A reader asks:

People are saying that the bond market is screaming recession. Has the bond market ever been wrong? Any notable examples and why was it wrong?

The bond market is known for being much smarter than the stock market but we don’t have to go back very far to find a time when it was wrong.

The bond market certainly DID NOT see the pandemic-induced inflation coming.

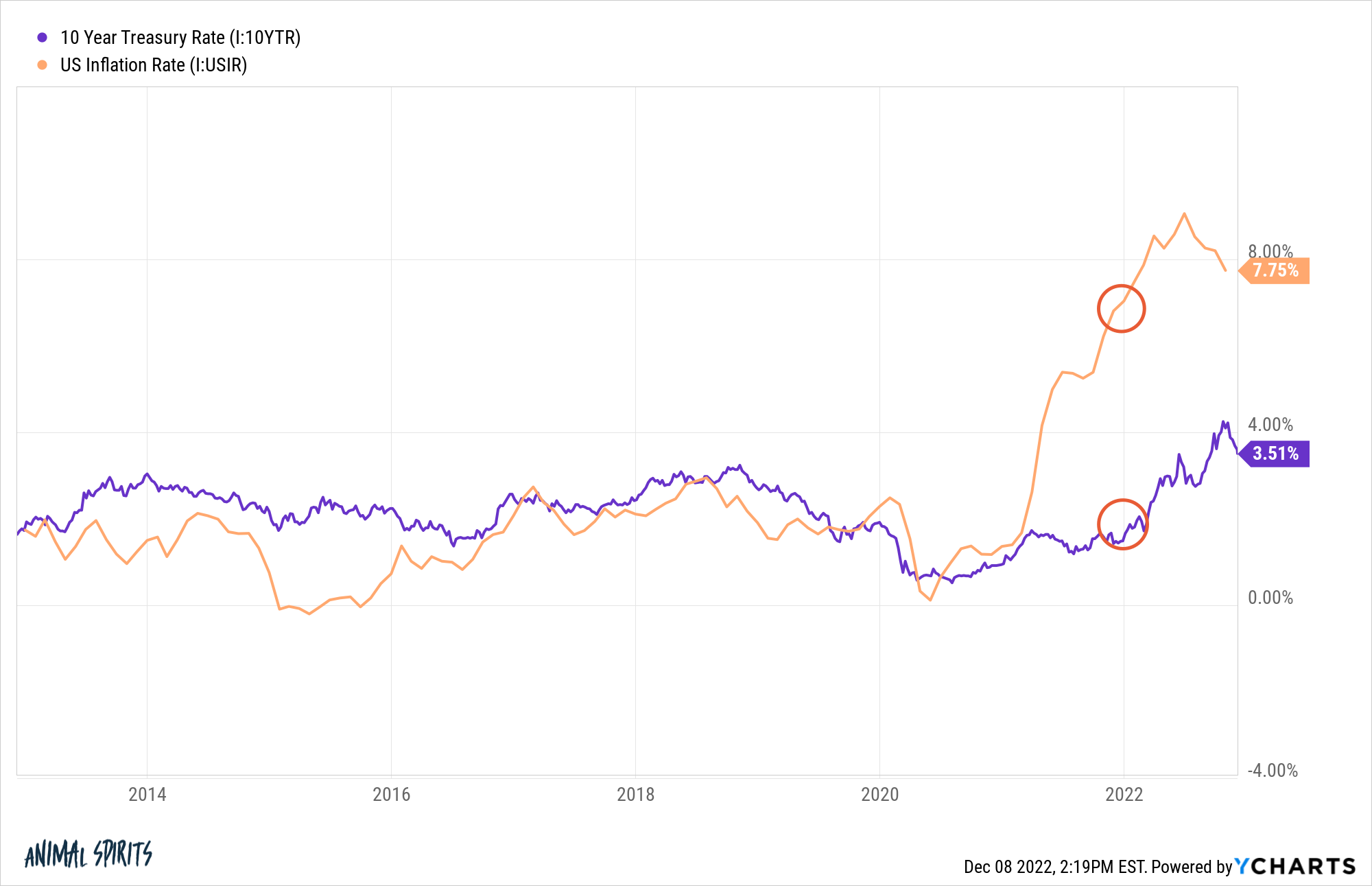

Just look at where 10 year treasury yields were coming into this year:

The 10 year was still yielding just 1.5% while inflation was already at 7% and trending higher.

The bond market was completely offsides and that’s one of the reasons we’ve had such a huge adjustment period this year with interest rates.

