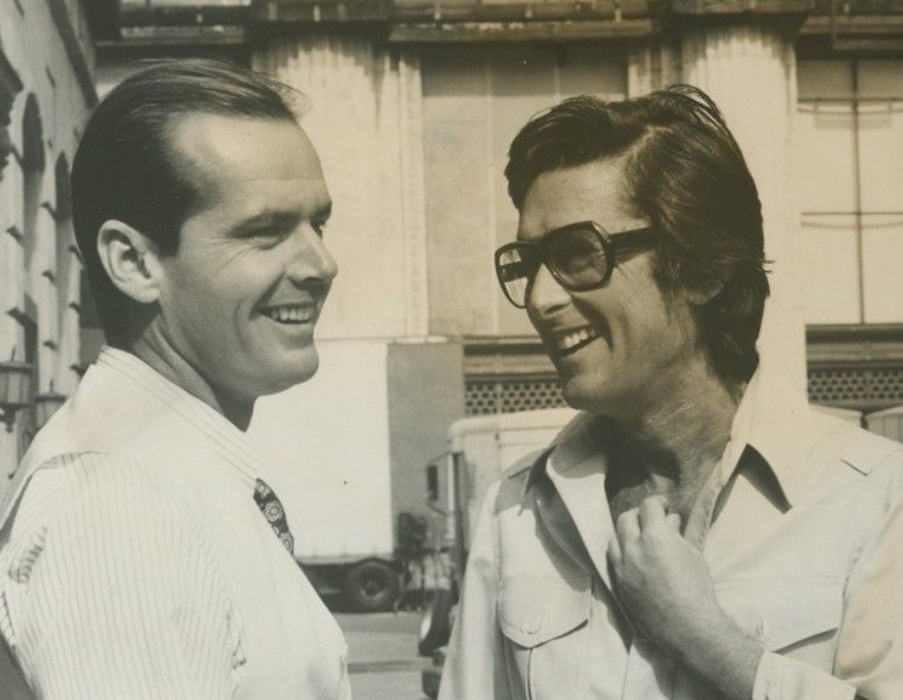

Before becoming one of the most important movie studio executives of the 1970s, Robert Evans took a break from the glitz and glam of Hollywood to work for his brother’s apparel line, Evan-Picone.

The company was so fashionable in the 1960s that every investment bank was pushing them to go public.

Before going that route, Robert’s brother Charles put a call into Charlie Revson, the founder and owner of Revlon.

After six months of back-and-forth negotiations, Revlon agreed to buy Evan-Picone. The deal was for $12 million (which would be more like $100 million today).

The brothers Evans each owned a piece of the company, although Charles received a bigger payout since he helped found the brand.

They both earned a life-changing amount of money from the sale but the risk profile of the brothers was polar opposite.

Charlie wanted to conserve his wealth while Robert wanted more.

Evans explains what happened next in his wonderful biography, The Kid Stays in the Picture:

As brothers, Charles and I were so alike yet so different. Charles ultraconservative, me a gambler. Today, Charles is a millionaire a hundred times over. Me, I’m still in hock.

Our first investment, after selling Evan-Picone, was in a speculative mutual fund. Charles, the far richer, put in $25,000; me, a quarter of a million. Two months later, the fund went bust, I mean bust—zero back on the dollar. How depressing it would have been to know then that it was a portent of our financial futures. Even in the gold-rush eighties, I came up a loser.

Evans spent much of his life going from boom to bust and back again — making a lot of money, losing it all and repeating the cycle.

He later admitted, “Going for broke rather than going backward had always been my style.”

This style helped him in the movie business but hurt his finances.

There’s nothing wrong with taking some risks, in your career or with your money. There is no reward if you take no chances.

But there are certain risks that are avoidable and unnecessary depending on your circumstances.

Warren Buffett once gave a talk to a group of MBA students at the University of Maryland.

A student asked the Oracle of Omaha to name some common errors successful people make with their money.

Buffett told the class:

Anyone who has become rich twice is dumb. Why would you risk what you need and have for what you don’t need? If you are already rich, there is no upside to taking on a lot more risk, but there is disgrace on the downside.

The problem is making money and keeping money are two very different skill sets. It can be difficult to transition from a mindset of risk-taking to do-no-harm.

The good news is while there are numerous ways to build wealth, there are just a handful of ways to screw it all up:

- Placing your trust in the wrong person or organization.

- Taking too much risk.

- Holding concentrated positions.

- Lacking sufficient diversification.

- Using too much leverage.

- Investing in things that sound too good to be true.

- Having unrealistic return expectations.

Unfortunatelty, an insatiable desire for more makes it difficult to avoid these pitfalls.

If you have no idea how much is enough, you’ll never be satisfied with what you have.

Further Reading:

Anticipated Joy vs. Anticipated Regret