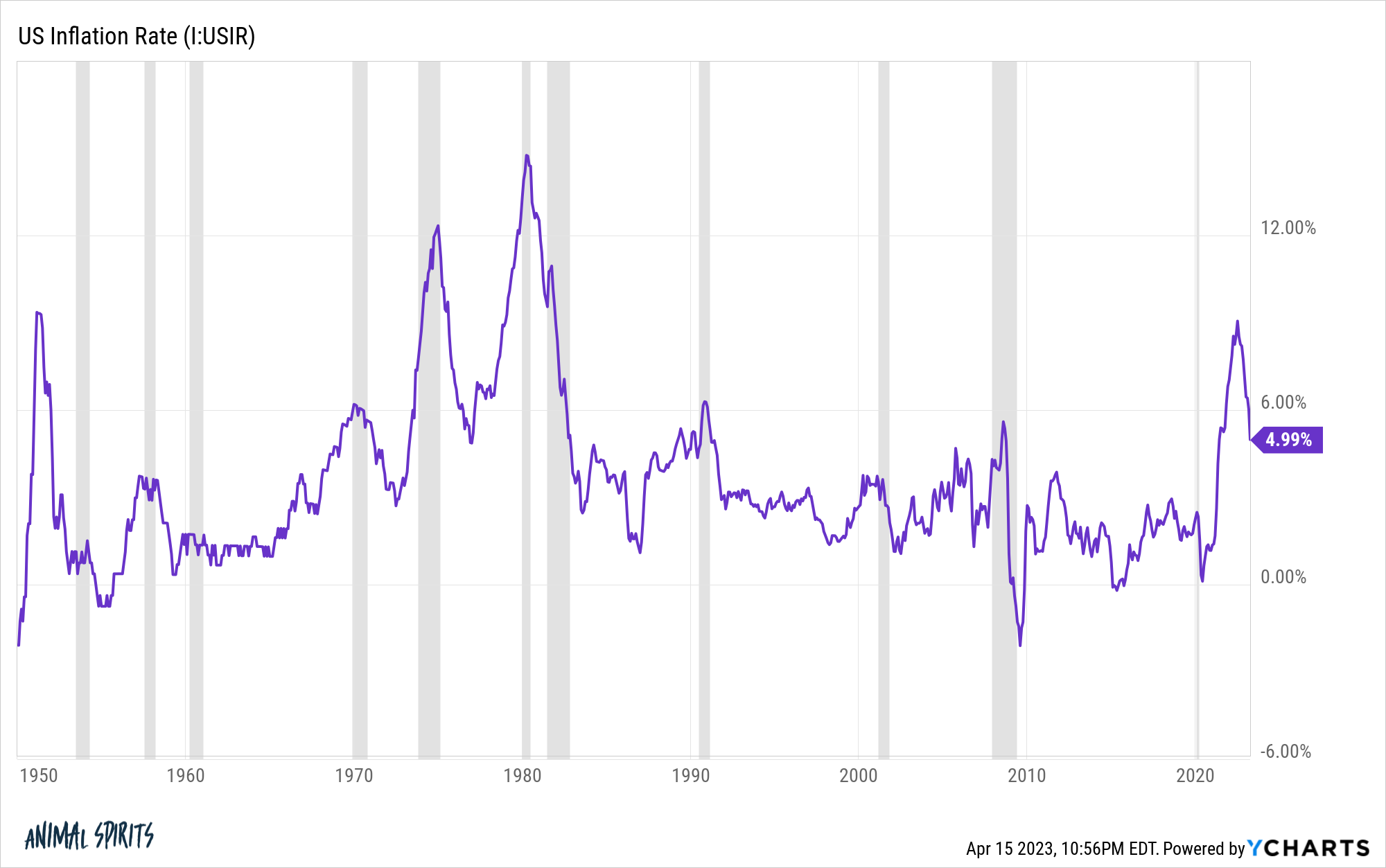

It took some time but inflation is finally heading in the right direction.

