I write a lot about the benefits of investing in the stock market over the long-run.

Anytime I share a chart or data point about these benefits invariably a handful of people will push back.

What about other countries they ask. Isn’t the U.S. just survivorship bias they protest.

I don’t mind people taking the other side here. That’s what makes a market. Long-term buy-and-hold investing is not for everyone.

To each their own.

The winners write the history books so it is fair to ask if long-term investing works elsewhere.

Elroy Dimson, Paul Marsh and Mike Staunton published a book the early-2000s called Triumph of the Optimists: 101 Years of Global Investment Returns that looked at the historical record of equity markets around the globe since the year 1900.

This book provides the answer to these questions.

And lucky for us, the authors update the data on an annual basis for the Credit Suisse Global Investment Returns Yearbook. The latest edition was just released and it’s filled with data and charts about the long-run returns in stock markets around the globe.

All of their performance numbers are real (after inflation) which helps make better comparisons across borders and economic regimes over time.

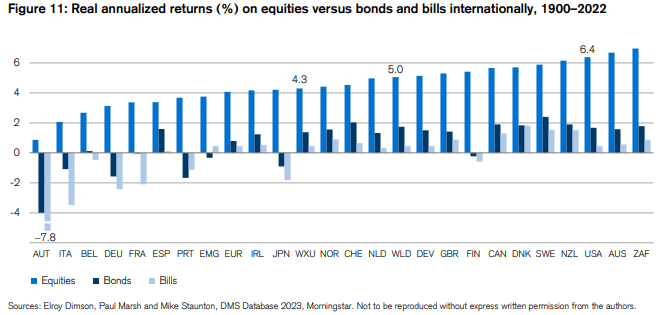

Here are the real annual returns from 1900-2022:

The U.S. is near the top but it’s not like they’re running away with it like Secretariat.

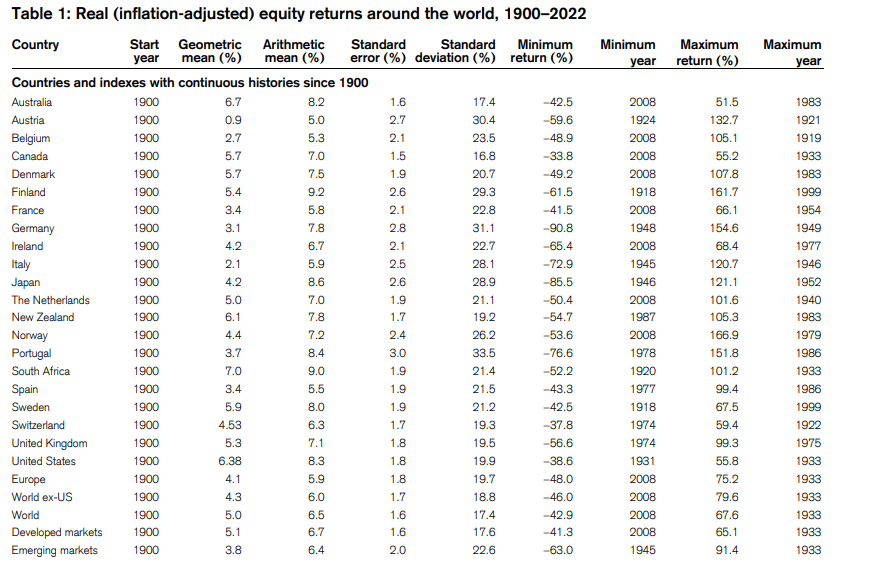

Here are more numbers for those who really like to dig into the data:

Sure, there have been some complete washouts over the years (Russia’s stock market was basically shut down for 75 years following World War I) but returns in other countries have been anywhere from OK to respectable to strong.

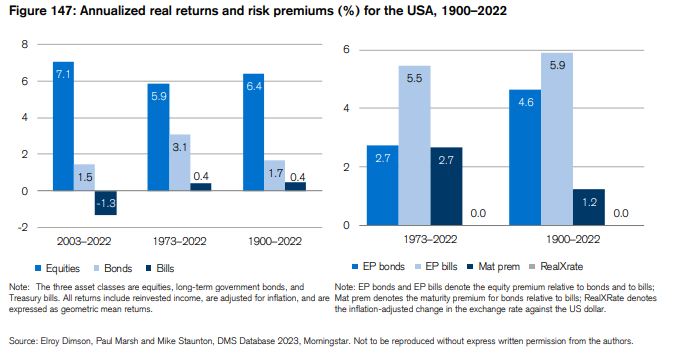

Dimson, Marsh and Staunton also break down real returns by stocks, bonds and cash over various time frames. Here are the results for the USA:

Pretty good if you ask me.