The bond market had to re-price in a hurry once it became apparent inflation was going to be here for a while.

You could blame the Fed for this. They were telling us all inflation was going to be transitory. It wasn’t supposed to stick around at these high levels for this long.

Maybe the bond market was simply taking marching orders from Jerome Powell and company.

It can also be helpful to understand what causes yields to change in the bond market.

The Fed does control short-term interest rates using the Fed Funds Rate but things like supply and demand for bonds have more to do with what happens to longer-term bonds.

Then you have variables like inflation expectations, economic growth, various Fed levers they can pull and maybe some yield trends if you’re into that kind of thing.

Add it all up and this is why interest rates are not only different for bonds of various maturities, but when rates rise or fall, they often do so at different magnitudes across the maturity spectrum.

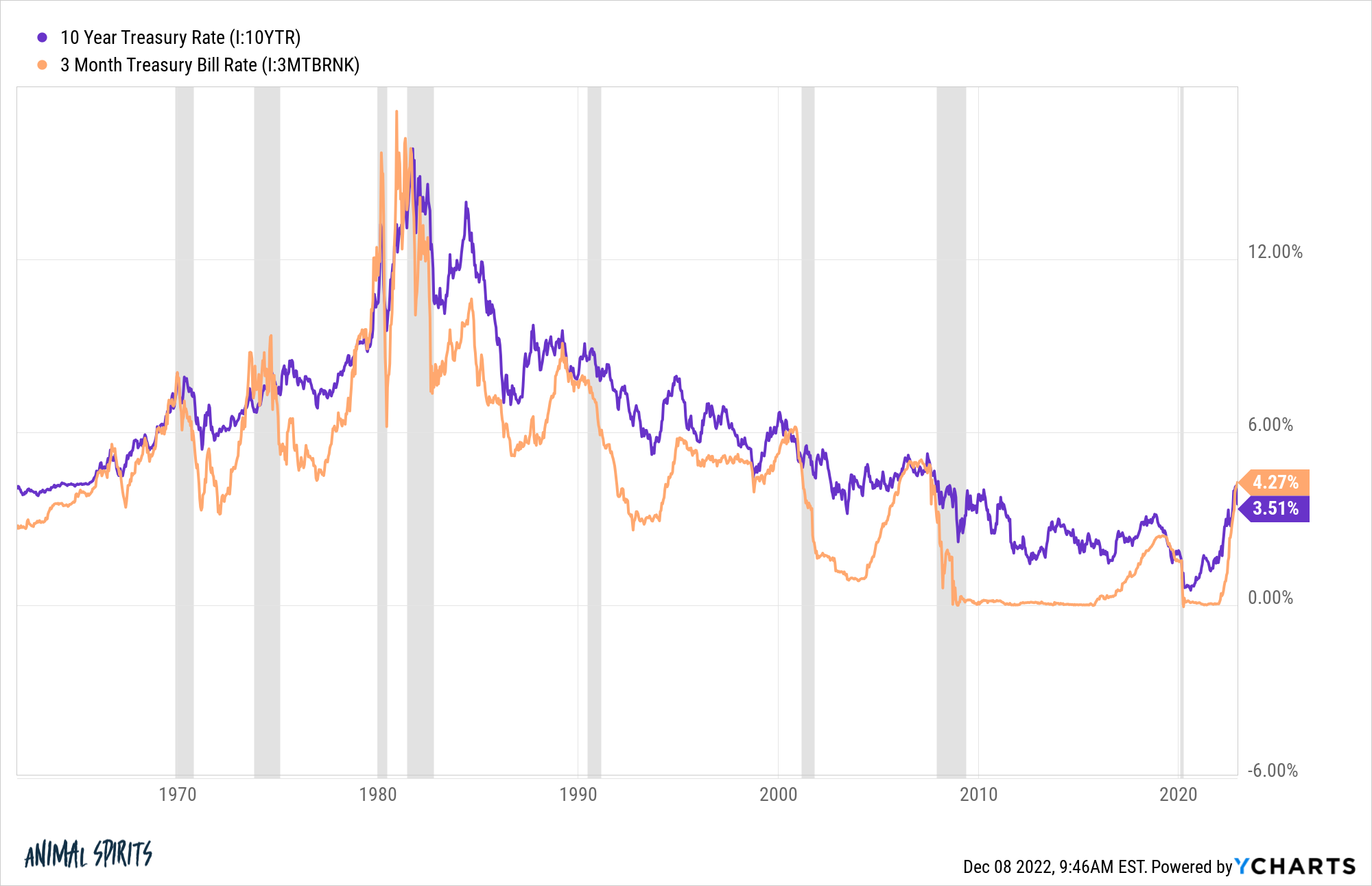

You can see how this plays out with 10 year treasuries and 3-month T-bills over time:

They move in the same general direction over time but often at a different pace.

