Today’s Animal Spirits is brought to you by Masterworks and AcreTrader:

See here to learn more about investing in contemporary art and here for important disclosures*

See here for more information on how to invest in farmland

On today’s show we discuss:

- Three things dampening the pain (The Irrelevant Investor)

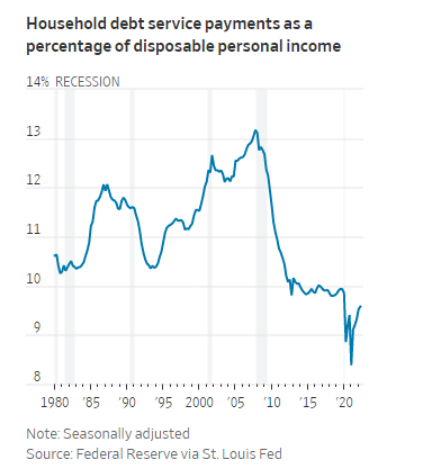

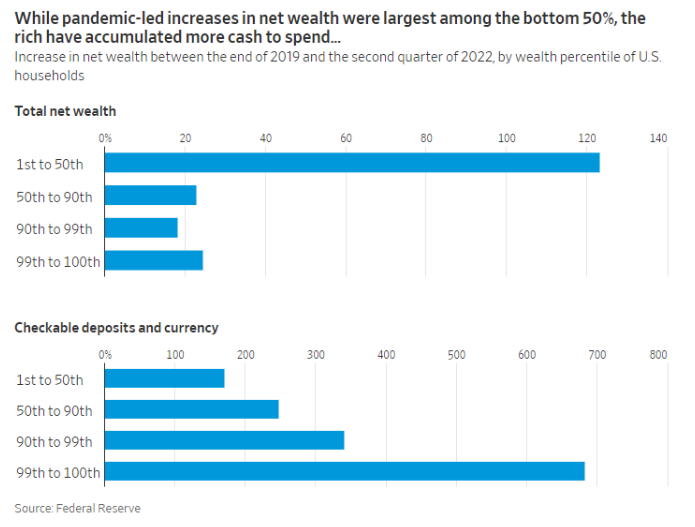

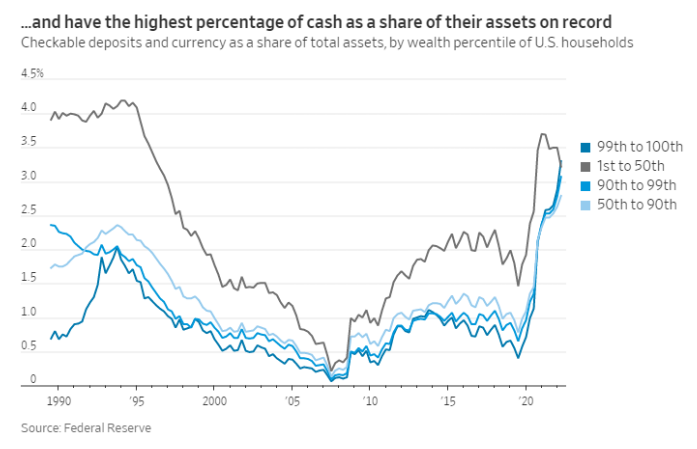

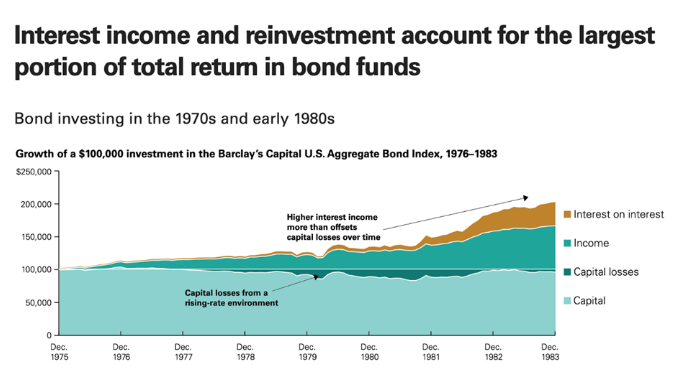

- Cash-rich consumers could mean higher interest rates for longer

- The economy is still in a post-pandemic spending boom for rich people

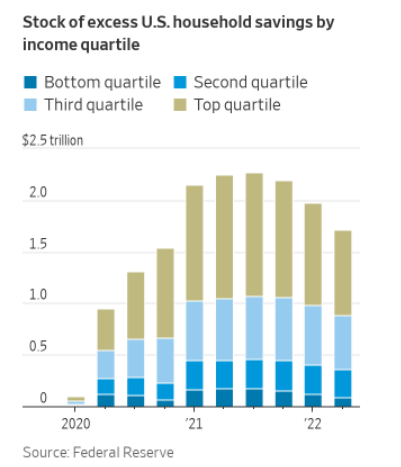

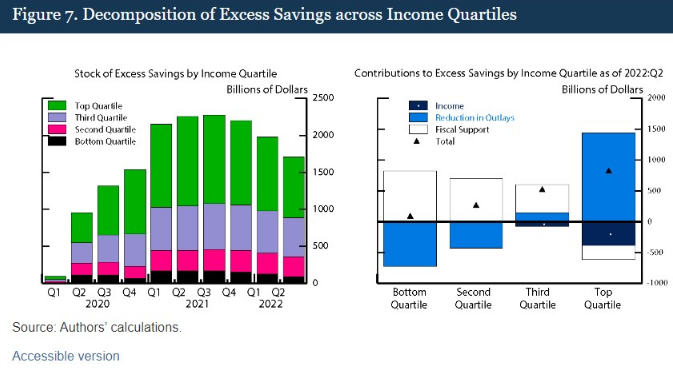

- Excess savings during the COVID-19 pandemic

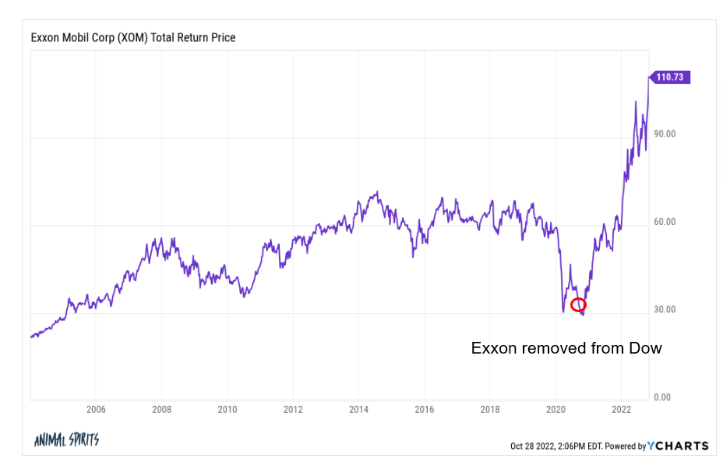

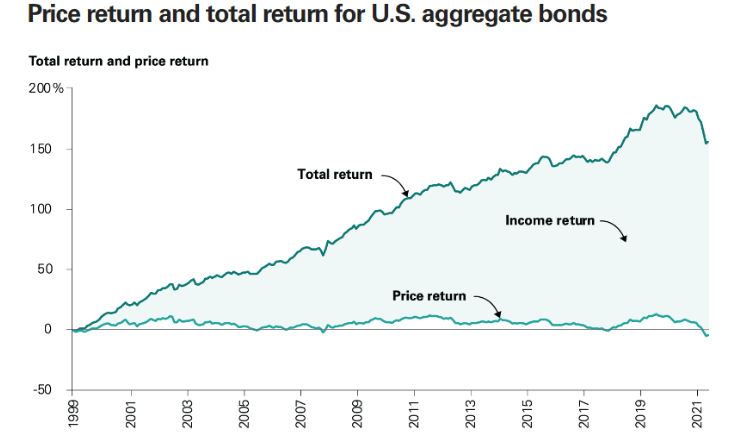

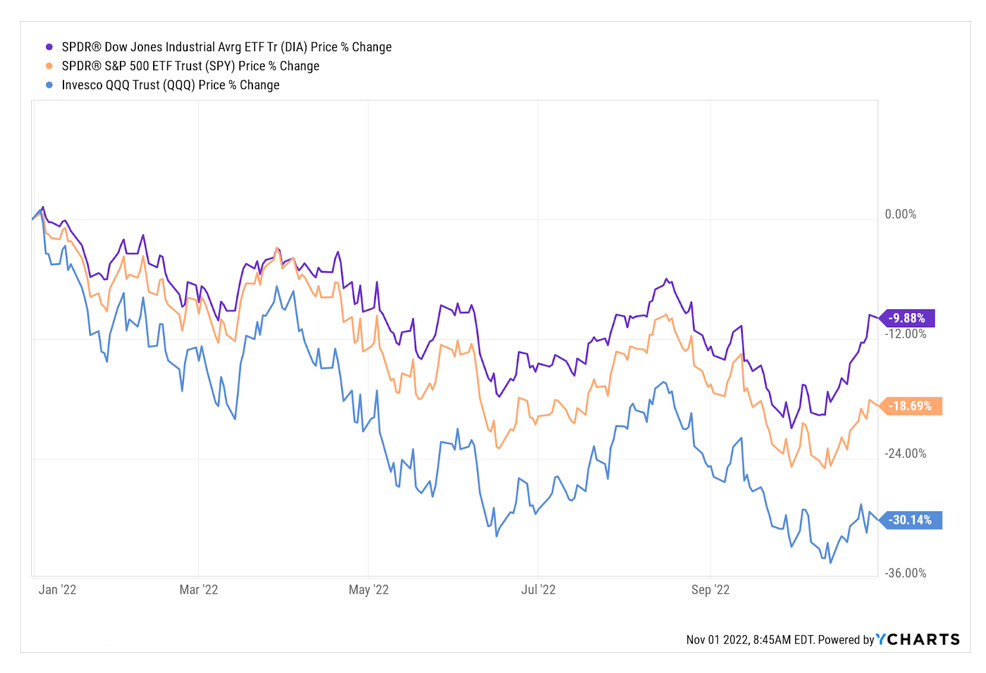

- The revenge of the Dow (The Irrelevant Investor)

- Mortgage rates hit above 7%

- A broken market is causing mortgage rates to surge

- Pending home sales down 10% in September

- Surging rents are pushing more people to live with roommates

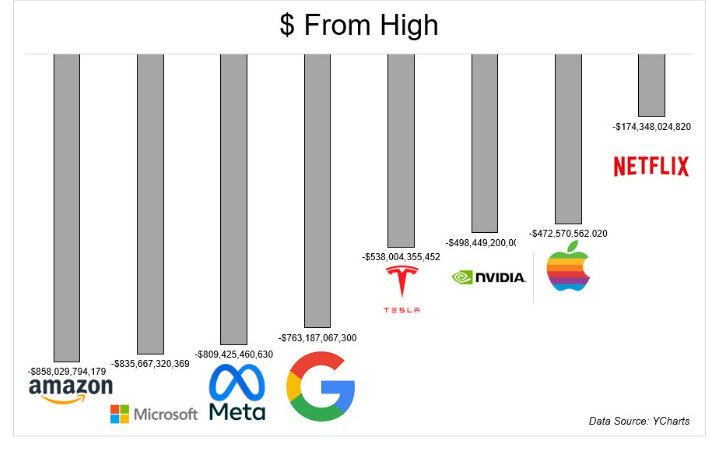

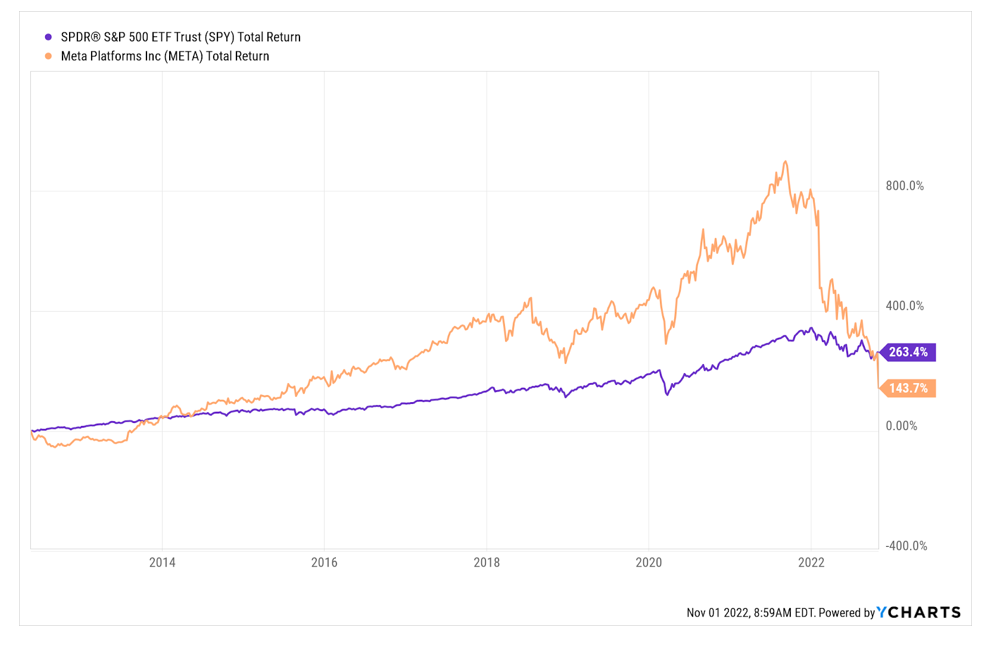

- How long can Mark Zuckerberg keep up his bet on the Metaverse

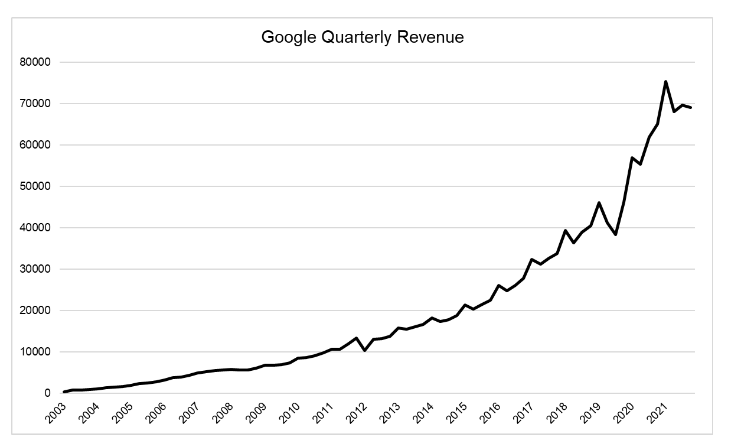

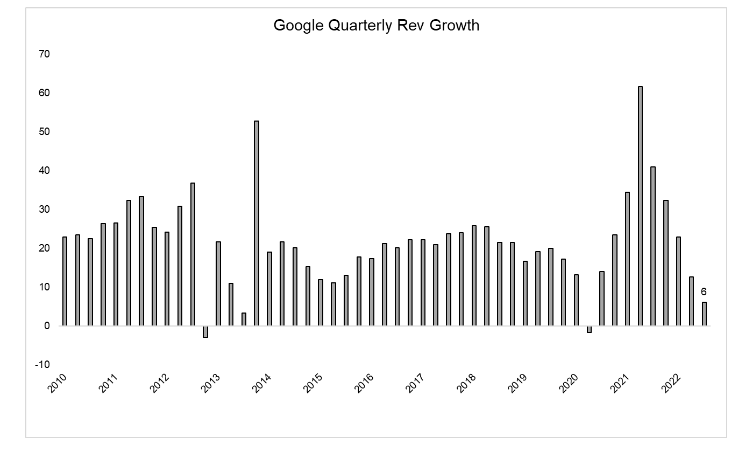

- Google earnings

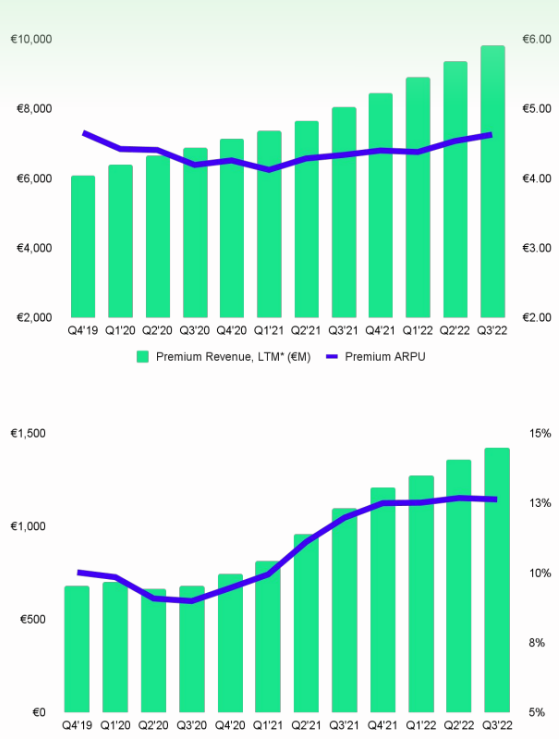

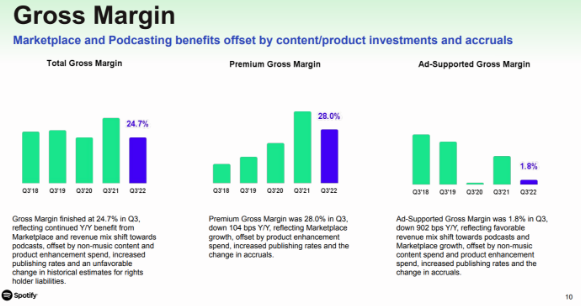

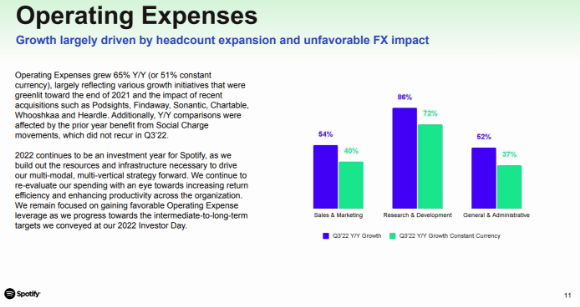

- Spotify earnings

- Meta earnings

- Amazon earnings

- Uber earnings

- $20 a month for Twitter verification

- The stand-in idea for Zoom

Listen here:

Recommendations:

Charts:

Tweets:

If you were to tell me at the beginning of the year that we'd have one of, if not THE worst year ever for most asset allocation strategies, I'd expect a lot worse sentiment.

But it seems rather chill.

What's your best guess as to why?

— Meb Faber (@MebFaber) October 28, 2022

Stimmy 1

Stimmy 2

Stimmy 3 pic.twitter.com/5qzrHlEndH— Lance Lambert (@NewsLambert) October 28, 2022

If you only owned the S&P intraday this year (buy the open, sell the close), avoiding owning over night, you'd be down 1.9%. pic.twitter.com/aeGe4B3ReT

— Bespoke (@bespokeinvest) October 28, 2022

GOLDMAN: “Our [prime book] data from 10/21 – 10/27 confirms [hedge funds] were firmly in super cap tech derisk mode .. info tech saw risk-off flows with long sales outpacing short covers nearly 1.5 to 1. .. we observed the largest notional long selling in tech in 7 months.” pic.twitter.com/Ir421PCn5n

— Carl Quintanilla (@carlquintanilla) October 29, 2022

On a recent Animal Spirits pod, I think @awealthofcs asked a question to the effect of whether ARK Innovation is one of biggest incinerators of shareholder capital in history. I wondered too and so ran the numbers. Here's a short thread–Ben I promise it's short–on what I found.

— Jeffrey Ptak (@syouth1) October 29, 2022

Through 33 months, the U.S. has already registered 15% inflation this decade.

We're on pace for +50% this decade. pic.twitter.com/WeDTi8DoTN

— Lance Lambert (@NewsLambert) October 30, 2022

The last time mortgage rates were above 7%, the dot-com bubble had recently burst. Rates were on the way down. They were in the middle of a four-decade stretch in which they mostly fell, underpinning the growth of the modern mortgage market: https://t.co/hCImre4a6V

— Ben Eisen (@BenEisen) October 27, 2022

"The cost of buying a new home has more than doubled in the past 10 months"

2. The rate hike's effects on the housing market will be significant: pic.twitter.com/UshGiXk0It

— Quartr (@Quartr_App) November 1, 2022

Pending home sales fell 35.2%, the largest annual decline & the fewest homes under contract in any October since at least 2015

[@Redfin] $RDFN pic.twitter.com/tMmMauRgkG

— The Transcript (@TheTranscript_) October 29, 2022

Steep drop in second home purchases. Loan locks -70% week ending October 26th. pic.twitter.com/UGnnJbrTg6

— Rick Palacios Jr. (@RickPalaciosJr) October 28, 2022

👀 house price trends by metro area pic.twitter.com/ECP4f7cpdD

— 📈 Len Kiefer 📊 (@lenkiefer) October 27, 2022

In the Greater Toronto Area, a metro region of nearly 6 MILLION people, there were a total of 45 *NEW* single-family homes sold by developers last month. In case you're wondering the state of that industry at present…

— Ben Rabidoux (@BenRabidoux) October 26, 2022

Toronto new single-family home sales fall 96% y/y in September.

New condo sales down 89%.

Data per BILD/Altus Group.

— Ben Rabidoux (@BenRabidoux) October 25, 2022

We have in this thread curated the 12 most important parts from yesterday's $META Q3 earnings call.

It is covering subjects like the massive CapEx guidance, TikTok, headwinds in the digital ads space, and, of course, The Metaverse.

1. Just like $GOOG, Meta is now cutting costs: pic.twitter.com/qHjo2SyuCB

— Quartr (@Quartr_App) October 27, 2022

AMZN revenue growth forecast is just 4.8% the lowest in history, and on the edge of shrinkage. pic.twitter.com/SG5awSPsmO

— zerohedge (@zerohedge) October 27, 2022

$AMZN ex-AWS: pic.twitter.com/qHEIzxm1eS

— Mokaya (@ekmokaya) October 31, 2022

#bitcoin trading is in a deep freeze, says Morgan Stanley pic.twitter.com/xz4zI6hnNm

— Carl Quintanilla (@carlquintanilla) October 27, 2022

Twitter departed the world of public companies just shy of its 9th birthday. To the question of who won and who lost, the answer should be obvious. From a start of $45 on 11/7/13 to Elon's buy this week at $54.20, the shareholder made 20.4%. That's cumulative. 2.1% per year. 1/

— Christopher Bloomstran (@ChrisBloomstran) October 29, 2022

NEWS @TheTerminal with @KurtWagner8 $TSLA engineers have been in meetings with $TWTR product staff today, assessing Twitter's code for Musk and there's been some 'code pairing' between Tesla/Twitter folks as they evaluate it.

Story to follow

— Ed Ludlow (@EdLudlow) October 27, 2022

New data: increase of n-word mentions has been 1,300%, peaking at 170 mentions every 5 minutes.

Elon has said nothing to quell this. https://t.co/DtuYM7VDi0

— Scott Galloway (@profgalloway) October 30, 2022

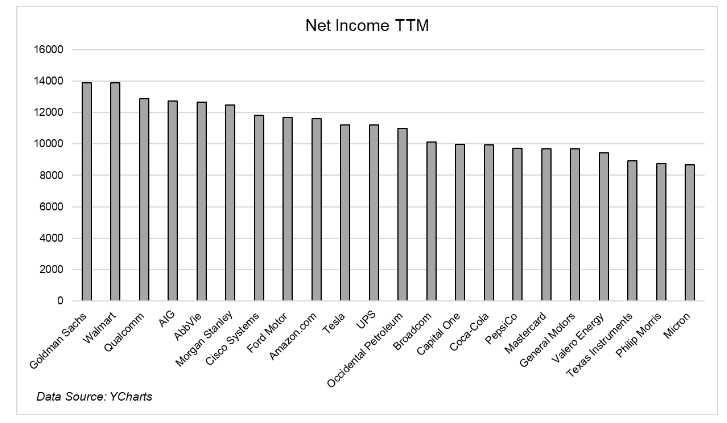

NEEDHAM: $GOOGL “missed every consensus P&L estimate .. ROICs are plummeting. .. We believe that GOOGL is worth more in pieces than together, so we welcome regulators' attempts to break up GOOGL. .. we calculate that YouTube would be valued at $300-$500B, if separately traded.”

— Carl Quintanilla (@carlquintanilla) October 26, 2022

Royal Caribbean reports the “single largest booking day in its 53-year history ..”$RCL (h/t @HammerstoneMar3) https://t.co/XX2swzxhfo

— Carl Quintanilla (@carlquintanilla) October 27, 2022

#OnThisDay in 1994, Pulp Fiction, Forrest Gump, The Shawshank Redemption and Jurassic Park were all showing at movie theaters. pic.twitter.com/1z7Hm9SZ4g

— WTF Facts (@mrwtffacts) October 29, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

*”Net Returns” refers to the annualized rate of return net of all fees and costs, calculated from the closing date to the sale date. IRR may not be indicative of paintings not yet sold, past performance is not indicative of future results.

**Wealthcast Media, an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. To learn more about the risks investing in Masterworks, see https://www.masterworks.com/about/disclaimer . To learn more about the risks of investing in AcreTrader see https://acretrader.com/company/terms#general-disclaimers. For additional advertisement disclaimers see here https://ritholtzwealth.com/advertising-disclaimers/