These are the last ten annualized inflation readings since the inflation rate peaked this past summer:

- June 9.06%

- July 8.52%

- Aug 8.26%

- Sept 8.20%

- Oct 7.75%

- Nov 7.11%

- Dec 6.45%

- Jan 6.41%

- Feb 6.04%

- March 4.98%

Every single reading since we hit 9% has been lower than the previous level.

It’s not coming down as fast as some people would like but at least the trend is lower. And once those 8-9% readings start dropping off it wouldn’t surprise me to see 2-3% inflation by the end of the summer.

The problem is that while the rate of change is slowing, the cumulative price change since the pandemic has been a bit much.

The U.S. consumer price index is up nearly 17% so far in the 2020s (so far).

For the entirety of the 2010s decade, inflation in total was just shy of 20%. So a little more than 3 years into the new decade, we’ve already experienced 85% of the total inflation from the last decade.

Higher prices aren’t any fun but there is a silver lining here — wages1 are up nearly 20% so far in the 2020s. Wages were up less than 27% in the 2010s.

That’s the rub when it comes to people experiencing rapidly rising wages — it either causes inflation or only happens when inflation is higher.2

Unfortunately, the swift economic and labor market recovery we’ve experienced these past few years would not have happened if they weren’t accompanied by inflation.

I think it was worth it.

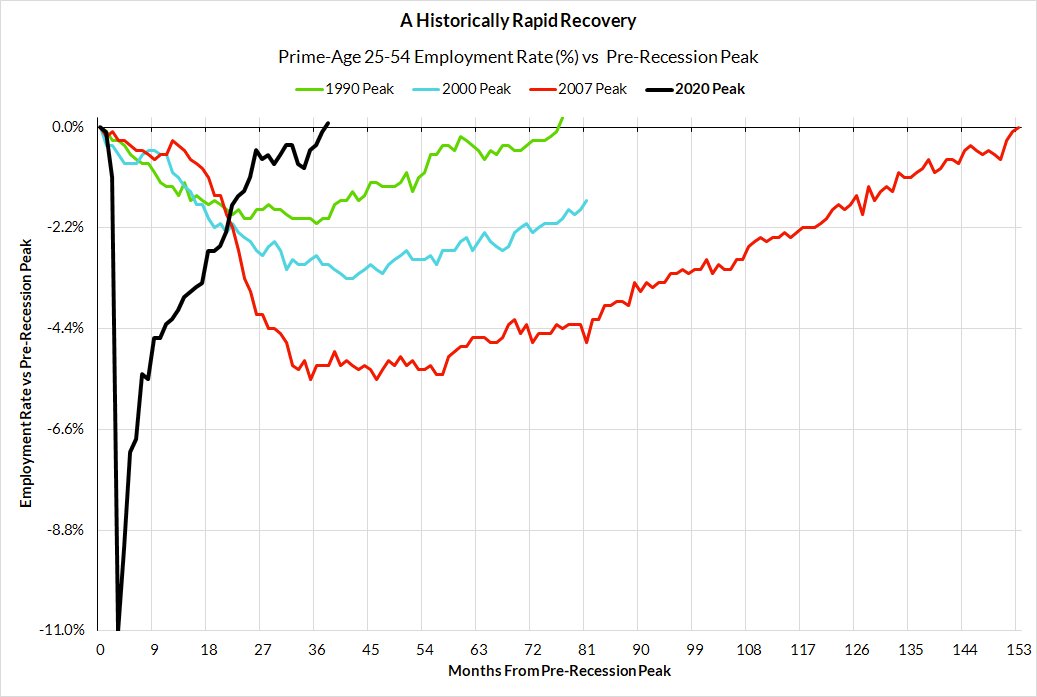

Skanda Amarnath shared a chart this past week on prime-age (25-54) employment recoveries from previous downturns:

The pandemic was a unique occurrence but it wasn’t guaranteed that all of those lost jobs in 2020 would be made back so quickly.

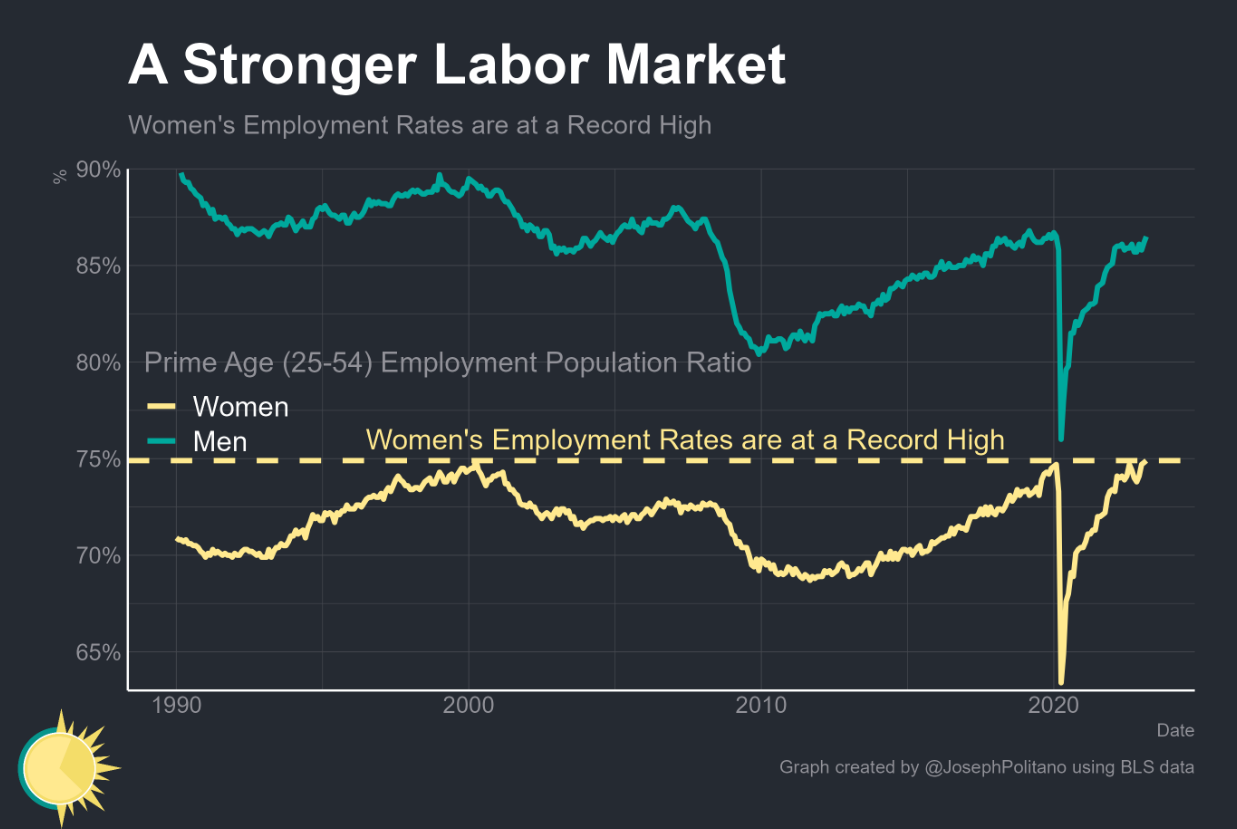

One of the prevailing narratives coming out of the pandemic was employment for women could be set back for years because so many women dropped out of the workforce during the initial stages of Covid for various reasons.

Joey Politano put together an excellent chart that shows prime age woman’s employment rates are now at record highs:

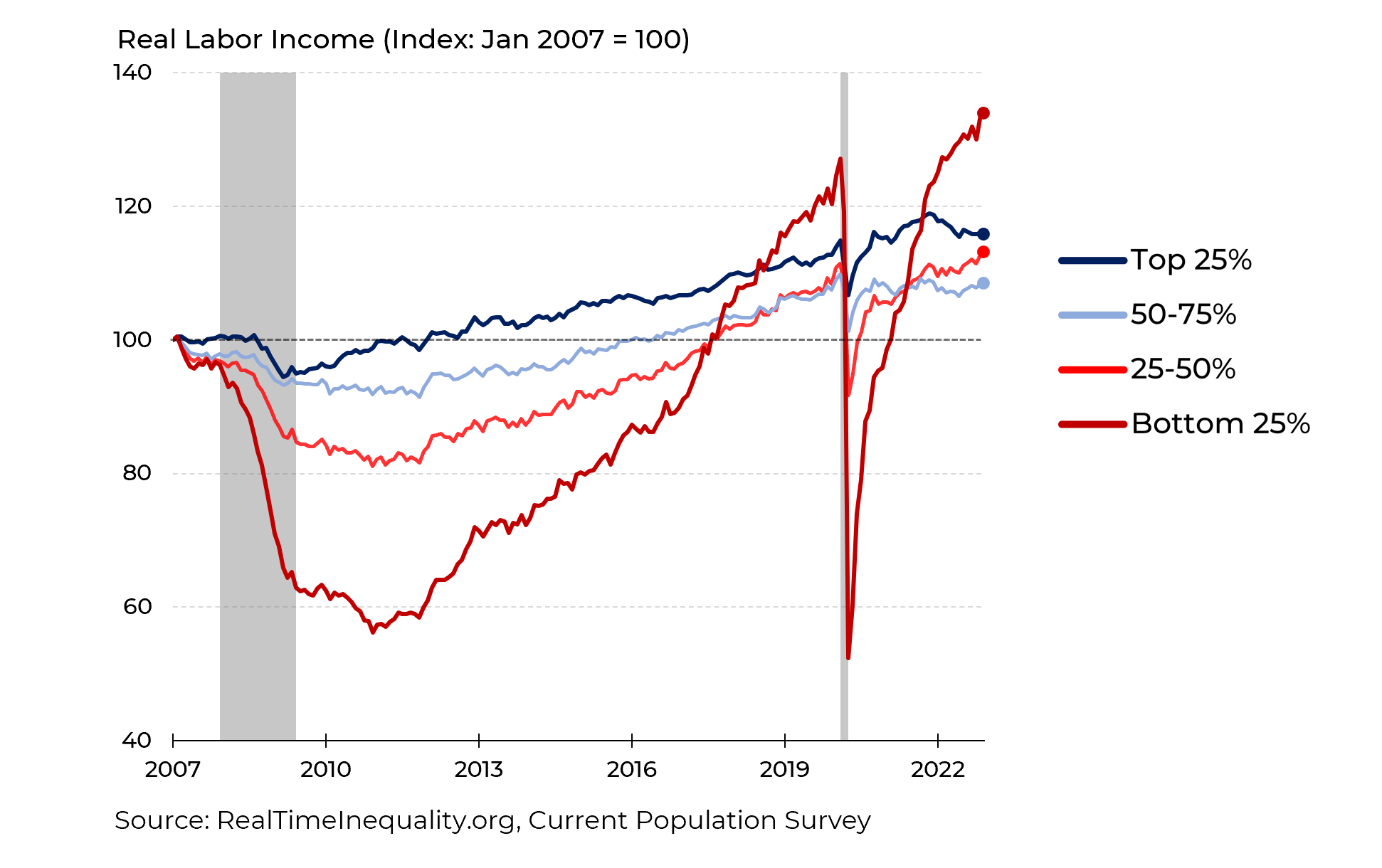

And one of the most pleasantly surprising outcomes of this cycle is the fact that incomes are growing the fastest for low-income workers (via Steven Rattner):

We truly are witnessing the most remarkable labor market recovery in history.

Inflation is not fun to deal with but I prefer this to the alternative of a slow recovery where the unemployment rate remains elevated, wages are stagnant and growth is muted.

I cannot predict what will happen with the inflation rate from here.

If the Fed goes too far we could see a recession that causes severe disinflation or even deflation. If the Fed threads the needle we could see inflation re-accelerate.