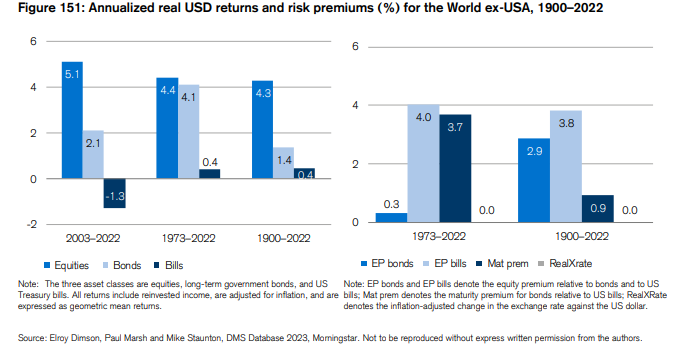

Now here is the rest of the world ex-USA:

It’s not as good but it’s not terribly worse.

The MSCI World ex-USA dates back to 1970. These were the annual returns1 from 1970 through January 2023:

- S&P 500: 10.5%

- MSCI ex-USA: 8.4%

That’s a pretty good lead for the old US of A but it’s not like the rest of the world has been chopped liver over the past 50+ years.

And the majority of the U.S. outperformance has come since the 2008 financial crisis.

These were the annual return through the end of 2007:

- S&P 500: 11.1%

- MSCI ex-USA: 10.9%

It was pretty darn close before the most recent cycle saw U.S. stocks slaughter the rest of the world. And it’s not like U.S. stocks have outperformed always and everywhere.

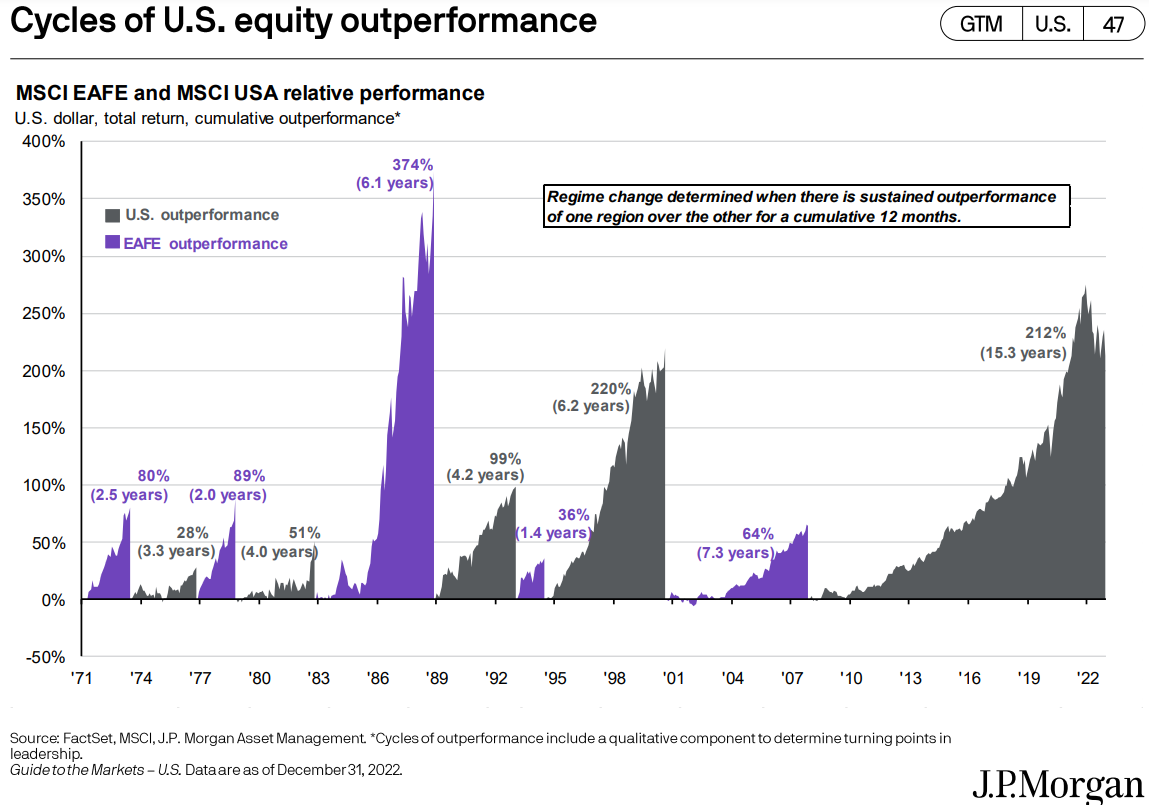

This chart from JP Morgan shows the cycles of over- and under-performance for both U.S. and international developed stocks:

The current run for U.S. stocks is by far the longest streak of outperformance since 1970.

Maybe stocks in the United States are now demonstrably better than stocks outside of the U.S. but I wouldn’t bet my life on it.

Many investors are happy to bet their entire stock portfolio on the United States because corporations are so much more global today.

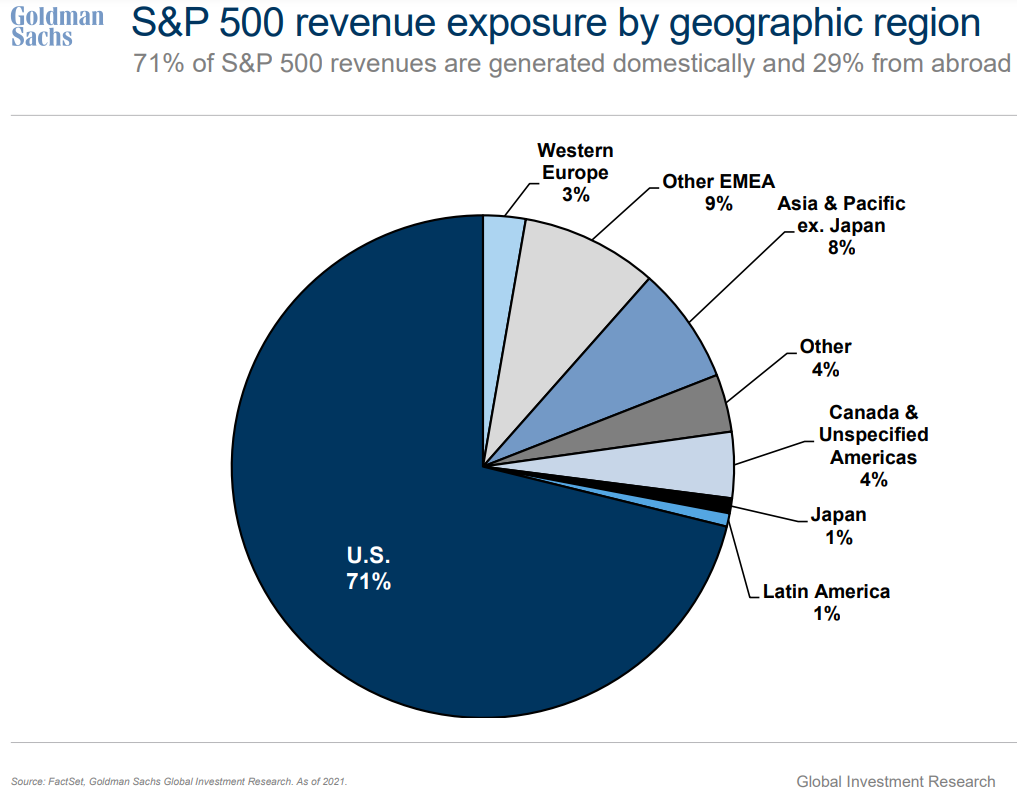

This pie chart from Goldman Sachs shows S&P 500 company sales exposure by geographic region:

So we’re looking at 71% of sales in the United States and 29% outside of our borders.

The U.S. still has plenty of advantages over the rest of the world. We have the biggest, most dynamic economy and financial markets in the world.

Betting against the United States has never been a winning proposition. I wouldn’t want to do it going forward either.

But I’m not ready to write off the rest of the world either. The internet has flattened the world in so many ways and it would be ridiculous to assume people in America are the only ones who wake up every day looking to better themselves in life.

I have no idea if the U.S. can pull off the same level of outperformance over the next 120+ years.

I don’t think international diversification can protect you from bad returns on a daily, weekly, monthly or even yearly basis.

International diversification is meant to protect investors over much longer time horizons where things like economic growth matter more than short-term fluctuations.

I am a long-term bull on the United States but I am also bullish on the rest of the world…warts and all.

Further Reading:

Why I Remain Bullish on the United States of America

1These returns are nominal not real.