Today’s Animal Spirits is brought to you by PacerETFs:

See here for more information on the Pacer Cash Cow ETF Series

On today’s show, we discuss:

- Fed pause wouldn’t necessarily refresh the Stock Market

- What do Americans want in a European Vacation? Fewer Americans

- Want to beat the Stock Market? Avoid the cost of ‘being human’

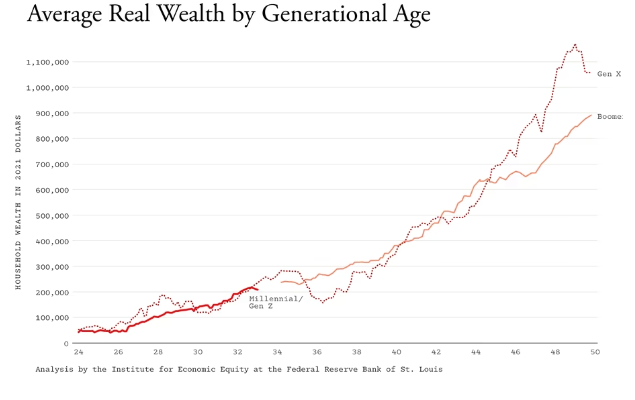

- The myth of the broke Millennial

- AI clones teen girls voice in $1M kidnapping scam

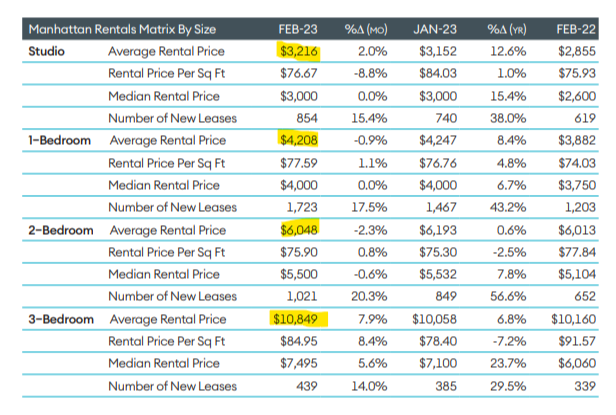

- Elliman Rental report – NYC

- Trayecto

- Amazon 2022 shareholder letter

Future Proof:

Listen Here:

Recommendations:

Charts:

Tweets:

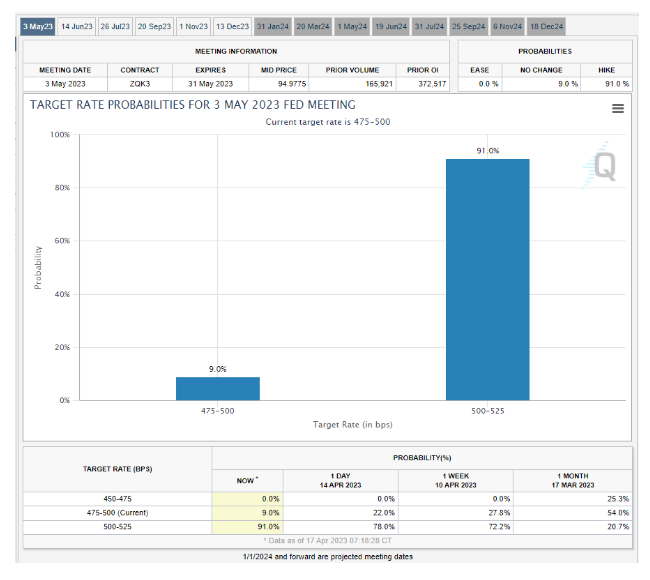

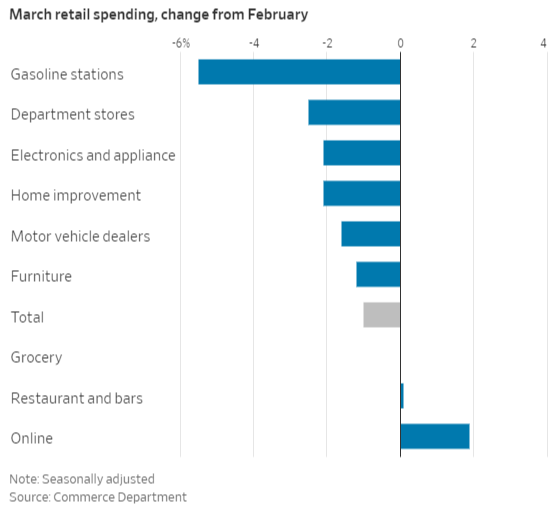

“.. Retail Sales – Yikes ..

.. the diffusion index is the lowest since April 2020, and .. it has never been this negative outside of a recession.”@bespokeinvest pic.twitter.com/boGHn1AjQ5

— Carl Quintanilla (@carlquintanilla) April 14, 2023

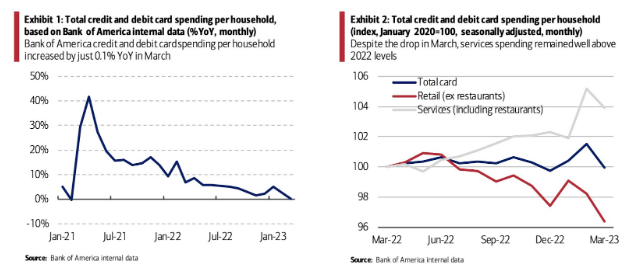

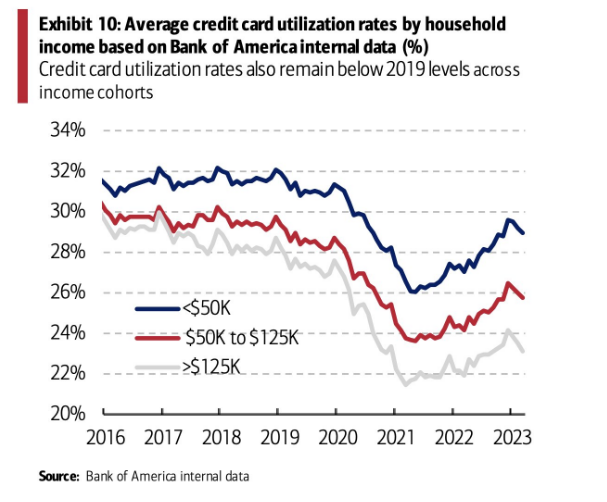

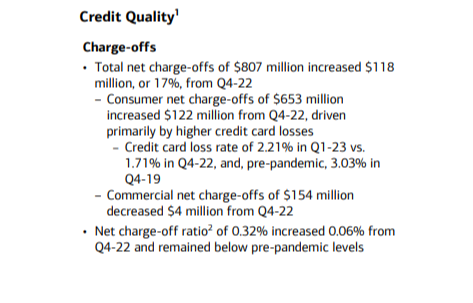

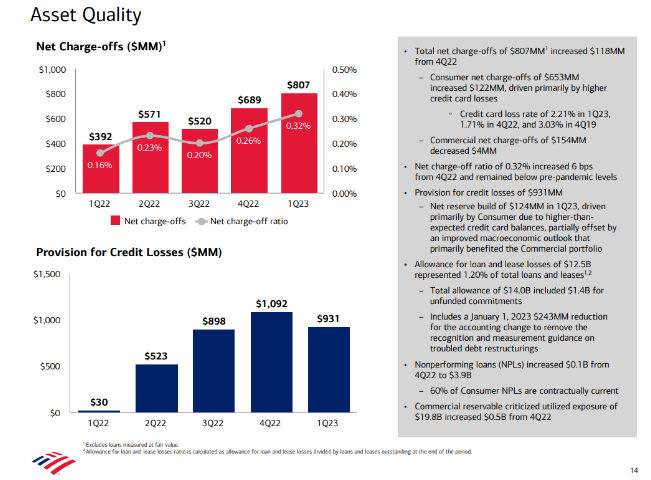

"Bank of America credit and debit card spending per household moderated further in March, to 0.1% year-over-year (YoY), the slowest pace since February 2021. Sequentially, card spending per household fell 1.5% month- over-month (MoM), seasonally adjusted." BofA pic.twitter.com/SK82eeS0v1

— Sam Ro 📈 (@SamRo) April 12, 2023

Vanguard also led in ETF flows w $25b (36% ahead of #2), closing mkt share gap w BlackRock which saw outflows (altho that won't last). Also crazy stat: Vanguard's US equity ETFs took in $13b in Q1, rest of industry combined saw outflows. Relentless bid staying relentless. pic.twitter.com/xcA9ABnhO2

— Eric Balchunas (@EricBalchunas) April 14, 2023

We expect Vanguard to dominate ETFs for quite a while and surpass BlackRock in market share in next two years-ish. Not only do they have the natural demand but also BYOA as mutual funds still make up about 3/4 of their aum and chunk of that will switch over to ETF format. pic.twitter.com/n3zYsGFe0A

— Eric Balchunas (@EricBalchunas) April 14, 2023

The last 10 annualized inflation readings:

June 9.06%

July 8.52%

Aug 8.26%

Sept 8.20%

Oct 7.75%

Nov 7.11%

Dec 6.45%

Jan 6.41%

Feb 6.04%

March 4.98%I spot a trend in there somewhere

— Ben Carlson (@awealthofcs) April 12, 2023

Energy prices declined over the past year, the first 12-month decline since January 2021. Together, food and energy explain just over a tenth of inflation over the past year. 15/ pic.twitter.com/u32ktek4O7

— Council of Economic Advisers (@WhiteHouseCEA) April 12, 2023

A few chart updates with our CPI calculations that include alternative shelter components.

Officially CPI shos headline inflation of 5.0% last 12m, our calculations show <3%:

Inflation was much higher in reality before and now much lower. pic.twitter.com/okOMZZofmd

— Jeremy Schwartz (@JeremyDSchwartz) April 12, 2023

A tight labor market has led to record gains for workers at the bottom — even after inflation.

By contrast, it took until 2017 for the bottom half of Americans to climb back to pre-Great Recession levels of real income. @Morning_Joe pic.twitter.com/LzX8RVl1hT

— Steven Rattner (@SteveRattner) April 13, 2023

The music industry is about to change forever.

This AI-generated song created by "ghostwriter977" is blowing up on TikTok.

It features AI Drake ft. The Weeknd, and is SO good. Sound on 🔊👇 pic.twitter.com/R7xb7xxOI1

— Rowan Cheung (@rowancheung) April 15, 2023

I’m pretty freaked out about job losses from AI

This is not like we created a new tractor for farmers that requires 10 fewer farmers

AI is a tool that will require fewer people for ALL work

This is like the release of a new mega tractor for every industry, all at the same time

— Andrew Steinwold (@AndrewSteinwold) April 15, 2023

#NEW The home price correction has lost more geographical steam in March.

In March, 23% of the nation's 200 largest housing markets registered a month-over-month decline in home prices.

77% of markets registered an increase.

Source: Seasonally adjusted ZHVI pic.twitter.com/X9Hb7iJAYU

— Lance Lambert (@NewsLambert) April 12, 2023

Among the nation's 400 largest housing markets tracked by Zillow, 218 markets are back to—or just set—a new all-time high for house prices. https://t.co/hZadj4ucrG

— Lance Lambert (@NewsLambert) April 15, 2023

#NEW Zillow home price data for America's 30 largest housing markets

1. MoM (month over month)

2. YTD (year to date)

3. Down from peak

4. YoY (year over year)

5. Change since March 2020

6. Pandemic Housing Boom gains at peakSeasonally adjusted, through March 2023 pic.twitter.com/FiKumLBOat

— Lance Lambert (@NewsLambert) April 12, 2023

That being said, prices are not jumping, but they are ticking up. Comparisons to 2022 will keep getting worse until Q3

Median price of single family homes is $439,900. Still up a tad over 2022

Median price of the new listings is $399,000. About 4% lower than last year.

3/6 pic.twitter.com/vqkSDJvZ5s

— Mike Simonsen 🐉 (@mikesimonsen) April 17, 2023

*New research* If remote work caused population loss in big expensive cities, why did their rents and house prices go up? My new paper with @ecarl_economics suggests one answer: household formation! https://t.co/rkUKZYlrTg

— Adam Ozimek (@ModeledBehavior) April 12, 2023

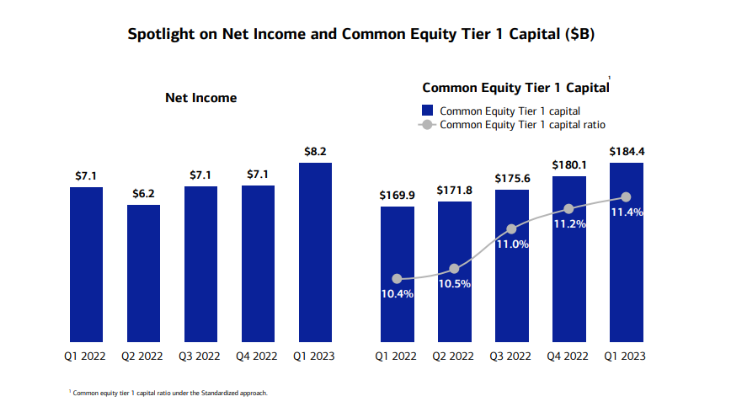

JPMorgan's Dimon: U.S. Economy Continues to Be on Generally Healthy Footings

JPMorgan's Dimon: Storm Clouds Remain on Horizon, Banking Industry Turmoil Adds to Risks

— *Walter Bloomberg (@DeItaone) April 14, 2023

At one point in the 1990s, over 80% of all U.S. deposits were explicitly covered by FDIC deposit insurance. Since then, insured deposits have fallen to ~55%, the lowest level since the 1960s. pic.twitter.com/u2rfBKWVf0

— John Paul Koning (@jp_koning) April 11, 2023

I don't think we've spent enough time marveling at the fact that Meta completely upended its business, renamed itself and insisted the metaverse was the Next Big Thing only to have AI prove that entirely wrong like six months later.

— Philip Bump (@pbump) April 17, 2023

New car inventory has officially hit HIGHEST level in 2 years. Big.

Brands with most availability:

— Ram (most)

— Buick

— Jeep

— Chrysler

— JaguarOnly downside?

There is still wide variation by brand segment.

Specifically, non-luxury and luxury imports still have the lowest…

— Car Dealership Guy (@GuyDealership) April 13, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.