My only forecast here would be that inflation will remain volatile in the short-run, as always:

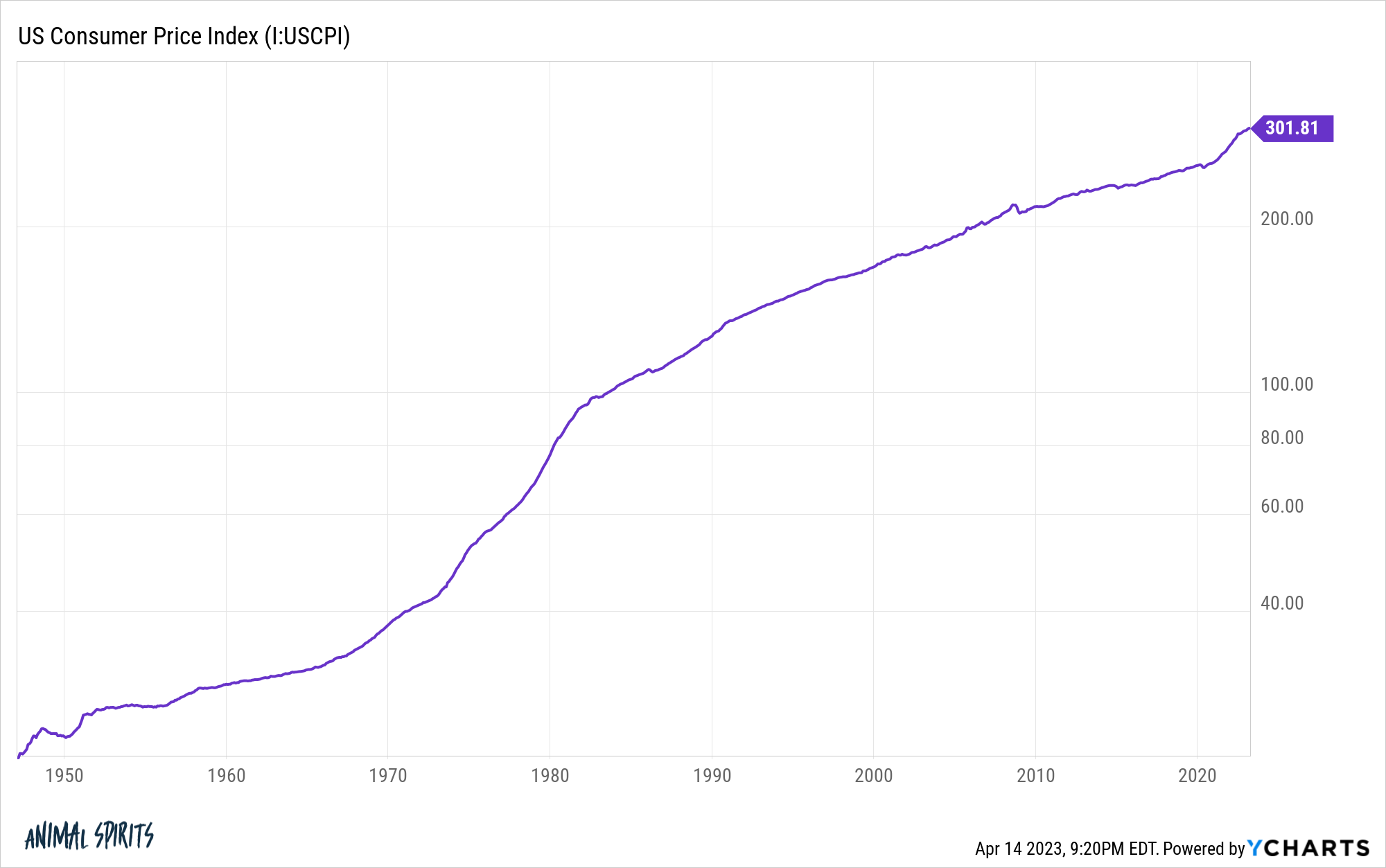

And in the long-run, as long as we continue to experience economic growth, the trend in prices will be higher:

I’m not here to argue that inflation is a good thing, especially when it reaches such lofty levels.

But some level of inflation over time is the price we pay for progress and it’s far better than the alternative.

Further Reading:

How Long Will it Take Inflation to Hit the Fed’s 2% Target?

1Average hourly earnings.

2Wages vs. inflation is kind of a chicken and the egg thing. Does higher inflation cause higher wages or do higher wages cause higher inflation?