When Russia invaded Ukraine in late-February, the price of oil was a little more than $90 a barrel.

It basically went straight up from there to well over $120 a barrel in about a week and a half.

Gas prices quickly moved up as well, getting as high as more than $5 a gallon by early summertime.

The energy picture felt bleak at the time and it seemed like it was only a matter of time until we broke through all-time highs in energy prices.

Just look at all of the headlines from March of this year:

We spent the entirety of the 2010s underinvesting in our energy infrastructure and then one of the most important energy sources in the world basically got cut off because of the war.

Things felt bleak considering inflation was already at the highest levels in four decades.

I specifically recall listening to an Odd Lots podcast in March that laid out the case for $200/barrel oil in March when tensions were high:

Tracy: I mean, how high do you think it could go? And what level would be worrying to you in terms of demand destruction?

Pierre: Well, I think, like close to $200 a barrel — so much higher than today. I feel like there’s no demand destruction at $110 a barrel and we’ll have to go significantly higher before demand can go down by enough. But that’s also assuming there’s no government mandate and some kind of confinement, where let’s say two days a month, we are not doing anything. And we are in confinement for two days a month. I mean, there could be some solutions like that to bring demand down, but if there’s no government mandate, then I think that around $200 oil will be enough to bring demand to balance the market.

Joe: Could we see $200 oil this year?

Pierre: Yes, I think so. Yes.

It sure felt like it was only a matter of time.

However, the opposite happened.

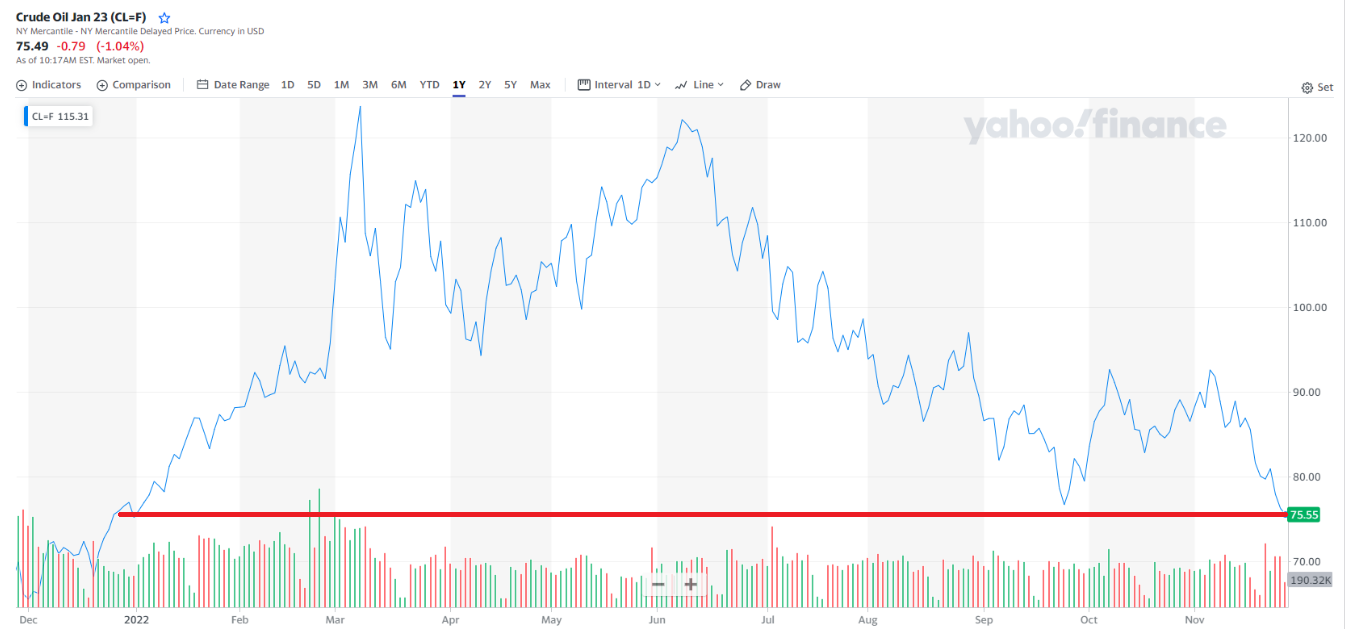

Oil prices have crashed from those March highs.

Here’s a story from Reuters this week about where things stand:

Oil prices fell close to their lowest this year on Monday as street protests against strict COVID-19 curbs in China, the world’s biggest crude importer, stoked concern over the outlook for fuel demand.

Brent crude dropped by $2.67, or 3.1%, to trade at $80.96 a barrel at 1330 GMT, having dived more than 3% to $80.61 earlier in the session for its lowest since Jan. 4.

U.S. West Texas Intermediate (WTI) crude slid $2.09, or 2.7%, to $74.19 after touching its lowest since Dec. 22 last year at $73.60.

Both benchmarks, which hit 10-month lows last week, have posted three consecutive weekly declines.

Not only are oil prices lower than they were before the war broke out in Ukraine, but they are basically flat on the year:

I bring this up not to dunk on these forecasts.1

Those forecasts all made sense given the information we had at the time.

This year is full of surprising outcomes in the markets but this one might be the most surprising to me.

And the crazy thing is it’s hard to find a good reason for oil prices coming down so much.

Sure, the White House released the strategic oil reserves and China continues to have its Covid lockdowns. Maybe the market is looking ahead to demand destruction from a potential recession. Or maybe the cure for high prices was high prices?

It sure doesn’t feel like there was a glaringly obvious catalyst for the move higher in oil prices to reverse.

The thing that’s hard about markets is you could be completely right about the geopolitics and still be wrong about the price action.

Or you could be completely right about the macro and still be wrong about the price action.

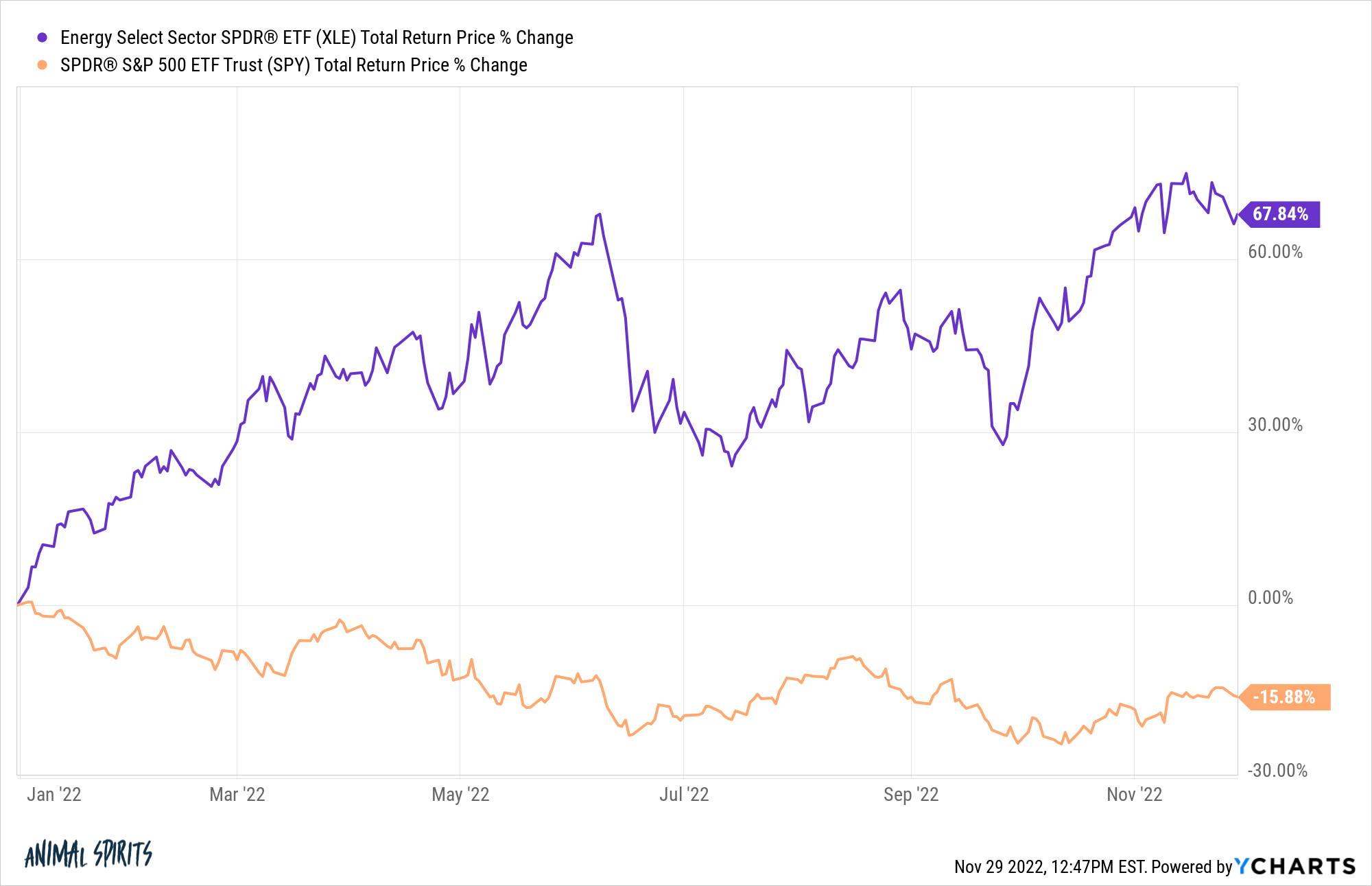

For instance, let’s say I would have told you before the start of the year that oil prices would be flat through the end of November.

How would you think energy stocks would do in that situation?

I guess energy stocks2 don’t need higher oil prices to outperform:

Energy is far and away the best-performing sector in the S&P 500 this year and there isn’t a close second place.3

Markets are full of contradictions, surprises, overreactions, underreactions and head-scratching moves.

It’s always been this way but the more I learn about the markets the more I realize how difficult they can be.

Humility should be your default setting when trying to figure out what comes next.

Further Reading:

Markets Are Hard: Seth Klarman Edition

1And who knows — maybe we’ll still see $200/barrel for some other reason.

2My guess as to why energy stocks are performing so well while oil prices have crashed is twofold: (1) Energy stocks have gotten crushed for years before the past 18 months or so and (2) It seems like investors now realize the importance of this sector going forward so they’ve bid up share prices. Maybe I’m wrong.

3In fact, energy is the only positive sector on the year. As of this writing, the next best performer is consumer staples, which is down 20 basis points or so. Utilities, healthcare and industrial stocks are also holding up well, all down less than 5% on the year.