3-month treasury bill yields are a good proxy for the Fed funds rate, savings account rates and CD rates. Because there is zero risk of default and little-to-no interest rate risk involved in these securities, they typically have much lower yields than longer-term bonds.

But look at them now — these ultra short-term government debt instruments are yielding 0.8% more than 10 year treasuries.

This is not normal and it’s why many people think the bond market is screaming recession in a crowded theater.

The hard part here is the Fed is effectively inverting the yield curve on purpose to snuff out inflation.

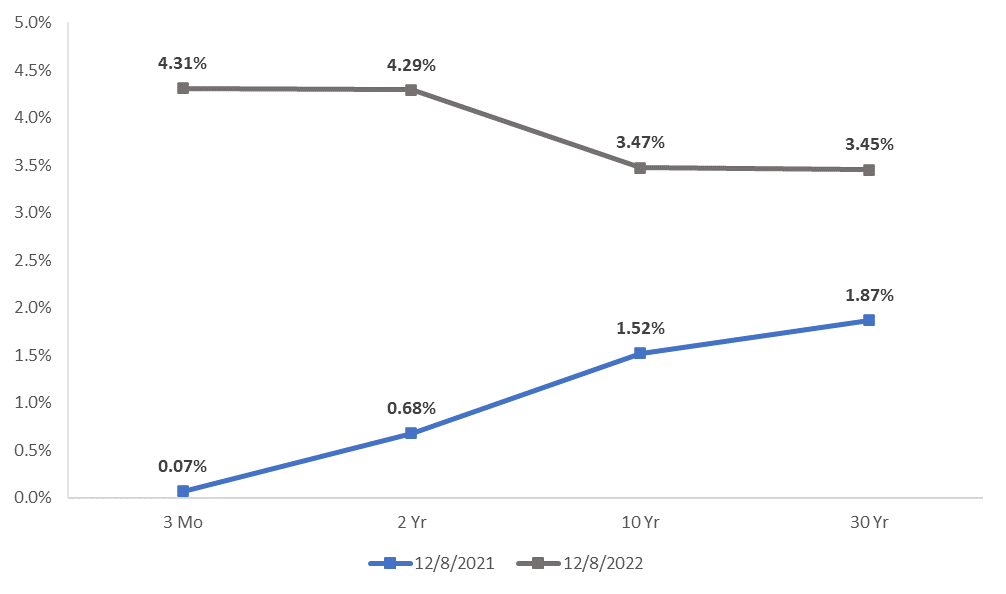

It’s instructive to see how various parts of the yield curve have moved over the past year to see how much of an impact the Fed is having:

Short rates have gone from floor to ceiling in the blink of an eye. And while long rates are higher, the move has been more muted.

It’s difficult to know exactly what the yield curve is telling us but here are some possibilities:

- The long end of the curve doesn’t believe inflation is a worry long-term but it’s still a problem in the short-term.

- Traders assume the Fed is probably going to have to cut rates in the next 12-18 months and are calling their bluff.

- The short end of the curve is being used to orchestrate a recession because that’s all the Fed can do to slow inflation.

- Economic growth is going to slow in the coming months as is inflation.

And maybe the biggest takeaway here is how difficult it is to predict the future path of inflation, economic growth and rates.

The bond market knows everything all of the other investors know (which is nothing about what the future holds).

My biggest reservation about trying to use the bond market to predict what’s going to happen with the economy is the Fed’s involvement in the market.

The Fed was buying all sorts of bonds during the pandemic to keep the financial system functioning. They overstayed their welcome and the fact that they stopped those bond purchases this year, in combination with rate increases, has made it even harder to understand what the bond market is telling us.

Can you really trust the bond market when it comes to the economy when the Fed is pulling so many levers?

I’m not saying we should ignore an inverted yield curve here but the bond market is showing us what the Fed is doing more than predicting what’s going to happen next.

We discussed this question on the latest edition of Portfolio Rescue:

Alex Palumbo joined me again to talk about finding a financial advisor and how young advisors can make their way in this industry.

Further Reading:

The Predictive Power of the Yield Curve

Here is the podcast version of today’s show: