Today’s Animal Spirits is brought to you by New York Life:

See here for more information on New York Lifes indexIQ ETFs

On today’s show, we discuss:

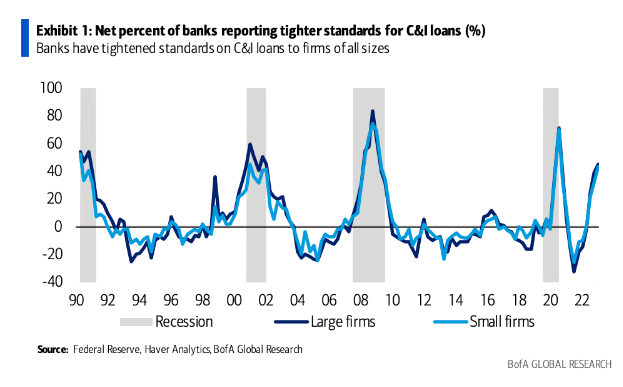

- Welcome to the superprime banking crisis

- Here’s what retirement with less than $1M looks like in America

- The age of AI has begun

- Attention is all you need (Packy on AI)

- Housing market update: Demand for mortgages ticks up as rates drop amid banking turmoil

- A tale of two housing markets: Prices fall in the West while the East booms

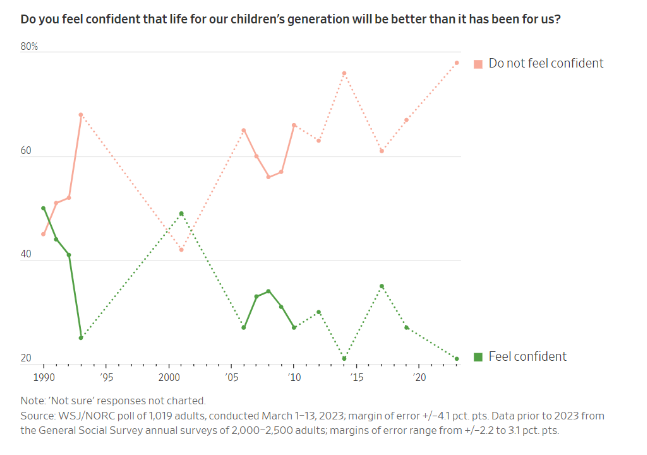

- What’s happening to the American Dream?

- Most Americans doubt their children will be better off, WSJ-NORC poll finds

- For sale: Mansions in Los Angeles at bargain prices

- More Millenials are turning 40 – and they’re changing travel as we know it

- Apple to spend $1B a year on films to break into cinemas

Future Proof:

Listen Here:

Recommendations:

- Daisy Jones and the Six

- Tootsie

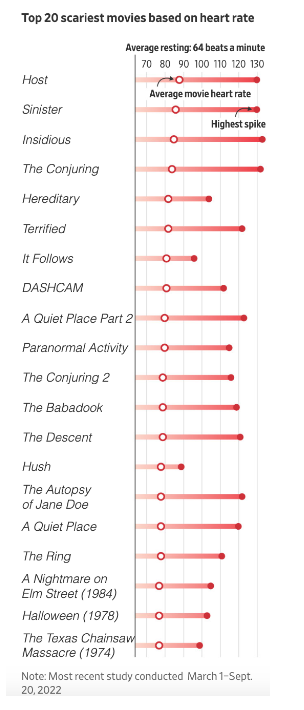

- Hollywood is betting on fear

- Apple sets Fall theatrical release for Martin Scorsese’s ‘Killers of the Flower Moon’

- Chef

- Jill on Money

Charts:

Tweets:

so this was wrt these two statements, but it seems like if you get into the nuance, Yellen is like "well the FDIC certainty won't be all up in that grill" and then Powell is more like "the banks will not be exploding" so it's a tough one, lots of language weirdness today pic.twitter.com/FScQbcuAGm

— Kyla Scanlon (@kylascan) March 22, 2023

A #duration crisis is much easier to solve than an #credit crisis!

— jeroen blokland (@jsblokland) March 26, 2023

https://twitter.com/mark_dow/status/1640437254274547712

Gruenberg: The ten largest deposit accounts at SVB held $13.3 billion in the aggregate.

— Nick Timiraos (@NickTimiraos) March 27, 2023

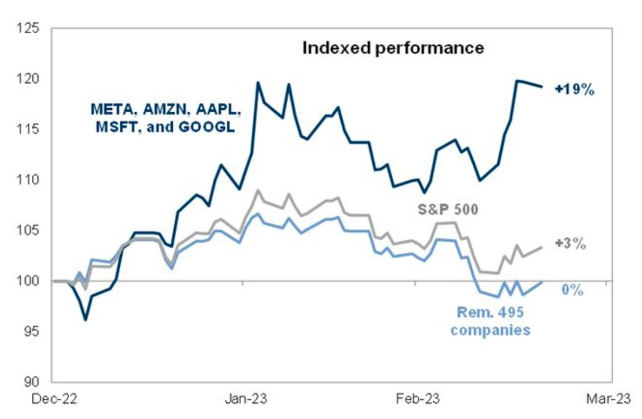

“.. $AAPL & $MSFT currently account for 13.3% of the S&P 500, the most on record. Not since $T & $IBM in the late '70s have two stocks been so dominant ..”

– Goldman pic.twitter.com/udNhDAMvnW

— Carl Quintanilla (@carlquintanilla) March 22, 2023

Fastest growth in Bitcoin addresses with more than 0 BTC since early 2021 pic.twitter.com/kg169ZxJ8W

— Will (@WClementeIII) March 24, 2023

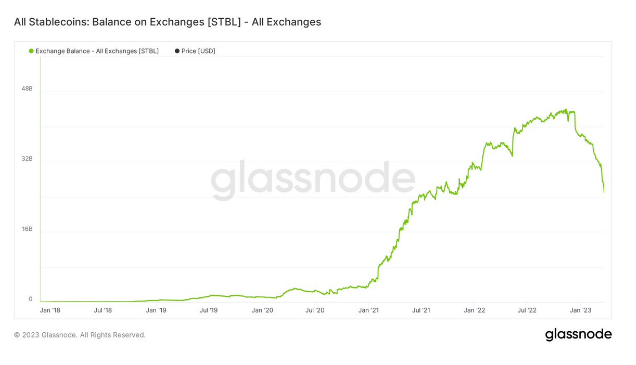

50% of all stablecoins have left exchanges in the past 4 months. No reason for the trend not to continue.

Looks like a bank stock.

$45B ➡️ $24B

SSR is confirming stablecoins are ending up in #Bitcoin pic.twitter.com/Fd7RsRZXGZ

— James Van Straten (@btcjvs) March 24, 2023

GPT-4 is able to infer authorship from a passage of text based on style and content alone.

Given the first four paragraphs of the March 13, 2023 @stratechery post on SVB, GPT-4 identified Ben Thompson as the author.https://t.co/G9ObYbvOTX pic.twitter.com/Ecjv83O8No

— Mike Conover (@vagabondjack) March 19, 2023

30yr FRM a stunning 320bps above the 10yr

The historical average is 195bps $MOVE pic.twitter.com/UtQxQ41PDB

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 22, 2023

Fresh stats. Here's the percentage of multiple offers over the past two weeks of PENDINGS:

– Sacramento region (58.7%)

– Sacramento (66.6%)

– Placer (40.6%)

– Yolo (64.5%)

– El Dorado (53.0%)NOTE: 58.7% is higher than normal for the time of year, but not 2021 where it was 75%.

— Ryan Lundquist (@SacAppraiser) March 23, 2023

Friday I captured around 200k images of our sun. I asked my friend @TheVastReaches for help working all the data so we could create an incredibly detailed image of our star, and we're nearly done. Take a look at this close crop of the final 140 MP pic we'll be sharing tomorrow: pic.twitter.com/VV16my1U1S

— Andrew McCarthy (@AJamesMcCarthy) March 21, 2023

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.